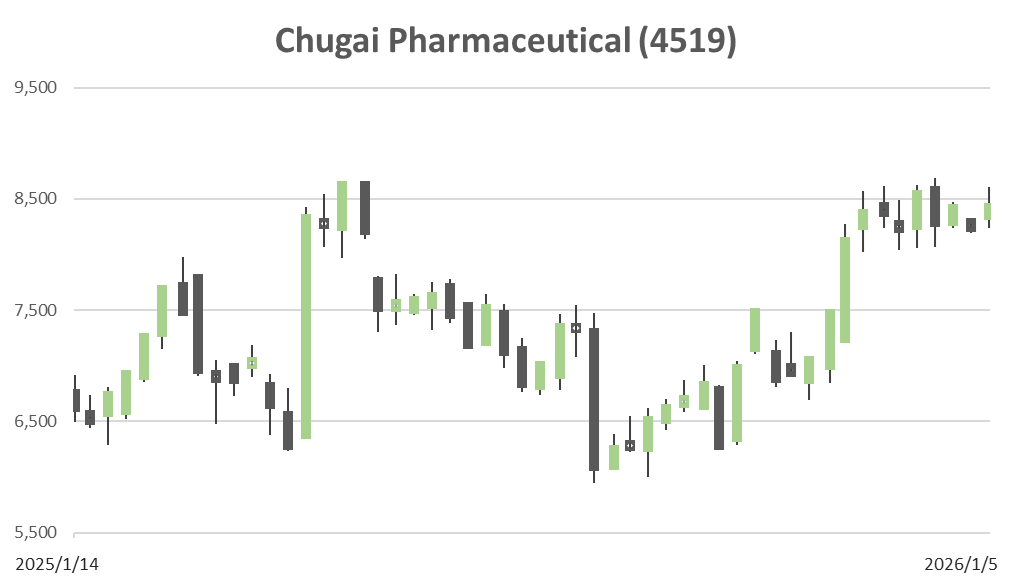

Chugai Pharmaceutical (Price Discovery)

Weak Hold

Conclusion

Weak Hold: The quality of the business is outstanding, and there is no indication of any instability in either earnings power or cash generation. Meanwhile, the share price has already largely priced in a favourable future outlook, and an upward revision to the outlook for future cash flows is required to generate further upside from the current level. Accordingly, it is appropriate to permit holding while taking a cautious stance on new investment.

Profile

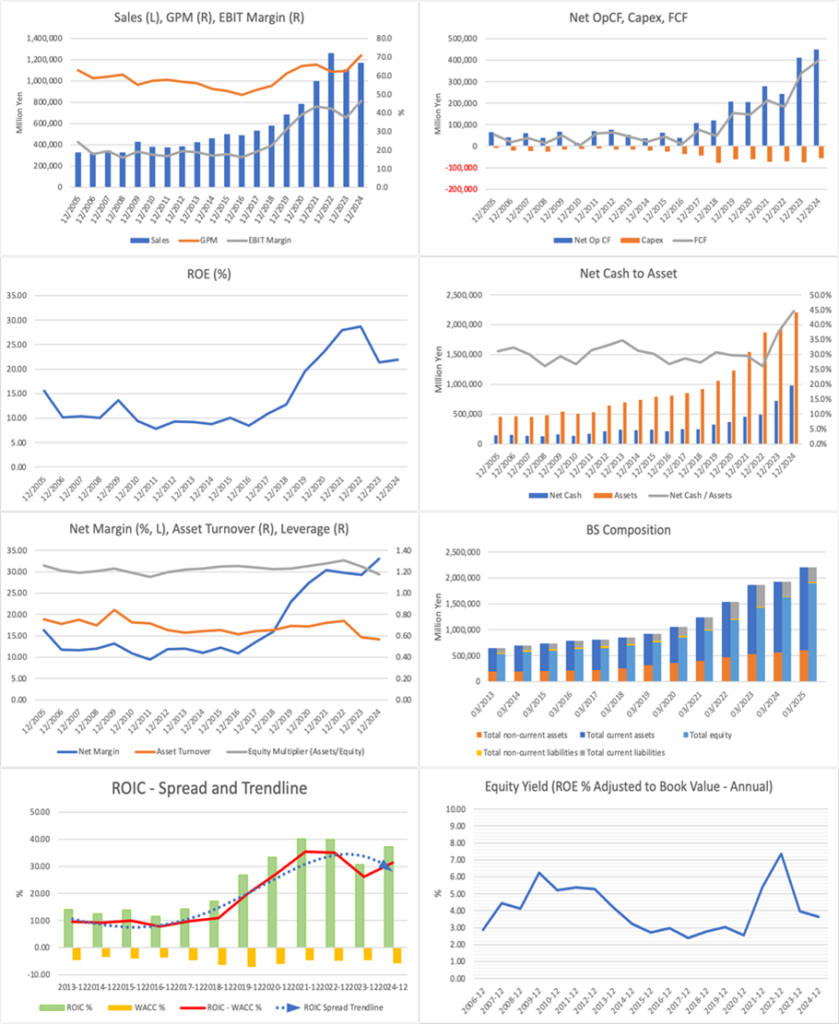

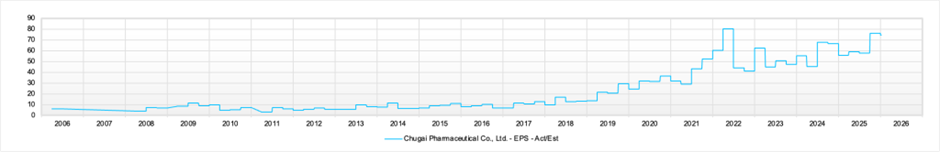

Chugai Pharmaceutical is a distinctive model even among Japanese pharmaceutical companies, incorporating not only domestic sales but also exports to Roche and income sources such as royalties and milestones through a strategic alliance with the Roche Group, while placing R&D capabilities at its core. The structure under which royalties and milestone income are recognised as primary income is confirmed in the financial statements. In terms of performance, sales and profit have increased significantly since 2020, and ROE and ROIC have also remained at high levels. Net sales expanded from 779.2 billion yen in 2020 to 1,166.3 billion yen in 2024, and net profit also increased from 207.8 billion yen in 2020 to 386.5 billion yen in 2024.

Sales ratio by segment, %: Domestic Products Oncology 21, Domestic Products Specialty 18, Overseas Products 46, Others 15 [Overseas] 60 (FY12/2024)

| Securities Code |

| TYO:4519 |

| Market Capitalization |

| 14,166,210 million yen |

| Industry |

| Chemistry |

Stock Hunter’s View

Further growth is expected from an oral obesity treatment. Market expansion could also accelerate with the expansion of insurance coverage.

Chugai Pharmaceutical can be expected to grow through orforglipron, an oral obesity treatment for which the Company holds royalty rights and US-based Eli Lilly holds global development and marketing rights. As multiple competitors’ data are being disclosed, orforglipron is increasingly being recognised again for its advantage in the obesity drug market, and it also produced favourable results in last year’s ACHIEVE-3 trial. It is expected to be covered by insurance in the United States as early as January–March this year.

In the FY12/2025 third-quarter (January–September) results, steady performance trends were confirmed, and the Company has also expressed confidence in achieving the full-year plan. In Japan, the impact of drug price revisions and penetration of generics continues; however, sales of new products (PHESGO, PIA SKY) and the key product Hemlibra (haemophilia) expanded. For Overseas Products, the third-party out-licensed product NEMLUVIO made a strong start, with overseas local sales exceeding assumptions.

In addition, through the acquisition of Renalys Pharma, the Company acquired an IgA nephropathy treatment approved in the US and Europe. It expects this to strengthen the renal development pipeline and sustain growth in domestic sales. Renalys holds exclusive development and marketing rights for the treatment in Japan, South Korea, and Taiwan, and Chugai Pharmaceutical intends to file for approval in Japan in 2026 as a first-in-class (breakthrough) treatment.

Investor’s View

Weak Hold: The quality of the business (earnings power, capital efficiency, and cash generation) is unquestionably high. Meanwhile, the valuation has already priced in considerably favourable future performance, and the median DCF does not fully justify the share price. The share price is unlikely to rise on good results alone, and it is inferred that it will move only when the consensus outlook for future cash flows is revised upward. Therefore, rather than immediately adding the stock to the portfolio with a bullish stance, it is appropriate to hold it while remaining cautious about new purchases.

Drivers of performance since around 2020

The primary reason for higher sales and profits since 2020 is that high-margin overseas income, such as exports to Roche and royalties, has become a larger share. The expansion of the top line has directly translated into profit, thereby maintaining high ROE and ROIC and increasing free cash flow. In Japan, while headwinds from drug price revisions and the penetration of generics have persisted, growth in new and key products has supported earnings and enhanced the resilience of the earnings base. In addition, although year-on-year comparisons are partially affected by changes in presentation categories, in substance, the strength of overseas income and the rise in cash generation have supported the performance trend since 2020.

Reasons the share price has been lacklustre since last year, despite strong performance

The sluggishness of the share price is attributable not to fundamentals but to the fact that investors have already priced a high-growth scenario into the share price. Good results support the downside to the share price, but they do not readily lead to an upward revision of valuation.

In Japan, structural factors remain in the form of drug price revisions and penetration of generics, and investors incorporate these as ongoing discount factors. While growth catalysts in overseas and new domains are valued, until the timing and magnitude of the profit impact are agreed upon, whether the outlook is revised upward tends to determine the share price reaction more than the mere existence of such catalysts.

Evaluation of the current valuation and fair value

Market forecasts are a forward PER of 34.1, an actual PBR of 7.29, a forward ROE of 21.8%, and a forward EPS of 250.5 yen. It is difficult to view the valuation as inexpensive. A PBR in the 7x range is clearly high, but assuming the sustainability of ROE above 20%, it can stand as a quality premium. Meanwhile, a PER of 34x has priced in growth and certainty to a significant extent, and PER expansion is prompted in phases, accompanied by a pronounced upward revision to the long-term profit outlook.

Fair value is estimated within a range using an FCF-based DCF model. Based on FY12/2024 FCF of approximately 399.4 billion yen, and valuing with a discount rate of 5.5–7.5%, initial growth of 1–6%, and terminal growth of 0.5–2.0%, the results are 4,200 yen in the bear case, 6,300 yen as the median, and 9,600 yen in the bull case. The current share price is above the median, and a further increase would require an upward revision to the outlook for future cash flows.

Assessment of Stock Hunter’s view

The bullish element in Stock Hunter’s view lies in orforglipron targeting the obesity domain, a vast market, and in Chugai holding royalty rights. Given that Eli Lilly is responsible for development and marketing, the earnings contribution in the event of success is likely to be linked to capital efficiency and cash generation, and leverage can be effective during phases of market expansion. The view that current performance is steady and that domestic headwinds are being offset by growth in new products and key products is also consistent with limiting short-term downside risk. The launch of out-licensed products and the reinforcement of the renal domain broaden medium- to long-term options for diversifying future income sources.

Meanwhile, points requiring attention are the uncertainty of the catalysts and the distance to monetisation. The obesity domain is subject to rapid changes in the competitive environment. If any of the clinical results, insurance coverage, or uptake falls short of market expectations, previously priced-in expectations are likely to be adjusted. In addition, the economic terms of royalties are not readily observable externally, and estimates of the profit impact are likely to vary across the market. While thickening the pipeline through acquisitions or in-licensing contributes to medium- to long-term value enhancement, the share price is re-rated when the outlook for profit and cash flow is ultimately revised upward. Therefore, if the realisation of earnings contribution requires time, it is unlikely to function as an upside factor for valuation in the near term. Moreover, because the current valuation is already high, the room for further valuation uplift is relatively limited even if positive catalysts emerge. Conversely, if unexpected adverse developments occur, the share price’s downside reaction is likely to be large, as both an earnings shortfall and a reduction in valuation multiples can occur simultaneously.

Conditions for a rise in the share price going forward

The most important factor is an upward revision to the consensus forecast of future cash flows. If, for orforglipron, the certainty of clinical results, insurance coverage, and uptake increases, and royalty income is incorporated explicitly into earnings forecasts, the upside potential for the share price is likely to increase.

Next, it is required that overseas income, including exports to Roche, grow stably and that the quality of earnings remain stable. As long as overseas income remains robust, downside resilience is likely to strengthen.

In Japan, it is essential to continue offsetting the headwinds of drug price revisions and generic penetration through growth in new and key products. In addition, clarifying capital policy and ensuring that the use of cash is compelling for both growth investment and shareholder returns can increase valuation by lowering the discount rate. In sum, rather than merely accumulating good results, the share price is likely to move upward in phases in which the market is convinced that the future earnings profile has been lifted by one notch.

Financials and Valuations

Price

PBR (LTM)

PER (LTM)

ROE (LTM)

EPS (Actual)

BPS (LTM)