eWeLL (Price Discovery)

Speculative Buy on dip / Sell if the stock rises on earnings

Conclusion

Growth momentum is strong, supported by AI services and medical and nursing care DX; however, the stock price is at a bullish level that discounts the long-term sustainability of high growth and a future strengthening of shareholder returns. The share price decline since the beginning of the year suggests that confidence in that premise may be waning. Therefore, pullbacks on earnings to be released on 13 February are a speculative buy opportunity. If the stock reacts positively, we will take profits.

Profile

eWeLL (5038) is a healthcare IT company that provides business support services for home-visit nursing stations and develops a business model that captures the growing demand for home medical care and community-based integrated care by streamlining back-office operations, such as records and billing, and improving efficiency in on-site operations. The operations of its customers, home-visit nursing stations, require compliance with systems and impose a heavy administrative burden. Because the Company’s services tend to be deeply embedded in daily operations, it aims to build earnings mainly through recurring billing.

Sales composition by business (%): Service provision for home-visit nursing stations 100 (FY12/2024)

| Securities Code |

| TYO:5038 |

| Market Capitalization |

| 36,238 million yen |

| Industry |

| Information / Communication |

Stock Hunter’s View

AI services are performing strongly. Attention is on the national policy “medical and nursing care DX.”

eWeLL provides, on a SaaS basis, systems that support efficiency improvements in the work of home-visit nurses who provide home medical care, centered on the electronic medical record for home-visit nursing “iBow,” and also including receipts and attendance management. It also offers BPO services in which dedicated staff handle administrative management on behalf of customers.

President Takehito Nakano is a former jet-ski professional who ranked second in the world. After an accident during race practice left him unconscious for 10 days, a nurse saved his life, and he aspired to pursue a business that supports the work of home-visit nurses and founded the Company in 2012.

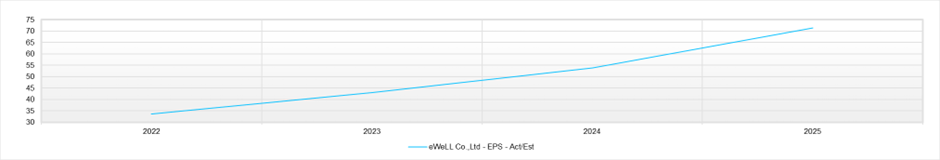

Currently, “AI Home-Visit Nursing Care Plan and Report,” the “Statutory Training Service,” and BPaaS are strongly driving the business. By service, recurring revenue is steady for both the core “iBow” and AI services. While the “Statutory Training Service” is seasonal, it has achieved approximately three times YoY sales growth. Because home-visit nursing stations that have not taken statutory training are subject to a 1% reduction in nursing care insurance, the number of contracts tends to increase toward March, which is the end of the fiscal year.

The Company plans to announce its full-year results on February 13. Attention will focus on the plan for the current fiscal year, including the impact of the FY2026 medical fee revision. In addition, for the new product “AI Visit Schedule and Route,” which began free applications in the second quarter, as of the end of October last year, the number of free applications was 1,130 (about 30% of all stations). Penetration is progressing steadily, particularly among large- and mid-sized stations, which are the primary target.

Investor’s View

Speculative Buy on pullbacks; take profits if the stock price rises on earnings.

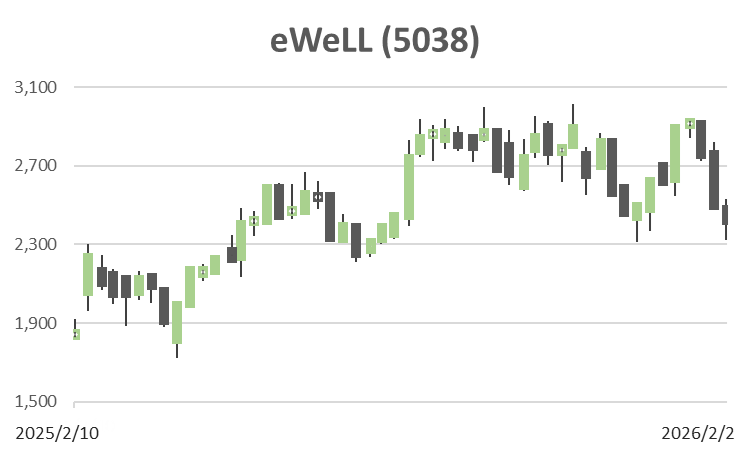

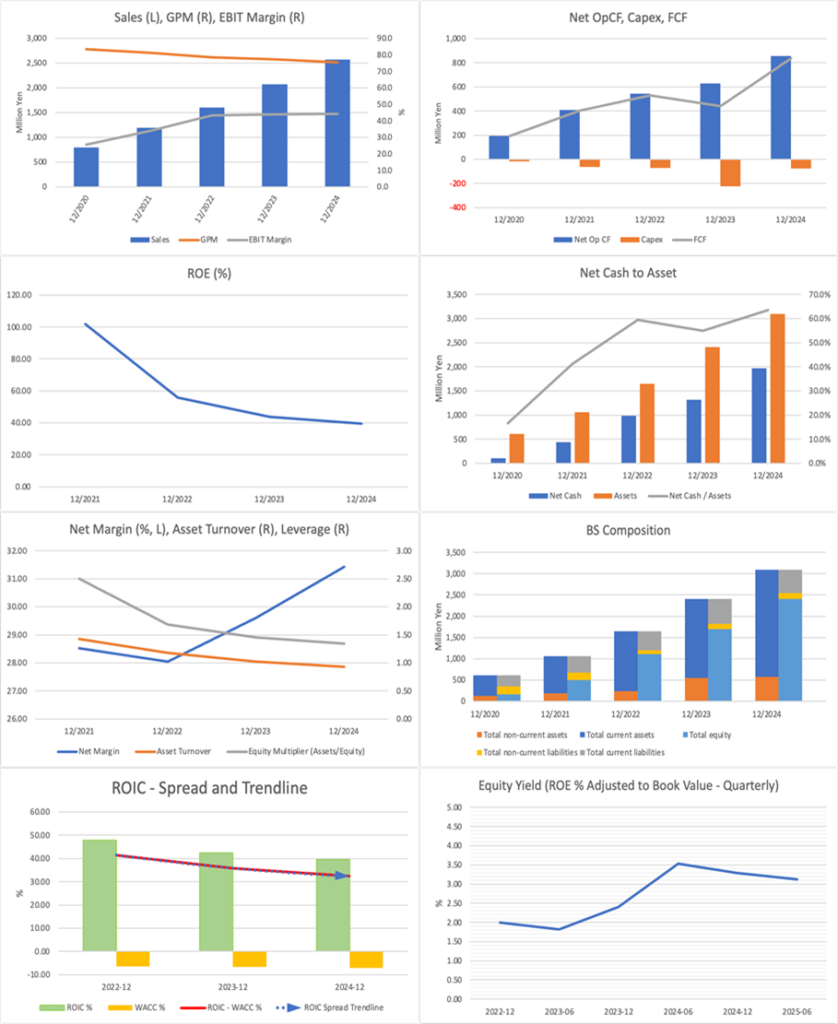

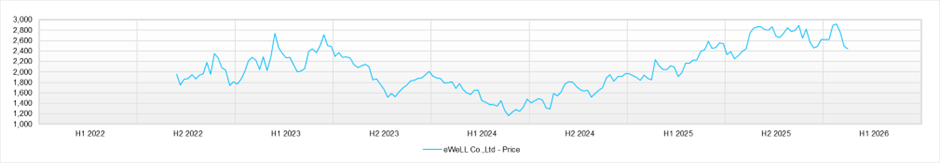

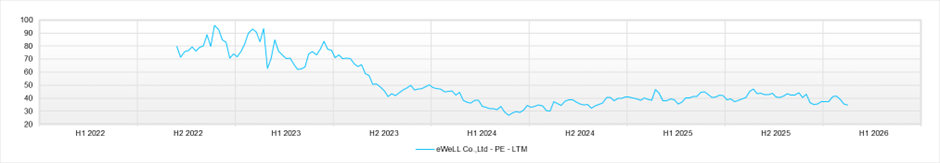

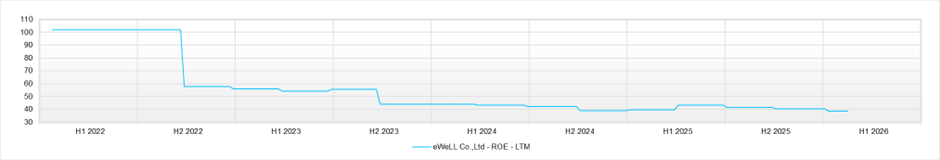

The stock price reflects the premise that mid-20% growth will be sustained. The long-term EPS growth rate implied by the combination of forecast PER of 35.4x, actual PBR of 11.8x, forecast ROE of 33.8%, forecast EPS of 68.8 yen, and forecast dividend of 16 yen (payout ratio of about 23%) is approximately 24%, which is broadly consistent with the EPS CAGR over the most recent three years (approximately 26%). However, a PER in the 35x range is difficult to reconcile with a scenario in which “high growth loses momentum in about three years.” The market is strongly discounting at least one of the following, or both: the continuation of high growth over at least four to five years (roughly an annual rate of 40%), or a future strengthening of shareholder returns (raising the payout ratio). Overall, the stock price is driven by extremely bullish expectations.

On the other hand, the stock price has declined by approximately 8% since the beginning of the year, despite solid recent performance, which cannot be overlooked. This suggests that market confidence in the sustainability of high growth over the medium to long term is beginning to waver, and that a valuation adjustment is underway. If the results for FY2025 4Q and the FY2026 plan, scheduled for announcement on February 13, support a high level of sustained growth, the stock could rebound in the short term.

As an investment action, a two-stage approach is reasonable. First, if the stock price declines significantly after earnings, we would consider purchases after recalculating investor expectations for growth. Second, if the stock price is flat or rises markedly on earnings, it would be rational to seek profit-taking opportunities, assuming there is additional valuation adjustment room given the high level of expectations already discounted.

Financials and Valuations

Price

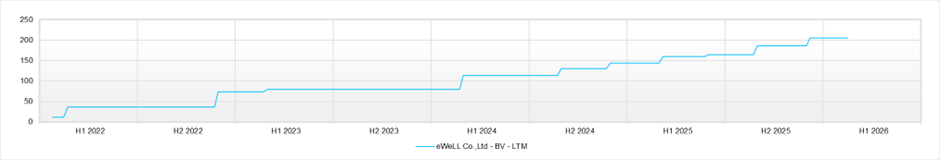

PBR (LTM)

PER (LTM)

ROE (LTM)

EPS (Actual)

BPS (LTM)