Kasumigaseki Capital (Price Discovery)

Take profit

Profile

Real estate consulting business. Mainly develops logistics facilities and flat hotels. Healthcare facilities and Dubai property developments are underway. The company was founded in September 2011 by Hiroyuki Ogawa and is headquartered in Tokyo. Sales by segment: real estate consulting 100 (FY8/2023)

| Securities Code |

| TYO:3498 |

| Market Capitalization |

| 140,558 million yen |

| Industry |

| Real Estate |

Stock Hunter’s View

Profit growth doubled, and each project is progressing well

Kasumigaseki Capital is a property developer involved in developing and operating logistics facilities, hotels and healthcare. The company achieved its long-sought promotion to TSE Prime Market in October last year.

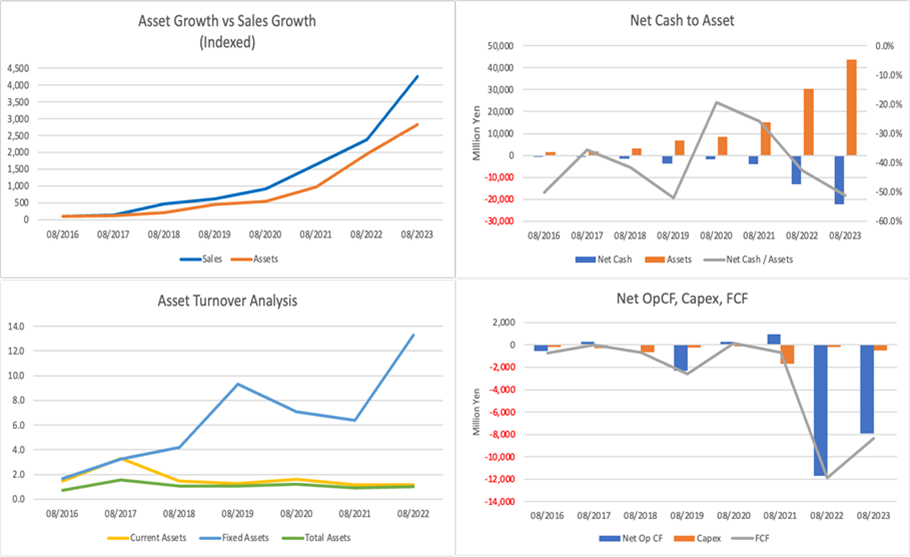

Despite COVID-19, the company has continued to purchase and develop land for hotels and logistics facilities, expanding its assets and doubling its annual profit growth each year from the previous two years to the current year. Investment resources are financed by retained earnings plus long-term debt, and business risks have not increased to any great extent.

The latest results were also strong, with sales of 33,595 million yen (+82% YoY) and operating income of 3,643 million yen (3.4 times YoY) in 3Q FY8/2024 (Sept 2023 – May 2024). Each business is running on target. In the logistics business, tenants have been decided for some plots in Fukuoka Koga and Sendai Izumi, which will be completed soon. In the hotel business, five new hotel development sites and properties (including properties to be renovated) were acquired, and one development site was transferred to the development phase. Three new facility development sites have been acquired in the healthcare business, and two development sites have been transferred to development.

As the pipeline continues to build up, recurring revenue is expected to increase through performance fees on the sale of completed properties, hospice operations and the launch of a small rental service for refrigerated automated warehouses in the coming years.

Investor’s View

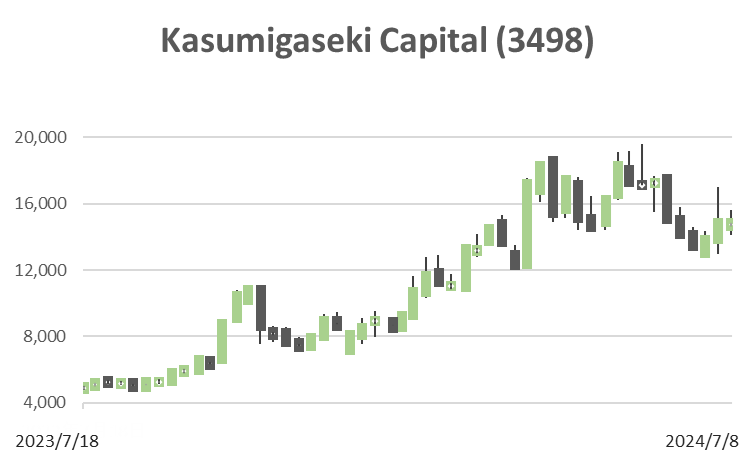

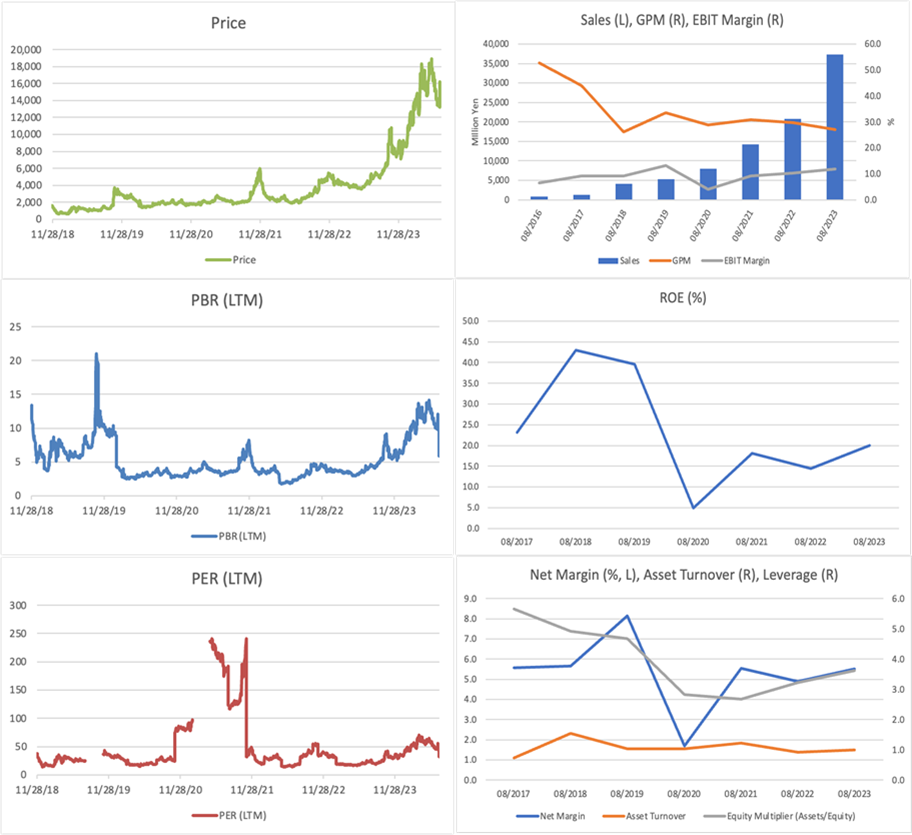

Take profit. The company delivers impressive profit growth against low interest rates and an unprecedented property market. FY8/2025 should continue to see high growth, but the share price, which has risen 3.4 times in one year, must have factored in the immediate future. The best of the typical share price performance of a highly successful small to mid-cap real estate stock has been out.

The company’s recent growth has been phenomenal: in the five years to the forecast FY8/2024, EPS, BPS, sales and assets have grown 6x, 9x, 11x and 9x, respectively. During this period, market capitalisation has increased 27-fold. The focus on logistics-related facilities, mainly refrigerated warehouses and hotels with targeted clientele in the broad real estate market, has enabled strong growth. Over the past three years, the total floor area of frozen and refrigerated warehouses has increased six-fold. The current pipeline includes 16 projects and is expected to continue to drive earnings growth. Management is also involved in healthcare facilities and developments in Dubai.

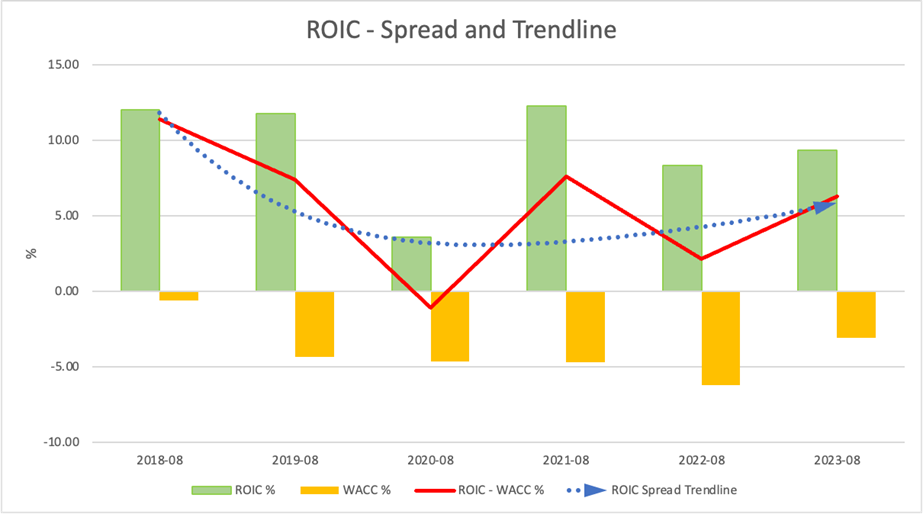

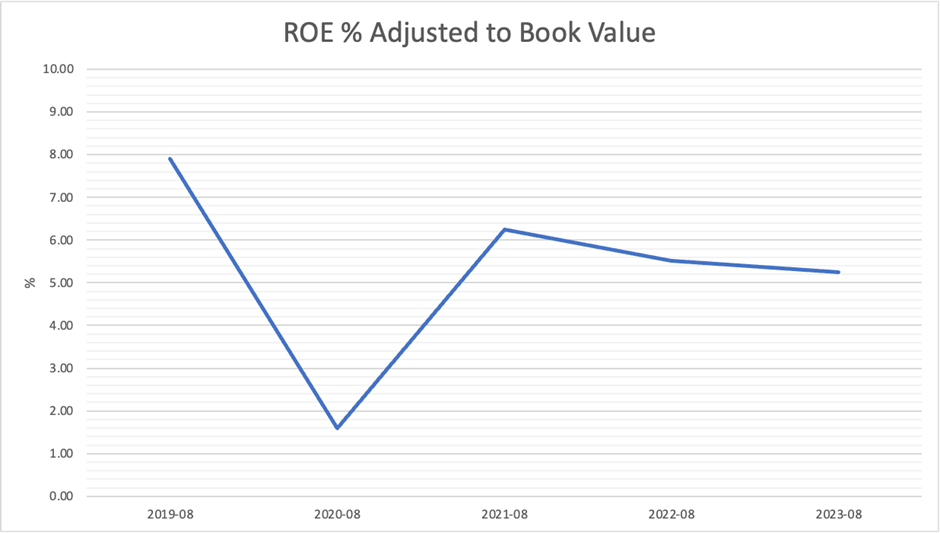

Forecast ROE is over 20% for FY8/2024, whereas PBR is 11x. The equity yield is more than 5%, which could be more attractive.

Forecast FY8/2024 PER is 30x, which makes us feel the share price is fairly expensive, albeit admitting the stellar financial performance. The dividend will be increased from 60 yen in the previous year to 170 yen in FY8/2024, but the dividend yield of 1.1% is not attractive. Suppose the low interest rate environment in Japan continues. In that case, even if interest rates rise somewhat, the unprecedented property market will continue to be buoyant, and the company can drive its earnings significantly. However, it is difficult for investors to calculate the value of the property pipeline in stock, and future returns are unpredictable. If FY8/2026 EPS shows no loss of momentum, the share price should soar further, but medium-term earnings are unforeseen at this point.