SENKO Group Holdings (Price Discovery)

Long-term Buy

Profile

Major logistics outsourcing company established in 1916. Logistics: motor vehicles, rail, shipping, international transport operations, and warehousing. Commercial and Trade: oil sales, commercial sales and trading operations. Others include lifestyle support, foodstuffs and information processing services. Sales by business segment % (OPM%): Logistics 64 (5), Commercial and Trade 22 (1), Others 14 (3) (FY03/2024)

| Securities Code |

| TYO:9069 |

| Market Capitalization |

| 174,348 million yen |

| Industry |

| Land transportation |

Stock Hunter’s View

Continued stable growth, mainly in logistics. Profits increase due to opening new bases and the effects of M&A.

SENKO GHD’s logistics business for the distribution industry, including general supermarkets and drugstores, is growing, while its frozen and refrigerated food storage and delivery operations remain strong. Large shippers include Sekisui Chemical, Sekisui House, Asahi Kasei and the Chisso Group.

In FY3/2024, sales increased by 11.8% and operating profit by 17.1% YoY. In addition to higher profits in the logistics business, improvements in the Life Support, Business Support and Product businesses also contributed. The effect of appropriate fee collection and price revisions also absorbed cost increases in labour and vehicle hire costs.

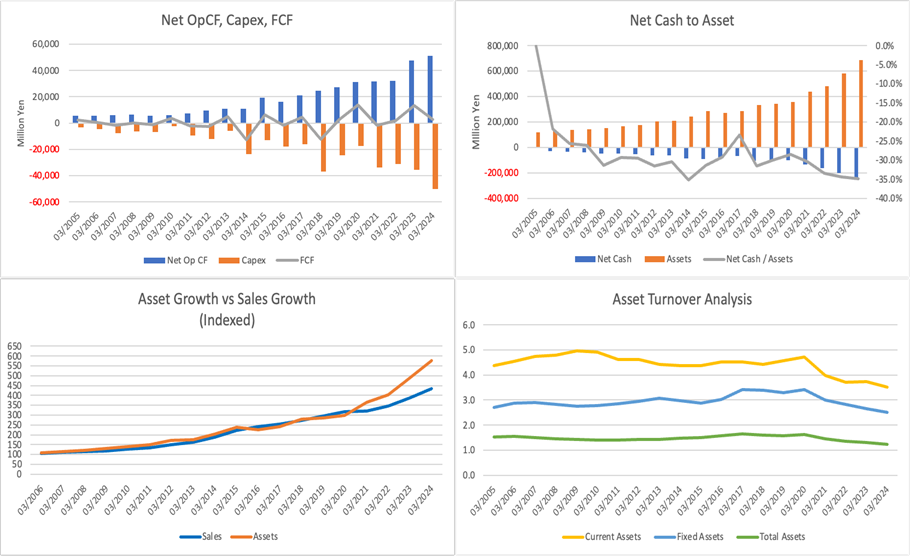

For the current financial year, operating revenue is planned at 850 billion (+9.2 % YoY) and operating profit at 34 billion (+13.7 % YoY). Eight centres are scheduled to operate in the logistics business, contributing to operating revenue of approximately 17 billion yen when fully operational. Another 17 billion yen is expected from 4 centres in operation from FY3/2026 onwards. The effect of sales expansion, mainly at the new centres, will likely result in continued stable profit growth.

The company is also characterised by its continuous execution of more than a certain number of mergers and acquisitions each fiscal year, and the sales composition of its non-logistics business has recently been expanding. In its medium-term management plan, the company has set a target of 1 trillion yen in operating revenue for FY3/2027, and it is expected that M&A will continue to be actively pursued, including in the non-logistics business.

Investor’s View

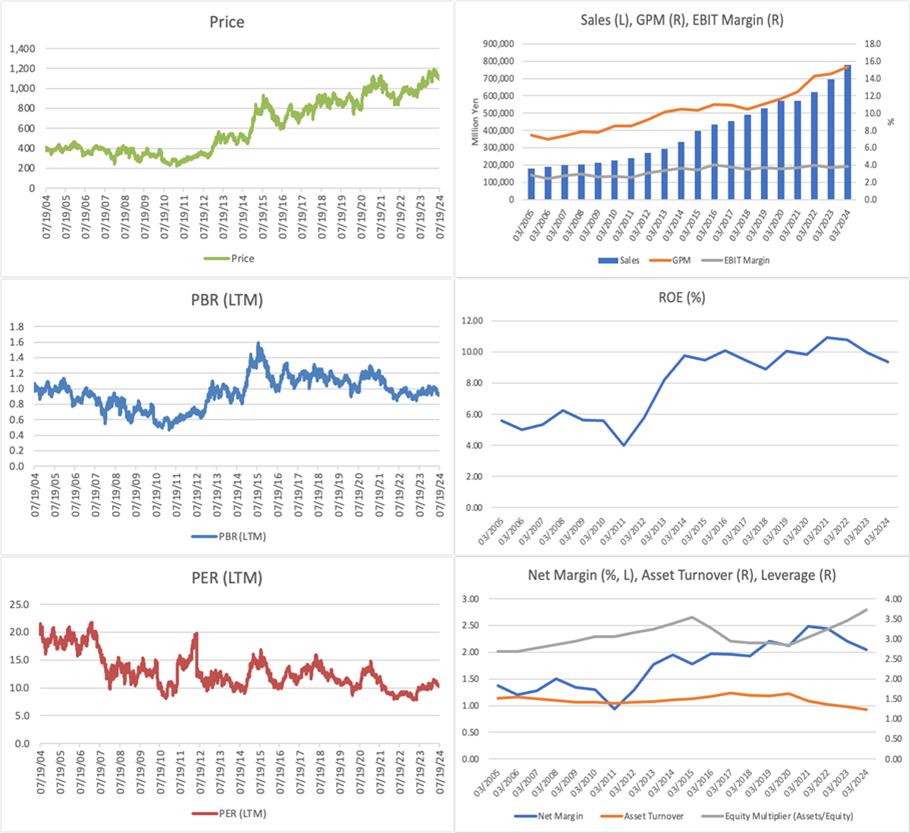

Lacks share price catalysts, and corporate strategy is not glamorous. However, management is solid, and earnings are stable over the long term. Price revisions are progressing very well. PER 9.7x and PBR 0.92x are undervalued. A perfect low-beta stock for long-term investment.

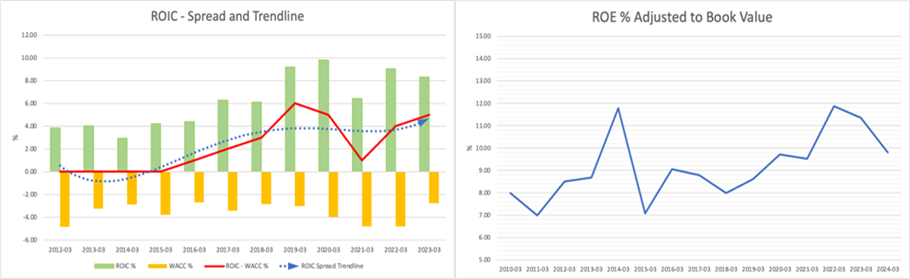

100% of the company’s sales are in Japan by region, and the business captures a wide range of domestic logistics needs. The share price performance has averaged +6.9% p.a. over five years but is an underperformer versus TOPIX at -3.2%. Nevertheless, management is highly rated as it has maintained good earnings, an ROE of around 10%, and created economic value for a long time. Valuations are cheap, and the equity yield is around 10%. It is a safe stock for long-term portfolios aiming for absolute returns and is recommended for investors looking for quality low-beta stocks. The average annual EPS growth rate over the five years is 5.7%.

It is positive that cash flow is fully allocated to capital expenditure. Most capital expenditure is the construction of new distribution centres. Assets have grown slightly faster in recent years, putting downward pressure on ROE, but this is offset to a large extent by improved equity leverage.

Notable in the current business is the smooth progress of price increases. In terms of operating profit vis-a-vis the previous year, operating profit increased by 17% in FY3/2024, with an increasing effect of 26 billion yen, despite negative factors such as wages, procurement costs and fuel costs totalling 21 billion yen. Of the increase in profit, 65% (17 billion yen) was due to price revisions. This year, the management continues to forecast a cost factor of 15 billion yen YoY, while it expects an increase in profits of 19 billion yen, 70% (13 billion yen) of which will be due to price revision. As a result, the company expects a 14% YoY increase in operating income.