Toyota Tsusho Corp. (Price Discovery)

Look to Sell

Profile

Toyota Tsusho Corporation is a general trading company in the Toyota Group. Toyota Motor Corporation holds 21.5% of the company’s shares, and Toyota Industries Corporation holds 11.1%. The company has six main divisions, but the proportion of profits from automobile-related businesses is thought to be extremely high. Automobile sales is the leading business in Africa, which accounts for 20% of the net profit.

The ratio of net income by business segment % (net income margin %): Metals 18 (2), Global Parts & Logistics 14 (4), Mobility 17 (6), Machinery, Energy & Plant Projects 8 (3), Chemicals, Electronics 17 (3), Food & Consumer Services 4 (2), Africa 21 (4) [Overseas revenue proportion] 72% <FY3/2024>

| Securities Code |

| TYO:8015 |

| Market Capitalization |

| 2,820,591 million yen |

| Industry |

| Wholesale business |

Stock Hunter’s View

Expectations for medium- to long-term growth remain unchanged. Businesses targeting emerging markets are attracting attention.

Toyota Tsusho Corporation, a general trading company affiliated with Toyota, has seen Toyota’s domestic production figures stagnate due to the impact of the Toyota vehicle certification scandal and the suspension of operations at its plants in the wake of Typhoon No. 10. However, Toyota’s full-year production is expected to be slightly below its 10 million unit target. The impact on Toyota Tsusho’s earnings for FY3/2025 is expected to be minimal.

In 1Q (April to June), the company recorded a net profit of 95.829 billion yen (up 3.4% YoY), and the progress ratio against the full-year plan was a favourable 27%. The favorable foreign exchange rates were the main factor behind the increase in operating profit. The focus of the 2Q financial results to be announced on October 31st will be the recovery in the Mobility business, the growth of the African business, which performed well in the 1Q, and the accumulation of highly profitable projects in the renewable energy business.

In April this year, the company announced a Medium-term Management Plan (covering FY3/2025 to FY3/2027) to achieve a net income of 400 billion yen and an ROE of 13% or more in FY3/2027. The company plans to invest more than 1 trillion yen over three years and to return more than 300 billion yen to shareholders over the same period. Although the company does not buy back its shares, it is actively working to return profits to shareholders by planning to increase dividends by raising the dividend payout ratio to 30% for the fiscal years ending March 2024 and 2025.

Also, watch for moves to end cross-shareholdings within the Toyota Group. Of Toyota Tsusho’s shares, Toyota and Toyota Industries own 32.9%, and the supply and demand for shares are being watched.

Investor’s View

Look to sell. Consider selling in 8-10 months.

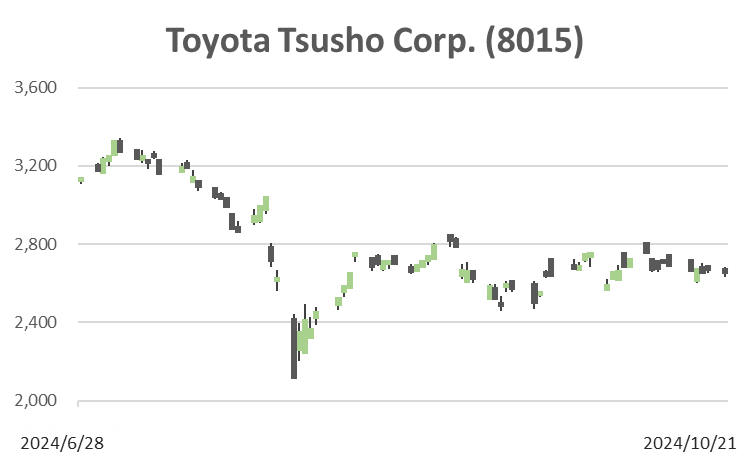

The company’s stock rose 70% last year but has fallen 4% since the beginning of the year. The shares are currently trading on PER of 7.8x and PBR of 1.1x.

Price

PBR

PER

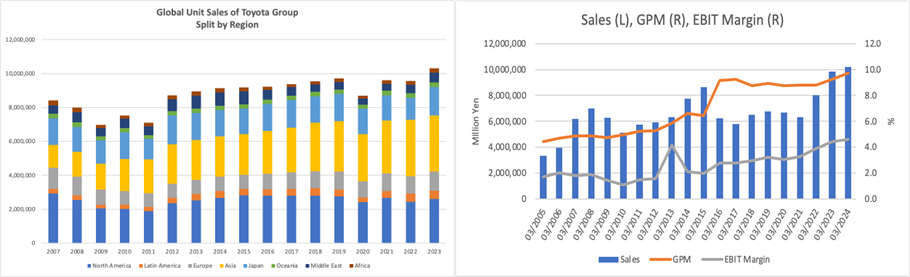

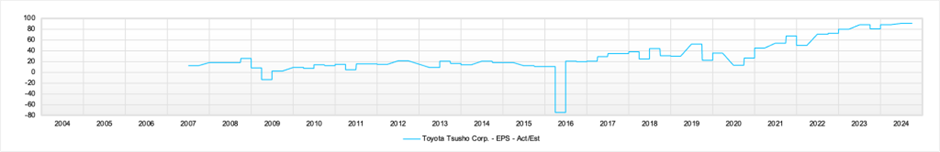

The earnings have been stable for many years. This owes to Toyota’s stable sales volume in each region of the world and as the company operates automobile business in a region where profit margins hold up relatively well.

Toyota Group global sales volume, Toyota Tsusho’s long-term business performance

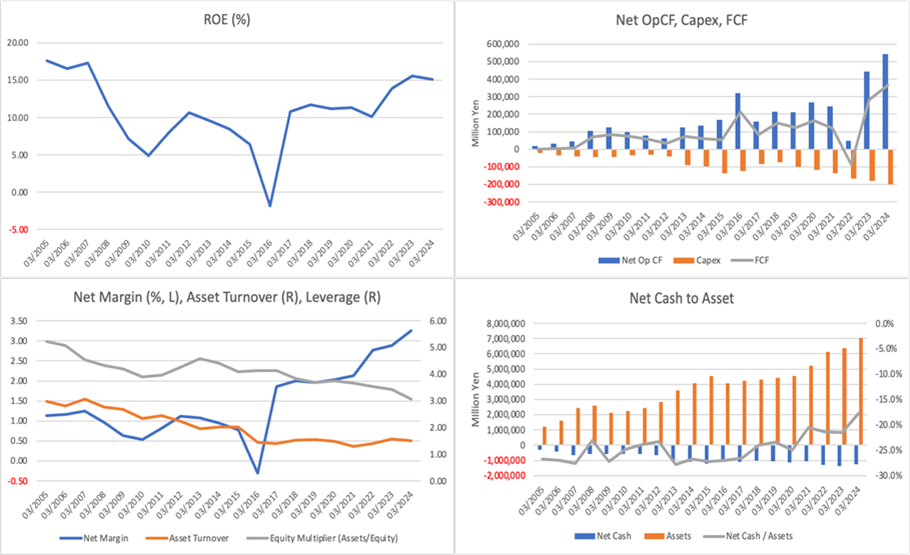

On the other hand, while being a general trading company, unlike Mitsubishi Corporation and Mitsui & Co., Toyota Tshusho does not take risks aggressively or use leverage, which had been boring for investors for a long time. However, the inflationary economy has sent profit margins higher, and the earnings momentum turned positive. ROE has also increased. In addition, the management team set a target of maintaining ROE above 13% in its Medium-term Management Plan. The management also announced a policy of allocating all operating cash flow to investment and shareholder returns and selling all policy-held shares below the cost of capital, even if they are profitable.

The outlook of Toyota’s medium- to long-term automobile sales volume is reassuring, and one can also expect further earnings contributions from non-automotive businesses. However, a disinflationary economy will likely push down profit margins. The momentum of profits and ROE will be lost, and the company will likely return to its nature of consistently generating profits but not growing particularly well.

The equity yield is attractive, and the valuation is low. Nevertheless, a significant discount is worthy for a trading company with an extremely opaque balance sheet. In addition, WACC is high, and the company does not create much economic value. The management team estimates the WACC at 8%.

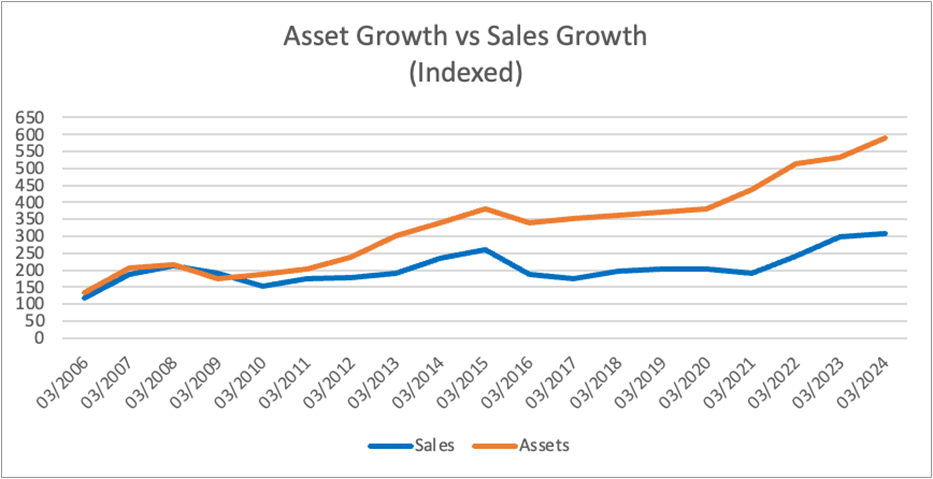

Furthermore, the asset turnover ratio has fallen significantly due to aggressive investments in recent years, and with the management policy of continuing aggressive investments in the future, assets will continue to expand to push down ROE. 70% of the sales are overseas, and the appreciation of the yen due to the narrower interest rate gap between Japan and the US will also negatively impact the share price. Investors should consider dumping the position in 8-10 months.

EPS

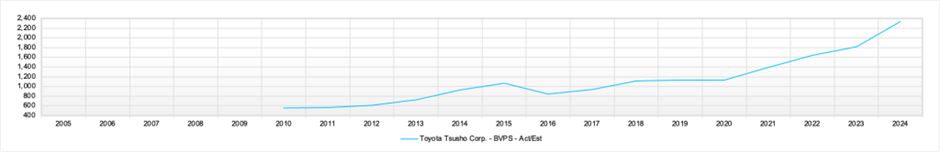

BPS