Fujikura (Price Discovery)

Sell

Profile

Fujikura Ltd. is one of the three major manufacturers of electric cables. Information and Communications manufactures optical fiber, network equipment, bare aluminum wire for industrial use, and enameled wire. Electronics Division manufactures printed circuits, membrane switches, connectors, and sensors. Automotive Division sells wire harnesses and other automotive parts. The company was established in 1885 by Zenpachi Fujikura. Sales by business segment % (OPM%): Information and Communications 37 (13), Electronics 21 (10), Automotive 22 (1), Energy 17 (6), Real Estate 1 (46), Others 1 (-12) [Overseas] 72 <FY3/2024>

| Securities Code |

| TYO:5803 |

| Market Capitalization |

| 1,559,792 million yen |

| Industry |

| Non-ferrous metals |

Stock Hunter’s View

Demand for AI data centres is strong. Production capacity is being increased ahead of schedule, with additional production also planned.

Fujikura, one of the three major electric cable manufacturers, is seeing strong demand for optical wiring components and optical cables for AI data centres.

Compared to conventional data centres, AI-related data centres require more optical wiring components, and demand continues to be strong across the industry. There are no signs that the momentum of AI investment will slow down, judging from the financial results of US tech companies, and it is expected that the tailwind for the company will continue for the time being.

The company announced its 2Q (April-September) financial results on 7th November, with sales of 447.539 billion yen (up 14.2% YoY) and operating income of 55.141 billion yen (up 79.2% YoY). At the same time, the company revised its full-year forecast upwards, raising its operating income forecast from 89 billion yen to 104 billion yen (a 49.7% YoY increase). On the other hand, the company’s assumption of 140 yen to the dollar for the second half of the year gives the impression of being somewhat conservative. With Information and Communication business expected to be the driving force, further profit increases can be expected.

At the same day’s financial results briefing, the company announced that it would bring forward its plans to increase production capacity and add to its production. The company believes that demand for AI servers will remain strong for the foreseeable future. If demand continues to be strong, production capacity will continue to increase as appropriate after 2025.

Investor’s View

Sell. The AI investment boom is a positive catalyst for share prices, but it is discounted in the share price. Historically, the company has not been a highly profitable or successful business. The profit margin should decline due to the capital investment cycle chasing the boom. The management team’s goal of focusing on capital efficiency depends on market conditions, and its insistence on a high equity ratio is not what investors are looking for.

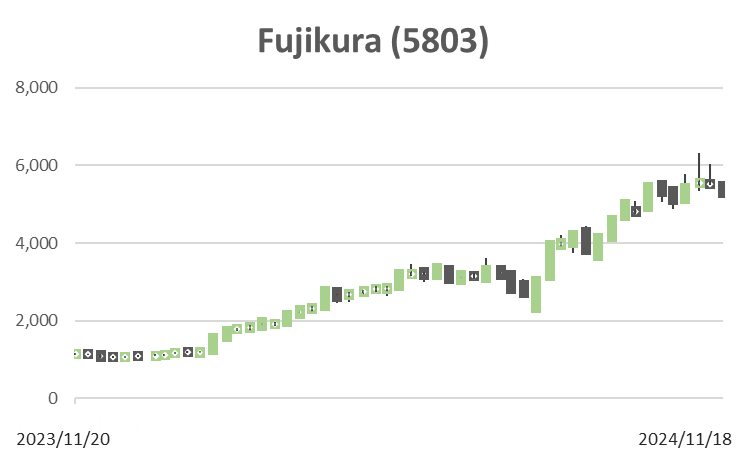

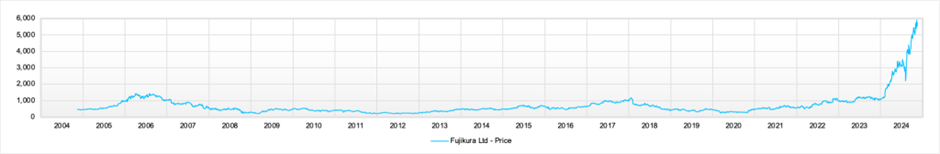

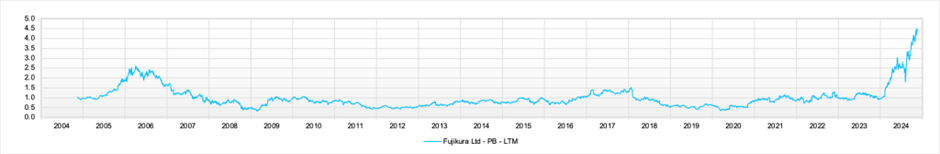

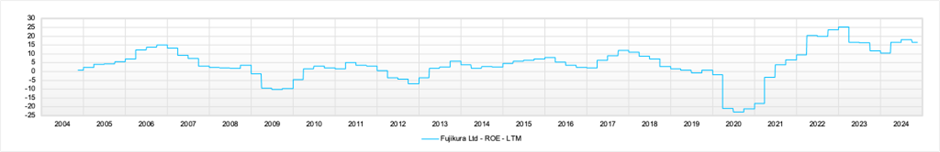

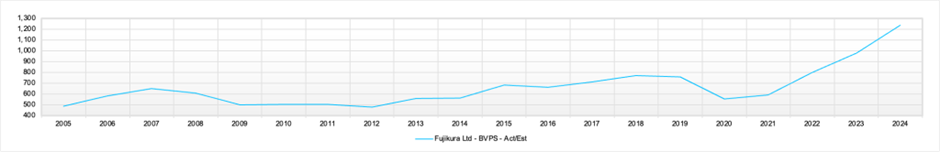

The company’s share price has risen fourfold since the beginning of the year. Should we chase the rally? The PBR had been around 1 for a long time until the end of last year, but it has now expanded to 4.5. On the surface, the stock price has surged, reflecting ROE reaching the 15-20% range over the past few years, the dramatic expansion of BPS, and the thematic interest in the benefits of generative AI.

Price

PBR

PER

ROE

EPS

BPS

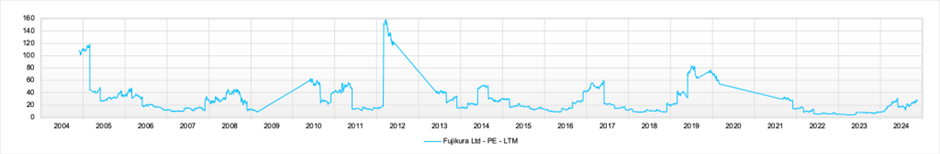

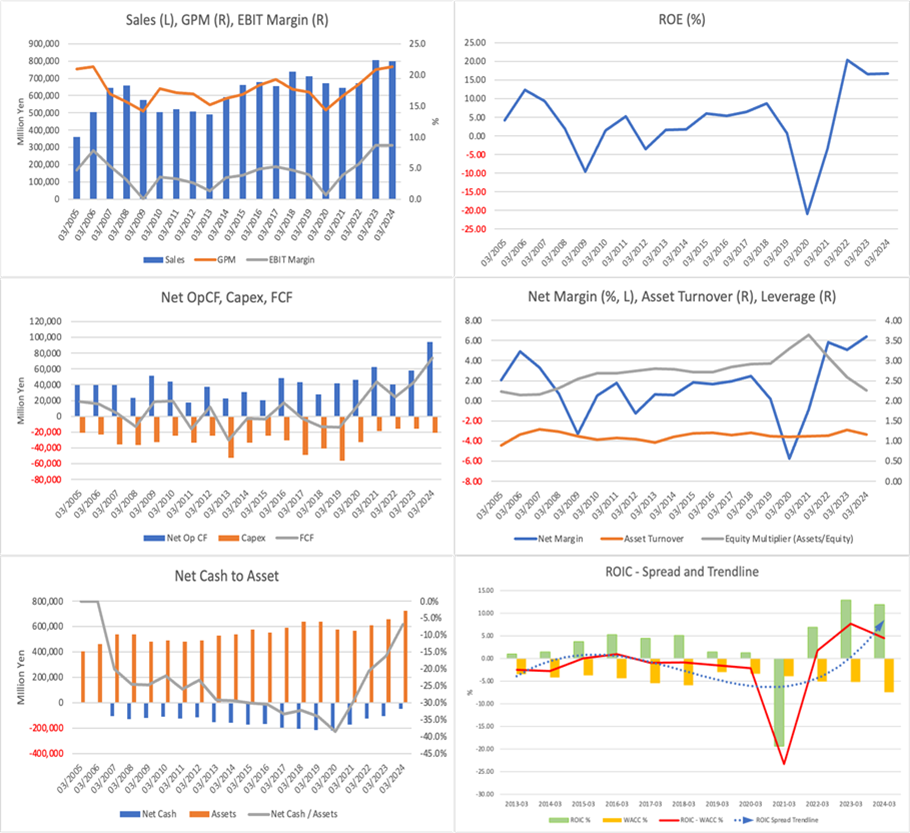

The dramatic rise in the PL profit margin from the bottom in FY3/2020 is remarkable. As a result, the ROE range has risen significantly, and the economic value, which was in the red until FY3/2022, has also begun to be generated favorably. The point to consider is whether the current high profit margin will be maintained. In this regard, the demand for optical wiring due to AI investment may significantly benefit the company, but it is not easy to predict this boom’s length, size, or cycle. In addition, according to the company’s medium-term plan, capital investment is expected to pick up from now on, and the company will enter a new cycle of increased depreciation. Without innovative productivity reforms, the EBIT margin will be pushed down.

Even though the PL profit margins have improved dramatically, it is essential to note that they, which had been persistently low, have recovered to a mediocre level for a manufacturing company. On average the EBIT margin over the past 20 years is 4.3% and the net profit margin is 1.4%. It is hard to imagine that the company is an excellent manufacturing company.

The management team has stated in the medium-term plan that their goal over the next three years is to increase the ROIC spread. While they expect to improve ROIC by increasing the operating income margin and asset turnover ratio, they expect the equity ratio to remain at around 50% three years out. This level of leverage is excessive, and the quality of the management team is questionable, sacrificing return on capital.