Sportsfield (Company note – 3Q update)

| Share price (12/19) | ¥566 | Dividend Yield (24/12 CE) | 2.8 % |

| 52weeks high/low | ¥512/923 | ROE(23/12 act) | 56.1 % |

| Avg Vol (3 month) | 11 thou shrs | Operating margin (23/12) | 25.4 % |

| Market Cap | ¥4.2 bn | Beta (5Y Monthly) | 1.4 |

| Enterprise Value | ¥2.5 bn | Shares Outstanding | 7.43 mn shrs |

| PER (24/12 CE) | 7.1 X | Listed market | TSE Growth |

| PBR (23/12 act) | 2.6 X |

| Click here for the PDF version of this page |

| PDF Version |

Revenue increased, but profits decreased in the 3Q of FY12/2024. The company aims to increase profits for the full year by making up for the shortfall in the 4Q.

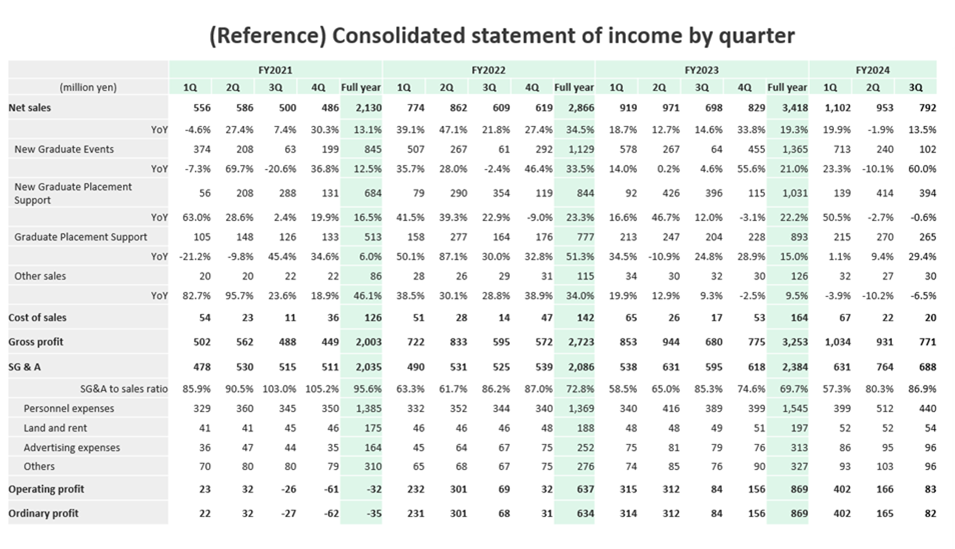

◇ 3Q FY12/2024 Financial Highlights: Double-digit revenue growth but increased expenses for growth led to a decrease in profits

Sportsfield announced its 3Q results (cumulative) results for FY12/2024 on November 12, 2024, with sales of 2.84 billion yen (+10% YoY), operating profit of 650 million yen (-8% YoY), ordinary profit of 650 million yen (-8% YoY), and quarterly net profit attributable to owner of the parent of 410 million yen (-10% YoY). This was in line with the company’s expectations. If we look at the 3Q (July-September) alone, sales were 790 million yen (+13% YoY), operating profit was 80 million yen (slightly down YoY), and ordinary profit was 80 million yen (slightly down YoY), showing signs of a recovery.

Sales are strong. In the first three quarters, the company’s main businesses (New Graduate Events, New Graduate Placement, and Graduate Placement Support) have achieved record sales, and consolidated sales have reached a new high. In the 3Q (July to September), New Graduate Events and Graduate Placement Support business sales have also reached record highs. The company is steadily translating the strength of demand for sports personnel into results.

Concerning profits, investments aimed at growth, such as strengthening the personnel structure, advertising investment to acquire registrants, and investment in internal systems, have increased selling, general, and administrative expenses, and profits have decreased YoY. However, the ordinary profit margin remains high at 22.8%, which is a moderate investment in growth.

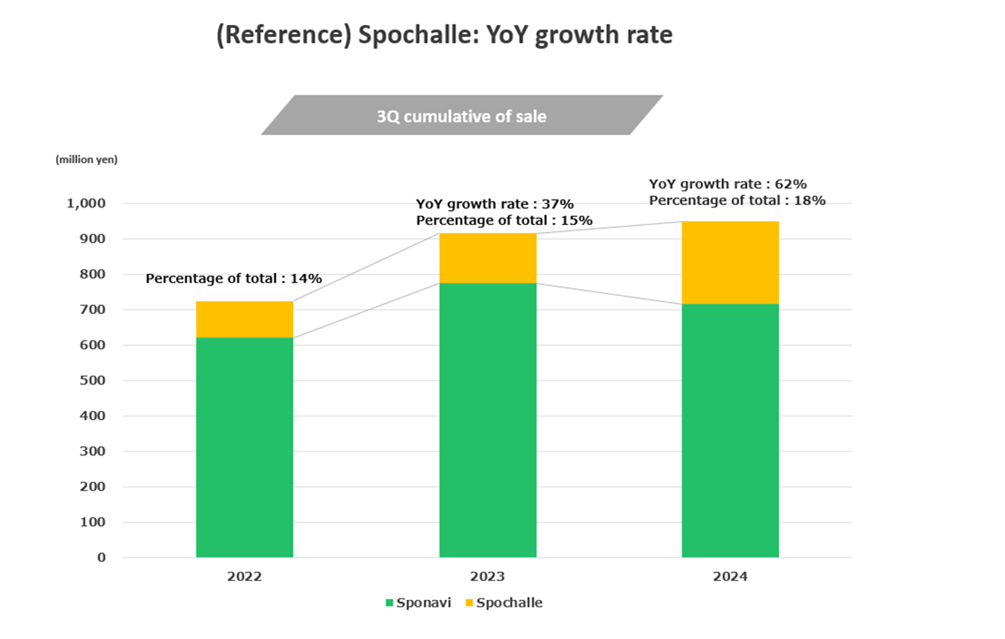

◇ New Graduate Placement Business: Sponavi is struggling to grow, but Spochalle is doing well

If we were to pick out a point of concern this time, it would be that sales in the New Graduate Placement Business are stalling as the quarter progresses. Although sales increased by 50% in 1Q, they decreased by 2% and slightly decreased in 2Q and 3Q, respectively, showing a lack of growth. Although it can be seen as a positive that the company was able to quickly capitalize on the strong demand for new graduates, looking at the details, both issues and achievements can be found.

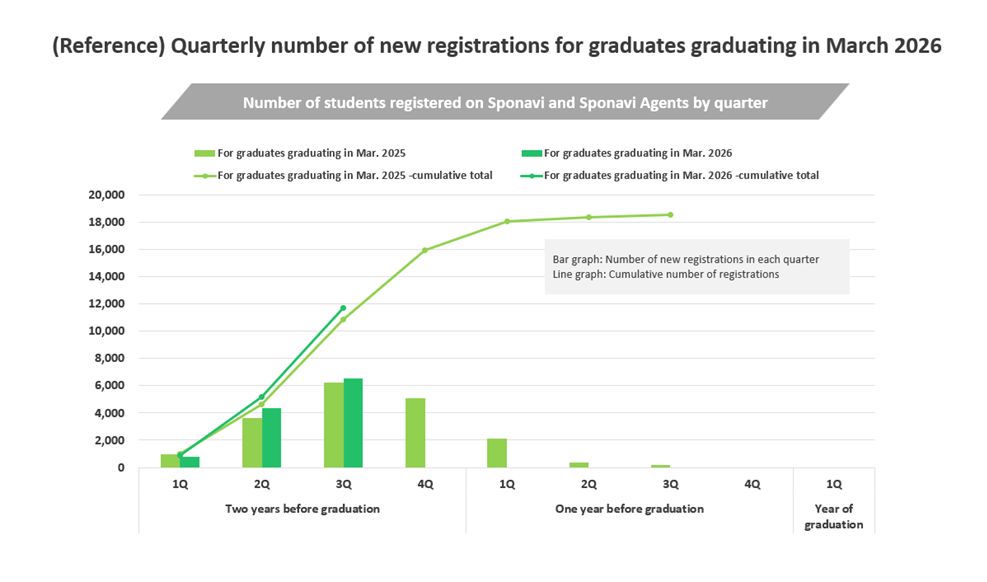

Sponavi, the mainstay of this business, is struggling to grow. The number of students registered on Sponavi, unique student introductions, and the coverage ratio for students graduating in March 2025 have only increased slightly YoY, while the closing ratio has decreased somewhat. As a result, Sponavi sales have decreased YoY (based on the author’s estimates from IR materials). As Sponavi is the company’s flagship business, we hope to see the results of the abovementioned growth investment for the human resources graduating in March 2026.

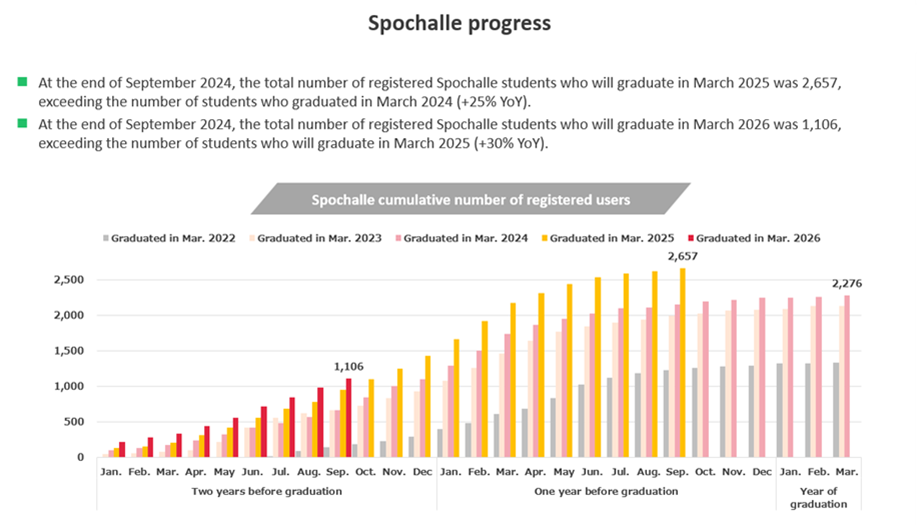

Meanwhile, sales of Spochalle (for students with sports experience, including student athletic teams, sports clubs, and semi-athletic teams) – which complements Sponavi – increased by 65% in the 3Q, and now account for 25% of sales in the New Graduate Placement Business. It could be said that it has grown to become a second pillar.

◇ End of share buyback

The company decided to buy back its shares on August 20, 2024, and the buyback period was from August 21 to August 27, 2024. The number of shares repurchased was 149,100, and the total buyback amount was approximately 100 million yen. There are currently no announcements regarding additional share buybacks.

◇ Full-year company forecast: revenue increase, operating, and ordinary profits increase plans unchanged

The company’s initial full-year forecast for FY12/2024 has been left unchanged: sales of 3.74 billion yen (+9% YoY), operating profit of 900 million yen (+3%), ordinary profit of 900 million yen (+3%), and net profit attributable to owner of the parent of 580 million yen (-3%).

The progress ratio of the cumulative total results up to the 3Q against the full-year forecast is 76.0% for net sales, 72.2% for operating income, and 72.0% for ordinary profit, so a turnaround in profits will be vital to achieving the full-year forecast.

Although it is difficult to expect significant growth in the New Graduate Placement Business due to seasonality, the company expects to achieve its full-year forecast due to firm orders for New Graduate Events of March 2026 and continued growth in the Graduate Placement Support Business.

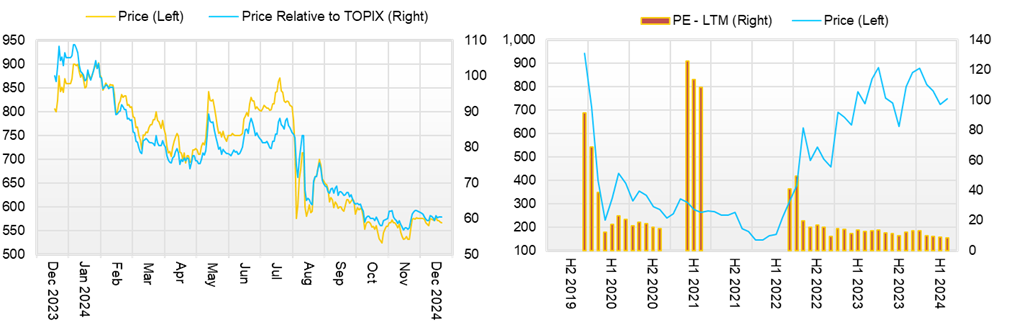

◇Stock Price Trends and Points of Interest

The stock price has fluctuated around 600 to 900 yen since 2023, but it fell below 600 yen on August 2 and 5, when the stock market as a whole fell sharply. Although it rebounded during the period of share buybacks, the 2Q and 3Q results were not enough to provide positive momentum, and the share price remains below 600 yen, in the 570 yen range. Although the double-digit revenue growth in the 3Q is positive, the share price is struggling to find a catalyst for a rise, as profits continue to decline.

If we summarize the points to look out for in the future, the first is whether the company will achieve its full-year earnings forecast. The company’s forecast for the full year is likely to be achieved if the strong orders received for the New Graduate Events Business (up 28% YoY in 3Q YTD and up 8% in 3Q alone) contribute to sales in 4Q as expected and this will provide a foothold for growth in the New Graduate Placement business. Furthermore, if the growth of the Graduate Placement Support Business continues, this will also lead to expectations for the FY12/2025 results.

The next thing to look at is the cumulative number of students registered on Sponavi, etc. (KPI for the New Graduate Placement business in March 2026) and the cumulative number of students registered on Spochalle. According to the company’s 3Q result announcement materials, both are ahead of the progress made in the year up to March 2025, but we would like to see further growth. We would also like to see an improvement in the sales efficiency of the company’s employees who are taking care of these registered users.

Finally, the content of the new medium-term management plan. We hope the necessary measures will be in place to aim for the Prime market while achieving high profitability and sound growth. In addition to expanding business, we would also like to focus on the company’s approach to capital allocation, increasing market capitalization, and improving stock liquidity.

Company profile

Sportsfield Co., Ltd. operates placement services for student-athletic teams and students with sports experience and placement services for these sports human capital graduates. The company’s main businesses are New Graduate Events, New Graduate Placement Support and Graduate Placement Support. The new graduate business is characterised by the detailed support provided by the company’s employees to registered students. Financially, the company has achieved growth while maintaining a high operating margin and return on equity.

Key financial data

| Unit: million yen | 2019/12 | 2020/12 | 2021/12 | 2022/12 | 2023/12 | 2024/12 CE |

| Sales | 1,918 | 1,883 | 2,130 | 2,866 | 3,418 | 3,749 |

| EBIT (Operating Income) | 194 | 16 | -32 | 637 | 870 | 903 |

| Pretax Income | 192 | 32 | -81 | 634 | 869 | 902 |

| Net Profit Attributable to Owner of Parent | 133 | 17 | -79 | 412 | 608 | 586 |

| Cash & Short-Term Investments | 696 | 972 | 976 | 1,458 | 1,467 | |

| Total assets | 1,114 | 1,501 | 1,551 | 2,136 | 2,323 | |

| Total Debt | 334 | 731 | 749 | 630 | 259 | |

| Net Debt | -362 | -241 | -226 | -828 | -1,208 | |

| Total liabilities | 684 | 1,054 | 1,183 | 1,356 | 934 | |

| Total Shareholders’ Equity | 430 | 447 | 368 | 781 | 1,389 | |

| Net Operating Cash Flow | 198 | -89 | 54 | 610 | 449 | |

| Capital Expenditure | 53 | 53 | 53 | 53 | 53 | |

| Net Investing Cash Flow | -25 | -32 | -68 | -7 | -68 | |

| Net Financing Cash Flow | 150 | 396 | 18 | -120 | -371 | |

| Free Cash Flow | 194 | -100 | 3 | 606 | 396 | |

| ROA (%) | 14.34 | 1.30 | -5.19 | 22.36 | 27.27 | |

| ROE (%) | 47.31 | 3.89 | -19.42 | 71.80 | 56.05 | |

| EPS (Yen) | 18.9 | 2.4 | -11.1 | 57.2 | 83.7 | 80.8 |

| BPS (Yen) | 61.0 | 63.3 | 51.3 | 107.9 | 188.7 | |

| Dividend per Share (Yen) | 0.00 | 0.00 | 0.00 | 0.00 | 16.50 | 16.00 |

| Shares Outstanding (Million shrs) | 7.05 | 7.06 | 7.17 | 7.23 | 7.27 |

Source: Omega Investment from company data, rounded to the nearest whole number.

Share price

Quarterly topics

Performance trends

Source: Omega Investment from company materials

New Graduate Placement Support Business

Source: Omega Investment from company materials

New Graduate Placement Support Business KPIs for the next fiscal year

Source: Omega Investment from company materials

Source: Omega Investment from company materials

Financial data (quarterly basis)

| Unit: million yen | 2022/12 | 2023/12 | 2024/12 | ||||||

| 3Q | 4Q | 1Q | 2Q | 3Q | 4Q | 1Q | 2Q | 3Q | |

| (Income Statement) | |||||||||

| Sales | 610 | 620 | 919 | 971 | 698 | 829 | 1,102 | 953 | 793 |

| Year-on-year | 21.8% | 27.4% | 18.7% | 12.7% | 14.6% | 33.8% | 19.9% | -1.9% | 13.5% |

| Cost of Goods Sold (COGS) | 19 | 52 | 70 | 32 | 23 | 60 | 74 | 28 | 29 |

| Gross Income | 591 | 568 | 850 | 940 | 675 | 769 | 1,029 | 925 | 764 |

| Gross Income Margin | 96.9% | 91.6% | 92.4% | 96.7% | 96.7% | 92.8% | 93.3% | 97.1% | 96.3% |

| SG&A Expense | 521 | 535 | 534 | 627 | 590 | 613 | 626 | 759 | 680 |

| EBIT (Operating Income) | 70 | 33 | 316 | 313 | 85 | 156 | 403 | 166 | 83 |

| Year-on-year | -361.0% | -152.9% | 35.5% | 3.7% | 22.0% | 377.3% | 27.7% | -46.9% | -2.2% |

| Operating Income Margin | 11.4% | 5.3% | 34.3% | 32.2% | 12.2% | 18.9% | 36.5% | 17.4% | 10.5% |

| EBITDA | 74 | 37 | 320 | 318 | 90 | 162 | 409 | 172 | 91 |

| Pretax Income | 69 | 32 | 315 | 313 | 85 | 157 | 402 | 166 | 82 |

| Consolidated Net Income | 45 | 23 | 206 | 202 | 53 | 147 | 258 | 105 | 50 |

| Minority Interest | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Net Income ATOP | 45 | 23 | 206 | 202 | 53 | 147 | 258 | 105 | 50 |

| Year-on-year | -161.4% | -155.1% | 38.3% | 3.4% | 17.7% | 544.6% | 25.7% | -47.9% | -5.2% |

| Net Income Margin | 7.4% | 3.7% | 22.4% | 20.8% | 7.6% | 17.8% | 23.4% | 11.1% | 6.3% |

| (Balance Sheet) | |||||||||

| Cash & Short-Term Investments | 1,509 | 1,458 | 1,146 | 1,462 | 1,519 | 1,467 | 1,600 | 1,807 | 1,706 |

| Total assets | 2,146 | 2,136 | 1,919 | 2,214 | 2,257 | 2,323 | 2,464 | 2,598 | 2,480 |

| Total Debt | 669 | 630 | 373 | 329 | 284 | 259 | 234 | 209 | 175 |

| Net Debt | -840 | -828 | -773 | -1,133 | -1,235 | -1,208 | -1,365 | -1,598 | -1,531 |

| Total liabilities | 1,388 | 1,356 | 932 | 1,025 | 1,015 | 934 | 938 | 966 | 898 |

| Total Shareholders’ Equity | 758 | 781 | 986 | 1,189 | 1,242 | 1,389 | 1,527 | 1,632 | 1,582 |

| (Profitability %) | |||||||||

| ROA | 18.36 | 22.36 | 25.84 | 22.66 | 21.98 | 27.27 | 30.16 | 23.45 | 23.71 |

| ROE | 59.64 | 71.80 | 62.45 | 50.06 | 48.40 | 56.05 | 52.61 | 40.00 | 39.76 |

| (Per-share) Unit: JPY | |||||||||

| EPS | 6.2 | 3.2 | 28.4 | 27.9 | 7.3 | 20.2 | 35.1 | 14.3 | 6.9 |

| BPS | 104.8 | 107.9 | 135.9 | 163.8 | 170.8 | 188.7 | 207.4 | 221.2 | 218.9 |

| Dividend per Share | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 16.50 | 16.50 | 16.50 | 16.50 |

| Shares Outstanding(million shrs) | 7.23 | 7.23 | 7.24 | 7.26 | 7.27 | 7.27 | 7.36 | 7.38 | 7.38 |

Financial data (full-year basis)

| Unit: million yen | 2019/12 | 2020/12 | 2021/12 | 2022/12 | 2023/12 |

| (Income Statement) | |||||

| Sales | 1,918 | 1,883 | 2,130 | 2,866 | 3,418 |

| Year-on-year | 26.5% | -1.8% | 13.1% | 34.5% | 19.3% |

| Cost of Goods Sold | 111 | 130 | 151 | 159 | 184 |

| Gross Income | 1,807 | 1,754 | 1,979 | 2,707 | 3,234 |

| Gross Income Margin | 94.2% | 93.1% | 92.9% | 94.4% | 94.6% |

| SG&A Expense | 1,613 | 1,737 | 2,011 | 2,070 | 2,364 |

| EBIT (Operating Income) | 194 | 16 | -32 | 637 | 870 |

| Year-on-year | 52.4% | -91.7% | -300.2% | -2061.9% | 36.5% |

| Operating Income Margin | 10.1% | 0.9% | -1.5% | 22.2% | 25.4% |

| EBITDA | 212 | 36 | -6 | 654 | 890 |

| Pretax Income | 192 | 32 | -81 | 634 | 869 |

| Consolidated Net Income | 133 | 17 | -79 | 412 | 608 |

| Minority Interest | 0 | 0 | 0 | 0 | 0 |

| Net Income ATOP | 133 | 17 | -79 | 412 | 608 |

| Year-on-year | 82.6% | -87.2% | -564.0% | -621.0% | 47.5% |

| Net Income Margin | 6.9% | 0.9% | -3.7% | 14.4% | 17.8% |

| (Balance Sheet) | |||||

| Cash & Short-Term Investments | 696 | 972 | 976 | 1,458 | 1,467 |

| Total assets | 1,114 | 1,501 | 1,551 | 2,136 | 2,323 |

| Total Debt | 334 | 731 | 749 | 630 | 259 |

| Net Debt | -362 | -241 | -226 | -828 | -1,208 |

| Total liabilities | 684 | 1,054 | 1,183 | 1,356 | 934 |

| Total Shareholders’ Equity | 430 | 447 | 368 | 781 | 1,389 |

| (Cash Flow) | |||||

| Net Operating Cash Flow | 198 | -89 | 54 | 610 | 449 |

| Capital Expenditure | 5 | 12 | 51 | 3 | 53 |

| Net Investing Cash Flow | -25 | -32 | -68 | -7 | -68 |

| Net Financing Cash Flow | 150 | 396 | 18 | -120 | -371 |

| Free Cash Flow | 194 | -100 | 3 | 606 | 396 |

| (Profitability %) | |||||

| ROA | 14.34 | 1.30 | -5.19 | 22.36 | 27.27 |

| ROE | 47.31 | 3.89 | -19.42 | 71.80 | 56.05 |

| (Per-share) Unit: JPY | |||||

| EPS | 18.9 | 2.4 | -11.1 | 57.2 | 83.7 |

| BPS | 61.0 | 63.3 | 51.3 | 107.9 | 188.7 |

| Dividend per Share | 0.00 | 0.00 | 0.00 | 0.00 | 16.50 |

| Shares Outstanding (million shrs) | 7.05 | 7.06 | 7.17 | 7.23 | 7.27 |

Source: Omega Investment from company materials