AViC (Price Discovery)

Accumulate

Profile

AViC operates internet advertising and SEO (search engine optimization) consulting services. It was established in 2013. Sales by business segment: Internet advertising 59%, SEO consulting 41% <FY9/2024>

| Securities Code |

| TYO:9554 |

| Market Capitalization |

| 8,016 million yen |

| Industry |

| Service |

Stock Hunter’s View

New customer acquisition is going well. With increased large projects and higher unit prices, the company will likely achieve high growth again this fiscal year.

AViC provides internet advertising and SEO (search engine optimization) consulting services. It supports communication between clients and users by providing a comprehensive service from marketing strategy planning to implementation. AViC delivers services directly to clients or via advertising agencies. Its primary business is managed advertising services, and its main source of income is media fees plus consulting fees.

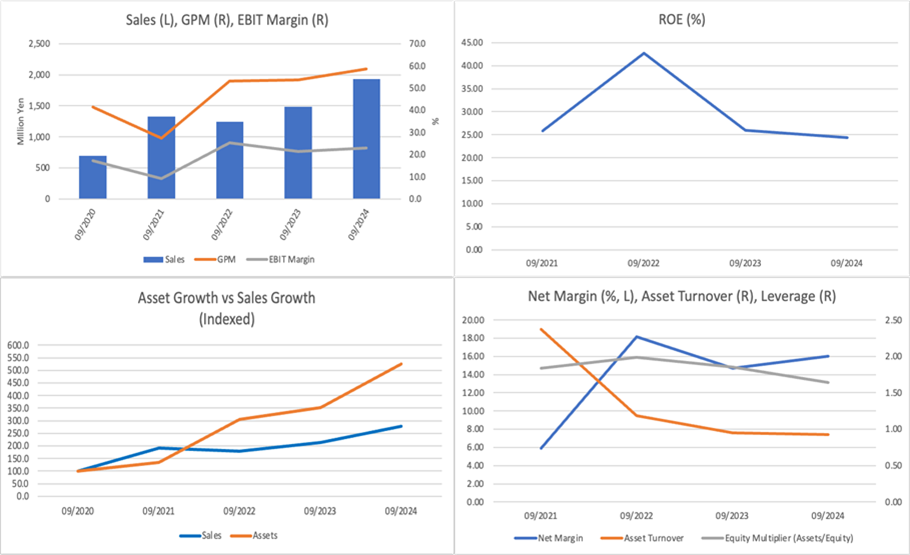

In the previous FY9/2024, the company achieved a 30% increase in revenue and a 40% increase in operating profit while focusing on acquiring new customers. Although there was some deviation from the plan in terms of hiring, progress was steady. Currently, the unit price per customer is increasing in line with an increase in large projects for enterprise customers. There are also multiple projects with a high probability of being ordered, and the company is forecasting high growth for FY9/2025, with sales of 2.517 billion yen (up 30.1% YoY) and operating profit of 671 million yen (up 50.4% YoY).

In addition, the company plans to record its first order from its Chinese joint venture in the 2Q (January to March). It plans to use this to expand its B2C marketing support for the Chinese market and its business related to Japanese companies expanding into China.

Investor’s View

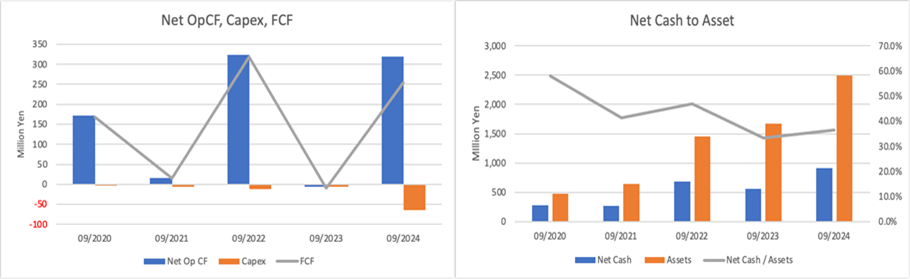

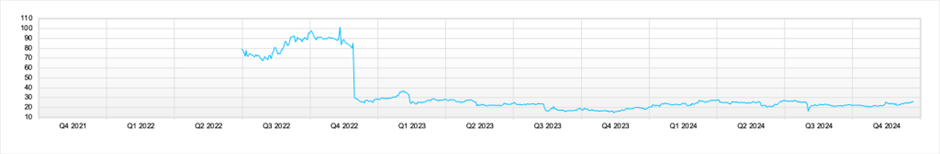

Accumulate. It is difficult to forecast the long-term of the company, but its earnings in the near term are strong, and the company should continue accumulating cash for the time being. The forecast PER after adjusting for net cash is 16 times, which is not so demanding. However, given the expectation of an upward swing in profits, an equity profit yield of around 6%, and limited liquidity, it should be sensible to start buying the shares now without waiting for a dip in the share price.

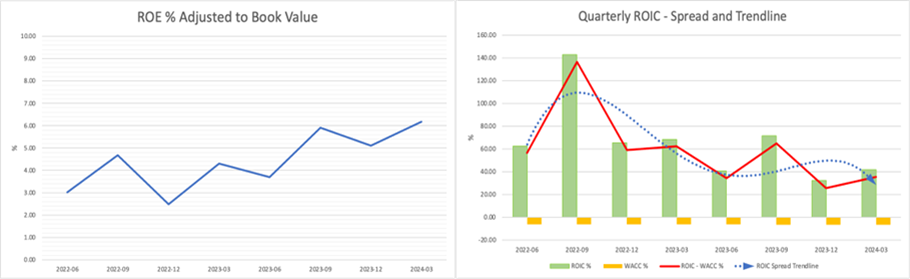

The company’s ROE is over 20% high because its PL profit margin is high, and leverage also works well. This is unsurprising for an IT company, but its BS is slim.

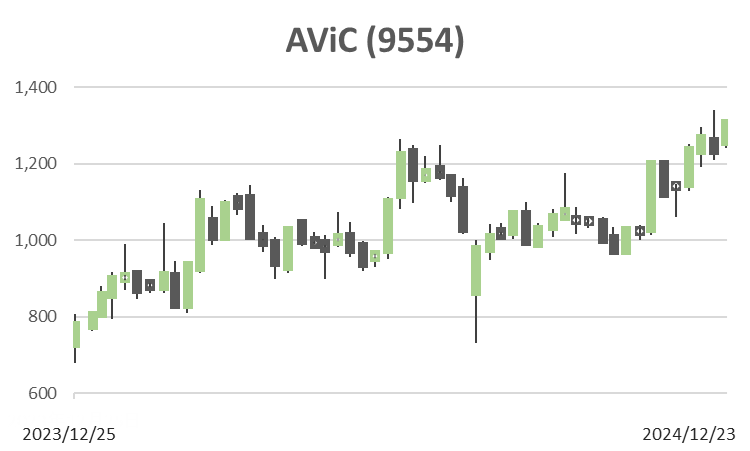

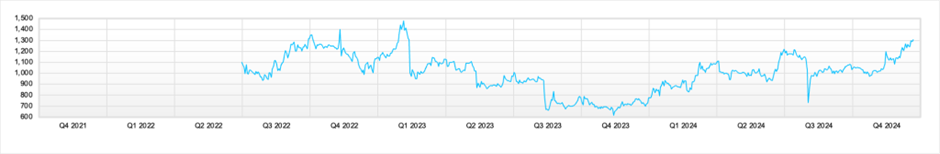

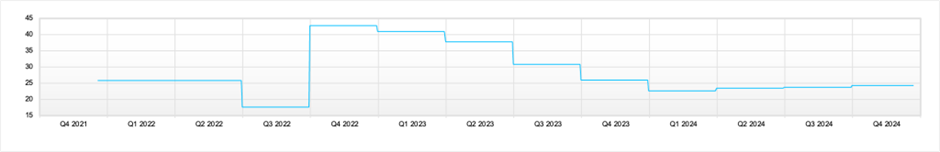

After falling 32% last year, the share price has risen 68% YTD. The excessive share price premium following the IPO in June 2022 has fallen away, and the share price appears to have been rated more sensibly, reflecting the value of the business. Sales increased by 29% and EBIT by 39% on a 4-year CAGR basis. As Stock Hunter points out, the business is strong at the moment. For the time being, cash is likely to continue to accumulate.

As indicated by the ROE adjusted for PBR, the equity yield has continued to rise since the end of last year and is attractive at around 6%. A PBR of 5x is nothing to be afraid of. Economic value is also being steadily created.

Price

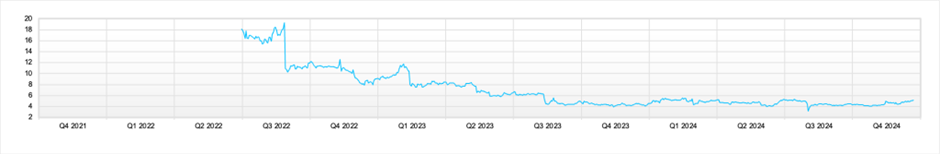

PBR

PER

ROE

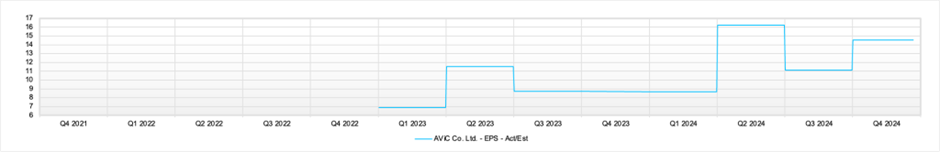

EPS