Dawn Corporation (Price Discovery)

Buy

Profile

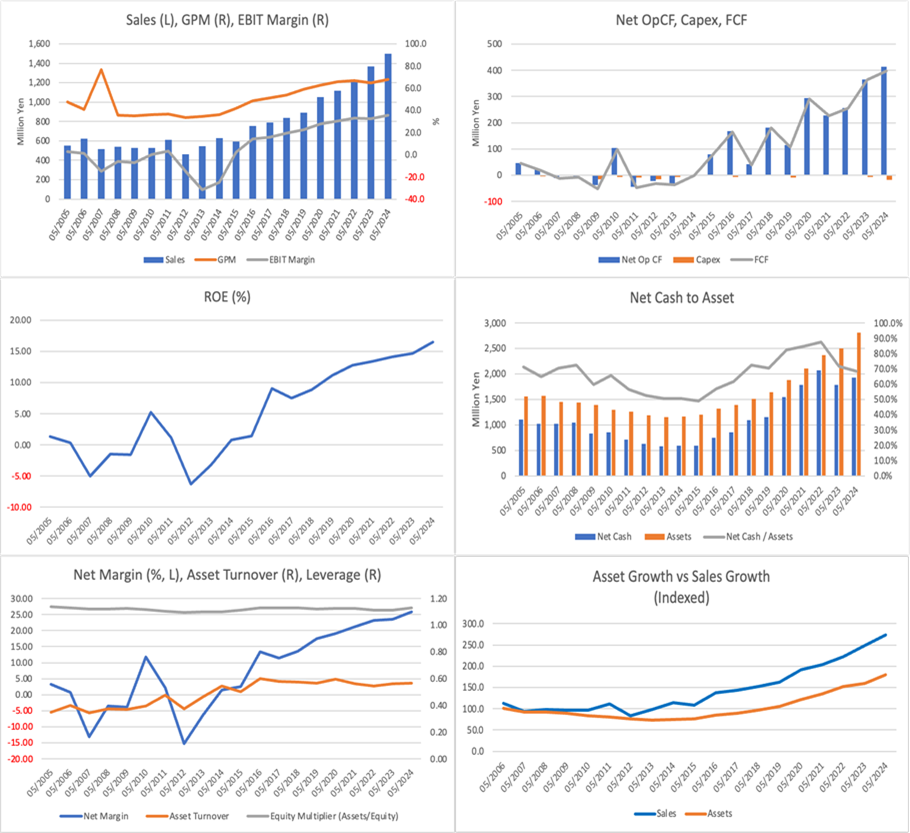

Dawn is a research and development company specialising in geographic information systems. Its main business is the development and sale of geographic information systems (GIS) and cloud services, with a focus on the disaster prevention. The company’s systems are used in the disaster prevention and security fields by local governments and other organisations and in the social infrastructure field by private companies. The company was established in 1991 and is headquartered in Kobe City. Sales by business segment %: Cloud Usage 52, Commissioned Development 41, License 5, Digital Maps 2 <FY5/2024>

| Securities Code |

| TYO:2303 |

| Market Capitalization |

| 6,927 million yen |

| Industry |

| Information / Communication |

Stock Hunter’s View

An essential company that protects human life. Increasingly being introduced in lifesaving, disaster prevention, and crime prevention.

Dawn has developed its cloud solutions related to geographic information in recent years based on the technology and know-how it has cultivated in its geographic information system (GIS) business, which was its original business when it was first established. It provides various systems that support people who work in lifesaving jobs via SaaS-type cloud services. As this area directly affects human lives, it is less likely to have its budget cut than other services for government agencies, and its business performance continues to expand due to the steady accumulation of cloud usage fees.

The ‘Live119’ video reporting system for fire and emergency services has become a social infrastructure in less than five years since its launch. This is partly due to its increased recognition through TV broadcasts and other media. In addition, the adoption of disaster prevention and crime prevention apps that distribute disaster prevention and crime information to citizens is also increasing. The crime prevention app has been adopted by the Tokyo Metropolitan Police Department, Aichi Prefecture, Hiroshima Prefecture, and others, and the Tokyo Metropolitan Police Department’s ‘Digipolis’ has reached an unprecedented 800,000 downloads for a government app.

For the fiscal year ending May 2025, the company plans to achieve record-high sales of 15.8 billion yen (up 5.3% YoY) and operating profit of 5.6 billion yen (up 5.1% YoY). The company also confirmed that its second-quarter results, announced on 9 January, were progressing smoothly. From 18 January, the Japan Coast Guard will begin operating the ‘Live118’ video reporting service.

Investor’s View

BUY. The company’s fundamentals are excellent, and the share price is being overlooked.

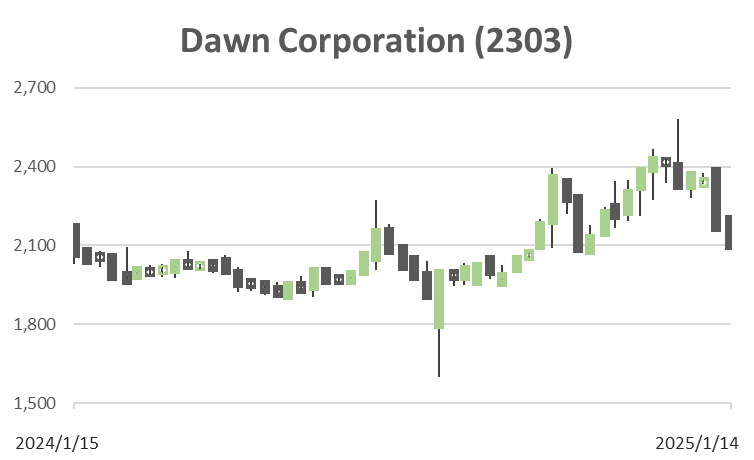

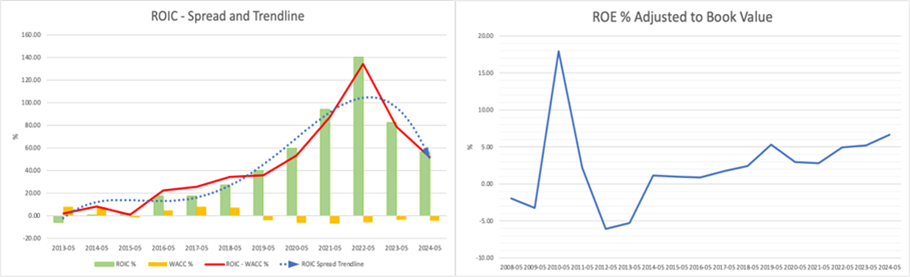

Cash flow generation has been plentiful in recent years. Net cash of 2.2 billion yen equals 28% of the market capitalisation. After adjusting for net cash, the forecast PER is 13 times. ROE is high, and the trend is upward. As measured by ROE adjusting for PBR, the equity yield is just under 7%. These figures make us think the share price is reasonably cheap.

Economic value creation is also good. Although valuations have fluctuated wildly in the past, over the last three years, they have been fairly stable at around PBR 3x and PER 20x. With the market continuing to be led by large-cap stocks, Dawn, which is small even among small-cap stocks, is being overlooked by investors. This is a good opportunity to hold for the long term, looking to achieve a significant return.

Price

PBR

PER

ROE