Fuso Chemical (Price Discovery)

Short-term Buy / Long-term Cautious

Profile

Fuso Chemical supplies ultra-high purity colloidal silica, a chemical mechanical polishing (CMP) material essential to the semiconductor manufacturing process, and has built up a near-monopoly position in the global market. The company’s business is divided into Life Science and Electronic Materials & Functional Chemicals. The former manufactures and sells fruit acids such as malic acid and citric acid, food additives, and gluconic acid, while the latter manufactures and sells ultra-high purity colloidal silica, resin additives, pharmaceutical raw materials, and photographic chemical raw materials.

In FY3/2024, the Life Science business accounted for 58% of sales (OPM 17%), and the Electronic Materials & Functional Chemicals business accounted for 42% (OPM 30%), with overseas sales accounting for 47% of total sales.

| Securities Code |

| TYO:4368 |

| Market Capitalization |

| 122,158 million yen |

| Industry |

| Chemistry |

Stock Hunter’s View

The world’s one-of-a-kind company in the CMP materials industry. The company has revised its earnings and dividend forecasts upwards, thanks to increased demand in the semiconductor market.

Fuso Chemical is a company that supplies ultra-high purity colloidal silica, a chemical mechanical polishing (CMP) material essential for semiconductor manufacturing, and it has a near-monopoly on the global market. As semiconductors continue to become more highly integrated and miniaturised, nano-level polishing and planarisation in manufacturing are essential. Still, only a few companies can provide a stable supply of ultra-high purity colloidal silica for cutting-edge semiconductors.

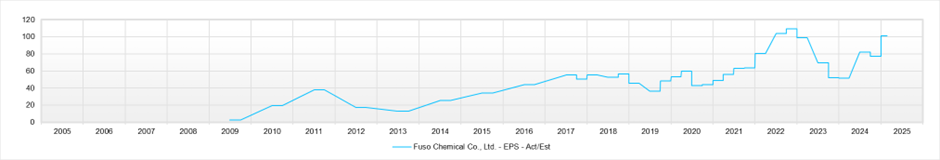

Against the backdrop of this growth in demand, the company revised its full-year earnings forecast for FY3/2025 upwards on 18 February. It raised its sales forecast from 68 billion yen to 69.4 billion yen (up 17.6% YoY) and its operating profit forecast from 13.5 billion yen to 16 billion yen (up 44.3% YoY). The main reason for this was strong sales to the semiconductor market. The company has also increased its year-end dividend forecast from 35 yen to 38 yen, bringing the annual dividend to 73 yen (66 yen in the previous year). This is the second time the company has increased its dividend forecast this year.

The company is working to increase production capacity and strengthen technological development to meet growing demand. In October last year, it completed the expansion of its facilities at its Kyoto office, and the second phase of construction at its Kashima office is scheduled for completion in July this year. As a result, the company’s facility capacity will expand by approximately 1.5 times compared to fiscal 2022. The company is also developing new products for next-generation 2nm (nanometer) generation cutting-edge semiconductors and SiC power semiconductors and is preparing a system for future growth.

Investor’s View

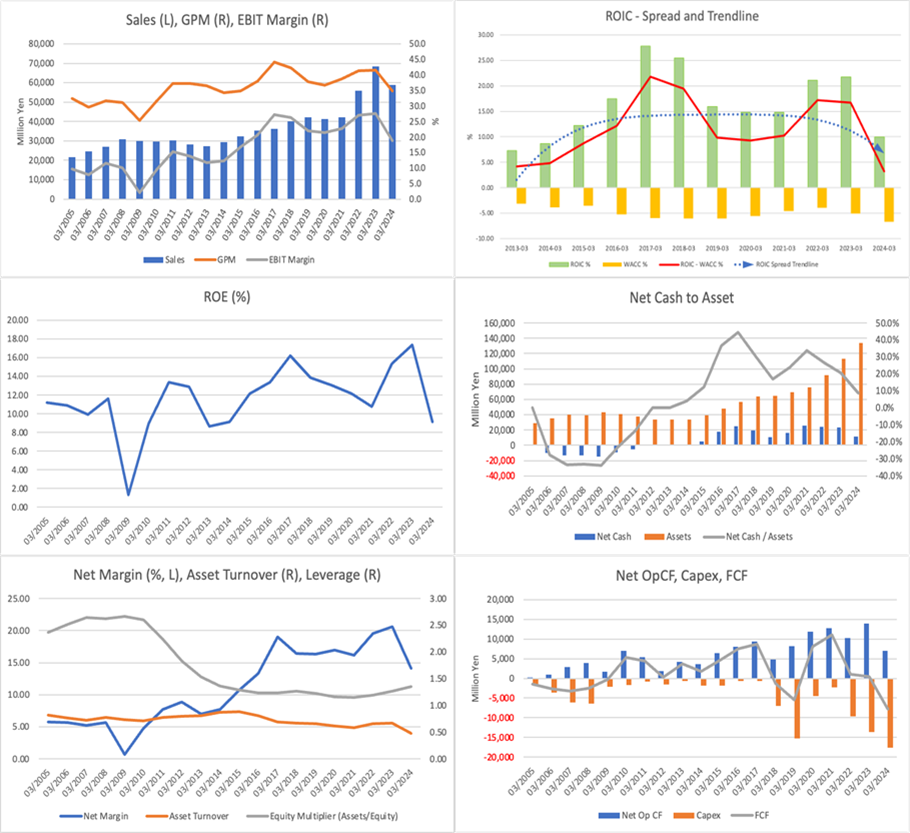

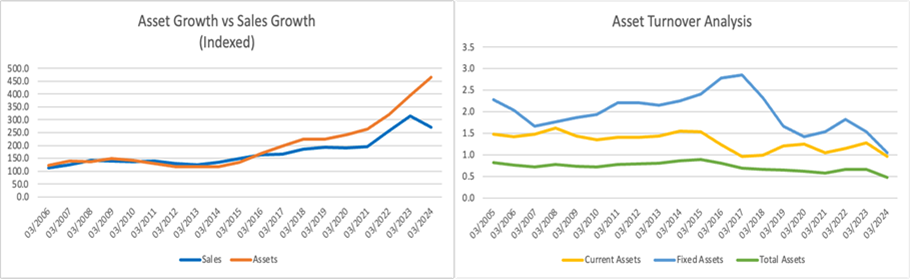

Tempted to buy over the short-term, cautious over the long-term. Near-term earnings are strong, and there may be positive surprises. On the other hand, the rapid expansion of production capacity weighs on the return on capital. The break-even point must have risen, and the earnings risk in the changeable semiconductor market is increasing. Hence, cautious valuations are sensible.

Fuso Chemical has established a dominant position in the supply of ultra-high purity colloidal silica. It maintains strong business performance, takes advantage of the semiconductor market’s recovery, and expands production capacity. The electronic materials business is driving growth, and while earnings continue to grow, the company is also focusing on returning profits to shareholders while actively investing in facilities and R&D. It is strengthening its response to the next-generation semiconductor market, aiming to improve its long-term competitiveness. Its financial base is also stable, and demand for polishing agents for cutting-edge semiconductors is expected to continue to increase. For these reasons, there is good scope for long-term growth.

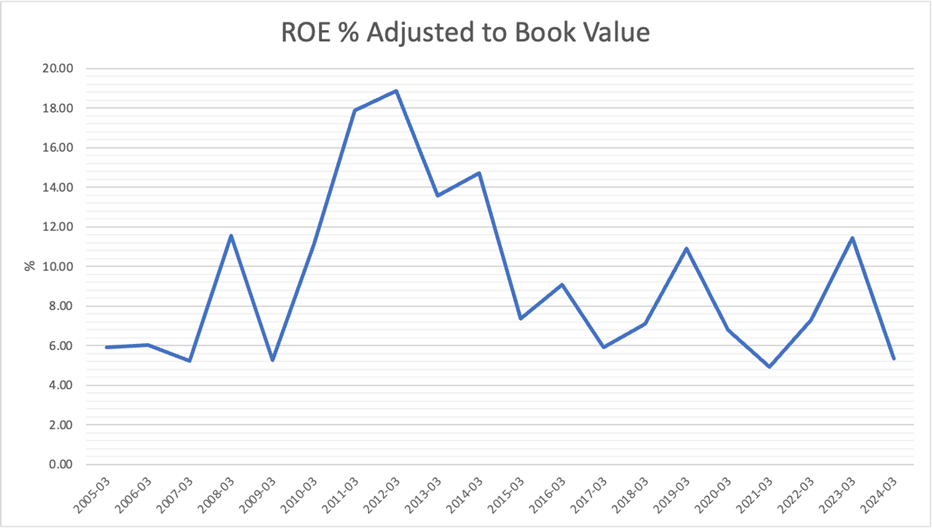

Solid business performance is expected in the short term, and a positive surprise is also possible. However, due to the rapid expansion of production capacity, ROE and ROIC are trending downward. The break-even point has also risen in line with the expansion of facilities, and the risk of earnings fluctuating due to changes in the semiconductor market is increasing.

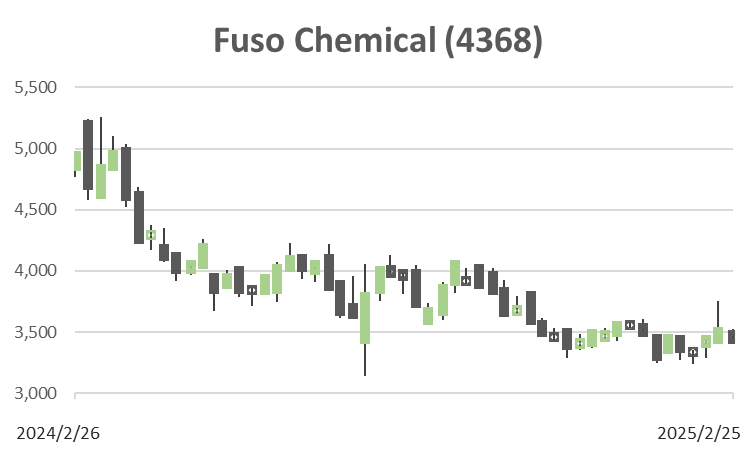

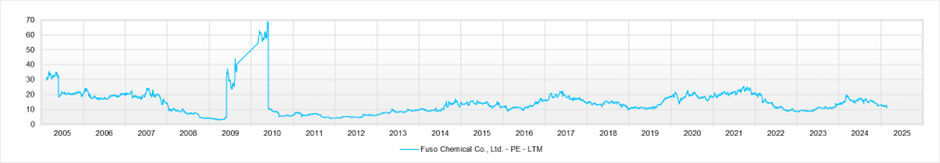

PER is just under 13 times, and PBR is 1.2 times, and combined with the fact that ROE is just under 10% and the company’s earnings are strong in the short term, the stock appears undervalued. However, the underlying trend in equity yield is negative due to the ongoing decline in capital efficiency, which is a factor that is suppressing the rise in share price. In 2023, the share price rose by 23% against a significant upward revision to the medium-term management plan and strong business performance. Last year, it fell by 15%, and since the beginning of the year, it has been weak, down 1%. These suggest that investors are already carefully factoring in the risk of a deterioration in capital efficiency, an increase in the break-even point, and the cycle risk of the semiconductor market.

When making investment decisions in the future, it will be necessary to carefully assess whether the results of growth investments will lead to actual improvements in business performance and whether capital efficiency will improve. Although profits will increase in line with sales growth, there is a high probability that capital efficiency will continue to decline. Even if PER increases slightly, the downward trend in capital efficiency will offset this, and there is expected to be no significant change in the PBR. Therefore, although there may be opportunities to buy in the short term, a cautious approach is appropriate for long-term investment.

Price

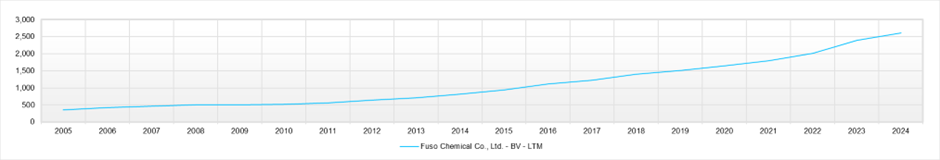

PBR (LTM)

PER (LTM)

ROE (LTM)

EPS (LTM)

BPS (LTM)