Zenkoku Hosho (Price Discovery)

Weak Hold

Profile

Zenkoku Hosho is Japan’s largest independent credit guarantee company, specialising in mortgage loan guarantees. In addition to its core mortgage guarantee services, the company offers a wide range of guarantees, including for education, apartment construction, and card loans, while also engaging in related businesses. As of FY2024/3, credit guarantee operations account for 100% of the company’s revenue. Alongside efforts to scale and streamline operations through strategic alliances, the company is also pursuing business expansion via M&A and venture investments.

| Securities Code |

| TYO:7164 |

| Market Capitalization |

| 406,068 million yen |

| Industry |

| Other financial business |

Stock Hunter’s View

Expansion of Guarantee Obligations through M&A. Current Mid-Term Plan within Reach.

Zenkoku Hosho is the largest provider of mortgage loan guarantees in Japan. As an independent guarantor not affiliated with any specific financial group, it can form partnerships with a wide variety of financial institutions across the country. Its strength lies in its ability to design a diverse range of guarantee products.

The company’s M&A activity has proved successful. For FY2025/3, full-year performance is expected to exceed initial guidance, with operating revenue projected at JPY 56.7 billion (+9.8% YoY) and operating profit at JPY 41.5 billion (+6.1% YoY). Accordingly, the company has revised its year-end dividend forecast upward, from JPY 197 to JPY 209 per share. Zenkoku aims for a payout ratio of 50% by the fiscal year ending March 2026, enhancing its appeal from a shareholder returns perspective.

The numerical targets of the current mid-term management plan (final year: FY2026/3) — guarantee obligations of JPY 19 trillion, operating revenue of JPY 60 billion, and ordinary profit of JPY 48.5 billion — appear well within reach. Progress is steady in executing its three strategic pillars: (1) expansion of the core business, (2) entry into adjacent businesses, and (3) enhancement of corporate value. The company is delivering growth through both organic and inorganic means.

Notably, the impact of rising interest rates is expected to be limited, given mechanisms such as the ‘5-Year Rule’ and ‘125% Rule’ that apply to mortgage loans.

* 5-Year Rule: A regulation whereby the total monthly repayment amount (principal plus interest) remains unchanged for the first five years, even if interest rates fluctuate.

* 125% Rule: Even when repayments are revised every five years, the increase in the monthly repayment amount is capped at 125% of the previous amount.

Investor’s View

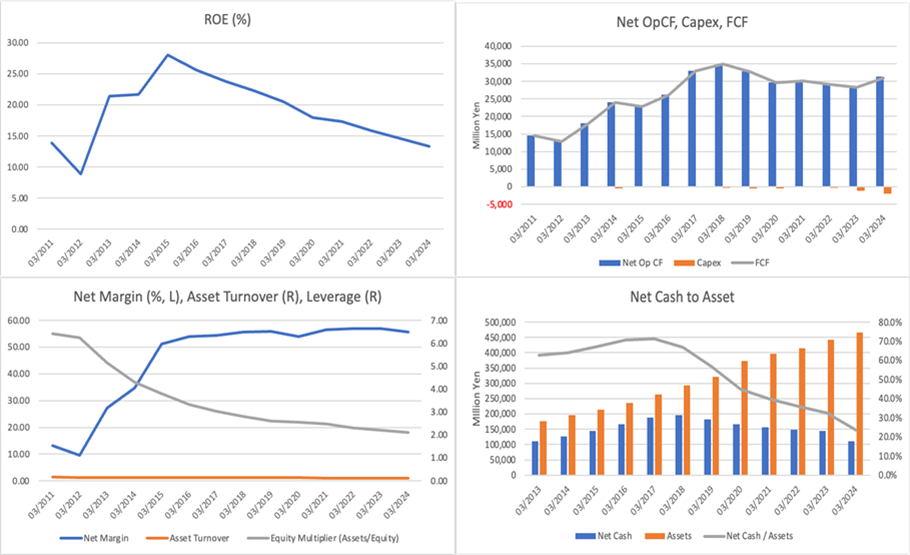

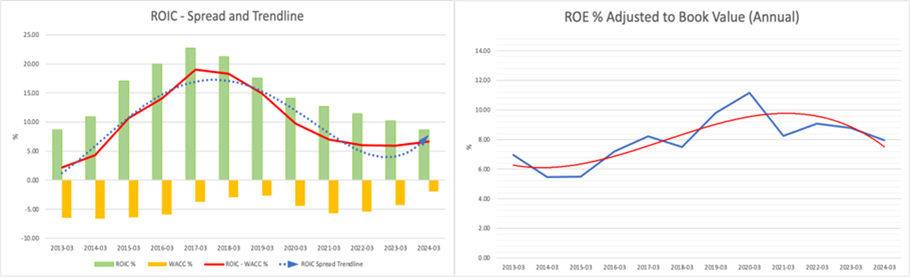

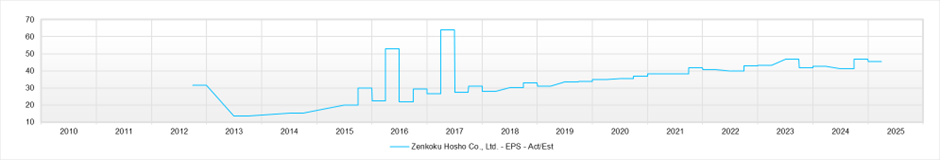

Weak Hold. Zenkoku Hosho, as the most significant independent player in the mortgage loan guarantee segment, continues to deliver steady top-line growth and exceptionally high post-tax margins underpinned by a highly robust financial position. On the other hand, the company is overcapitalised, and its declining ROE trend is likely to persist. ROE, which approached 30% in FY2015, has dropped sharply over the past decade, driven by a significant reduction in leverage. While total assets have doubled, shareholders’ equity has tripled over the same period. This suggests pursuing excessive financial safety at the expense of return on equity. Little evidence suggests that capital efficiency has been a conscious management focus.

Although total shareholder return is high by Japanese market standards, the more pressing concern for equity valuation is the continued erosion in ROE. While the company continues creating economic value, the ROIC spread is not compelling. The level of invested capital appears excessive. Valuation expansion could be material if the company implements measures directly targeting this inefficiency. The company’s mid-term plan presents only a scattergun list of ideas with little persuasive substance regarding ROE improvement.

Company Overview

Zenkoku Hosho is Japan’s largest independent credit guarantee company, with a business focus on mortgage loan guarantees. Since its founding in 1981, the company has played a central role in the Japanese housing finance market by partnering with financial institutions to guarantee loans for home purchases, refinancing, and renovations. As of FY2024/3, credit guarantee operations account for 100% of its revenue, supported by consistently high operating margins.

In addition to core mortgage guarantees, Zenkoku has broadened its product offering to cover education, apartment construction, and card loans. It also engages in credit research, debt collection, insurance agency, and contract management services. These initiatives aim to enhance operational efficiency and value-added services.

In recent years, Zenkoku has pursued business diversification through M&A and venture investments in startups, seeking synergies with its core business as part of a broader growth strategy. Nevertheless, the company’s structure relies heavily on credit guarantees, and new investments’ revenue contribution and risk management warrant careful scrutiny. Striking a balance between stable core earnings and expansion into new domains will be essential for future value creation.

Business Characteristics and Model

Zenkoku’s business model centres on guaranteeing mortgage loans. It collects guarantee fees—either lump sum or monthly—from borrowers and assumes the risk of substitute payment. This structure benefits both borrowers and financial institutions. Notably, as the only genuinely independent mortgage guarantee provider in Japan, Zenkoku can partner with over 700 institutions nationwide without the constraints of group affiliation.

The company also participates in peripheral guarantee services and debt recovery through its subsidiaries. More recently, it has expanded into credit-risk-adjacent areas such as RMBS acquisition and ABL lending.

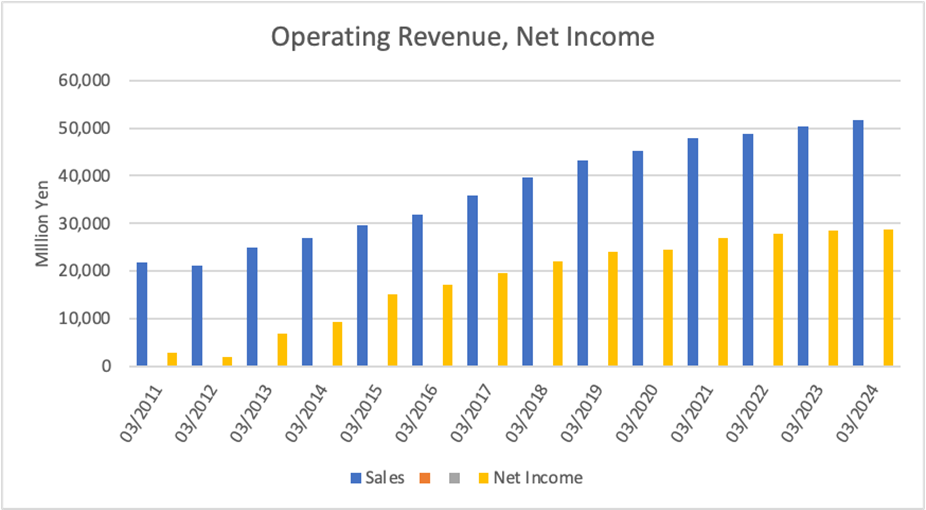

Long-Term Performance

Between FY2020/3 and FY2024/3, operating revenue grew from approximately JPY 45.2 billion to JPY 51.6 billion, representing a CAGR of around 2.8%. Operating margins consistently exceeded 75%, highlighting the firm’s outstanding profitability. Operating cash flow remained strong, while substitute payment ratios and delinquent guaranteed obligations stayed extremely low. Meanwhile, shareholders’ equity surged, resulting in a decline in ROE from 18.0% in FY2020 to 13.1% in FY2024. This shift in capital structure has dampened the apparent return profile of the business.

Recent Performance (FY2025/3 Q3)

For the nine months ended Q3 FY2025/3, operating revenue rose to JPY 33.4 billion (+4.8% YoY), ordinary profit to JPY 25.3 billion (+0.8%), and net profit attributable to parent company shareholders to JPY 18.1 billion (+1.6%), indicating solid revenue and profit growth. The increase was driven by the accumulation of guarantee obligations and negative goodwill from M&A. Although higher credit-related expenses, personnel costs, and system expenses slightly eroded the operating profit (-1.3%), the structural earnings base remains robust.

Full-Year Forecast (FY2025/3)

The full-year guidance remains unchanged, with operating revenue projected at JPY 55.7 billion (+7.9% YoY) and net profit at JPY 30.0 billion (+4.2%). Guarantee obligations are expected to exceed JPY 19 trillion, ahead of the mid-term plan target. Although credit-related costs and system investments are trending higher, these are being offset by increased investment income and gains from ABL lending, preserving earnings momentum.

Growth Strategy and Risks

Zenkoku’s growth strategy focuses on expanding its share in the mortgage loan market and advancing into adjacent fields such as RMBS, venture investment, and corporate venture capital (CVC). Organic growth is driven by product development and penetration into niche segments, while inorganic growth is pursued by acquiring competitor guarantee portfolios.

However, new housing starts are in secular decline, and growth in the mortgage loan market overall cannot be assumed. There is a risk that excessive accumulation of guarantee obligations could lead to an inflated risk asset base. Furthermore, RMBS and ABL lending, though similar in credit risk profile to the core guarantee business, do not directly contribute to improved capital efficiency.

Mid-Term Management Plan

The current mid-term plan (FY2023–2025) envisions becoming a “mortgage loan platform provider,” with key targets including JPY 19 trillion in guarantee obligations and ROE of 14% or higher. While the guarantee balance target is on track, aided by M&A, the trajectory for ROE recovery remains uncertain.

The plan’s capital policy includes a phased increase in the dividend payout ratio and flexible share buybacks but stops short of more fundamental measures to optimise the capital structure. While a variety of initiatives are listed, their specific impact on ROE is insufficiently substantiated, weakening the plan’s credibility.

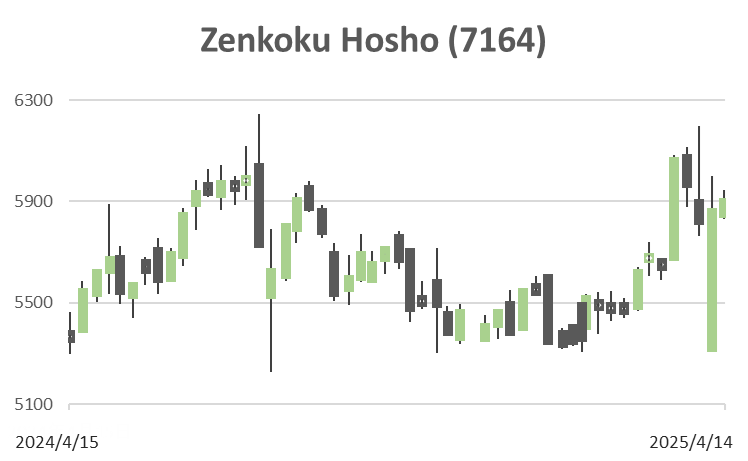

Share Price and Valuation

As of the end of FY2024/3, the stock trades on 13.6x PER and 1.3x PBR, broadly in line with market averages. The expected total shareholder return for the current fiscal year is just under 70%, including buybacks, reflecting a progressive shareholder return policy. However, ROE has halved over the past decade from nearly 30% to around 13%, acting as a cap on valuation upside.

The ROIC spread over capital cost is limited, and while economic value creation is ongoing, it is not especially compelling. Given that declining financial leverage is the principal cause of lower ROE and that there is no clear strategy for capital optimisation, a material re-rating appears unlikely in the absence of structural change.

Investment Conclusion

Zenkoku Hosho is undoubtedly a high-quality company that combines stable growth and strong profitability. However, the lack of a clear focus on capital efficiency — a key driver of enterprise value — is a long-term concern for equity valuation. While the stock’s stability and attractive shareholder return profile justify continued interest, upside potential appears limited. We therefore maintain a “Weak Hold” stance, pending any meaningful shift in capital policy that could enhance structural returns.

Price

PBR (LTM)

PER (LTM)

ROE (LTM)

EPS (LTM)

Dividend Yield (LTM)