KADOKAWA (Price Discovery)

Weak Hold

Profile

KADOKAWA is a comprehensive entertainment company engaged in publishing, animation, live-action video production, gaming, web-based services, and education/EdTech. It is powerful in intellectual property (IP) based on comic books and light novels. The company is advancing its medium-term management plan aimed at maximising the lifetime value (LTV) of IP, through initiatives such as internal production enhancements and the acquisition and establishment of animation studios. While its domestic print publishing segment has been affected by cyberattacks, growth in digital and overseas sales has helped offset the impact. The gaming business has been buoyed by the strong performance of the blockbuster title “ELDEN RING”.

Revenue composition by segment % (OPM%): Publishing & IP creation 54 (7), Animation & live-action 17 (10), Games 10 (31), Web services 8 (2), Education & EdTech 5 (13), Other 5 (-22) 【Overseas】16 (FY3.2024)

| Securities Code |

| TYO:9468 |

| Market Capitalization |

| 575,847 million yen |

| Industry |

| Information / Communication |

Stock Hunter’s View

Strengthening of in-house animation production to ensure stable IP creation. “ELDEN RING” boosts gaming profitability.

KADOKAWA is a diversified entertainment company operating across publishing, animation, live-action production, gaming, web-based services, and education/EdTech. It excels at managing intellectual property (IP) derived from comics and light novels that can be adapted across multiple media formats.

In recent years, the company has accelerated the establishment and acquisition of animation studios. In July of last year, it announced the acquisition of veteran studio Doga Kobo (Nerima, Tokyo), known for hits such as “Chiikawa” and “Oshi no Ko”, which attracted significant attention. In its medium-term management plan, which ends in FY2028, KADOKAWA has committed to enhancing IP value, with animation at its core, aiming to increase the number of productions from five to 20 per year.

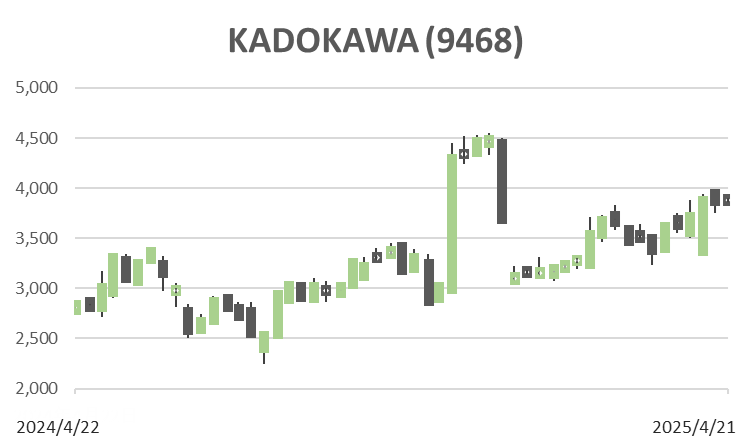

Although the domestic print publishing division was impacted by cyberattacks, strong sales of “ELDEN RING” and its downloadable content (DLC) in the gaming segment contributed to solid growth. In the cumulative third quarter of FY2025 (April to December), the company posted consolidated revenue of 206.6 billion yen (+10.5% YoY) and operating profit of 15.8 billion yen (+18.8% YoY), marking a double-digit increase. The full-year forecasts of 271.7 billion yen in revenue (+5.3% YoY) and 16.3 billion yen in operating profit (-11.7% YoY) remain unchanged and appear conservative. A release of “ELDEN RING” for the upcoming Nintendo Switch 2 is expected within the year.

Investor’s View

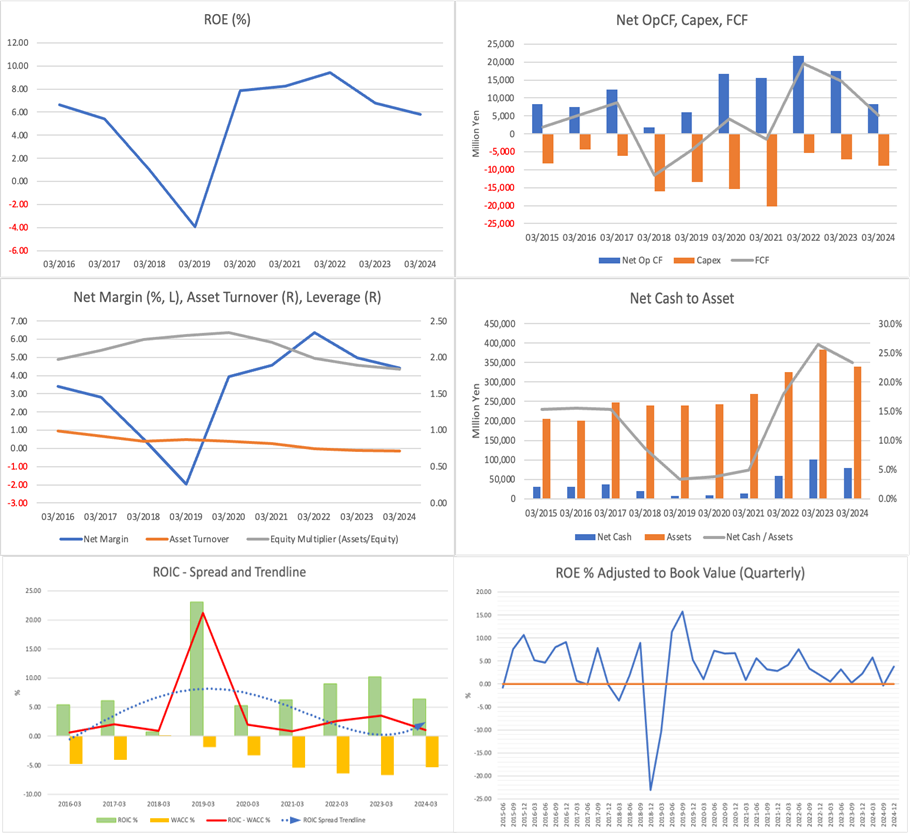

Weak Hold. Despite securing ample cash through multiple capital alliances, funds remain largely unutilised, and the bloated balance sheet continues to suppress ROE. While global expansion of IP remains central to management’s ambitions, it is still unclear whether such initiatives will meaningfully restore capital efficiency.

Thoughts

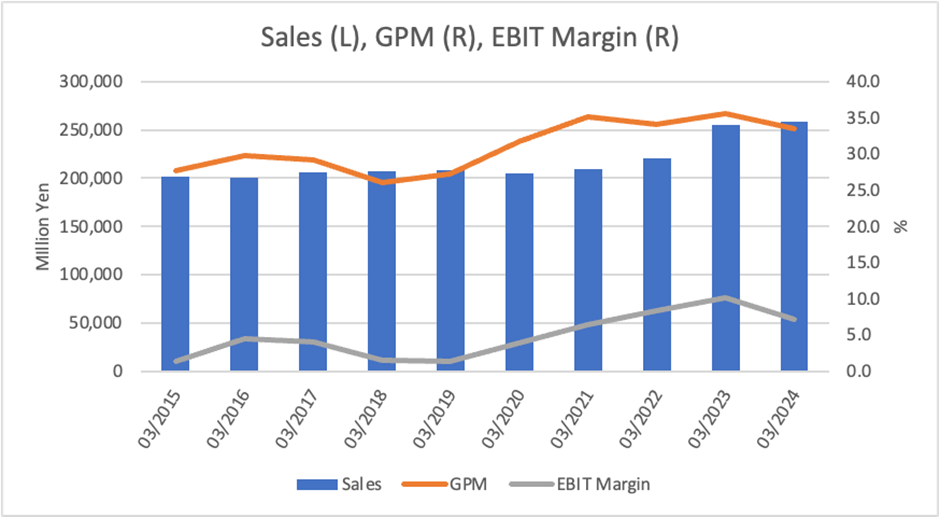

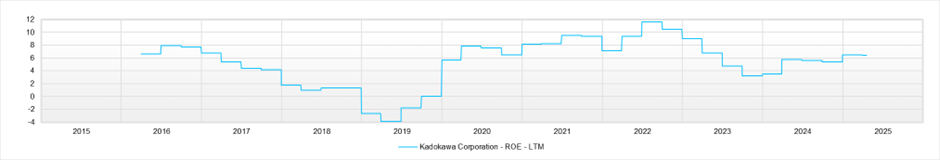

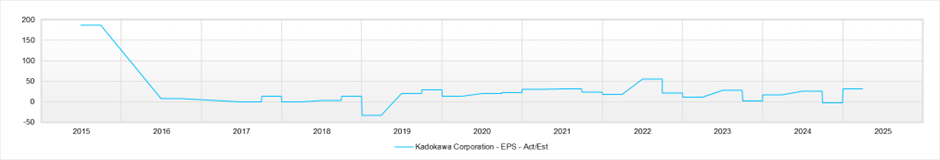

Since the 2020s, KADOKAWA has actively strengthened its balance sheet and pursued strategic investments. Total assets increased from 243 billion yen in FY2020 to 353 billion yen in FY2024. Although equity capital also rose, and the equity ratio remains sound at around 55%, asset turnover declined significantly from 0.85 to 0.62 over the same period. As a result, the ROE fell from 7.8% in FY2020 to 5.8% in FY2024, indicating that profitability has not kept pace with asset growth. Operating cash flow dropped sharply from 17.5 billion yen in FY2023 to 8.3 billion yen in FY2024, raising questions as to whether growth investments are translating into tangible financial returns.

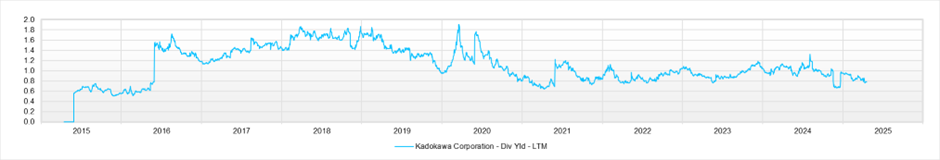

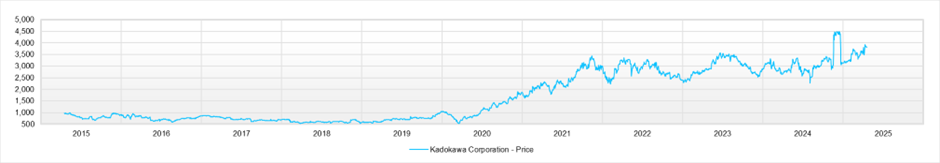

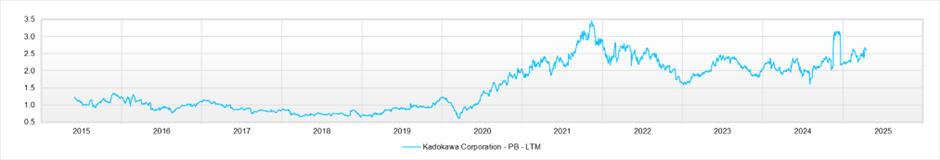

From the standpoint of economic value added (EVA), there is little room for optimism. ROIC is currently hovering near 5%, with the spread over WACC narrowing close to zero (see ROIC – Spread and Trendline graph), suggesting that value creation has effectively stalled. While cash and equivalents exceed 80 billion yen, the company has yet to deploy these resources meaningfully for shareholder returns or new investment. PBR, once in the 4x range in 2021, has dropped to around 2.7x. The earnings yield (ROE adjusted to Book Value) stands at approximately 5.8%, far below the 10% threshold generally regarded as a sign of undervaluation, and market sentiment remains cautious.

The medium-term management plan calls for expanding annual animation production to 20 titles, along with overseas business development, with IP portfolio management at its core. However, whether these strategies will genuinely lead to improved earnings and capital efficiency depends on the company’s ability to execute and differentiate globally. A conservative DCF valuation suggests limited upside potential from current share price levels. Unless KADOKAWA demonstrates a clear commitment to improving capital efficiency, through either ROIC expansion or a renewed capital allocation policy, the stock warrants a cautious stance.

Shareholder Composition

KADOKAWA’s shareholder base is dominated by strategic partners, with Sony Group holding the most significant stake at 10.0%, followed by Kakao (8.4%), Tencent (8.0%), NTT (4.4%), and Nintendo (0.8%). In January 2025, Sony subscribed to a new issue of 12 million shares, further deepening their alliance. Domestic institutional ownership is relatively limited, with a high proportion of shares that institutions do not hold. The presence of significant content and tech partners reflects a deliberate strategic positioning, and the shareholding structure will likely play a key role in the company’s future capital strategy and mergers and acquisitions (M&A) activities.

Financials and Valuations

Price

PBR (LTM)

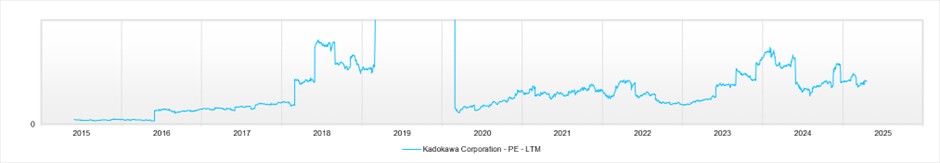

PER (LTM)

ROE (LTM)

EPS (LTM)

Dividend Yield (LTM)