INNOVATION HOLDINGS (Company note – 4Q basic)

Return to double-digit profit growth trajectory

Reorganized sales force beginning to deliver solid results

| Click here for the PDF version of this page |

| PDF version |

SUMMARY

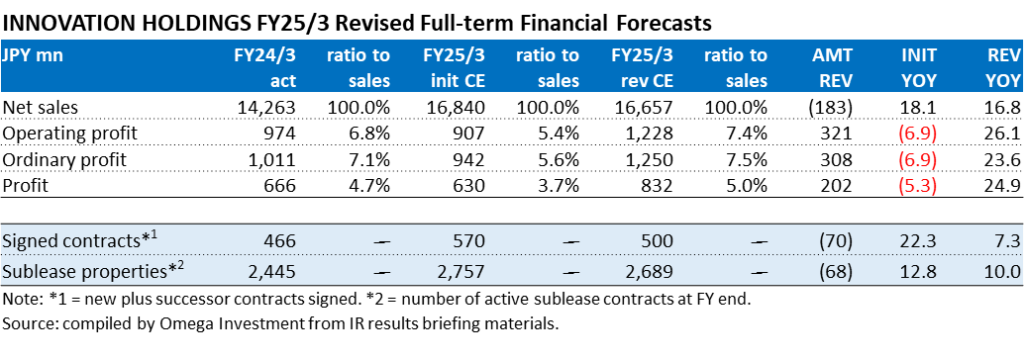

- Despite the initial cautious outlook for FY25/3 guiding for a second consecutive year of OP decline, positioned as a transition phase toward accelerating growth while profits would remain under pressure from upfront investments to strengthen the sales organization, 1H store subleasing segment OP rose +34.1% due to GPM up sharply on reduced procurement costs (vacancy rent associated with aggressive procurement last term) and contract renewals, as well as control of SG&A expenses, resulting in a 35% upward revision to full-term OP. Strong double-digit profit growth continued in the 2H, and management notes that the reorganized sales force is making a contribution.

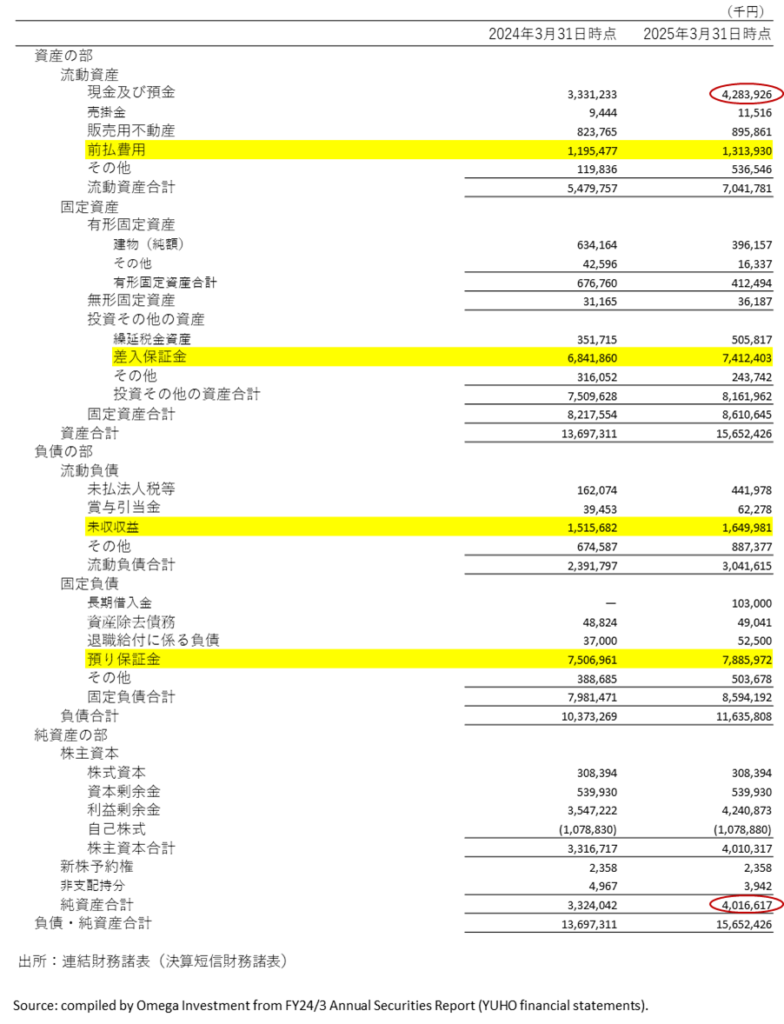

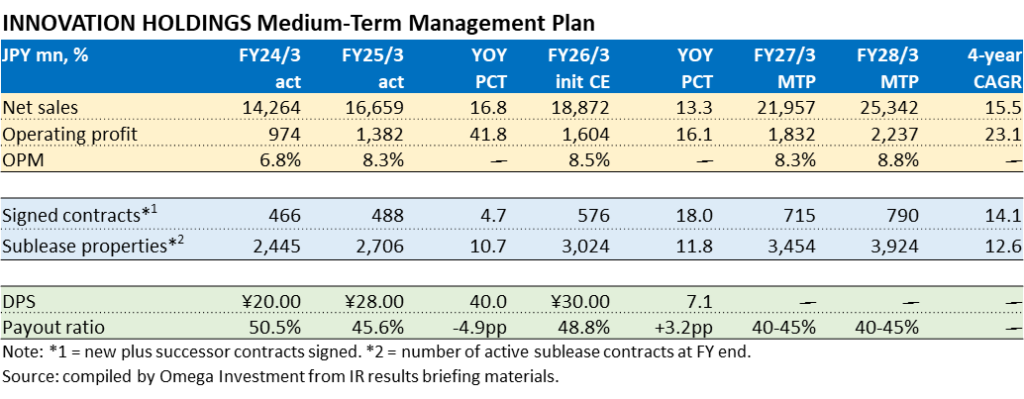

- From FY24/3, the Company announced a change to its dividend policy, effectively raising the target payout ratio from the 30% level to the 40% level. Since listing, total cash dividends have grown at +32.6% CAGR, with DOE topping 10% and the payout ratio topping 50% in FY24/3. While making the necessary investments to accelerate growth going forward, the Company is also strengthening shareholder returns as a priority management issue. In FY25/3, the annual dividend was hiked from ¥20.0 → 28.0 (+40% YoY). For FY26/3, the Company is indicating a 5TH consecutive hike of the annual dividend from ¥28.0 → 30.0 for a payout ratio of 48.8%.

INNOVATION HOLDINGS Sustainable double-digit growth with high stability

Source: compiled by Omega Investment from IR results briefing materials.

Financial Indicators

| Share price (7/29) | 1,000 | 26.3 P/E (CE) | 16.3x |

| YH (25/3/6) | 1,038 | 26.3 EV/EBITDA (CE) | 7.6x |

| YL (25/4/7) | 854 | 25.3 ROE (act) | 28.1% |

| 10YH (23/3/10) | 1,340 | 25.3 ROIC (act) | 24.7% |

| 10YL (20/4/6) | 477 | 25.3 P/B (act) | 4.18x |

| Shrs out. (mn shrs) | 17.674 | 26.3 DY (CE) | 3.00% |

| Mkt cap (¥ bn) | 17.674 | | |

| EV (¥ bn) | 12.597 | | |

| Equity ratio (3/31) | 25.6% | | |

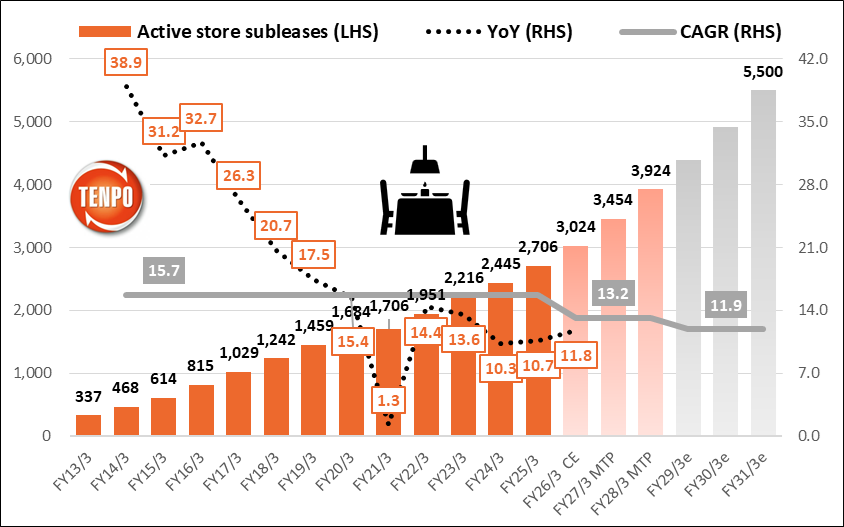

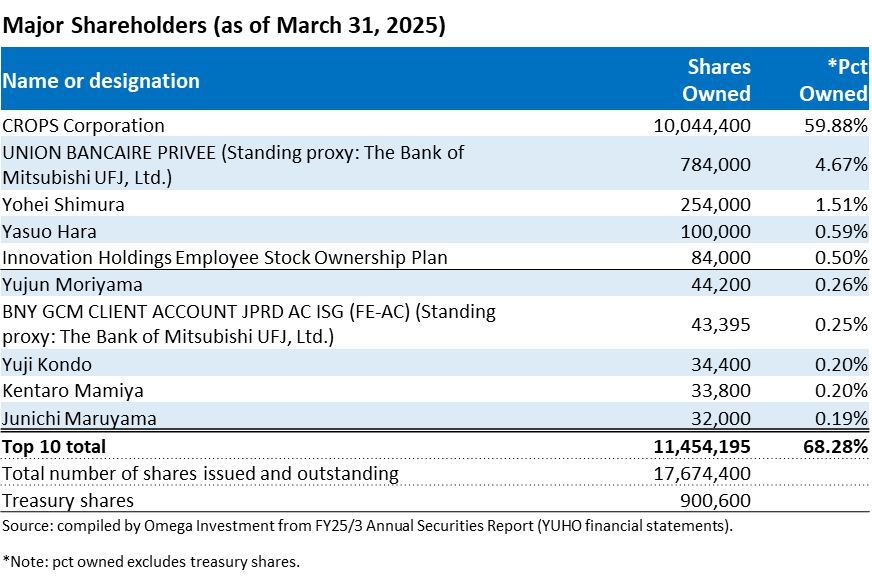

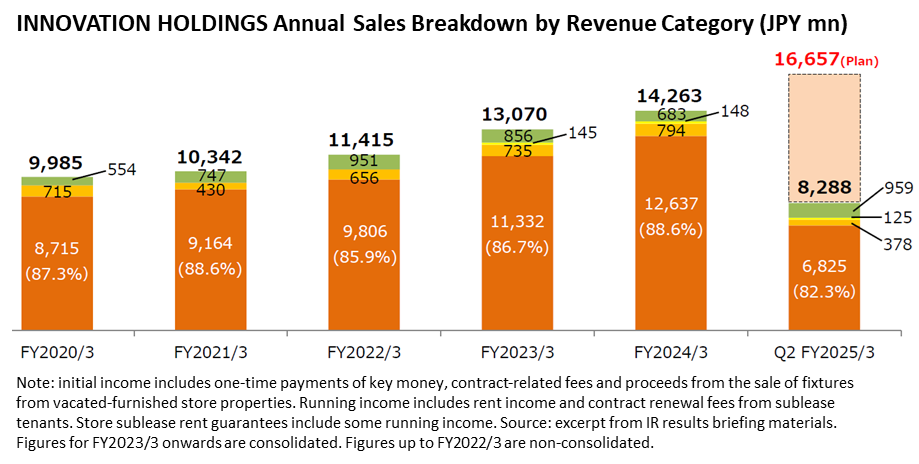

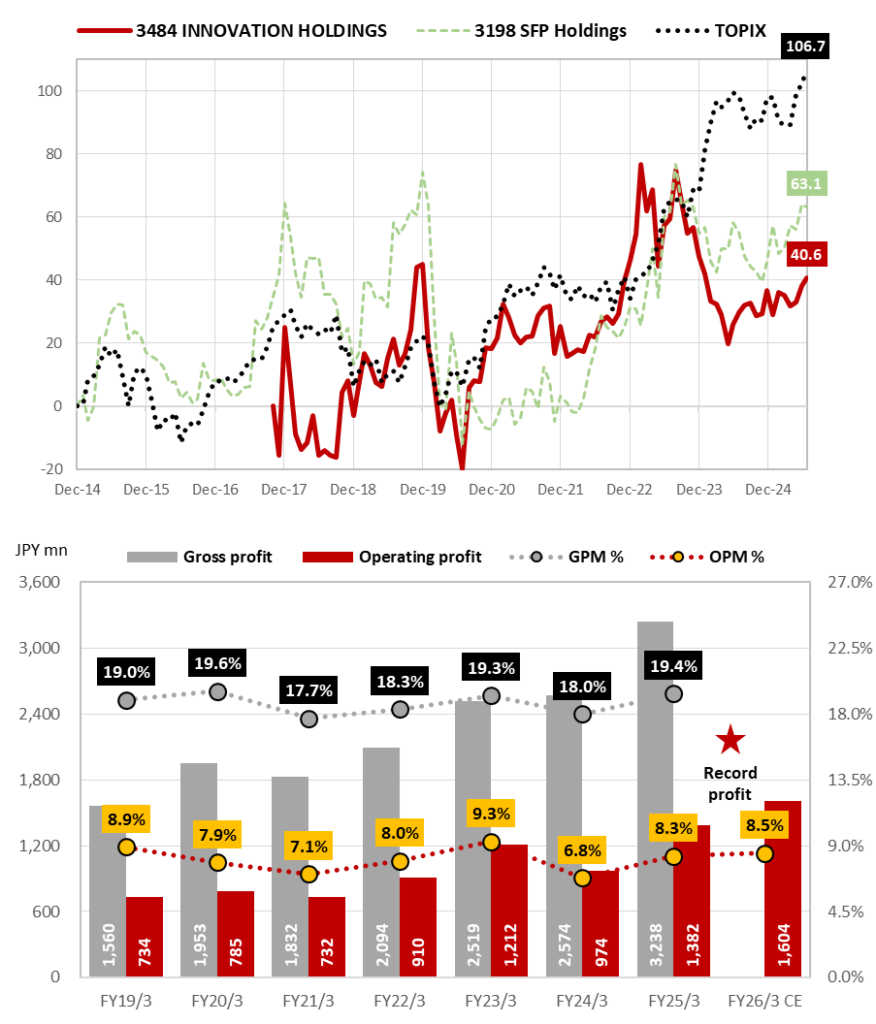

Omega Investment’s case for INNOVATION HOLDINGS as an attractive opportunity

Over the last 8 fiscal years since listing in Oct-2017 through FY25/3, net sales have grown at +15.2% CAGR, OP has grown at +20.5% CAGR, total shareholders’ equity at +18.4% CAGR and total cash dividends at +32.6% CAGR, with DOE topping 10% in FY24/3, and the payout ratio topping 50%. As can be seen from the graph on the bottom of P1, double-digit growth in active store sublease contracts is both remarkably consistent and sustainable.

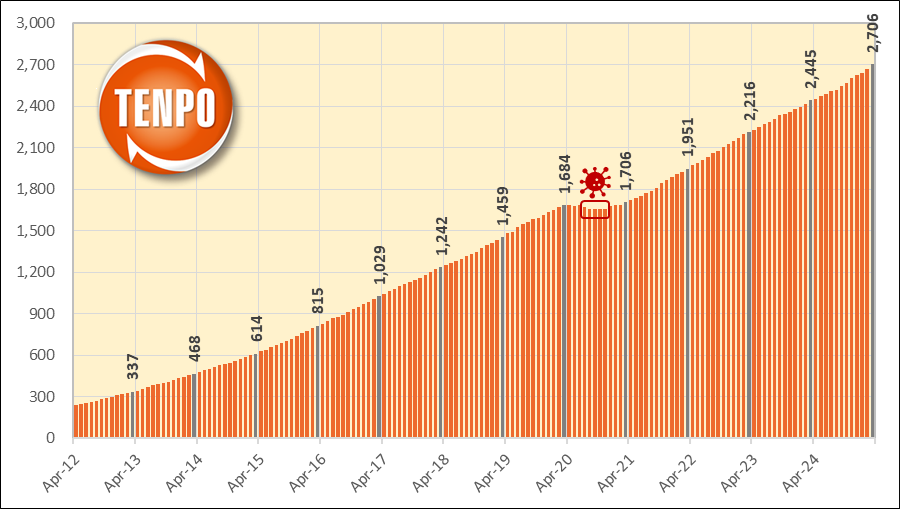

Part ① : Introduction

INNOVATION HOLDINGS subleased store properties uncorrelated with the market

Even during the height of COVID-19 in 2020, active subleased stores only dipped slightly, closing up YOY for the fiscal year. The strength of the business model can be summarized as careful selection of store properties mainly in central Tokyo (①the store property is on the 1F facing a street (regardless of station proximity), ②monthly rent is affordable in absolute terms (averaging around ¥300-350k/mo.), and ③the property is a vacated-furnished store (lowers the initial investment cost)) are ALWAYS in high demand. Average turnover has been quite consistent over time, equivalent to roughly 10% every year, or 50% every 5 years. Relative to the pre-pandemic level of 1,459 stores in Mar-2019, active subleased store properties increased +67.6% to 2,445 stores in Mar-2024, or +10.9% 5Y CAGR.

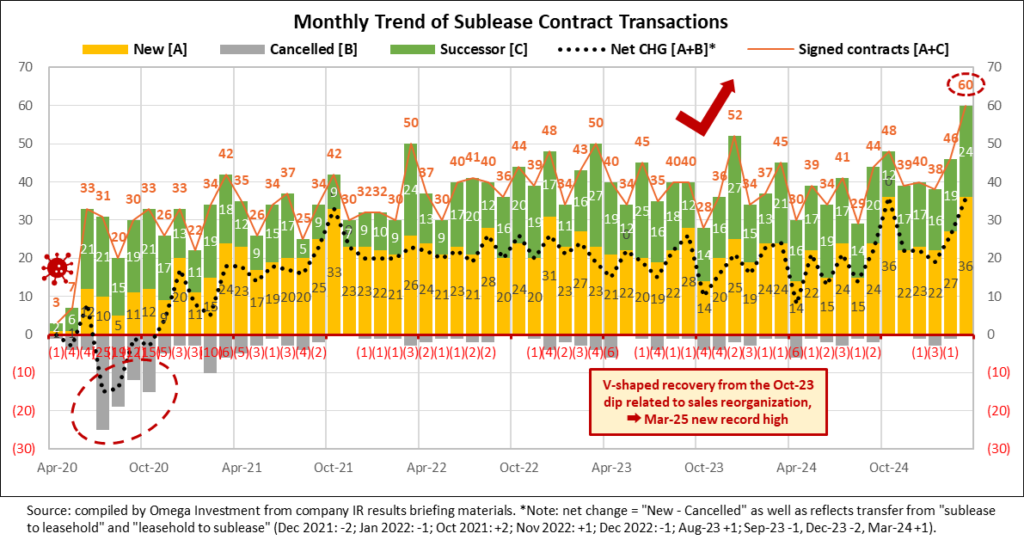

Monthly trend of TENPOINNOVATION active subleased store properties

Source: compiled by Omega Investment from company IR results briefing materials

*Note: average turnover does not equal cancellations. The lower graph lists separately successor contracts (new tenants) and contract terminations (low). The upper graph shows the trend of active sublease contracts at month-end.

One of a kind Metropolitan Tokyo restaurant store property subleasing specialist

TENPO INNOVATION’s 3 Main Criteria for Selecting Store Sublease Properties Always in High Demand

●The store property is on the 1F facing a street (regardless of station proximity)

●Monthly rent is affordable in absolute terms (averaging around ¥300-350k/mo.)

●The property is a vacated-furnished store (lowers the initial investment cost)

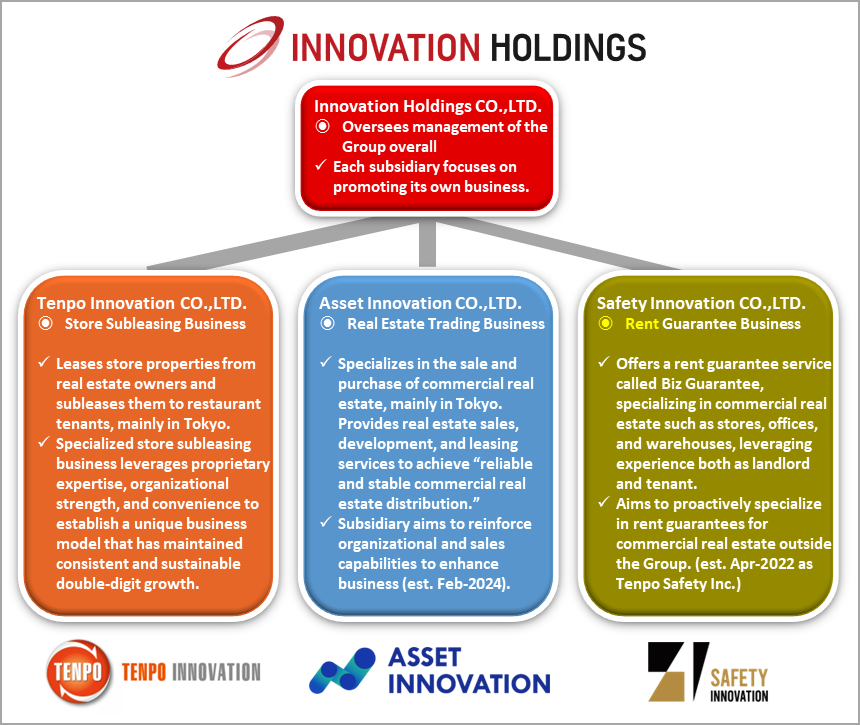

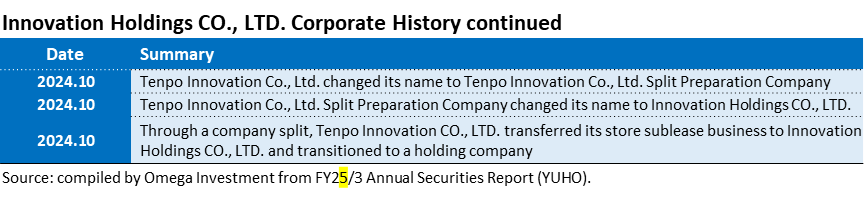

Transition to a Holdings Company Structure

The Group decided to transition to a holding company structure in order to optimize the allocation of management resources, to promote the development of the next generation of management personnel, and to create a structure that will enable flexible decision-making and flexible responses to changes in business conditions in order to promote business expansion by focusing more on each of the Group’s businesses. By transitioning to a holding company structure, the holding company will oversee the management of the entire Group, while each subsidiary will focus on promoting its own business, thereby maximizing the corporate value of the Group.

The effective date of the absorption-type split was October 1, 2024. The Company continues to be listed as a holding company on the TSE Prime market. Details of the new holding company structure, new trade names/corporate logos, etc., are outlined in the exhibit below.

New Group Holdings Company Structure from October 1, 2024

Source: compiled by Omega Investment from IR results briefing materials and related press releases regarding the transition to a holdings company structure.

Part ② : Business Overview

Business description and strengths / attractive features of the business model

When you go to the Company’s website and open the home page, you are presented with an aerial view of central Tokyo. Then if you click on the lower right-hand corner, a 1:24 minute flashy YouTube video with a catchy soundtrack starts playing, highlighting some headline bullet points about the attractiveness of the Tokyo restaurant market.

TOKYO × TENPO INNOVATION

Grab Tokyo.

The world’s largest number of passengers Shinjuku Station: 3.59 million

The world’s largest number of restaurants Metropolitan Tokyo: 79,601

The world’s top gastronomic city No. of Michelin-star restaurants: 226

We compete in this city with the highest potential.

The world’s most traversed pedestrians Shibuya

The world’s best subculture district Akihabara

There is more we can do.

99% untapped market.

We will not stop and will keep pushing forward.

It will become a big swell and envelop this city.

From because we can do it → to so we will do it.

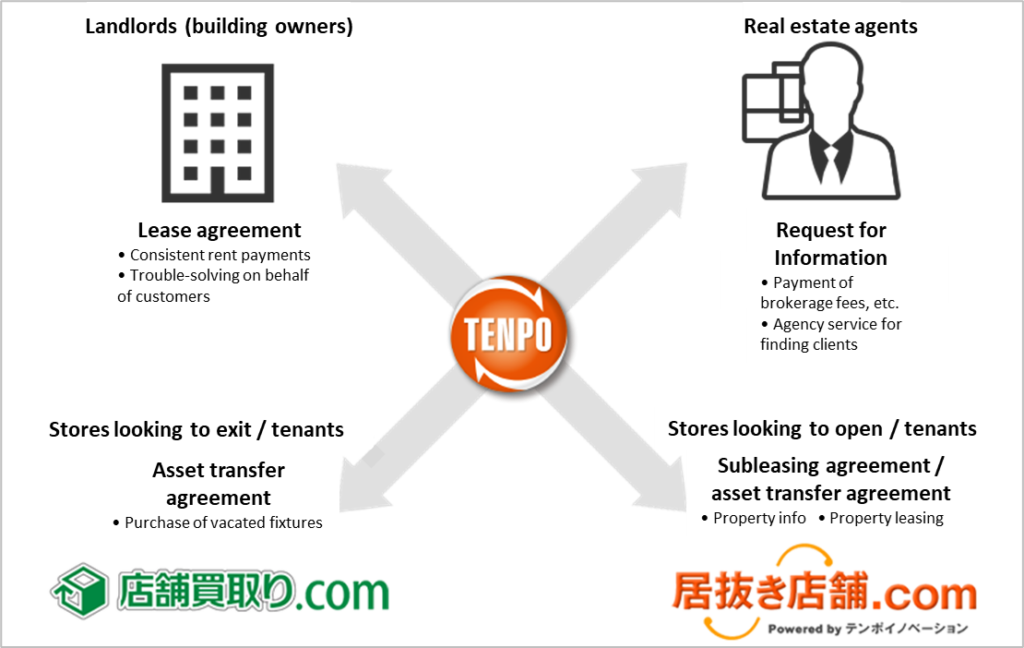

TENPO INNOVATION: Restaurant store property subleasing specialist

TENPO INNOVATION is a real estate company, but it does not handle agency brokerage business and management business as in the case of a general real estate company. Further, TENPO INNOVATION is a real estate company specializing in stores. General real estate companies handle residential properties, offices, warehouses, parking lots, among others. The Company doesn’t handle any of these, and only specializes in store properties. And roughly 90% of contracts are for restaurants, so the Company is a specialist in store subleasing business for restaurants.

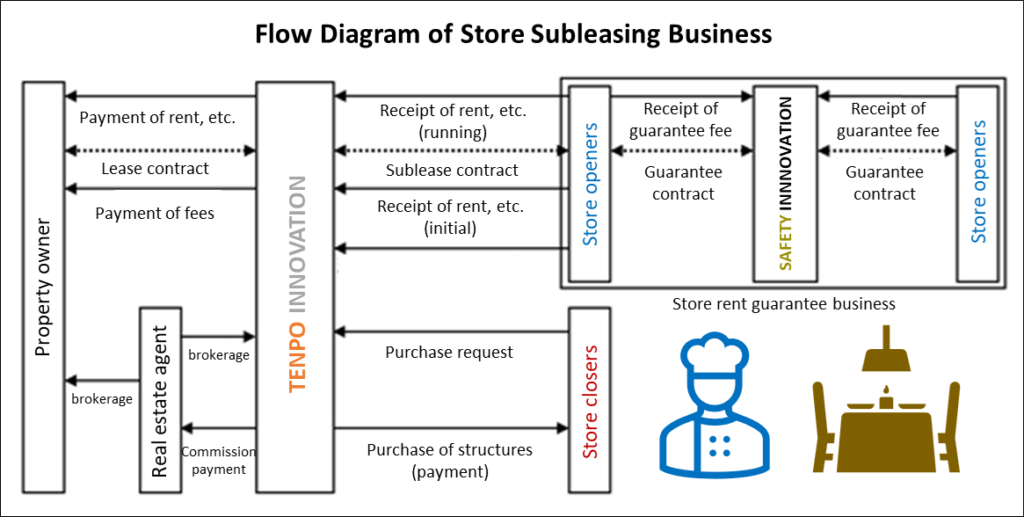

The Company leases mainly vacated-furnished store properties from real estate owners, and then subleases them to restaurant operators. According to the Company, the standard format of lease contracts with owners stipulates 3-months notice required to cancel a contract, and it is automatically granted a lease right, whereby unless the Company cancels a contract, in principle it can continue to renew the lease. This lease right is a key factor in the long-term stability of the Company’s subleasing business, as demonstrated in the exhibits on P4. Standard sublease contracts with restaurant operators stipulate 7-months notice required to cancel a contract. Store operators are required to give a deposit equivalent to 10-months rent, provide a co-signer on the lease, and enter a rent fulfillment guarantee agreement, now handled mainly in-house, as described on the following page.

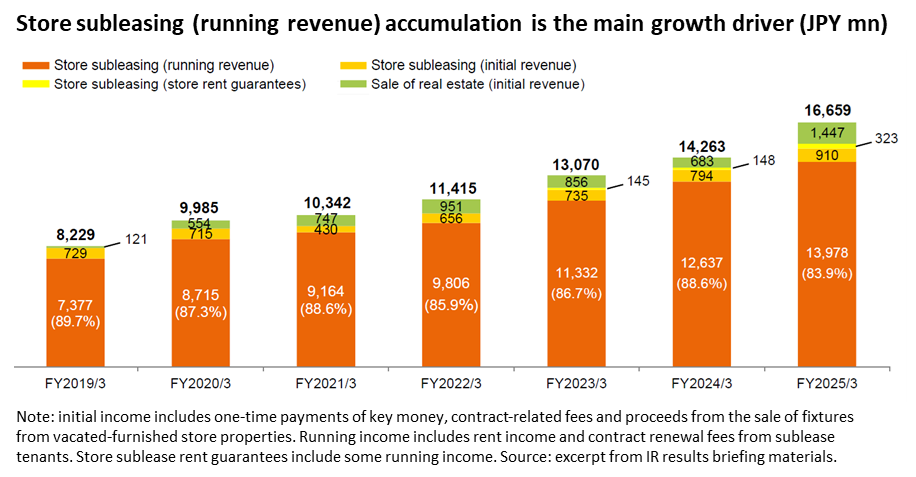

Revenue from store subleasing business is divided into “initial” and “running.” Initial revenue consists of 1) non-refundable “key money,” a custom specific to the Japanese market, which is a mandatory payment from a new tenant to a landlord, and is not returned when the lease is cancelled, and 2) proceeds from the sale of fixtures to the new tenant entering a vacated-furnished property. Running revenue consists of monthly rent payments from store tenants. According to the Company, the breakdown is roughly 10% from initial revenue and 90% from running. While the restaurant industry itself is known to be plagued with a relatively high number of failures, making average contract length effectively immaterial, the Company says average turnover has been quite consistent over time, equivalent to roughly 10% every year, or 50% every 5 years.

Expertise in finding and subleasing relatively small, low rent, vacated- furnished restaurant store properties, mainly in central Tokyo.

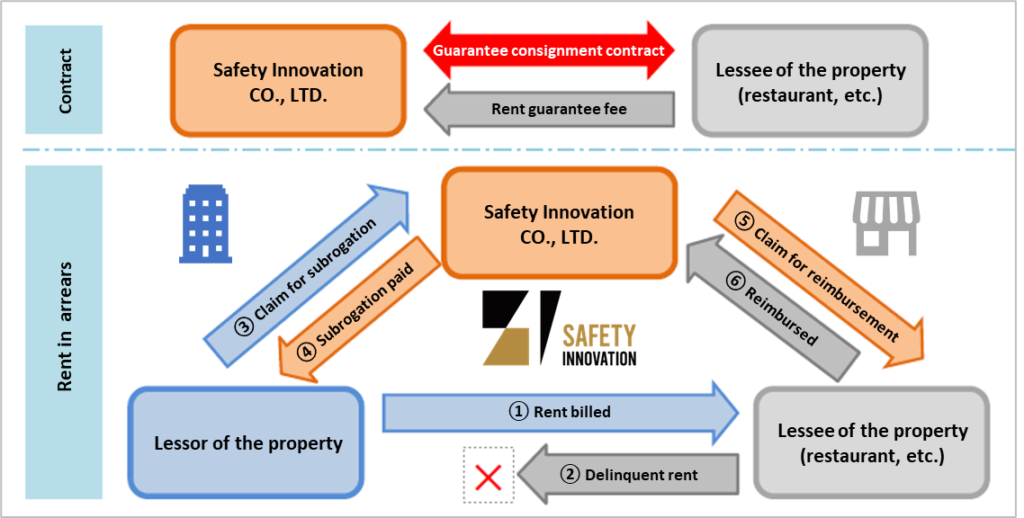

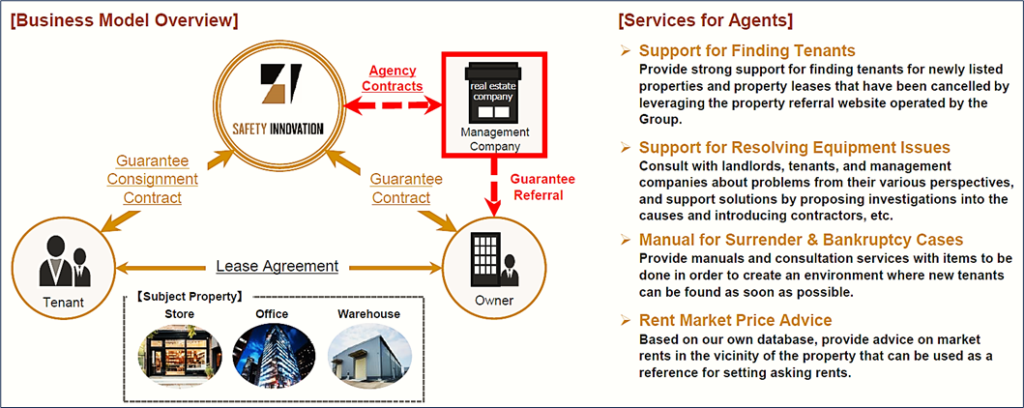

Store rent guarantee business of Safety Innovation CO., LTD.

Since the Revised Civil Code went into effect from April 2020, rent guarantees for store lease properties are expanding socially as a system that benefits both property landlords and tenants. In the past, the Company had tenants enter a rent guarantee contract automatically upon application, and the business was consigned to outside providers of rent guarantees. However, with over 17 years experience in subleasing over 2,000 restaurant store properties, and unique screening know-how, the Company is fully capable of assessing the risk of its subleased properties. In April 2022, the Company established Tenpo Safety Inc. (currently Safety Innovation CO., LTD.) with the aim of bringing this income stream in-house.

According to the Company, every contract signed requires entering a rent guarantee agreement, and the rent guarantee fee is equivalent to roughly 1 month’s rent. The majority of these contracts are handled by the newly established Safety Innovation CO., LTD. Thus, the number of contracts signed exceeds 100 per quarter, the majority of which directly contribute to the Group’s profit each quarter. This business carries a virtual 100% OPM, and growth is linked directly to signed contracts. Along with the rise in profitable successor contracts, store rent guarantee business will be a structural driver of margins going forward.

*Note: The trade name was changed from Tenpo Safety Inc. to Safety Innovation CO., LTD. in February 2024.

Safety Innovation CO., LTD. Store Rent Guarantee Business Overview

The company is also engaged in real estate trading business, which is revenue recorded from the sale of real estate for sale, etc. For subleasing business, procuring attractive store properties is a key point, and real estate agents are a prime source of good information on viable candidate properties meeting the Company’s requirements. However, from a real estate agent’s point a view, one month’s rent, or roughly 300,000-350,000 yen, is the standard commission to find a tenant, which is not a significant amount of money. At the same time, commission on the purchase or sales of a property can be several million yen up to 10,000,000 yen.

Since real estate agents have valuable information on subleased properties, the intent is to strengthen relationships with real estate agents and to meet the real estate transaction needs of clients. Since the average purchase price of real estate is small, around 90 million yen, and the properties are quickly resold, the average holding period is about 7.7 months (sometimes more than a year), and the average gross profit margin is about 35%, and properties procured as vacant units are sometimes leased within the Group and then sold at a higher value. Next, we look at the typical workflow for the 3 main areas of operation for mainstay restaurant store subleasing business.

Store property leasing from owners (procurement)

Through sales activities to real estate agents by sales representatives assigned by major train station areas, introductions from business partners and existing store operators, etc., as well as through in-house website “TENPOKAITORI.com,” (‘Store repurchase’.com) which specializes in store purchases, the Company collects information on stores that are considering withdrawing from the market, and proceeds to research properties to be handled by the Company. TENPO INNOVATION has accumulated expertise in property evaluation based on lengthy experience in handling store properties and subsequent verification and analysis of such properties.

Note: TENPOKAITORI.com (‘Store buy-backs’.com) and INUKITENPO.com (‘Vacated-furnished stores’.com) are websites operated by the Company.

INUKITENPO.com website specialized in vacated-furnished store properties

As of the writing of this report, there were 111,113 members (registered applicants to open stores), with a cumulative record of listing 91,829 properties, currently listing 3,328 properties, mainly in Tokyo’s 23 Wards, but including Greater Tokyo, Kanagawa, Saitama and Chiba Prefectures.

In addition, each property survey is conducted based on the know-how cultivated through the experience and expertise of TI’s property management staff, which supports the handling of properties. After the property survey, TI negotiates with the lender or real estate agent of the candidate property, negotiate the details of the lease agreement, pay the deposit and other contractual fees, and conclude the lease agreement between the property owner and the Company.

Store property subleasing to tenants

For store properties for which TI has concluded lease contracts, we solicit prospective tenants by using real estate agents as intermediaries and by introducing them to members of TI’s website “INUKITENPO.com” (‘Vacated-furnished stores’.com), which provides information mainly on vacated-furnished store properties, a mechanism that facilitates those who wish to open stores to search for properties. The site enhances the value of information by quickly posting and updating property information obtained daily, which is one of the Company’s strengths in matching prospective tenants with stores. After receiving an application for a property from a prospective tenant, staff conduct a credit screening, negotiate the details of a sublease agreement, receive a security deposit and other contractual payments, and conclude a sublease agreement with the tenant.

Store property management

In property management work, TENPO INNOVATION is utilizing its accumulated know-how to address issues such as rent collection and troubleshooting that plague real estate owners and property management companies, performing the work itself on their behalf. In addition, in order to prevent problems or detect and deal with them at an early stage, it checks properties, collects information, and builds relationships with store operators, etc.

Property Management

Property management is based on the results of on-site surveys of subleased properties. The survey of each property is based on the know-how cultivated through the experience and expertise of the Company’s procurement staff, and this supports the handling of properties. The company focuses on preventing problems before they occur, and from the property procurement stage, a detailed inspection record is prepared for each property, including leaks and equipment problems.

Screening management is conducted according to the nature and stage of the problem, and an organizational structure has been established to respond to the problem in the shortest possible time and to do everything possible to prevent serious problems. The number of properties handled by each property management staff member is approximately 140, and the department is dispatched more than 1,000 times a year.

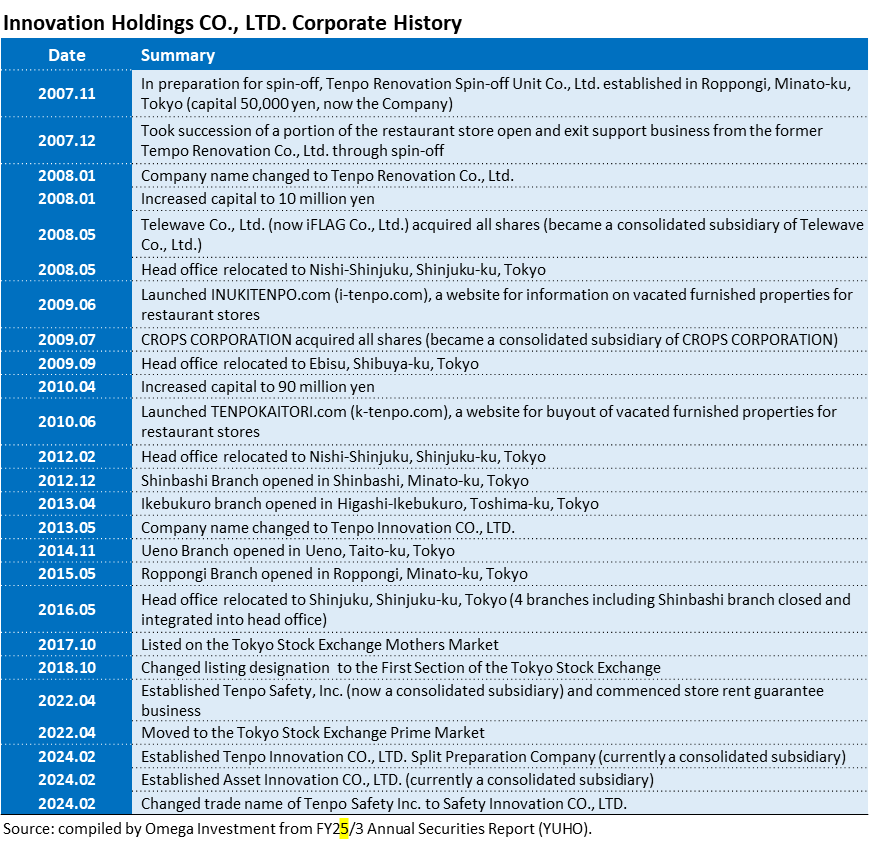

Corporate history

In November 2007, the Company was established as Tenpo-Renovation Inc. to prepare for the spin-off of Tenpo-Renovation Inc. in December 2007, and took over a part of the restaurant exit support business (introduction of properties and support for those who wish to open new restaurants, and purchase of restaurant facilities and support for those who wish to exit) from Tenpo-Renovation. The former Tenpo-Renovation Inc. was established in October 2001 as a subsidiary of REINS International Inc. for the purpose of managing restaurants (the trade name at the time of incorporation was Rayfields Corporation, with brands such as “Gyu-Kaku,” the largest yakiniku chain in Japan, as well as Izakaya and Shabu-Shabu restaurants).

In April 2005, the company started a new restaurant opening/closing support business (the actual beginning of the present Company’s business activities). At the time of the corporate spin-off in December 2007, the restaurant opening/closing support business was divided into the business related to REINS International properties and the business related to properties other than REINS International properties, and the Company took over the business related to properties other than those related to REINS International properties. It became a consolidated subsidiary of Telewave (now iFlag) in the same year, a consolidated subsidiary of CROPS CORPORATION (9428) in 2009, and changed the Company’s name to TENPO INNOVATION in 2013.

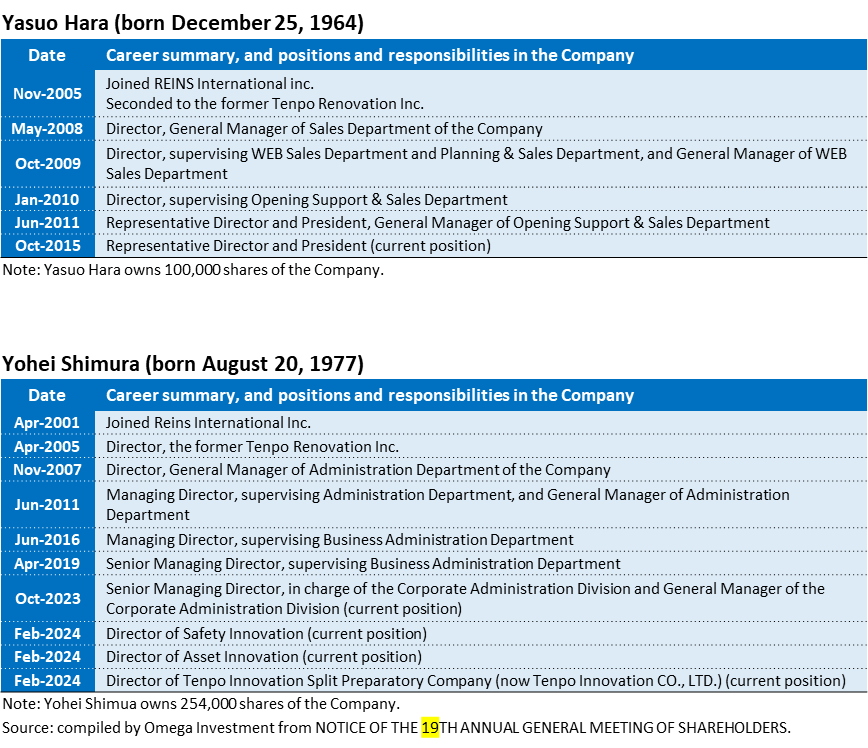

Details about the transition to the Group holdings company structure as Innovation Holdings CO.,LTD. from Oct-2024 are stated on P4. Next, we look at the origin story of how these 2 directors developed the current profitable business model.

Origin story of TENPO INNOVATION’s current attractive business model

When the Company was originally established in 2007, it was not real estate business, rather, consulting business to support restaurant store exiting and opening. The only thing that had been decided was to engage in business related to restaurant store openings in Tokyo, but it was not clear in what form the business would be monetized. The most important focus at that time was not only handling restaurant store properties, but also introducing the business model of prosperous restaurants in the form of franchises, undertaking construction work on store properties, consulting work for unprofitable restaurants to help them improve their sales, etc., however, the Company stopped all of these activities when demand was low and the business was unprofitable. Management found the highest demand was for introductions to vacated-furnished store properties in good locations in Tokyo, and accordingly focused efforts in that area.

TI converted its consulting business into real estate business in order to earn recurring stock income from subleasing. This was a critical turning point for the Company. It would likely have been difficult for professionals well-versed in real estate to be successful in this area. The market for store properties is quite small and highly specialized, even within the real estate industry. Management’s background was in a company that operated “Gyu-Kaku” yakiniku restaurants, and they were admittedly amateurs in the real estate field. However, they did have professional expertise in restaurant business, and significant accumulated store property know-how.

Management’s aim was to engage in a unique business specializing in store properties rather than plan to engage in the real estate business in a comprehensive manner. It took a while to find the right model, but this put the Company on a sustainable growth path.

Subleasing store property selection criteria, general policy on tenant selection

There are 3 main criteria when selecting properties to lease for the purpose of subleasing: 1) The store is on the ground floor facing a street, 2) rent is affordable in absolute terms, and 3) it is a vacated-furnished store. Conventional wisdom is that a “good store property” has high pedestrian traffic, is near a station and/or is located on a main street. For fast food and other major restaurant chain stores, that is likely a requirement. However, for individual or small business restaurant operators, the corresponding high rents for those store properties is simply a non-starter economically, considering initial start-up costs in addition to running costs. In TI’s accumulated experience, there is always high demand for store properties with low rent and that are vacated-furnished stores, even if the location is slightly further away from a station. Similar to low rent, the key point about vacated-furnished properties is lowering the initial investment cost.

According to the Company, there are actually not many requirements when selecting prospective tenants. The Company is quite strict in selecting store properties to procure for subleasing, however in the case of prospective tenants, after undergoing a routine credit screening, incoming tenants are required to put down a 10-month security deposit, have a co-signer on the lease as guarantor, and enter a rent guarantee agreement. In the end, it is very difficult to judge whether a new tenant will have a successful restaurant business or not, since the restaurant industry itself has a high open and close ratio, and many restaurants are prone to failure. TENPO INNOVATION’s business model is designed such that, even if a tenant opens a restaurant that fails, if the store property meets the aforementioned criteria, the Company can simply recruit the next tenant, as these store properties are always in high demand.

Attributes of prospective tenants that work in their favor would include having existing store (s) with a good track record, as well as being able to fund the opening without taking out a loan. Regarding type of restaurant format, TENPO INNOVATION’s portfolio reflects general trends in the overall market. For example, there are a large number of Izakaya (Japanese-style pubs) and ramen (Chinese noodles) shops as tenants.

Reasons TENPO INOVATION’s business model can deliver both growth and stability

Regarding stability, a key point is the lease right automatically granted when TI leases a store property from an owner. In principle, unless the Company cancels the lease contract, it can continue to renew it. In the case of the global outbreak of COVID-19 from Feb-2020, confronted with declarations of a state of emergency, stay-at-home orders and shortened/suspended business hours for restaurants by the Governor of Tokyo, out of an abundance of caution, TI decided to give 3-months notice on a certain number of lease contracts in April, resulting in the pickup in contract cancellations in July through October of that year. However, strong underlying demand for TI’s carefully selected store properties supported a rapid turnaround.

Regarding growth, there is the growth achieved from steadily increasing the number subleased store properties. However, there is also a less understood structural growth element from rising profit margins on store subleasing business. Specifically, there are initial acquisition costs associated with entering a new lease agreement, including one-time costs of non-refundable key money, contract-related costs, etc. Annual subleasing contract cancellations have been consistent over time, averaging 10% every year, or 50% every 5 years. When one of TI’s existing tenants exits the business, and a new tenant is recruited, the aforementioned acquisition costs of the store property were sunk on the first subleasing contract, and from the second contract onward, key money and other initial income are effectively pure profits, without an associated acquisition cost. Roughly 35% of current sublease contracts have been replaced by successor tenants, but this ratio is steadily rising over time, resulting in a steady structural increase in profit margins going forward.

Part ③ : Earnings Review

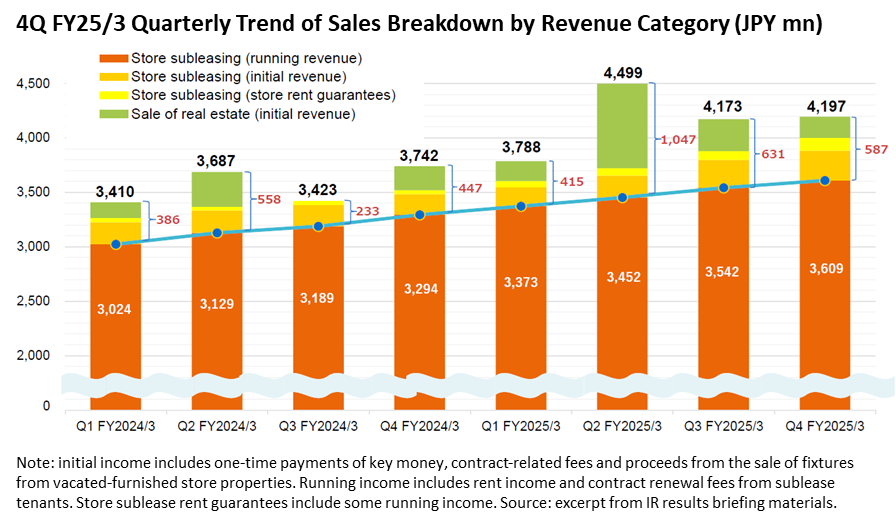

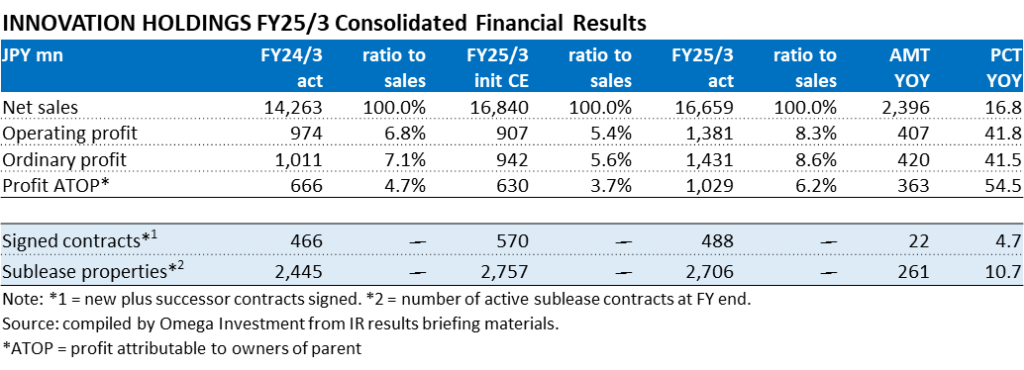

FY25/3 consolidated net sales +16.8% and OP +41.8%

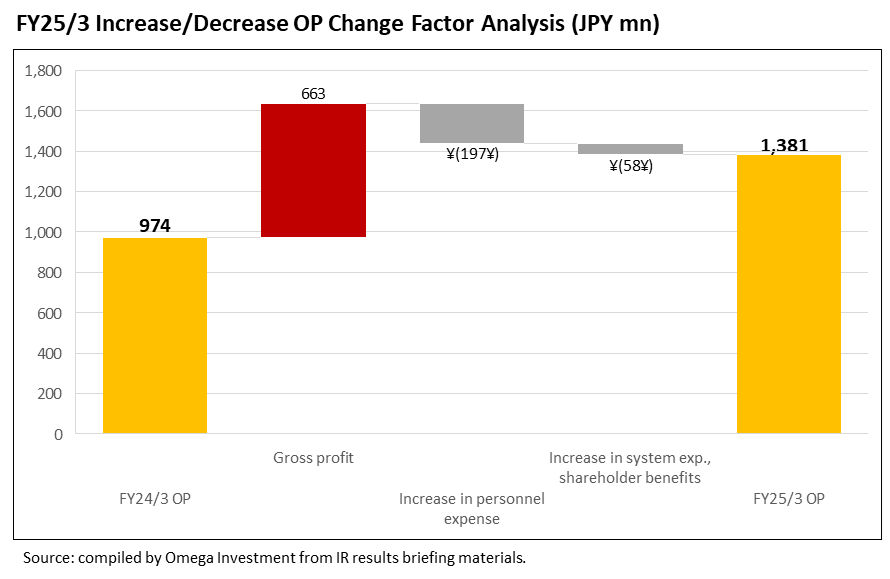

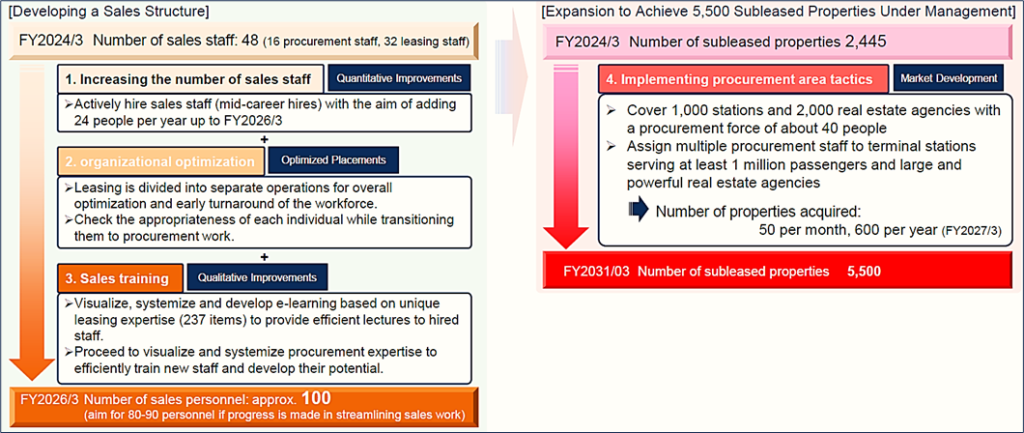

As can be seen from the table below, active sublease properties at FY-end increased by 261 to 2,706 (+10.7% YoY), and as can be seen from the graph on the bottom of P4, the number of signed contracts (new + successor) posted a record high during the Jan-Mar 4Q. Consolidated net sales increased +16.8% YoY. Gross profit increased +25.8% YoY and GPM rose 1.4pp from 18.0% → 19.4%, getting a boost from the increase in subleased properties, sales of large real estate properties, store subleasing initial revenue, and growth in high-margin rent guarantees. Operating profit increased +41.8% due to rising rental income, recording real estate sales, and winding up of upfront growth investment expenses, while controlling SG&A expenses. For real estate trading business, the Company sold 8 properties and acquired 8 properties (2 properties sold and none acquired in 4Q Jan-Mar).The no. of properties owned at the end of the FY was 4.

Initial forecasts for FY26/3 and the Medium-term Management Plan are shown on the bottom of the next page. Headline numbers for FY26/3 are net sales +13.3% YoY, operating profit +16.1%, and OPM rising 0.2pp from 8.3% → 8.5%. The Company is forecasting signed contracts to increase by 88 to 576 (+18.0%) and active store sublease contracts at the end of the fiscal year to increase by 318 to 3,024 (+11.8%). Key business initiatives for the three subsidiaries are outlined on the following 2 pages. The Company is indicating a 5TH consecutive hike in the annual dividend from ¥28.0 → ¥30.0 for a payout ratio of 48.8%.

FY26/3 key business initiatives by subsidiary

●Tenpo Innovation

●Safety Innovation

●Asset Innovation

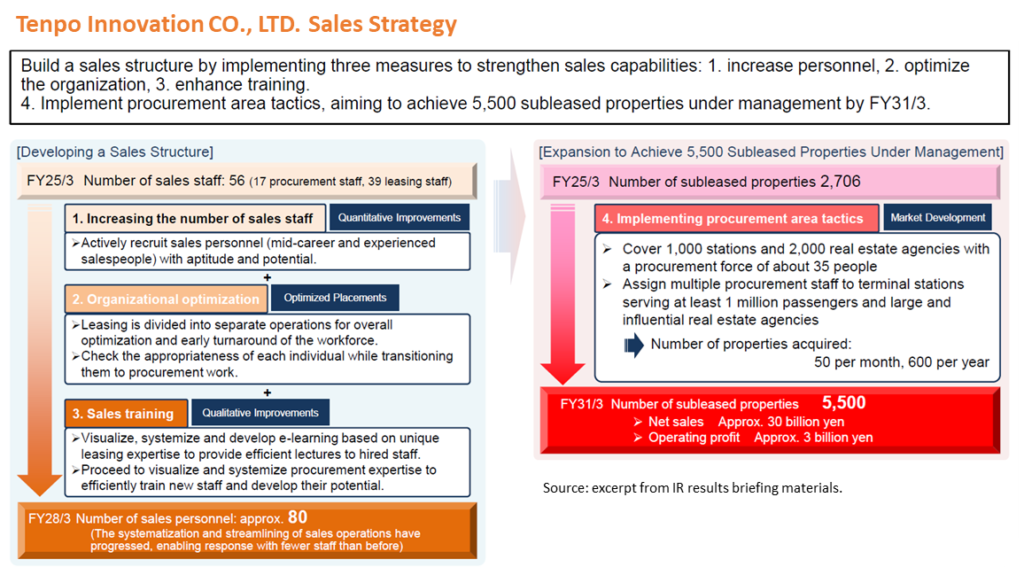

Tenpo Innovation CO., LTD. – Store subleasing business

① Procurement expansion

➡Start procuring properties from new channels and begin full-scale handling of properties in upper floors and non-food service establishments

- Increase the number of properties procured by sourcing them from new channels such as real estate industry organizations

- Full-scale handling of well-located upper floor properties (3F and above) mainly occupied by non-food service establishments (clinics, gyms, etc.)

② Recruitment

➡Based on the results of FY25/3 (21 sales staff and 9 property management staff hired), continue to actively recruit new employees

- Aim to hire roughly one sales staff per month. Plan to actively recruit property management staff, as in the previous term

- Continue to reduce recruitment unit costs (13% reduction in FY25.3)

③ In-house websites

➡Expand attracting customers for in-house websites “INUKITENPO.com” (finding tenants for vacated-furnished stores) and “TENPOKAITORI.com” (purchase of vacated equipment)

- Improve the quality and quantity of properties listed on “INUKITENPO.com” and enhance convenience to achieve 10,000 annual member registrations

- Boost the presence of “TENPOKAITORI.com” by expanding advertising, increasing the number of properties handled, and continuing existing initiatives

Safety Innovation CO., LTD. – Rent guarantee business

① Strengthening sales

➡Strengthen sales capabilities through aggressive branch expansion and recruitment, and promote the development of new agencies and the utilization of guarantees

- Open branches in Osaka, Shinjuku, and Fukuoka, and plan to proactively recruit approximately 23 new staff

- Conduct proactive sales agency development through station-by-station visit plans and campaigns, and implement thorough route visits)

② Human resource development

➡Utilize study sessions, case sharing, and a Q&A LINE group, etc. to develop personnel with expertise in finance and real estate

- Conduct regular company-wide study sessions, timely sharing of market trends and individual case studies, and efficient training through a Q&A LINE group

- Aim for self-reliance within three months of employment while continuously fostering professionals in the rent guarantee industry

Asset Innovation CO., LTD. – Real estate trading business

① Developing new customers

➡In addition to recruitment and focused sales efforts in the six central wards of Tokyo, proactively expand customer base by approaching general corporations and real estate brokers

- Increase the number of procurement experienced staff (plan to hire two additional staff this fiscal year) and deploy sales personnel primarily in the six central wards of Tokyo to prioritize customer acquisition

- Launch new sales initiatives targeting general corporations and send direct mail to real estate brokers to enhance brand awareness

② Digital transformation (DX) and collaboration

➡Improve business efficiency through the introduction of business systems (DX) and conduct study sessions to enhance collaboration within the Group companies

- Introduce business systems to enhance operational efficiency and standardization

- Continue to hold biannual business briefings for Group companies to share procurement and sales information

Earnings Reference

●2Q FY25/3 (upw rev)

●FY25/3 initiatives under the holding company

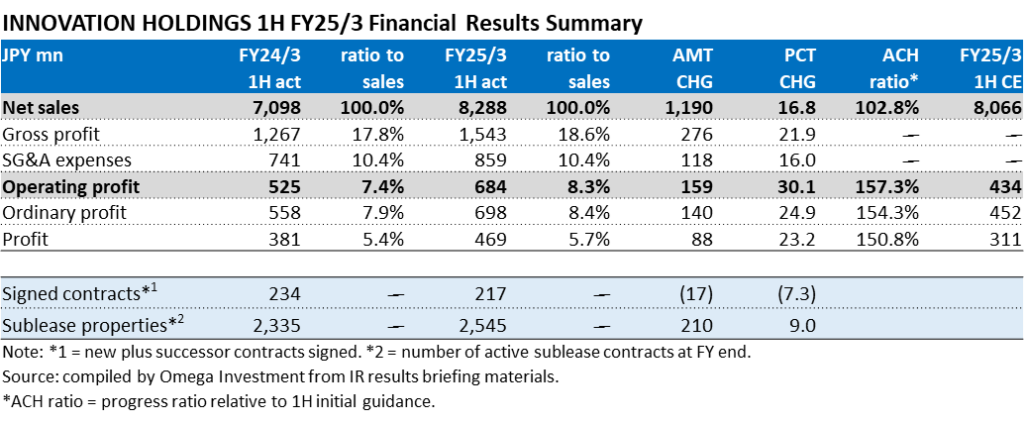

1H FY25/3 consolidated net sales +16.8% and OP +30.1%

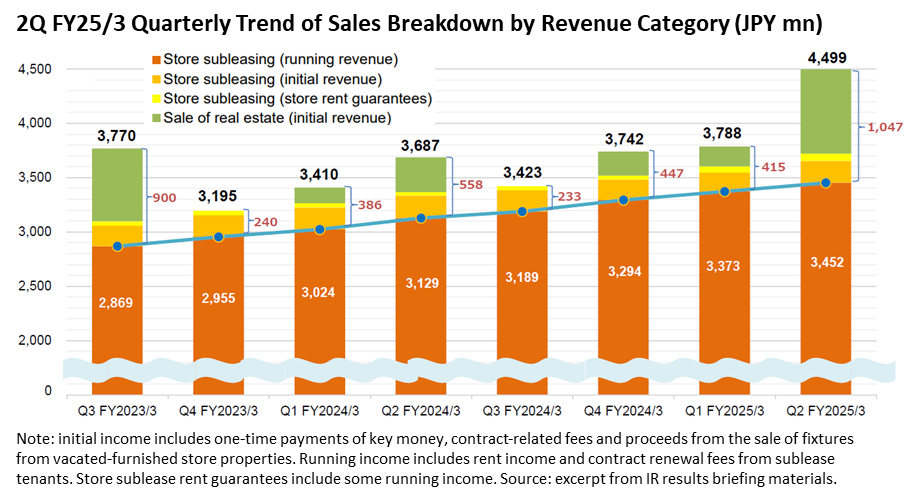

In the restaurant industry, sales and the number of customers increased mainly in urban areas and tourist destinations, helped by the recovery in inbound visitors driven by the weak yen. For drinking establishments, the number of customers during late hours and the demand for large banquets gradually returned, but store operators continued to struggle with high raw materials and utilities costs, and the labor shortage. While the number of contracts signed (new + successor) decreased by 7.3% due to the ongoing reorganization of sales, the quarterly trend improved from 1Q 103 → 2Q 114), and store subleasing segment sales increased +10.9% on sublease properties up 210 to 2,545, +9.0%. Segment OP rose +34.1% due to GPM up sharply on reduced procurement costs (vacancy rent associated with aggressive procurement last term) and contract renewals, as well as control of SG&A expenses.

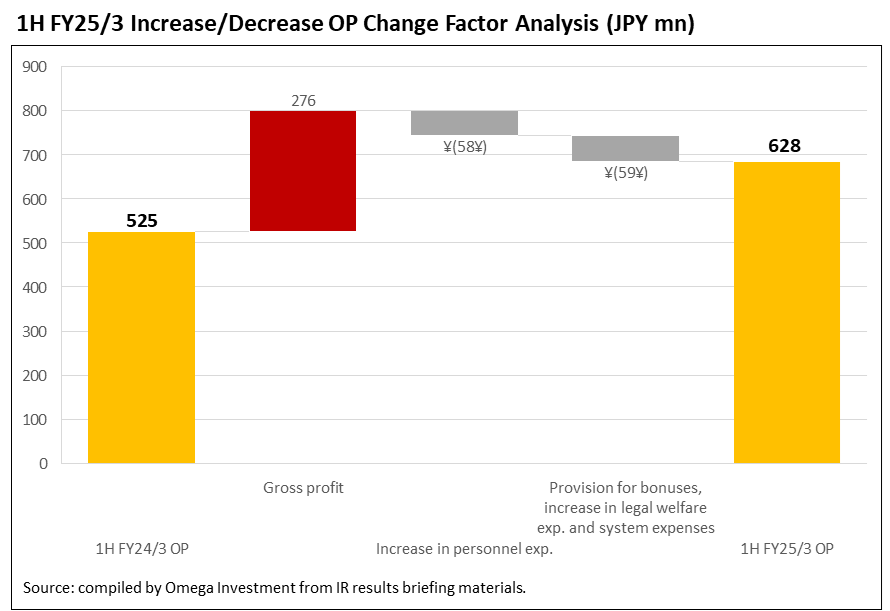

Real estate trading business posted a strong quarterly contribution in Q2 on the sale of one large property, with 1H segment sales increasing +8.0%, and segment OP increasing +13.7%. The new subsidiary Asset Innovation sold 3 properties and acquired 6 (Q2 sold 2 and acquired 5), bringing total inventory to 7 as of the end of September. As can be seen from the table below, relative to the initial forecasts for 1H OP -17.3%, the sharp improvement in GPM from 17.8% → 18.6% and control of SG&A absorbing increased personnel costs (see OP change factor analysis graph on P21) resulted in 1H consolidated OP rising +30.1% YoY, beating the initial forecast by 57%, and the Company accordingly revised up full-term forecasts shown on the bottom of P21.

FY25/3 Business expansion initiatives under the new holdings company structure

During the first year of the new MTP in FY25/3, while net sales are forecast to increase, operating profit was initially forecast to decline another -6.9% YoY due to the impact of higher SG&A expenses accompanying the increase in headcount for aggressive expansion of each business. However, the sharp improvement in GPM from 17.8% → 18.6% and control of SG&A absorbing increased personnel costs resulted in 1H consolidated OP rising +30.1% YoY, beating the initial forecast by 57%, and the Company accordingly revised up full-term forecasts, now forecasting record profit for year 1. The effect of sales reorganization is expected to emerge going forward.

Tenpo Innovation CO., LTD. – Store subleasing business

Vision: Change business practices in the subleasing industry and create a new standard for store properties

① Sales

- Measures to expand purchasing opportunities (Property Development Department) and division of labor and specialization of leasing operations (Sales Department)

- Along with increasing procurement, establish procurement channels centered on web-based purchasing and implement measures to build relationships with leading suppliers

- Shift from traditional all-in-one leasing to a division of labor by business, pursuing total optimization and specialization

② Training

- Training system to quickly turn inexperienced sales representatives into an effective force

- Efficient education through active use of e-learning tools such as videos

- Establish and disseminate mission, vision, and values for each department, and organize and manualize procurement know-how

③ Recruitment

- Continue to actively recruit based on the previous year’s results (23 sales hires)

- Established the “Recruitment Promotion Department” to succeed the Sales Development Department of the previous fiscal year, and plans to actively recruit property management staff in addition to sales staff

- Aiming to maximize the number of applicants, while increasing efficiency and reducing costs

④ In-house websites

- Improve the appeal and presence of our websites “INUKITENPO.com” (finding tenants for vacated-furnished stores) and “TENPOKAITORI.com” (purchase of vacated equipment)

- Expand the range of properties handled by “INUKITENPO.com” and improve convenience by using search engine optimization (SEO) measures and use of LINE, etc.; expand the range of properties handled by “TENPOKAITORI.com” and increase awareness through advertising, begin operations by a specialized team

Safety Innovation CO., LTD. – Rent guarantee business

Vision: Become No. 1 in the rent guarantee industry in terms of the number of commercial real estate rent guarantee contracts

① Startup preparations

- Initially, place priority on approaching Group business partners, with full-scale recruiting activities beginning in the second half of the fiscal year

- Conduct sales activities to real estate companies (on the scale of 1,000 companies) that deal with subleasing business to increase awareness in the Tokyo metropolitan area

- Full-scale recruiting activities are scheduled to begin in the 2H of the current fiscal year (planning to hire approximately 15 employees), and planning to establish a branch in the Tokyo metropolitan area

② Business flow

- Proactively utilize IT while improving workflow and manuals, and establish a training / education system

- Proactive use of cloud services and OCR to develop workflows and manuals for making contracts, screening, and collection

- Improve convenience and reduce the burden on clients, while improving operational efficiency and training systems

Actively acquire projects outside the Group through rent guarantees specializing in commercial real estate properties. Expand business through synergies by leveraging store property know-how and providing added value to agents.

Asset Innovation CO., LTD. – Real estate trading business

Vision: Become a leading company in commercial real estate distribution

① Developing customers

- Taking the opportunity of the company’s establishment, strengthen organizational and sales capabilities, and actively collect information and cultivate customers

- Strengthen sales and marketing for purchasing to Yamanote Line and surrounding stations (plan to add 2 sales staff this fiscal year) and develop sales channels other than RE agents

- Strengthen purchasing capabilities through direct mailings to RE agents and property owners

② Training and collaboration

- Start compiling know-how and creating manuals, and hold study sessions for Group cooperation

- Through organizing know-how and creating manuals, aim to increase human resource short-term competitiveness

- Hold study sessions for Group companies twice a year to share information on purchases and sales

Part ④ : Share Price Insights

Key takeaways:

❶ The current P/E and P/B are trading on discounts of 33% and 20%, respectively, to their historical averages. EV/EBITDA is trading on an 43% discount. Importantly, DY is trading 88% above its historical average.

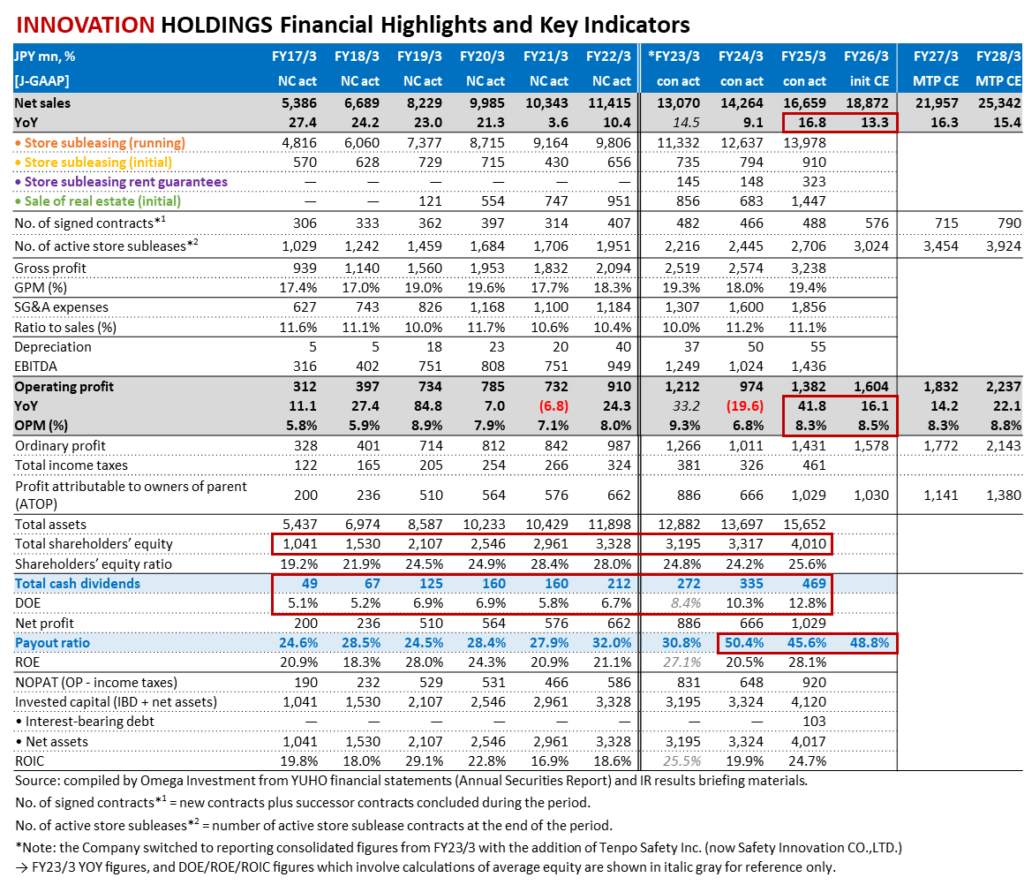

❷ The equity ratio on the surface may appear low at 25.6%, however this reflects the fact that the B/S is comprised of a large amount of deposits paid and received (see B/S on P26). The Company is effectively debt-free, and the B/S is extremely healthy.

❸ Following the revised dividend policy from FY24/3 raising target payout effectively from the 30% level → to the 40% level, DOE topped 10% for FY24/3, and the payout ratio topped 50%.

Sharp underperformance in FY24/3 can clearly be attributed to discounting margin deterioration in the short-term from leading upfront investments to capture the substantial growth opportunity going forward under the new holdings company structure.

Despite initial expectations for a second consecutive year of OP declining YoY, the current share price has yet to incorporate the revised outlook on the sharp improvement in GPM and control of SG&A absorbing increased personnel costs, now forecasting record profit. Omega Investment believes the disconnect between profit growth and current weak relative share price is unsustainable.

Consolidated Balance Sheets