Ajinomoto (Price Discovery)

Hold

Conclusion

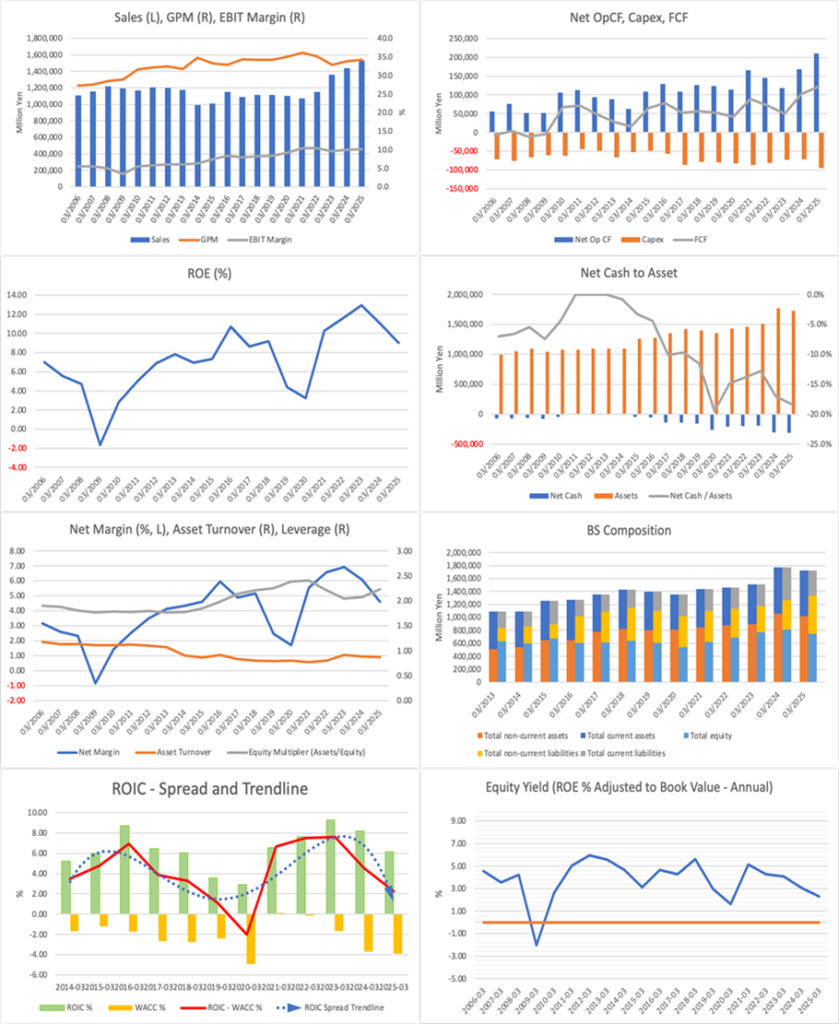

Hold. In addition to the solid earnings base in foods, the company has high-growth domains in pharmaceuticals and bio, and electronic materials (for AI), and its shareholder returns are also proactive. However, the share price is already at a high valuation that discounts commensurate growth expectations. Upside potential is limited by deteriorating earnings visibility and doubts about the improvement in capital efficiency, and caution is warranted for new tactical buying.

Profile

Ajinomoto is a global food and materials company that, starting from umami seasoning (MSG), has “seasonings and foods” and “frozen foods” as its core, while expanding its business domains into “healthcare, etc. (pharmaceuticals and bio/media and amino acid applications, etc.)” and electronic materials based on amino acid technology. BtoC household seasonings and foods have high demand stability and serve as the foundation of earnings, even amid volume fluctuations following price revisions and increases in raw material and logistics costs. On the other hand, the growth drivers are the healthcare domain (for biopharmaceuticals, etc.) and electronic materials; particularly high growth is expected, as expanding demand for AI servers provides a tailwind, driven by film-shaped insulating materials (ABF, etc.) used in the packaging process of advanced semiconductors.

Sales ratio by business % (operating profit margin %): Seasonings and Foods 59 (13), Frozen Foods 19 (3), Healthcare, etc. 21 (10), Others 1 (10) [Overseas] 69 (FY3/2025)

| Securities Code |

| TYO:2802 |

| Market Capitalization |

| 3,519,732 million yen |

| Industry |

| Foodstuff |

Stock Hunter’s View

The earnings base of food is solid. Pharmaceuticals, bio, and electronic materials are also high-growth.

Ajinomoto is Japan’s largest food manufacturer and developed umami seasoning (MSG, or monosodium glutamate). The company has a strong image of seasonings and frozen foods. Still, it also handles the pharmaceuticals and healthcare domain and electronic materials, and among these, the film-shaped insulating material necessary to produce high-performance semiconductors boasts a 95% global share. At present, shipments for AI servers are robust.

The FY3/2026 second-quarter (April–September) results were 738.881 billion yen (down 0.7% YoY) in revenue and 86.754 billion yen (down 0.2% YoY) in business profit, indicating a plateau. In Japan, frozen foods struggled amid volume declines following price increases, while decreases in BtoB seasonings and higher production costs also weighed on the market. On the other hand, demand for BtoC seasonings was stable, and the food business as a whole can be said to have been solid. By region, Asia was solid, and further global business expansion is expected, with product strength, manufacturing know-how, and the sales platform as strengths.

Also, in the pharmaceuticals and healthcare domain, which is a growth area, growth in amino acids for biopharmaceuticals and media applications led to growth. Electronic materials are also expected to achieve further high growth, with AI applications as a tailwind.

The company is also proactive in shareholder returns, and plans an annual dividend of 48 yen, an increase of 8 yen from the previous fiscal year. At the same time as the 2Q earnings announcement, it also announced its second share repurchase of the fiscal year (up to 3.0 million shares, 80.0 billion yen).

Investor’s View

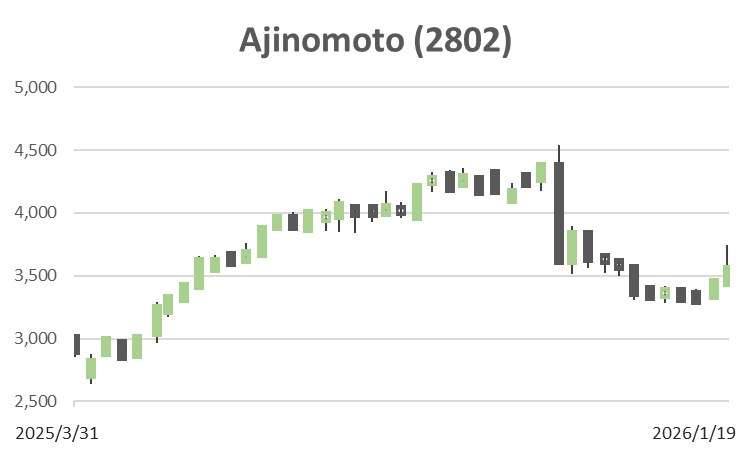

Hold. The share price discounts commensurately high growth expectations, and the valuation is elevated. At present, upside potential is limited due to deteriorating earnings visibility and doubts about improvements in capital efficiency; continued ownership is reasonable for institutional investors, but it is difficult to find sufficient attractiveness for tactical capital to initiate new buying.

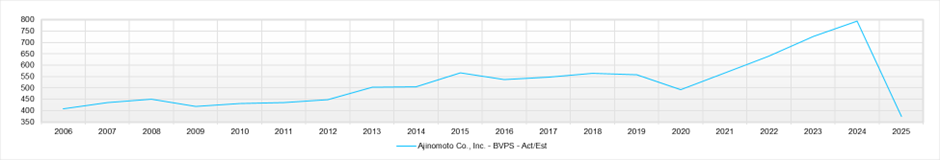

Up to 2023, the company’s shares had significantly increased in valuation, driven by a growth story, improved profit margins, and expectations for ABF (electronic materials). On the other hand, the share price has been lacklustre since 2024. Factors that distort earnings visibility, such as impairment losses and restructuring expenses related to the sale of Ajinomoto Althea, became apparent, and in addition, the fact that EPS, ROE, and ROIC actually declined markedly for two consecutive years restrained upside in the share price.

However, management has positioned profitability and capital efficiency as essential indicators of medium-term ASV performance in the “2030 Roadmap” and is presenting a bullish outlook. The company forecasts normalised EPS of 135 yen; based on this, the forecast PER is 27.0x. The actual PBR is 4.97x. The company forecasts a current fiscal-year ROE of about 16% and a forecast dividend of 48 yen. When reverse-calculated from these indicators, the EPS expected growth rate discounted in the share price is estimated to be a little over 9%, suggesting that a commensurately solid earnings-growth scenario is already discounted in the share price. In other words, the market allows an optimistic valuation while leaving open the question of whether the stable ROE range of 10–14% in recent years will shift upward as management forecasts, and whether EPS predictability will improve.

In the food sector, JT (2914) is the largest, accounting for about 25% of the sector’s market capitalisation, followed by Ajinomoto at about 13%. Ajinomoto’s valuation is extremely high compared with the sector average (PER of about 20x, PBR of about 1.9x), reflecting the view that the business’s quality is outstanding. Considering the long-term earnings stability derived from demand stability, which institutional investors seek in holding food company equities, it is not sensible to significantly underweight a high-quality name in a portfolio. On the other hand, for tactical investors such as individuals and hedge funds, it is difficult to find sufficient reason to expect near-term share price upside. As stated above, the valuation already discounts a certain level of growth expectations, and the Hold recommendation is reasonable.

In addition, the sale of land and shares, impairment losses, and restructuring expenses are often classified as “one-off factors” for accounting purposes, but in practice, they occur almost continuously at a large company such as this. Investors base fair value estimates and valuations on reported EPS, and a listed company should not position figures that arbitrarily adjust for one-off factors as its true earning power. In the first place, management is fully accountable for the stated EPS, and it is difficult to support inflating it for various reasons. Such a stance undermines the transparency of the explanation and could ultimately damage confidence in management. Ajinomoto’s earnings forecast for the current fiscal year incorporates a gain on the transfer of land, but the amount has not been disclosed. Management should fully recognise that a situation in which one-off gains and losses that investors cannot forecast occur on an ongoing basis impairs earnings visibility and can be a typical discount factor in the valuation investors assign.

Financials and Valuations

Price

PBR (LTM)

PER (LTM)

ROE (LTM)

EPS (Actual)

BPS (LTM)