Hamee

| Securities Code |

| TYO : 3134 |

| Market Capitalization |

| 22,864 million yen |

| Industry |

| Retail Business |

Profile

Hamee’s core businesses are commerce and platforms. The former is the design and sale of accessories for smartphones and tablets. It owns the iFace brand, and about 70% is sold online. Platform business is a cloud-based EC business support system named Next Engine.

[Sales composition %, OP margin %] Commerce 81 (24), Platform 16 (31), Others 2 (-37) [Overseas] 8 <FY4/2020>

Investment View

The attractions of the shares are 1) high ROE of above 20% or more, 2) high growth of BPS driven by organic growth of both commerce business and platform business, 3) finance operations with careful consideration of shareholders, and 4) conheret management. Stock price has fallen sharply since September 2020, and TSR is quite negative. However, judging from the share price fluctuations over the last five years, the current stock price is seen as neither oversold or overbought. In addition, as will be described later, the stock price is lagging those of other peers in E-commerce sub-sectors. The fair value calculated by Toyo Keizai by its original residual income valuation is 1660 yen. The detailed assumptions of this calculation are not disclosed, but it looks like a sensible number. We view Hamee’s BPS growth optimistically and think it worth considering Hamee stocks in a portfolio and take a view. However, investors must also consider where the high multiples of those growth stocks could go, against the backdrop of signs of a rising interest rate environment and the growth bubbles seen so far in the equities market.

As per the current business, it is interesting to note that the profit margin of the platform business, which has been on a downward trend for several years, is improving significantly. It is the most notable momentum of all current aspects of the company’s business. Cash generation is so much that the company is starting to struggle with what to do with it, and there is a risk that cash will accumulate in BS to dilute ROE. Nevertheless, if investors believe the improvement in profitability of the platform business is structural, the stock price may well rise interestingly.

| Period | Revenue (mn, yen) | EBITDA (mn, yen) | EPS (yen) | PER (CE)(X) | PBR (X) | ROE (%) |

| 4/17 | 8,502 | 1,272 | 44 | 30.4 | 6.6 | 25.8 |

| 4/18 | 9,377 | 1,627 | 54 | 35.4 | 8.2 | 25.2 |

| 4/19 | 10,303 | 1,525 | 52 | 17.3 | 3.1 | 20.3 |

| 4/20 | 11,325 | 2,227 | 68 | 21.3 | 4.4 | 22.8 |

TSR Observation

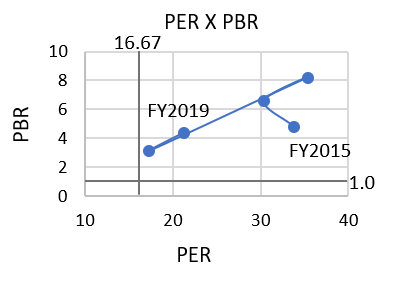

The company has achieved remarkable success in the short time since its IPO in April 2015. As a result, TSR has been very high and is satisfactory for long-term investors. Almost all of the stellar TSR performance is attributable to the fine BPS growth. Based on the latest stock price and the BS in the third quarter of the FY March 2021, TSR has increased by CAGR + 23% over the past five years. During this period, BPS registered + 24%. The dividend yield was extremely low and was not a factor. PBR was occasionally quite high during the same period, but the 5-year CAGR was + 1%, contributing little to TSR. It is impressive that Hamee shares have maintained a high investor reputation of about five times their equity capital since the listing. But upward momentum in share price valuations appears to have gone. For Japanese equities with ROE greater than 8%, it is observed that PBR is highly correlated with ROE. In the case of Hamee shares, the multiples may be implying that investors do not expect upside in ROE though they believe that the company will maintain a high ROE of just over 20% going forward.

| Fiscal year | 4/2016 | 4/2017 | 4/2018 | 4/2019 | 4/2020 | 4/2021 | 5YR CAGR |

|---|---|---|---|---|---|---|---|

| Share Price(a) | 585 | 1,031 | 1,667 | 773 | 1,316 | 1,587 | 22% |

| Dividend per Share | 1.5 | 4.5 | 5.5 | 6.5 | 7.0 | 8.0 | |

| Accumulative Dividend(b) | – | 5 | 10 | 17 | 24 | 32 | |

| (a) + (b) | 585.0 | 1,036 | 1,677 | 790 | 1,340 | 1,619 | 23% |

| Total Shareholder Return | 177% | 287% | 135% | 229% | 277% | ||

| PBR | 4.8 | 6.6 | 8.2 | 3.1 | 4.4 | 5.0 | 1% |

| BPS | 127 | 170 | 216 | 254 | 297 | 372 | 24% |

| Dividend Yield | 0.3% | 0.4% | 0.3% | 0.8% | 0.5% | 0.5% |

4/2021 Dividend: Company forecast, 4/2021 BPS: The latest reported BPS (Q3)

Peer Comparison

Hamee shares are lagging In the E-commerce sub-sector, which consists of 36 stocks including Rakuten (4755) and Monotaro (3064). The shares of Hamee rose 9% in 12 months, and ranked 25th in the subsector. They were down 4% in the last 6 months and are ranked 21th. Operating profit margin, comprehensive net income margin, and ROE are all average levels. However, both PER and PBR are slightly cheaper than the simple sub-sector average, and if investors can predict stock price relevant financials such as ROE and cash flow a bit more optimistic than the consensus, it could drive their investment decisions. Of the total market capitalization of 624 billion yen in the sub-sector, Hamee shares rank as the 16th comprising 4%, or 25.5 billion yen. Rakuten, Monotaro, ZOZO (3092), and Mercari (4385) account for 80% of the market capitalization of the subsector. The market capitalization of the Internet industry, which consists of eight sub-sectors, is 2.79 trillion yen.

Thoughts on Cash Flow and ROE

Thanks to the rapid business success, the company has gained capacity to generate good cash flow in a short period of time. However, at the moment, they appear to be struggling as to what to do with CF. Shareholders want the management to invest more and more in their core business if they have cash, because the company’s ROE is so high. The management is keen on Investment and spent 1 billion yen in FY4/2019, but investors cannot predict the return of this investment. It is rated well that the management is coherent to the core business and there are no signs of undisciplined investment to scale up the business such as by M & A, which is rather common amongst DX companies. However, if the management turns to chase scale expansion, there is a risk that short-term ROE will be sacrificed, while if they are too cautious about cash flow recycling, cash will easily accumulate and ROE will be structurally diluted. It seems that the management has entered a difficult phase. This is a typical turn that many young, fast-growing companies experience and can result in a turning point in equity valuation.

As a way to use cash, management has bought about 3% of the outstanding shares from the market through two share buybacks since 2019. Buying back shares at a high PBR dilutes the BPS of existing shareholders. However, in reality, share buybacks affect investor expectations and the trading, and are sometimes a quick fix for stock prices. The share buyback in 2019 had no effect on the stock price, but the share buyback in March 2020 was agile after the stock price fell sharply and had an effect. At that time, quite a few companies recognized that they had no problem with cash and that the stock price was low. But most of them were reluctant to buy back their own shares to act for shareholders. Many shareholders must have been dissatisfied with the indecisive management. Hamee’s shareholders have had the positive experience that this management will not hesitate to act to defend the shareholders.

Threats and Opportunities

Opportunities

- The penetration of iFace brand equities and the continued popularity. Japanese market for iPhone is big and the demand for model changes persists. This business has high margins.

- Steady growth of platform business and the scope for future market development. Profit margin may well reverse for the better direction.

- Attractive ROE. Excellent cash flow generation.

- The management looks to adhere to a consistent business portfolio over the medium to long term.

- The management wants to emphasize stock businesses in view of the maturing growth of mobile terminals.

- Shareholder friendly actions in the capital market.

Threats

- Recycling of cash flow is not easy. Cash is being generated so fast that there is risk of diluting return on capital as cash accumulates in BS. Should there be large investments, the returns are unpredictable by investors.

- Due to the saturation of the domestic smartphone penetration rate, it is expected that Hamee will need to depend only on model change demand.

- If there is a large investment in the Other Businesses segment that is posting losses, the company-wide profit margin will be diluted easily.