Sansei Landic

| Securities Code |

| TYO : 3277 |

| Market Capitalization |

| 7,403 million yen |

| Industry |

| Real Estate |

This write-up briefly describes the findings regarding the business value and stock value of Sansei Landic from the investor’s point of view. Please refer to company materials and various researches to understand the details of the business. We are listing the stock on our Equities List with a view to conduct further research and would look to share our renewed insights with investors.

Attraction of Business

The strength of the company lies in its ability to negotiate and coordinate complex real estate rights relationships. With this capacity the company is able to raise the real estate value significantly. The company purchases land of low asset value from the owner and adjusting the rights relationship, sells it and earns stable ROE of 10% or more. The main business is the handling of leasehold land and the revitalisation of old unutilised property. According to the company, the profit from the leasehold land commands a major part of the real estate segment earnings. It is considered difficult for other companies to either catch up or make an entry in the leasehold land business, and the superiority, which the company demonstrates as a pioneer, will unlikely be undermined. The desire for improving the value of real estate, which is difficult to raise the value as is, drives the long-term demand. On the other hand, the market is still almost undeveloped so the market growth is expected to be long-term. Consequently the company is expected to perform steadily over a long period of time, if not at a surprising pace.

The management is felt to be consistent and solid, and should be able to steadily increase BPS as they have demonstrated over a long time. Since the IPO in 2012, BPS has grown at a compound annual rate of 11%. During this period, the real estate market as a whole has been strong and investors have not witnessed how market fluctuations will affect the business of Sansei Landic and how well the management will try to override the difficulties. However, considering that the demand for leasehold land handling is solid and that the inheritance of assets is ceaseless, the impact may be milder than feared.

In 2020, the COVID-19 virus had a serious impact on the company’s face-to-face negotiations with customers, resulting in stagnant sales activities and a decline in sales. Profit fell sharply, partly due to the management’s disposal of some real estate for sale to bolster cash position. However, the full-year financial results to Dec 2020 exceeded the company’s targets, and, good or bad, the management guidance proved a little too cautious.

All in all, we feel that the business of Sansei Landic will recover rather quickly, supported by a healthy balance sheet, as the economy and the society head toward normalization. Already in Q1 2021, the delay in sales activities due to coronavirus has been recovered, and both sales and profits rose over the same period of last year and exceeded the management’s forecasts. Of note is the significant increase of leasehold land business, which is driving the recovery of the real estate segment.

Investment view

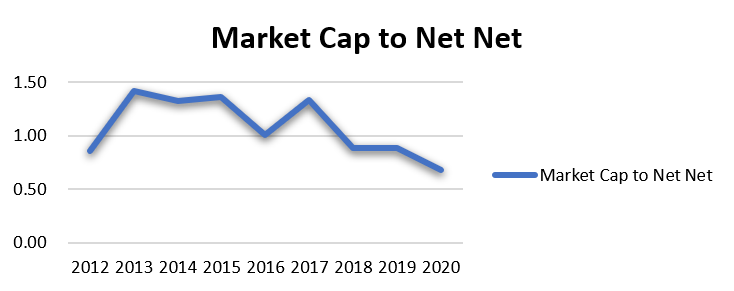

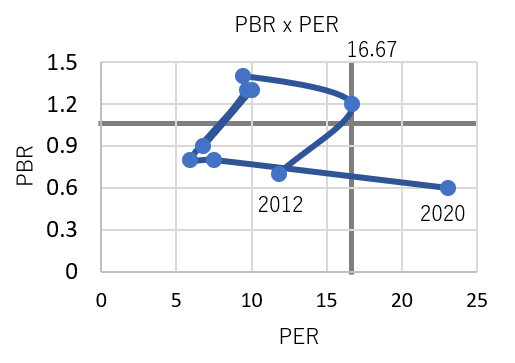

It does not take much to talk about the cheapness of the stock. PBR has been around 0.8 times in the last few years. Market capitalization is 0.82 times of Net-Net (net current assets = current assets – total liabilities). Taxation considered, the stock price of 710 yen, which is 0.66 x the Net-Net, is considered to be the rock solid bottom. The Shikiho calculates the fair value at 1243 yen a share based on its own residual earnings method.

ROE has been stable at a little above 10% for the past years since the IPO in 2012. In the meantime PBR has fallen consistently to below 1x. We believe that the discount of the shares will disappear if investors understand that the current slump in profits is temporary, that the company will keep its leading position and continue to earn reasonably high return on shareholders’ funds, and that there is little to worry about the impairment of the BS. Hence the shares are thought to be good long-term value.

Reasonably high ROE is a straight reflection of the good profit margin of net income. which shows the good profitability of the core operation, where the unique and well-managed real estate business earns most of the profits.

The average ROE of 11% from 2012 is split into a net profit margin of 5.5% x leverage of 2.0 x asset turnover of 1.0. The financial leverage is not particularly high and the asset turnover is neutral. Both are fairly stable over the long term. This can be taken as proof that the business is under good control of the management.

| Period | Revenue (mn, yen) | EBITDA (mn, yen) | EPS (yen) | PER (CE)(X) | PBR (X) | ROE (%) |

|---|---|---|---|---|---|---|

| 12/17 | 13,099 | 1,833 | 133 | 10.0 | 1.3 | 13.9 |

| 12/18 | 16,833 | 1,822 | 119 | 5.9 | 0.8 | 11.3 |

| 12/19 | 18,020 | 1,912 | 137 | 7.5 | 0.8 | 11.7 |

| 12/20 | 17,775 | 896 | 42 | 23.1 | 0.6 | 3.6 |

About Share Price Discount

If there is a reason why the stock price must be valued significantly below its asset value, it would be a serious concern about asset impairment. As per Sansei Landic, the concern should be that real estate for sale, which accounts for nearly 80% of current assets, may be at great risk of book value devaluation due to a decline in profitability. However, no significant impairment losses have been reported in the last 10 years.

The company reports book value devaluation of real estate inventories due to the decline in profitability in its annual reports. These numbers averaged 0.7% for the seven years from 2013, compared to the value of real estate for sales at the beginning of each fiscal year. This looks quite small. In 2020, the management aggressively disposed of real estate for sale and at the same time, reported 2% devaluation of real estate inventory, which came in as the largest devaluation over the last decade. Although the details of these are not disclosed, it is assumed that management has been actively recycling real estate for sale since 2020, and the purpose is to maintain a margin of cash position while keeping inventories in good health. For the time being, this financial operation may well continue until the management feels fine with the operating environment, and could weigh on the short-term business performance. Nevertheless, from a medium- to long-term perspective, the current earnings slump should be seen as temporary.

Share Price Observation

YTD TSR (Total Shareholder Return) is satisfactory, finally surpassing TOPIX by a wide margin thanks to the rise in stock price triggered by the share buyback in February 2021. However, up to that point, TSR had been disappointing, measured over five years or since the IPO in 2011. This is in spite of the management’s effort to raise the dividend consistently. From 2015 to 2020, BPS, the result of management efforts, grew at a CAGR of 10% , while PBR, which reflects investor expectations, posted -14%. The TSR for the same period registered -1%.

Total Return

| 1M | 3M | 6M | YTD | 1Y | 3Y | 5Y | IPO (Dec.2011) | |

|---|---|---|---|---|---|---|---|---|

| 3277 | 6.3 | 10.7 | 15.7 | 17.6 | 0.8 | -10.6 | -0.8 | 3.6 |

| TOPIX | 1.4 | 2.0 | 10.0 | 7.6 | 25.2 | 5.7 | 10.0 | 7.8 |

Source: Omega Investment from various materials.

Foreigners held 2.0% of the shares in 2014 and raised their holdings to 7.1% by 2016. They reduced the stake to 3.0% in 2020. It appears that as they left the share price slumped. There has been no return since they disposed of the position on the share price strength in 2018. It was a sensible investment to take money when the stock price went up with good trading volume after holding for several years. The price multiples were approaching the high end of the historic range. To our observation, since then, no institutional investors, who are good at buying stocks at a big bargain, have emerged. Investors may be thinking that it is too risky to pick up a small real estate stock near the top of the real estate market cycle, given no scope for interest rate declines and after the booming real estate market in Japan.

For the stares of poor liquidity, the share buyback in the market in February 2021 proved a strong catalyst and sent the share price higher. The timing was right. The buyback at a time when investors tend to worry about the performance and cash flow of small real estate companies has effectively showed the company’s confidence. The company bought 200,000 shares in the market, which is 2.37% of the outstanding shares, and invested 167 million yen in about two months until April 20. It is a share buyback at a bargain price, and many investors who evaluated this are expecting another share buyback.

If the combination of surplus cash and cheap stock price encouraged the management to do the share buyback, normalisation of the economy will mean that the management will not opt for another share buyback, as they will rather spend on inventory buildup. This should disappoint some investors. The management will likely use some cash and buy back shares if it turns out in 2021 that inventory buildup will not progress much as concerns on the economy linger. Treasury stock will be excluded from the number of shares in circulation, according to the formula of JPX in its new market reclassification plan. In the case of Sansei Landic, there is no concern as to whether the shares are listed in Standard Market, even though the company may execute share buyback further.

Bulls and Bears

Bulls

- Cheap PBR and market capitalisation below Net-Net. The business is able to produce good ROE for a long period of time, and possibly BS does not carry risk of serious impairment, as far as investors check from the public materials available.

- The potential market size of Japanese leasehold land business is large and looks a promising market. In Japan, about 870,000 households own real estate that is based on the former Land Lease Law. These real estates have separate land use rights (of land lease) and ownership rights (of land). Sansei Landic has dealt with just over 8,000 deals since 1991, and the market is largely undeveloped. The company expects about 400 transactions a year and is expected to register solid growth over the long term.

- The company’s real estate business requires a complicated execution process and the competition is not so intense. Therefore, the company is able to deliver stable and reasonably high profit margin. Large companies are reluctant to enter because they see the business as not scalable due to face-to-face sales and the complexity of rights negotiations and coordination.

- If the corona infection calms down and the socio-economics move toward normalisation, the company should recover quickly. Already in the 2021 Q1 results, the top line sales have regained momentum, and business results have exceeded the management’s forecast rising over the same period of the previous year. leasehold land sales have increased significantly and are driving the real estate sales business.

- Many of the directors own shares to a visible degree. CEO Matsuzaki owns 15.4% (1.3 million shares). He joined Sansei Landic in 1993 and became CEO in 2003. Board members, who are defined as insiders, own 22.5% of the company.

- The possibility of further share buyback and the chance that it could increase investor attention to the company. The management’s guidance tends to err on the upside when the business momentum weakens, and it is vice versa when the momentum is up.

Bears

- The soundness of real estate inventories is thought to have been maintained over the long term, but the reality cannot be seen by investors. One cannot say that there is absolutely no possibility of large impairment losses. Real estate for sale accounts for the majority of current assets. It accounts for 70% of total assets.

- Investors have not seen the company in the downturn of the real estate market and it is difficult to predict how they will be impacted and how the management can resist the turndown. Investors cannot determine how cyclical Sansei Landic business is.

- Management is not necessarily unwilling toward IR, but contacts with institutional investors appear few, and it is difficult to find a good answer as to how the company will be known to investors. Many foreign investors are unaware of Japan’s leasehold land market, where it is possible to increase real estate value to an interesting degree through rights adjustments.

- Management seems to be reluctant to introduce new businesses that could dilute the stock value. On the other hand, it should be difficult to achieve attractive growth that satisfies investors with just the existing businesses. M & A is an option, but it is doubtful if there are good fits and fine synergies in the Japanese market.

- The shares are illiquid and investors need considerable time and careful attention to trade the shares in the market. It is not an investable stock for investors looking to generate returns in less than a year. Long-term investors and small funds may not be concerned with this.

Business

The company purchases real estate of complicated rights, and adjusts the rights and resells. It also runs detached house construction and real estate brokerage.

(sales mix %, operating margin %) Real estate sales 91 (12), construction 9 (0) <FY12/2020>

Originally, the company operated brokerage of real estate and rent of condominiums, apartments and buildings. It started a real estate sales business as business grew. In 1991, it started a leasehold land business, which other real estate companies did not touch upon very much. Currently it generates a major part of the revenue of the real estate sales segment. In March 2005 it started a construction business, which includes single-built house construction and renovation work.

The company discloses the real estate business by dividing it into leasehold land, old unutilised properties, and freehold. Old unutilised properties refers to land and buildings with rent rights, such as apartments and buildings that are aging and do not generate sufficient profits. The company purchases these properties from the building owner, requests the renter (the renter of the building renting a part of the building) to move out, lets them know a new relocation destination and pays the relocation costs as necessary. The lease contract is canceled by agreement and Sansei Landic takes full ownership of the property. After the renter moves out, the vacant land and building, or the vacant lot after the building is dismantled, are sold to real estate companies, business companies and individuals through a real estate agent.

(Source: Created by Omega Investment Co., Ltd. from annual reports)