Kidswell Bio(Company Note)

| Share price (9/27) | ¥635 | PER(22/3 CE) | – X |

| 52weeks high/low | ¥864/393 | PBR(21/3 act) | 12.66 X |

| ADVT (¥mn, monthly) | ¥378mn | ROE(21/3 act) | -68.50% |

| Mkt cap | ¥19.4bn | DY (22/3 CE) | – % |

| Shrs out. | 30.640 mn, shrs | Shr eqty ratio (21/6) | 43.0% |

| Listed market | TSE Mothers | Foreign shareholding ratio | 3.20% |

| Click here for the PDF version of this page |

| 4584CN20210928EN |

KIDS WELL, ALL WELL

Creating new value with Regenerative Medicine (Cell Therapy) and New Biologics

Points of interest

A drug discovery venture company originated from Hokkaido University. Leading biosimilar and delivered some products. Focuses on regenerative medicine applying SHED and development of new biopharmaceuticals. Aiming to return to profitability in FY2022/3 by expanding biosimilars. In July 2021, the company renamed itself from Gene Techno Science to Kidswell Bio to devote itself more into pediatric diseases.

Summary

- Kidswell Bio (KWB or the Company) is a drug discovery venture company originated from Hokkaido University. It was established for the purpose of developing diagnostic and therapeutic medicines based on the research and development results of the Institute of Genetic Medicine, Hokkaido University. Research on biosimilars started in 2002. Up to now, two products have already been developed and launched. Multiple products are in the pipeline for new biopharmaceutical development and are aimed for launching in the 2030s. The company is strengthening development of regenerative medicine focusing on the therapeutic agents for diseases of high unmet needs using stem cells from human exfoliated deciduous cells (SHED) and cardiac stem cells (CSC). The company was listed on TSE Mothers in 2012. In February 2021, it announced a new Mid-Term Strategic Plan. In July the same year, the company renamed itself to Kidswell Bio looking to provide new medical care for pediatric diseases and rare diseases of all generations.

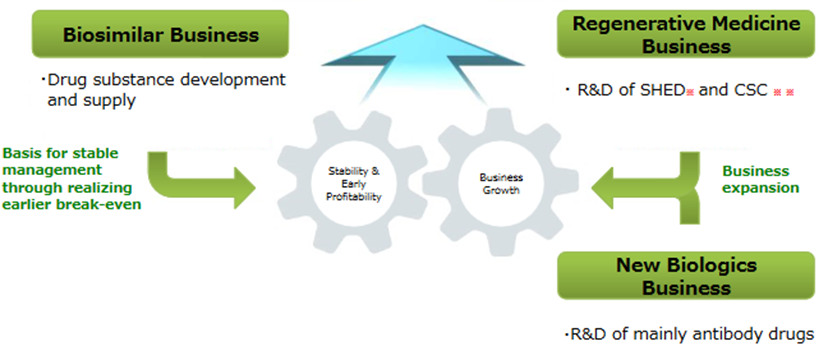

- The company operates the following three main businesses.

Biosimilar: Development of follow-on products for bio medicines. The company is a pioneer in the biosimilar products in Japan that offers alternative options amongst bio medicines, which tends to be very expensive. Two products have already been sold by the affiliated pharmaceutical companies, and the third item is expected to be launched in 2021. Drug discovery ventures need to finance new drug development hugely. The earnings from the sale of biosimilars lessen this financial burden.

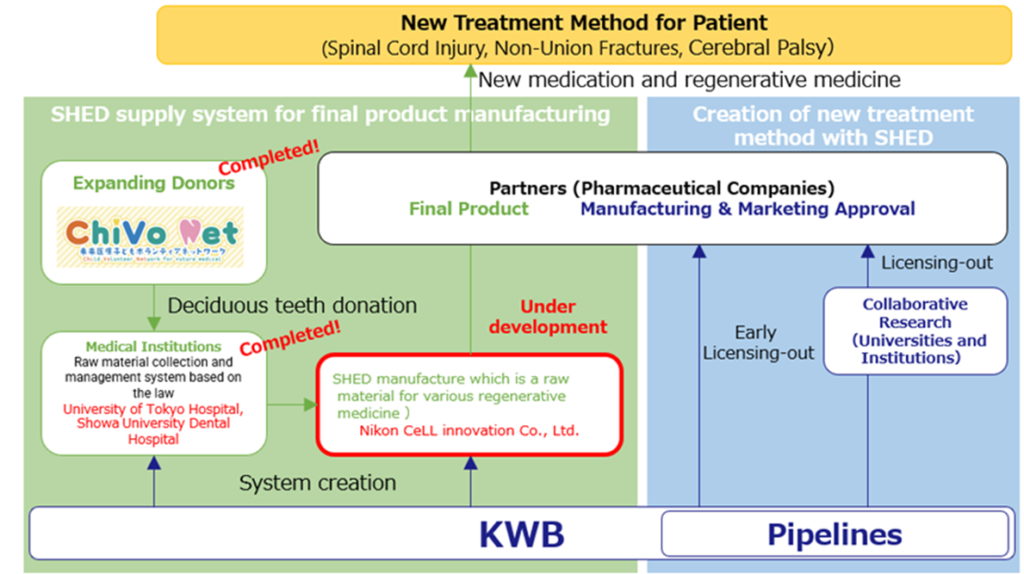

Regenerative medicine (cell therapy): In recent years, the company has been endeavoring to establish a cell therapy platform that utilizes stem cells. Utilizing stem cells from human exfoliated deciduous teeth (SHED), which mainly use deciduous teeth, eight products are in the pipeline and the company is accelerating out-licensing activities to pharmaceutical companies. Also, the company is developing a master cell bank to build a stable supply system for milk teeth. As for cardiac stem cells (CSC), JRM-001 has advanced to phase III clinical trials and is expected to be launched.

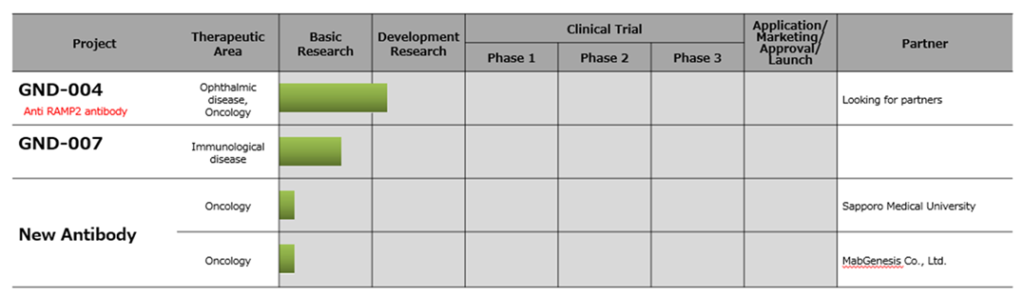

New biologics: Multiple new medicines under in-house research and development are in the pipeline. GND-004 (anti-RAMP2 antibody) is a drug candidate for eye diseases and oncology, and nucleic acid drug candidate GND-007 is in research to cure immune diseases. Once a new biologic medicine becomes successful, great returns can be expected. But it is still in the research stage and is expected to be launched in the early 2030s.

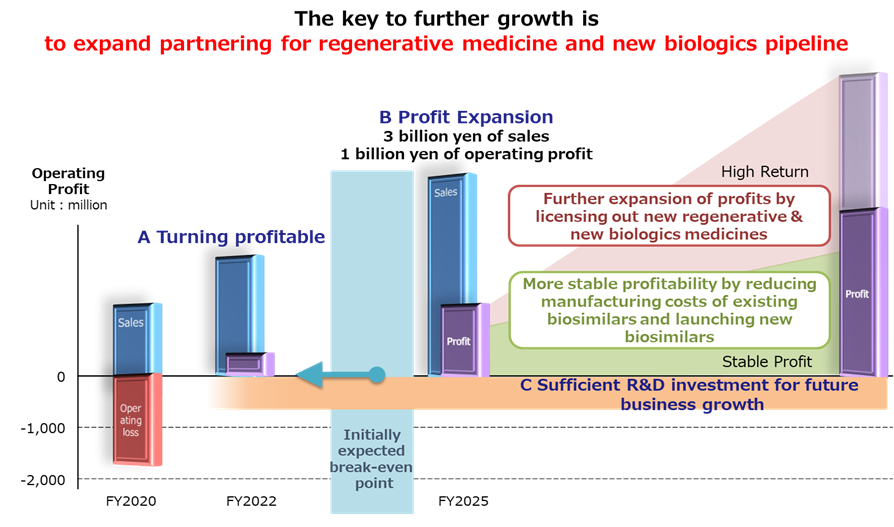

- Mid-Term Strategic Plan: In February 2021, the company announced a new Mid-Term Strategic Plan for FY2021 to FY2025. Maximizing the profits from the abovementioned three business models, the company plans to achieve profitability ahead of schedule. It expects operating surplus in FY2023/3, sales of ¥3bn and operating profit of ¥1bn in FY2026/3. Development of biosimilars and regenerative medicine is expected to proceed well in the future. It is critical to secure reliable partners for out-licensing from the pipeline.

- In FY2021/3, sales were ¥990mn, R&D expenses were ¥960mn, operating loss was ¥960mn, and net loss was ¥1bn. Operating income came in above the company estimate because some R&D expenses were delayed to the next fiscal year. By the stock rights exercises, the company raised ¥740mn. As a result, the cash and deposits at the end of March 2021 was ¥1.46bn. In FY2022/3, the company guidance is sales of ¥1.9bn (+91% yoy) and operating loss of ¥1.72bn.

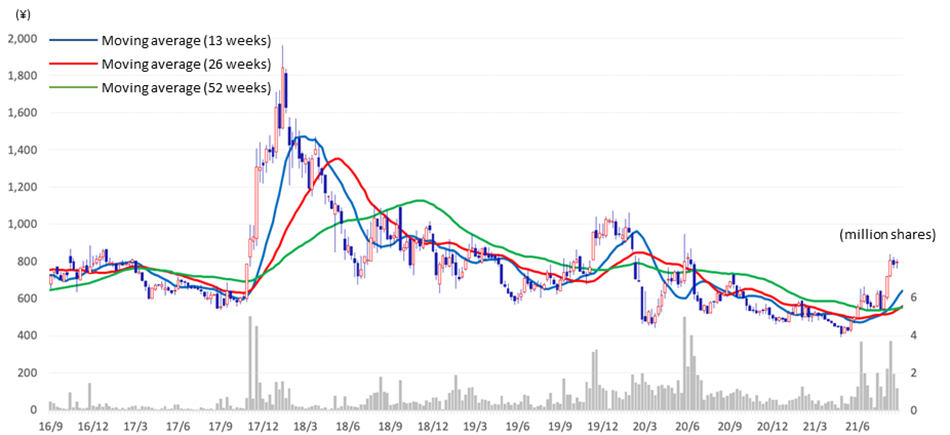

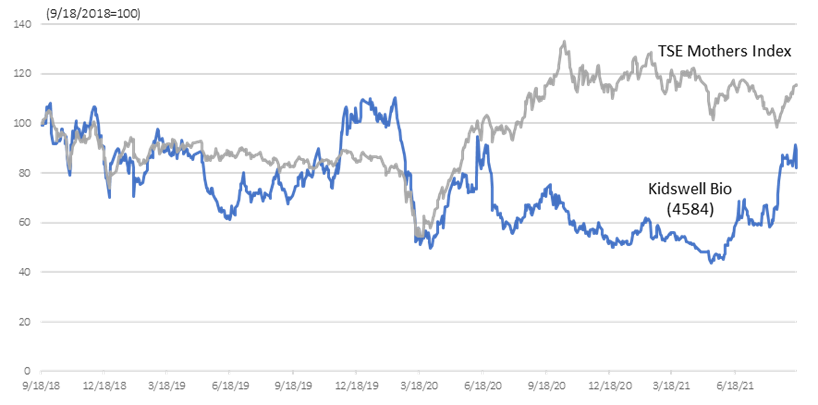

- Stock price move: The company’s stock price rose significantly on the back of the announcement of the strategic plan and the announcement of full-year financial results. Year-to-date the stock price increased by 60%, which should reflect investors’ positive expectations on the strategic plan. Results in accordance with the revealed roadmap must be demonstrated going forward.

Table of contents

Key financial data

|

Fiscal Year |

2016/3 |

2017/3 |

2018/3 |

2019/3 |

2020/3 |

2021/3 |

|

Net sales |

1,160 |

1,089 |

1,059 |

1,021 |

1,077 |

996 |

|

Cost of sales/SG&A |

1,981 |

2,273 |

1,973 |

1,827 |

2,249 |

1,966 |

|

R&D expenses |

1,075 |

1,433 |

1,107 |

945 |

898 |

963 |

|

Others |

906 |

840 |

865 |

882 |

1,350 |

1,002 |

|

Operating loss |

-820 |

-1,184 |

-913 |

-805 |

-1,161 |

-969 |

|

Ordinary loss |

-785 |

-1,176 |

-903 |

-816 |

-1,187 |

-991 |

|

Net loss |

-787 |

-1,224 |

-904 |

-856 |

-7,316 |

-1,001 |

|

Current assets |

1,520 |

3,421 |

2,692 |

2,821 |

3,322 |

3,346 |

|

Cash and cash equivalents |

817 |

2,379 |

1,891 |

2,009 |

2,032 |

1,461 |

|

Total assets |

1,694 |

3,706 |

3,025 |

3,151 |

3,592 |

3,933 |

|

Total shareholder’s equity |

403 |

3,500 |

2,604 |

2,731 |

1,487 |

1,610 |

|

Equity ratio (%) |

22.6 |

93.8 |

85.0 |

85.6 |

39.8 |

38.0 |

|

Cash flow from |

-607 |

-1,759 |

-438 |

-860 |

-1,325 |

-1,267 |

|

Cash flow from |

-121 |

-149 |

-50 |

0 |

-137 |

-22 |

|

Cash flow from |

946 |

3,471 |

– |

978 |

1,221 |

718 |

|

Increase/decrease in |

817 |

2,379 |

1,891 |

2,009 |

2,033 |

1,461 |

Notes) Unit: mn,yen

Consolidated financial statements from the FY2020/3. There is no continuity before.

Cash flow from operating activities:Expenditures such as R&D expenses and SG&A expenses mainly centering on drug development.

Cash flow from financing activities:Income from issuance of shares associated with the exercise of stock rights

Source: Omega Investment from company materials

Business summary

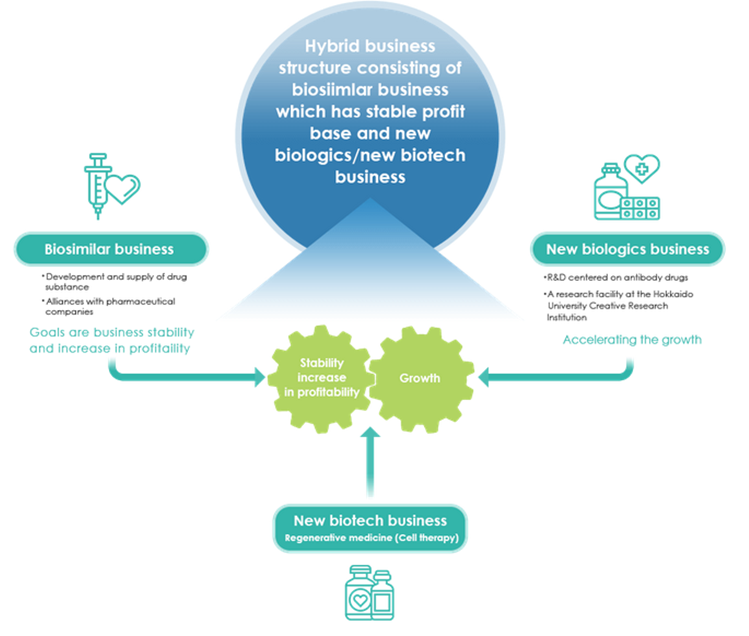

Business model: Hybrid business structure

Drug discovery ventures take about 10 years to launch a new drug going through the process of basic research, out-licensing, and clinical trials, and there must be financing of R&D in billions of yen every year for the whole process. The company started research on biosimilars in 2002 and is a pioneer of biosimilar business in Japan. It has already launched two products and generates annual sales of over ¥1bn. Revenues from biosimilars help business finance, which is critically important for drug discovery ventures. It establishes a hybrid business structure in which the development of new bio medicines, which will drive the future growth, is supported by the biosimilars, which will generate stable profit much earlier.

The table below shows the detail of the business line.

|

Business |

Period |

Risk |

Rate of return |

Pipeline, etc. |

|

Biosimilar |

Short term |

Low |

Low→Mid. |

Already launched 2 products. Sales to increase as the line-up expands to 3 to 4 products. Profitability rises as R&D expense and manufacturing costs are cut back. |

|

New biotech business |

Mid-term |

Middle |

Mid→High |

8 pipelines for SHED are in progress. To establish a platform for SHED by building a master cell bank. CSC JRM-001, currently under phase III clinical trial, will contribute to sales after launching. |

|

New biologics |

Long term |

High |

High |

Pipelines of multiple products are in the R&D stage. Launching is expected in the early 2030s |

Thanks to the operation of three different businesses, the company can keep the drug portfolio well-balanced by proper mix of timespan, risk and return. As a result, it does not suffer long-term deficit due to low or no sales, which is not unusual for drug discovery ventures.

In addition, the dilution by new shares resulting from the exercising of stock rights is of great concern to shareholders. The earnings contribution of biosimilars in the portfolio should moderate this concern.

Hybrid business structure

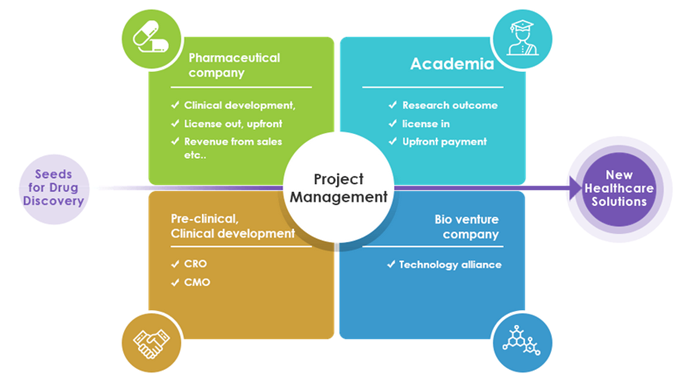

Business model: Virtual business development

Development of new drugs requires significant R&D expenditure, investment in clinical trials and manufacturing facilities, etc., and venture companies alone cannot bear the burden. Thus, there exists a system of cooperation among venture companies, academia, CRO/CMO and out-licensed pharmaceutical companies that allocate the burden in accordance with the expertise of each party. In the case of Kidswell Bio, it has built a collaborative system with best partners by utilizing its research and development capabilities, as well as the experience, know-how, and networking capabilities nurtured through business. By developing a virtual business that needs no manufacturing facilities, the company delivers high capital efficiency by light equipment.

Virtual business development x Project management ability

Biosimilar

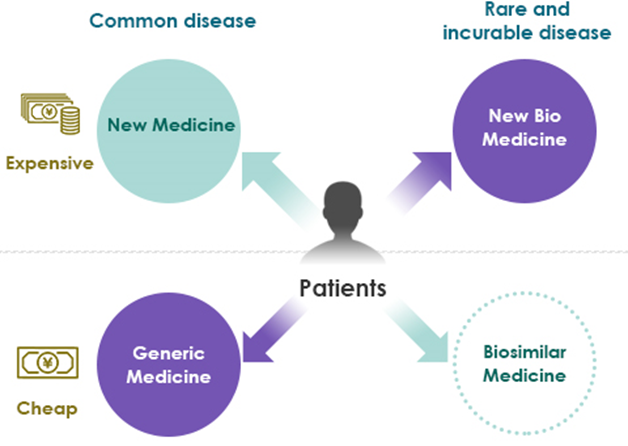

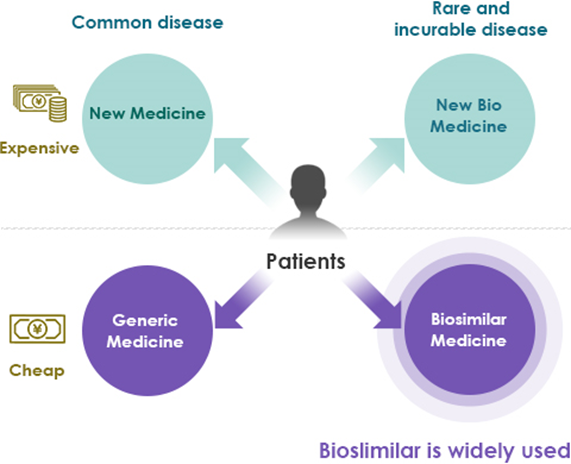

The term generic drug has become commonplace. It is a medicine with the same active ingredients, quality, efficacy and safety as the new drug, and is sold after the patent for the original drug is expired. The development of new medicine requires huge R&D expense and clinical costs, their prices become very expensive. Therefore, the use of generic medicines is recommended from the viewpoint of controlling medical costs.

Traditional pharmaceuticals are for general diseases and are produced mainly by chemical synthesis of small molecule compounds. But in recent years, bio medicines produced by recombinant proteins has progressed. Biomedicines are produced by purifying polymer compounds synthesized in microorganisms and cells. They are therapies for intractable diseases and rare diseases. Biomedicine has become even more expensive due to the difficulty of its manufacturing process, and there is a need to develop biosimilars, such as generics as against the traditional medicines.

Current status

Ideal

Source: Company materials

The production of biomedicine requires high technology, and it is produced by gene recombination technology or cell culture, therefore, unlike generics for the traditional small molecule drugs, it is not possible to produce the same product. Compared to the predecessor, it is possible to produce the same protein with similar efficacy and safety, but it is difficult to show identity due to the complicated molecular structure. Biosimilar is required to show equivalence and homogeneity. Unlike generic drugs, biosimilar development must meet the requirements as rigid as those for new drug development, and the hurdles are high.

Comparison of generic drugs and biosimilars

|

Generic drug |

Biosimilar |

|

|

Definition |

Drugs with the same active ingredient, |

If a safe volume exerts a sufficient effect, |

|

Product |

Small molecule compound |

Polymer compound |

|

Stable |

Ingenuity required for stabilization |

|

|

Easy to show identity |

The molecular structure is complicated, |

|

|

Manufacturing |

Manufactured by |

Manufactured by using cell culture |

|

Development |

Bioequivalence test |

Comparison of quality characteristics |

|

NHI price listing |

50% of the original product |

70% of leading biomedicine |

Source : Omega investment from various materials

In recent years, biosame (biomedicines that are produced by the same manufacturing equipment for the original biomedicine, and have the same molecular structure, but are sold by the original drug pharmaceutical company via its group companies) has emerged. Biosames are currently listed at 70% of the original drug price, which is the same as biosimilars. The appearance of biosame poses a threat to biosimilars as a competitor, and biosimilar manufactures are required to take actions such as further reduction of manufacturing costs.

Biosimilar’s revenue model consists of revenue from main drug substance supply to manufacturing pharmaceutical companies, and milestone revenue paid in accordance with the progress of drug development. The company also earns revenue by concluding a joint R&D contract to provide its know-how to pharmaceutical companies.

As described above, the development of biosimilars requires advanced R&D capabilities and cost reduction know-how at the manufacturing stage, so only those with real experience can enter the market. The entry barrier is high. The company was one of the first to pay attention to biosimilars and developed it by utilizing the technology, knowledge and know-how cultivated in new biomedicine development. The launch of GBS-001 in May 2013 marked the company’s great achievement as a pioneer in the Japanese biosimilar market. Currently, the company is the only bio-venture company that sells more than ¥1bn in biosimilars. It is ahead of other companies in the biosimilar competition.

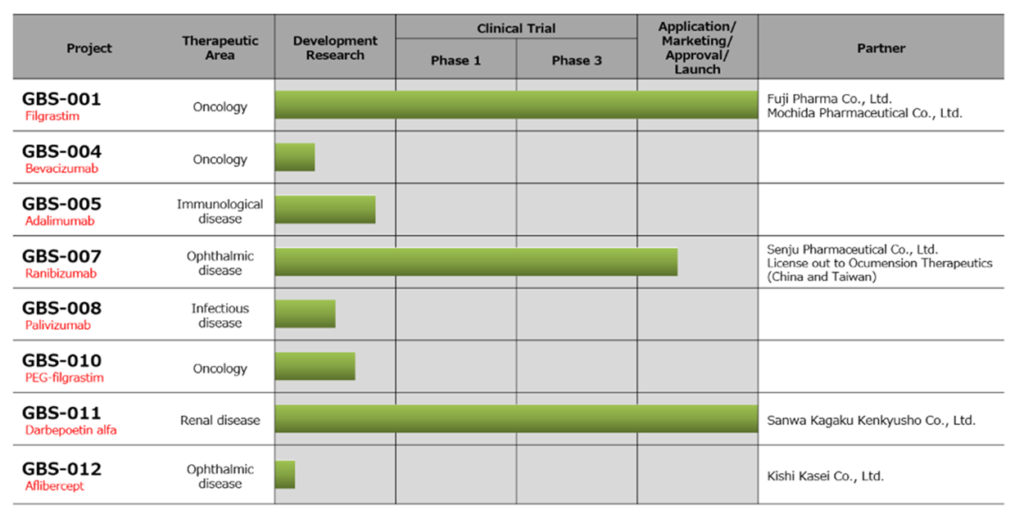

See the table on the next page for the company’s current biosimilar pipeline. Two products, GBS-001 and GBS-011, have already been launched, and GBS-007 is scheduled to be launched within this fiscal year.

☆ GBS-001 (Filgrastim BS (biosimilar), target disease: cancer)

A successor to predecessor GRAN® (Kyowa Kirin)/NEUPOGEN® (Amgen, USA). GRAN is preparation of G-CSF (granulocyte colony stimulating factor) used for neutropenia caused by cancer chemotherapy, which increases neutrophils. A joint research with Fuji Pharma Co., Ltd. started in October 2007, and Fuji Pharma and Mochida Pharmaceutical Co., Ltd. obtained domestic manufacturing and marketing approval in November 2012, and the medicine was launched in May 2013.

Biosimilar pipeline

Source: Company materials

The company provides a stable supply of undiluted solution to Fuji Pharma, and Fuji Pharma and Mochida Pharmaceutical sell it in two brands and via two channels. The GBS-001-producing cell line is introduced from Dong-A ST Co., Ltd. (formerly Dong-A Pharmaceutical Co., Ltd., South Korea).

☆ GBS-011 (Darpeboetin alpha BS, coping disease area: renal disease)

Epoetin Alpha, a treatment for renal anemia, enhances the sustainability of the effect. Its predecessor is NESP® (Kyowa Kirin) /Aranesp® (Amgen, USA). It was jointly developed with Sanwa Kagaku Kenkyusho Co., Ltd, which later in September 2019 obtained domestic manufacturing and marketing approval. It was launched in November 2019. Sanwa Kagaku Kenkyusho is solely responsible for manufacturing and sales, and the company shares profits based on the sales.

☆ GBS-007 (Ranibizumab BS, Target Disease Area: Eye Disease)

An angiogenesis inhibitor for the treatment of vision loss such as age-related macular degeneration. The predecessor is LUCENTIS® (Novartis, Switzerland). In November 2015, the company signed a basic agreement on a capital and business alliance with Senju Pharmaceutical Co., Ltd., which has a high level of expertise in the field of ophthalmology. The two companies signed a joint commercialization agreement in May 2016. In September 2020, Senju Pharmaceutical applied for domestic drug manufacturing and marketing approval and it’s been approved in September 2021. It is scheduled to be launched within this fiscal year and is expected to contribute to the sales from this fiscal year. In addition, GBS-007 will be outsourced to Ocumension Theraputics for overseas marketing and will be sold in China and Taiwan.

In addition to the above three products, the company schedules to launch four products by FY2025, and plans to promote the development of highly cost competitive biosimilars. Candidates include Nivolumab BS (Opdivo), Pembrolizumab BS (Keytruda), Ravulizumab BS (Ultomiris), Brolucizumab BS (Beobu) and Ustekinumab BS (Stelara).

Regenerative medicine

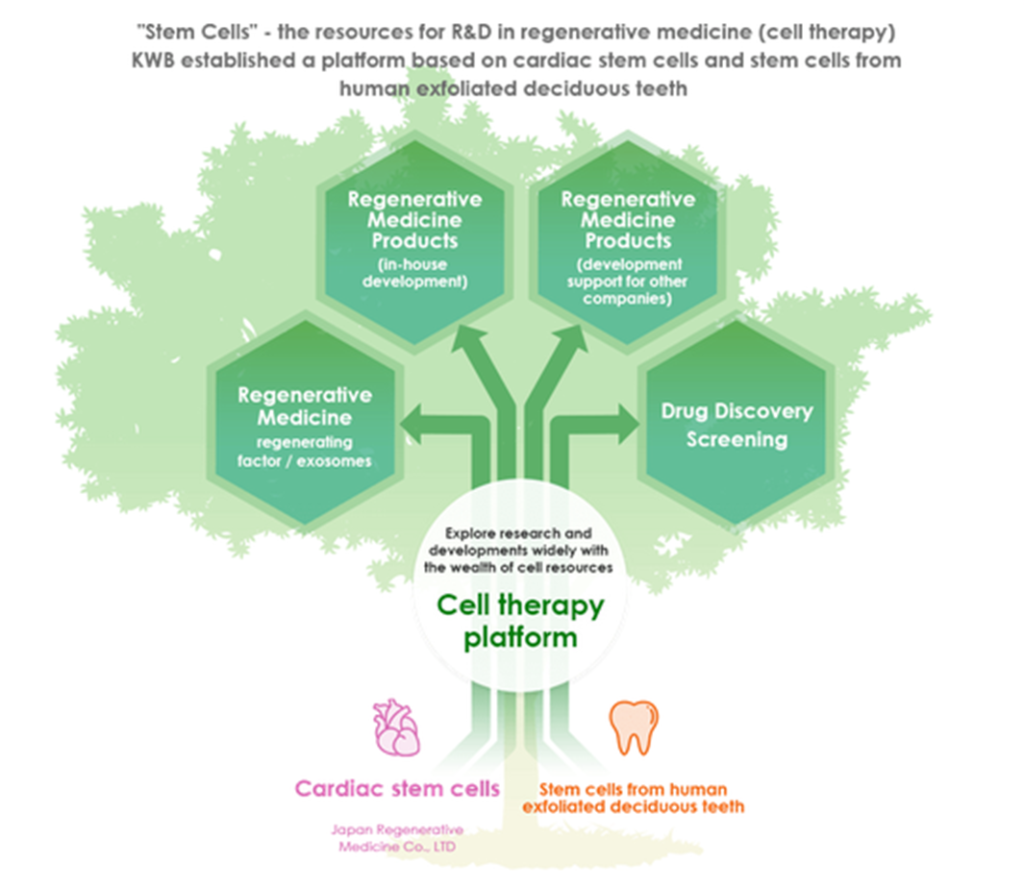

In the field of regenerative medicine, the company aims to establish a cell therapy platform that utilizes stem cells from human exfoliated deciduous cells (SHED) and cardiac stem cells (CSC).

Regenerative medicine (cell therapy) is a medical treatment that repairs and regenerates the functions of lost tissues and organs by using the cultured and processed cells and tissues of the patient or others. Research and development of stem cells are progressing rapidly thanks to the advancement of cutting-edge biotechnology. Stem cells include pluripotent stem cells (ES cells, iPS cells) and somatic stem cells. The company is looking at regenerative medicine applied to the SHED in each of the latter stem cells.

Image of Cell Therapy Platform

The Company has been working on regenerative medicine centered on SHED since 2019. In April 2019, the Company acquired Advanced Cell Technology and Engineering Ltd., which was developing medical technology and regenerative medicine products using SHED. The Company made it a fully owned subsidiary and has been accelerating the research and development of SHED-related business. In November 2020, the Company reorganized Cell Technology business, focusing only on areas related to cell therapy platforms.

Regarding cardiac stem cells (CSC), Japan Regenerative Medicine Co., Ltd., which was conducting research on cardiac stem cells within the Noritsu Koki Group, became a 100% owned subsidiary in February 2020. Noritsu Koki was the Company’s parent. The Company aims to launch regenerative medicine development (JRM-001) using the cardiac stem cells that Japan Regenerative Medicine is developing.

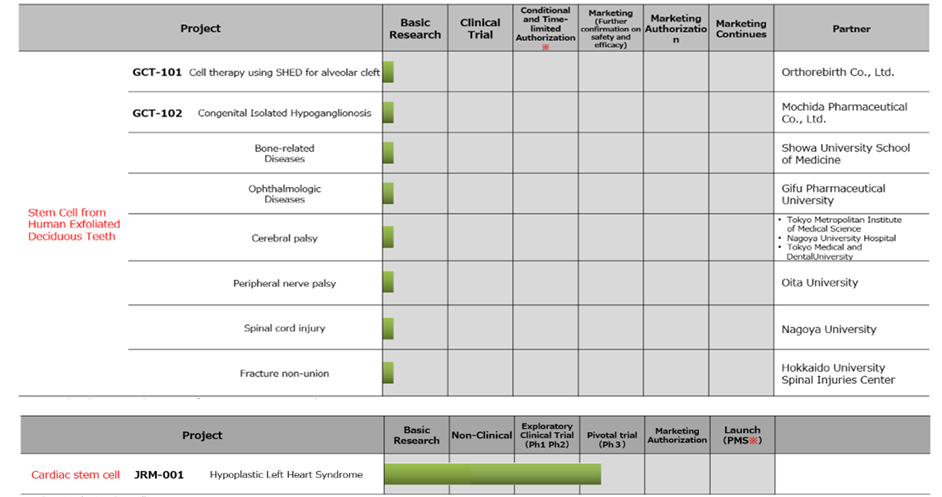

The pipeline of regenerative medicine is shown in the figure below.

Regenerative Medicine (cell therapy) pipeline

SHED project list

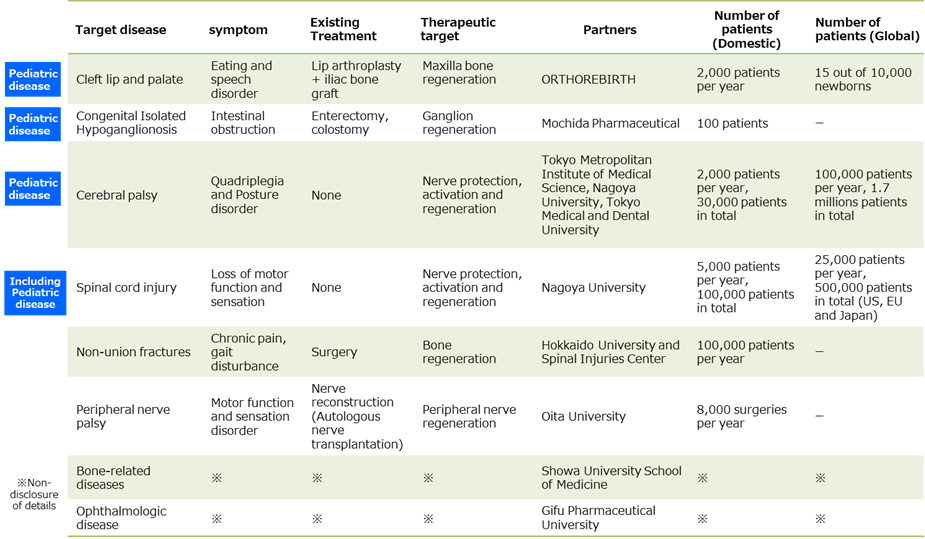

See the table above for details on the SHED project. The company plans to start clinical trials by FY2022 and aims to launch three products by FY2030. Of these, the followings are expected to make early development progress.

☆ GCT-101(Development of products such as regenerative medicine utilizing SHED, target diseases: cleft lip and palate)

Cleft lip and palate is a congenital disease caused by a congenital abnormality of the oral cavity, and the number of patients in Japan is about 2,000 a year. Pulp stem cells have excellent bone regeneration ability and can be the optimal cell source for regenerative medicine of cleft lip and palate. In collaboration with ORTHREBIRTH Co., Ltd., the Company is conducting research and development on a new treatment method that combines the artificial bone filler possessed by ORTHREBIRTH with SHED.

☆ GCT-102(Development of products such as regenerative medicine utilizing SHED, target diseases: intestinal ganglion cell deficiency)

Congenital isolated hypoganglionosis is an intractable disease that presents with intestinal obstruction due to a lack of nerve cells that control the peristaltic movement of the intestine, and an effective treatment method has not yet been established. SHED are cells derived from the same nerve as intestinal ganglion cells, and by administering SHED to supplement the deficient intestinal ganglion cells, recovery of peristaltic movement can be expected. The Company has entered into a joint commercialization agreement with Mochida Pharmaceutical, aiming to create a new treatment method by combining the Company’s SHED with Mochida Pharmaceutical’s knowledge and achievements in the gastrointestinal field.

MCB establishment

In advancing regenerative medicine using SHED, establishing a stable supply system for deciduous teeth, which are raw materials for various regenerative medicine products, is indispensable. The company is building a master cell bank through the acquisition and reorganization of Advanced Cell Technology and Engineering Ltd., partnership with medical institutions and an alliance with with Nikon CeLL innovation. This is progressing well. See the figure above on the next page for the structure of the master cell bank.

Building a SHED development platform

The project JRM-001 related to cardiac stem cells (CSC) is as follows.

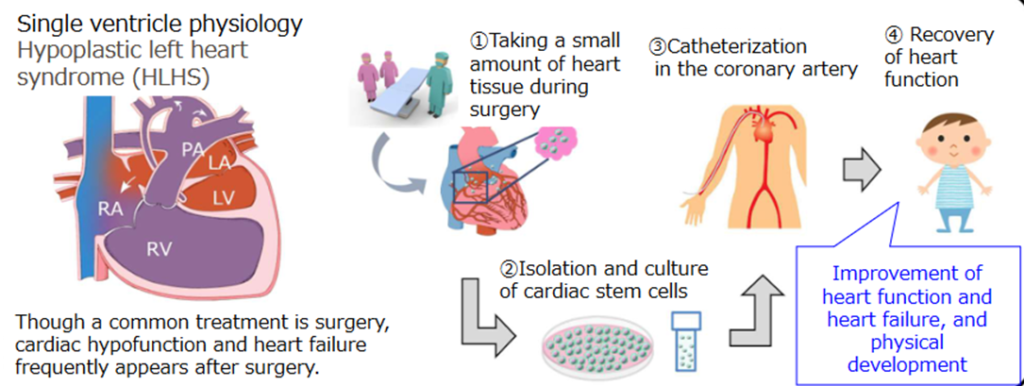

☆ JRM-001 (Development of products such as regenerative medicine utilizing intracardiac stem cells, target diseases: pediatric congenital heart disease)

The world’s first regenerative medicine using cardiac stem cells for pediatric congenital heart disease, which is being researched and developed by subsidiary Japan Regenerative Medicine. Childhood congenital diseases that have some abnormality in the heart by birth occur in newborns at a rate of 1%. In order to alleviate these symptoms, cardiac stem cells are cultured from a section of the heart obtained by surgery and are administering to the patient to improve cardiac function.

Treatment image of JRM-001

JRM-0JRM-001 is already in the phase III clinical trial stag. It will be completed early and by FY2022, an out-licensing partner will be selected to start a collaboration. The company wants to obtain manufacturing and marketing approval by FY2024. Initially, JRM-001 is for in-house use, but by conducting joint research with the partnering company, the company is considering application to other heart diseases, allogenic development and overseas expansion.

New biologics pipeline

Source: Company materials

New biologics

The development of antibody drugs has been the main business since the company was founded. Currently, biomedicine comprises over 30% of the global pharmaceutical market, and 7 of the top 10 large-scale pharmaceuticals (blockbusters) are biomedicines.

The revenue model of the new biologics business can be divided into two. One is a service revenue, which is gained by concluding a joint R&D agreement at the research and development stage and providing the company’s know-how to pharmaceutical companies. The other revenue comes from out-licensing patent to pharmaceutical companies. This includes lump-sum contract payments, milestone payments paid according to development progress, and royalty payments paid in accordance with sales after launch.

See the figure above for the company’s new biopharmaceutical pipeline.

☆ GND-004 (Anti-RAMP2 antibody, target disease: eye disease, cancer)

The company succeeded in creating candidate antibodies for epoch-making new antibody drugs that inhibit neovascularization on a new mechanism, and applied for domestic and international patents. The company is proceeding with non-clinical trials for a therapeutic drug candidate for patients with ophthalmology-related diseases for which existing preparations do not work and those cancer patients for whom Bevacizumab does not work. The company will continue out-licensing activities to pharmaceutical companies.

☆ New antibody

The company concluded a joint research agreement with Sapporo Medical University for developing anti-cancer drugs using antibodies that invade cancer cells in January 2020. Another joint research agreement for the acquisition of new antibodies that kill cancer cells was signed with MabGenesis Inc. in January 2020. The company aims at out-licensing to pharmaceutical companies from both projects.

Also, the company disclosed the research and development of new biopharmaceuticals in its Mid-Term Strategic Plan revealed in February 2021. Specifically, it plans to develop antibody drugs in the fields of malignant lymphoma, vasculitis, and pulmonary hypertension, and aims for early launch (for details, refer to the chapter of the Mid-Term Strategic Plan).

Mid-Term Strategic Plan

In February 2021, the company announced a Mid-Term Strategic Plan for FY2021 to FY2025.

Key points are;

- Driving the growth of the business model that consists of the current three business lines, aiming for early profitability (operating profit in FY2022)

- Achieving sales of ¥3bn and operating income of ¥1bn in FY2025.

- For this end, by FY2025, the company will have launched four biosimilar products including the existing three products, out-license in the field of regenerative medicine, develop new biologics and find out-licensing partners, and spend on research and development necessary for growth. The company will continue to review costs such as SG&A expenses as well.

- From after FY2026, the company will continue its focus on the development of regenerative medicine and new biologics to achieve high returns.

Mid-Term Strategic Plan roadmap

The robust growth of biosimilars will be a major factor to achieve profitability. As mentioned earlier, most of the drug discovery venture companies earn little sales until launching any drug. By contrast, Kidswell Bio generates cash flow from its biosimilars, which have been developed for nearly 15 years. As a result, the company’s profitability is becoming more likely and that ahead of schedule. Since biosimilars have passed the top of their investment cycle they are expected to add to bottom-line profit more in the future.

Kidswell Bio also disclosed the development of new biologics which includes three new products.

New biologics planned for new development

|

Target disease |

Current treatment challenges |

No. of patients |

Development direction |

|

Malignant lymphoma |

Less radical treatment and higher mortality CAR-T cell therapy was developed, but side effects are strong and treatment costs are high |

30,000 people |

Research and development of antibodies with a new mechanism of action that binds to malignant lymphoma and directly kills it, independent of the patient’s immune system |

|

Vasculitis (Kawasaki disease, etc.) |

Immunoglobulin administration. In addition to concerns about safety, the effect is not sufficient, and the development of radical treatment is an urgent issue. |

40,000 people |

Identify the root cause substance and create an inhibitory antibody against it |

|

Pulmonary hypertension |

There are treatments with vasodilators, but the effect is limited |

250,000 people |

Creating an inhibitory antibody against a substance that is a candidate for the root cause |

Source: Omega Investment from Company materials

For investors in drug discovery ventures, enormous returns from the launch of new biopharmaceuticals must be the biggest attraction. Until now, the company’s new biologics pipeline was small, therefore the announcement of the development of three new products is positive for the company’s valuation. We would like to pay close attention to the progress of these R&D and the possibility of out-licensing partners.

Regarding regenerative medicine、

- Clinical trials will start by FY2022 aiming at launching 3 products by FY2030

- The Company will also work on the development of designer cells as the next generation cell therapy

- Out-licensing partners for JRM-001 will be confirmed by FY2022 and manufacturing and marketing approvals will be obtained by 2024

New Drug Pipeline (SHED) Aiming for Early Out-licensing

|

Target |

Symptoms |

Existing treatment |

Number of patients |

Existing partners |

The goal |

|

Cerebral palsy |

Tetraplegia, |

None |

Cumulative total of 30,000 people a year |

Nagoya University, Tokyo Medical and Dental University |

Maintaining posture and improving limb athletic ability |

|

Spinal cord injury |

Loss of motor and sensory function |

None |

Cumulative 100,000 people |

Nagoya University |

Recovery of perception, improvement of walking ability |

|

Non-Union Fracture |

External chronic pain, Gait disturbance |

Surgery |

100,000 cases a year |

Hokkaido University |

Avoiding surgery, free from chronic pain |

Source: Omega Investment from Company materials

Regenerative medicine is a relatively new business operating for just a few years. However, the construction of a master cell bank is progressing well and so is the alliances with research institutes such as universities. We should like to keep a close eye on the progress of regenerative medicine as well.

As per biosimilar

- Add one more product to the current three products to launch four by FY2025.

- Operate joint research with chromocenter Inc. and SOLA Biosciences to reduce manufacturing costs to an overwhelming levels and achieve cost competitiveness and profitability.

- Develop new biosimilars with much higher cost competitiveness.

In drug discovery ventures, few companies can deliver satisfying returns to shareholders who take high risk, while spending ¥1bn in R&D expenses every year and earning almost no sales. The fact that Kidswell Bio can finance its new drug development costs partially by the sales of biosimilars differentiates itself from the peers. If the profitability shown in the Mid-Term Strategic Plan becomes more visible, the stock price should react positively.

Financial results

1)FY2021/3 financial results; 7.5% decrease in sales, operating loss reduced by ¥190mn

The company’s full-year financial results for FY2021/3 are net sales of ¥996mn (down 7.5% YoY), operating loss of ¥969mn (operating loss of ¥1,161mn in the previous year), and ordinary loss of ¥991mn (ordinary loss of ¥1,187mn in the previous year) and net loss of ¥1,001mn (net loss of ¥7,316mn in the previous year).

Sales were almost in line with the company forecast revealed at the beginning of the term. As the manufacturing cost of GBS-001 was cut back as planned, the gross profit margin improved significantly from 39.4% in FY2020/3 to 88.0% YoY. R&D costs were significantly below the budget thanks to the increased efficiency of the development process. Personnel expenses rose due to new hires to promote R&D, but part of the R&D expenses for biosimilars was carried over to the next fiscal year to the tune of a little less than ¥100mn, and costs were lower in other pipelines, too. As a result, the operating loss was ¥969mn, improving from the loss of ¥1,161mn in the previous fiscal year.

Cash and deposits at the end of March 2021 was ¥1,461mn, a YoY decrease of ¥571mn. Operating cash flow was negative ¥1,267mn. Cash flow from financial activities was ¥718mn, resulting from the income by the issuance of convertible bond-type bonds with stock rights and the issuance of shares by exercising of stock rights totaled ¥738mn. The business highlights are as follows.

a)Regenerative medicine (cell therapy)

- Started clinical research to be supplied with deciduous teeth, which are raw materials for pulp stem cell production, in collaboration with the University of Tokyo Hospital.

- Concluded a joint research agreement with Hokkaido University and the General Spinal Injuries Center to create a treatment method for intractable fractures using SHED.

- Significantly accelerated moves toward JRM-001 manufacturing and marketing approval application aimed at FY2023 by adding a factory for Phase lll clinical trial.

b)Biosimilar

- Cancelled the alliance for joint commercialization of adalimumab biosimilar products with Changsheng Bio-Tech Co., Ltd.

- •Application for domestic drug manufacturing and marketing approval of biosimilars in the field of ophthalmic treatment with Senju Pharmaceutical Co., Ltd. (approved in September 2021)

c)New biology

- Cancellation of license agreement for development, manufacturing and marketing rights of anti-human α9 integrin antibody

d)Cell bank/Culture supernatant

- Establishment of new dental pulp stem cell business structure with Reverse Co., Ltd. and Dojin Group Co., Ltd.

Revenue trends

|

JPY, mn, % |

Net sales |

YoY |

Oper. |

YoY |

Ord. |

YoY |

Profit |

YoY |

EPS |

DPS |

|

2018/3 |

1,059 |

-2.7 |

-913 |

– |

-903 |

– |

-904 |

– |

-47.27 |

0.00 |

|

2019/3 |

1,021 |

-3.6 |

-805 |

– |

-816 |

– |

-856 |

– |

-43.84 |

0.00 |

|

2020/3 |

1,077 |

– |

-1,161 |

– |

-1,187 |

– |

-7,316 |

– |

-264.65 |

0.00 |

|

2021/3 |

996 |

-7.5 |

-969 |

– |

-991 |

– |

-1,001 |

– |

-34.79 |

0.00 |

|

2022/3 (CE) |

1,900 |

90.7 |

-1,720 |

– |

-1,740 |

– |

-1,741 |

– |

-58.18 |

0.00 |

|

2021/3 Q1 |

121 |

-57.3 |

-237 |

– |

-244 |

– |

-244 |

– |

-8.72 |

– |

|

2022/3 Q1 |

303 |

150.1 |

-309 |

– |

-313 |

– |

-314 |

– |

-10.50 |

– |

Note) Consolidated financial statements from the FY2020/3, there is no continuity before FY2019/3.

Source: Omega Investment from Company materials

2)FY2022/3 Q1 financial results – Sales of ¥300mn (2.5 times YoY), operating loss of ¥300mn (improved by ¥70mn)

In FY2022/3 Q1, sales were ¥303mn (up 150.1%), operating loss was ¥309mn (operating loss of ¥237mn in the previous year), and ordinary loss was ¥314mn (ordinary loss of ¥244mn in the previous year), and net loss of ¥314mn (net loss of ¥244mn in the previous year).

Sales came in line with the company forecast recording revenue for GBS-001 and GBS-011. Cost of sales increased significantly YoY (+¥110mn) due to the final development cost to complete MCB (¥96mn). Also, R&D expenses rose by booking expenses for GBS-007 approval this year instead of last year. The company continued the overall cost cutting efforts and cut back other SG&A expenses but allowed operating loss to deteriorate.

The business highlights during Q1 are as follows.

a)Regenerative medicine (cell therapy)

- JRM-001 was designated as a product for regenerative medicine for rare diseases.

- Appointment of academic advisor specializing in research on practical application of regenerative medicine technology.

b)Others

- Establishment of ChiVo Net Future Medical Children Volunteer Network to build regenerative medicine business model utilizing SHED and started a collaboration with Showa University Dental Hospital.

3)Full-year forecast for FY2022/3: Sales ¥1.9bn (+91% YoY), operating loss ¥17.2bn.

The company forecasts for FY2022/3 are sales of ¥1,900mn (+ 90.7%), operating loss of ¥1,720mn (operating loss of ¥9,69mn in the previous year), and ordinary loss of ¥1,740mn (ordinary loss of ¥991mn in the previous year) and net loss attributable to owners of the parent of ¥1,741mn (net loss of ¥1,001mn in the previous year).

Sales of existing biosimilar drug substances and royalty income are expected to grow steadily, and the launch of GBS-007 is expected to contribute to sales. In addition, sales of APIs related to the API manufacturing process for the fourth biosimilar product and profits related to the completion of Master Cell Bank are expected.

The company forecasts R&D expenses in SG&A to be ¥1,800mn (¥969mn in the previous year). In addition to the carry-forward expenses from the last fiscal year, final development expenditure for commercial production of GBS-007 and the costs related to clinical trial and final production of JRM-001 are included.

However, the company showed, as the numbers excluding one-time factors, sales ¥1,350mn, gross profit ¥1,000mn and operating loss of ¥520mn. One-offs include establishment costs of the manufacturing process for the fourth biosimilar product, sales and COGS resulting from the completion of the master cell bank. These adjusted numbers suggest that the company may post surplus in FY2023/3, as it indicated in the mid-term business plan.

Stock price trends

Drug discovery bio-ventures are not able to raise sales over short-term and suffer long-term deficits, valuation by ordinary financial analysis is usually difficult. It is not easy to calculate by various corporate valuation methods, considering the uncertain sales after a drug launch and the uncertainties until the launch. There will be no choice but to make a comprehensive judgment by carefully examining the pipeline progress and the financing of R&D expenditures necessary for new drug development.

The company’s stock price rose sharply following the announcement of the FY2021/3 financial results. The stock price continued to rise after the Q1 result announcement. In the Mid-Term Strategic Plan announced in February 2021, the company indicated profitability in FY2023/3. Investors appears to have rated the business progress well, which included the financial results, the launch of new biosimilars, development of other pipeline products and the master cell bank business. The share price was up more than 60% year-to-date, which is a significant outperformance over the Japanese stock market.

It is still a long time before the new biology, which is the greatest hope of shareholding investors, will contribute to profits. In the foreseeable future more reality in the roadmap indicated in the Mid-Term Strategic Plan i.e., early profitability and profit growth, should prove positive for the stock price.

Stock price transition (last 5 years)

Mothers Index Chart for TSE (last 3 years)

Financial data

|

FY (¥mn) |

2012/3 |

2013/3 |

2014/3 |

2015/3 |

2016/3 |

2017/3 |

2018/3 |

2019/3 |

2020/3 |

2021/3 |

|

[Statements of income] |

||||||||||

|

Net sales |

207 |

60 |

301 |

321 |

1,160 |

1,089 |

1,059 |

1,021 |

1,077 |

996 |

|

Cost of sales |

91 |

15 |

141 |

147 |

500 |

397 |

422 |

412 |

653 |

119 |

|

Gross profit |

115 |

45 |

159 |

174 |

660 |

692 |

637 |

609 |

424 |

876 |

|

SG&A expenses |

432 |

403 |

671 |

998 |

1,480 |

1,876 |

1,550 |

1,414 |

1,585 |

1,846 |

|

R&D expenses |

264 |

206 |

412 |

689 |

1,075 |

1,433 |

1,107 |

945 |

898 |

964 |

|

Operating loss |

-316 |

-358 |

-512 |

-824 |

-820 |

-1,184 |

-913 |

-806 |

-1,161 |

-970 |

|

Non-operating income |

0 |

0 |

0 |

34 |

50 |

35 |

11 |

3 |

1 |

2 |

|

Non-operating expenses |

1 |

16 |

5 |

0 |

15 |

27 |

0 |

14 |

27 |

24 |

|

Ordinary loss |

-317 |

-373 |

-516 |

-790 |

-785 |

-1,176 |

-903 |

-816 |

-1,187 |

-991 |

|

Extraordinary income |

0 |

7 |

5 |

|||||||

|

Extraordinary expenses |

0 |

45 |

45 |

6,132 |

8 |

|||||

|

Loss before income taxes |

-317 |

-373 |

-517 |

-790 |

-785 |

-1,222 |

-902 |

-854 |

-7,314 |

-999 |

|

Total income taxes |

3 |

3 |

2 |

1 |

1 |

2 |

1 |

1 |

2 |

1 |

|

Net loss |

-320 |

-377 |

-519 |

-792 |

-787 |

-1,224 |

-904 |

-856 |

-7,316 |

-1,001 |

|

[Balance Sheets] |

||||||||||

|

Current assets |

504 |

919 |

1,881 |

1,092 |

1,520 |

3,421 |

2,692 |

2,821 |

3,322 |

3,346 |

|

Cash and cash equivalents |

285 |

887 |

1,610 |

599 |

817 |

2,379 |

1,891 |

2,009 |

2,032 |

1,461 |

|

Non-current assets |

3 |

3 |

4 |

54 |

173 |

284 |

332 |

329 |

269 |

587 |

|

Tangible assets |

1 |

1 |

0 |

0 |

2 |

1 |

1 |

1 |

1 |

3 |

|

Investments and other assets |

2 |

2 |

3 |

53 |

171 |

282 |

330 |

328 |

267 |

581 |

|

Total assets |

508 |

922 |

1,886 |

1,146 |

1,694 |

3,706 |

3,025 |

3,151 |

3,592 |

3,933 |

|

Current liabilities |

160 |

24 |

50 |

92 |

1,279 |

189 |

404 |

400 |

880 |

1,114 |

|

Short-term borrowings |

810 |

25 |

||||||||

|

Non-current liabilities |

6 |

9 |

783 |

783 |

11 |

16 |

16 |

19 |

1,223 |

1,209 |

|

Total liabilities |

166 |

34 |

833 |

876 |

1,290 |

205 |

421 |

420 |

2,104 |

2,323 |

|

Total net assets |

341 |

888 |

1,052 |

270 |

403 |

3,500 |

2,604 |

2,731 |

1,487 |

1,610 |

|

Total shareholders’ equity |

341 |

888 |

1,031 |

249 |

383 |

3,472 |

2,568 |

2,695 |

1,451 |

1,291 |

|

Capital stock |

778 |

1,239 |

1,571 |

1,576 |

2,037 |

4,194 |

100 |

591 |

611 |

1,032 |

|

Legal capital reserve |

681 |

1,143 |

1,474 |

1,479 |

1,940 |

4,097 |

3,372 |

3,864 |

9,917 |

10,337 |

|

Retained earnings |

-1,118 |

-1,495 |

-2,014 |

-2,806 |

-3,594 |

-4,818 |

-904 |

-1,760 |

-9,077 |

-10,078 |

|

Evaluation/conversion difference |

-0 |

3 |

2 |

1 |

-21 |

202 |

||||

|

Subscription rights to shares |

21 |

21 |

21 |

23 |

32 |

34 |

57 |

116 |

||

|

Total liabilities and net assets |

508 |

922 |

1,886 |

1,146 |

1,694 |

3,706 |

3,025 |

3,151 |

3,592 |

3,933 |

|

[Statements of cash flows] |

||||||||||

|

Cash flow from operating activities |

-362 |

-304 |

-729 |

-970 |

-607 |

-1,759 |

-438 |

-860 |

-1,325 |

-1,267 |

|

Loss before income taxes |

-317 |

-373 |

-517 |

-790 |

-785 |

-1,222 |

-902 |

-854 |

-7,314 |

-999 |

|

Cash flow from |

-0 |

-0 |

-1 |

-49 |

-121 |

-149 |

-50 |

-0 |

-137 |

-22 |

|

Purchase of |

-49 |

-116 |

-149 |

-100 |

||||||

|

Cash flow from |

346 |

907 |

1,454 |

9 |

946 |

3,471 |

978 |

1,221 |

718 |

|

|

Proceeds from issuance of |

346 |

917 |

234 |

9 |

486 |

3,932 |

|

973 |

40 |

138 |

|

Net increase in cash |

-15 |

601 |

722 |

-1,010 |

217 |

1,562 |

-488 |

118 |

-240 |

-571 |

|

Cash and cash equiv. at |

301 |

285 |

887 |

1,610 |

599 |

817 |

2,379 |

1,891 |

2,009 |

2,032 |

|

Cash and cash equiv. at |

285 |

887 |

1,610 |

599 |

817 |

2,379 |

1,891 |

2,009 |

2,032 |

1,461 |

|

FCF |

-362 |

-305 |

-732 |

-1,021 |

-729 |

-1,909 |

-488 |

-860 |

-1,462 |

-1,289 |

Company Profile

Company Profile

Main business image

Kidswell Bio Corporation

【Head Office】

1-2-12, Shinkawa, Chuo-ku, Tokyo, 104-0033, Japan

https://www.kidswellbio.com/en/

【Laboratory】

Kita 21-jyo, Nishi 11-chome, Kita-ku, Sapporo

Center for Promotion of Platform for Research on Biofunctional Molecules, Creative Research Institution, Hokkaido University

Number of Employees : 39

History

| Month/Year | Event |

|---|---|

| Mar. 2001 | Gene Techno Science Co., Ltd. in Kita-ku, Sapporo City, with the aim of developing the results of functional research on immune-related proteins at the Institute for Genetic Medicine, Hokkaido University as diagnostic and therapeutic agents, and providing contract service services in drug development. Established (capital 10,000 thousand yen) |

| Jun. 2002 | Established a new research institute in the Hokkaido Center of the National Institute of Advanced Industrial Science and Technology to strengthen research and development of new biopharmaceuticals and start considering entry into the biosimilars business. |

| Nov. 2003 | Moved the head office to the laboratory |

| Jun. 2007 | Licensed out anti-α9 integrin antibody to Kaken Pharmaceutical Co., Ltd. in the new biopharmaceutical business |

| Oct. 2007 | In the biosimilar business, licensed in with Fuji Pharma Co., Ltd. for production cells and basic production technology for filgrastim biosimilars. |

| Apr. 2008 | Moved the head office to Chuo-ku, Sapporo |

| May 2008 | Relocated to the Institute for Genetic Medicine, Hokkaido University |

| Jun. 2008 | Established Tokyo office in Chuo-ku, Tokyo |

| Nov. 2012 | Fuji Pharma Co., Ltd. and Mochida Pharmaceutical Co., Ltd. acquired domestic manufacturing and sales products for filgrastim biosimilar products jointly developed with Fuji Pharma Co., Ltd. (launched in May 2013) |

| Dec. 2012 | Listed on the Tokyo Stock Exchange Mothers |

| Sep. 2013 | Relocated the research institute to the Center for Promotion of Biological Functional Molecular Research and Development, Hokkaido University Research Organization |

| Jan. 2014 | Concluded a joint development contract with Sanwa Kagaku Kenkyusho Co., Ltd. for darbepoetin alfa in the biosimilar business (launched in November 2019) |

| Mar. 2016 | Concluded a capital and business alliance agreement with NK Relations Co., Ltd. and Launchpad 12 GK (both are affiliated companies of Noritsu Koki Co., Ltd. and are currently absorbed and merged with the company). |

| Jun. 2016 | As a result of a tender offer for the Company’s shares by Noritsu Koki Bio Holdings GK (a company whose trade name was changed from GK Launchpad 12), the voting rights of the Company became over 50%, and Noritsu Koki Bio Holdings GK and Noritsu Koki shares Become the parent company of the Company together with the company |

| Apr. 2019 | Made Cell Technology Co., Ltd. a wholly owned subsidiary of the Company through a share exchange. Due to the issuance of new shares in connection with the share exchange, Noritsu Koki Bio Holdings LLC and Noritsu Koki Co., Ltd. will have less than 40% of voting rights, and will no longer be the parent company and will become other affiliated companies. |

| Jul. 2019 | Moved the head office to Chuo-ku, Tokyo |

| Feb. 2020 | Made Japan Regenerative Medicine Co., Ltd. a wholly owned subsidiary by transferring shares from Noritsu Koki Co., Ltd. |

| Nov. 2020 | Excluded the company from the scope of consolidation due to the transfer of all shares of Cell Technology Co., Ltd. |

| Feb. 2021 | Formulation of medium-term management plan (FY2021-2025), FY2022, operating profitable, FY2025, targeting sales of ¥3bn and operating income of ¥1bn |

| Jul. 2021 | Company name changed to Kidswell Bio Co., Ltd. |

| Sep. 2021 | Concluded a joint research agreement with NanoCarrier Co., Ltd. for the development of the next generation cell therapy “designer cells” based on SHED. |

Management (Officer)

President & CEO:

Masaharu Tani

The Univ. of Tokyo, MSc, MBA.

Joined the Clinical Development Dept. at Suntory, implementing clinical trials and moved to Takeda Pharmaceutical, where worked at the Business Development Dept. and Strategic Product Planning Dept. After Takeda, joined Whiz Partners, a Japanese investment company in 2013 and joined GTS (currently KWB) in 2014. Appointed as CFO in 2015 and CEO in 2017 at GTS.

Corporate Officer, CTO, Research & Development Div.:

Masayuki Kawakami

Kyoto Univ. Graduate School of Engineering, Ph.D.

Worked for research laboratories of FUJIFILM Corp. mainly in oncology area with Harvard Univ. and Novartis (then Sandoz). Worked for Toyama Chemical Corp. and then for FUJIFILM Pharmaceuticals USA to promote an anti-influenza drug clinical development. Joined GTS (currently KWB) in April 2017 and appointed as CTO in April 2018.

Corporate Officer, CBO, Business Development Div.:

Shinya Kurebayashi

Massachusetts Institute of Technology, MSc, Physics.

Worked in Investment Banking Div. at Goldman Sachs Japan and involved in M&A, IPOs and bond offerings of pharmaceutical and medical device companies at Morgan Stanley (Mitsubishi UFJ Morgan Stanley Securities). A member of launching ImPACT of Cabinet Office. In 2015, joined Advanced Cell Technology And Engineering Ltd. (ACTE) and established Administration Dept. and led business development and IPO preparation at ACTE. Joined GTS (currently KWB) in March 2019.

Corporate Officer, CFO, Business Administration Div.:

Yasuo Sakae

Graduated from the Faculty of Sociology, Hitotsubashi University. After being in charge of securities sales at the Tokyo branch of Commerzbank (a subsidiary of Commerzbank) and the head office in Germany, Sakae joined Yamanouchi Pharmaceutical Co., Ltd. (currently Astellas Pharma Inc.), mainly promoting the globalization of the finance division and established CVC (Corporate Venture Capital) and took the lead. Joined the Company in 2018 after working as CFO at Astellas US, General Manager of Procurement Department and General Manager of Management Promotion Department (in charge of budget and finance) at Astellas Pharma Inc., and Vice President, Corporate Strategy & Communications at Astellas Europe.

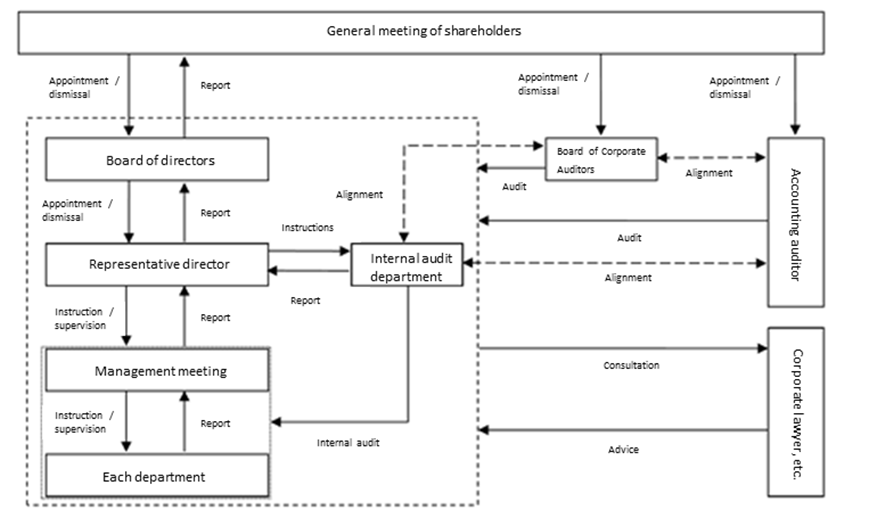

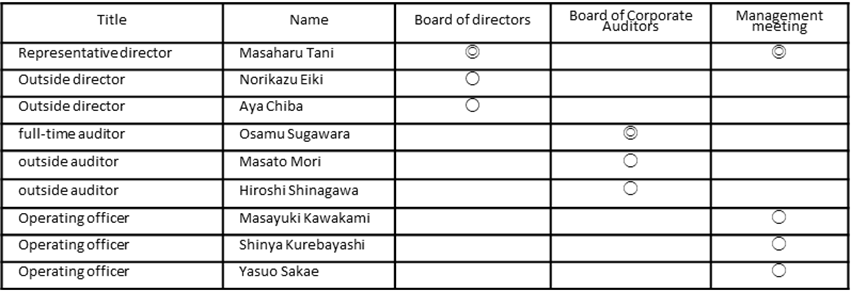

Corporate governance system

Members of each institution (◎ is the chair)

Status of major shareholders

| Name | Number of shares owned | Ratio of the number of shares owned to the total number of issued shares (%) |

| Noritsu Koki Co., Ltd. | 9,471,832 | 31.97 |

| Yuichi Otomo | 1,685,750 | 5.69 |

| NanoCarrier Co., Ltd. | 1,000,000 | 3.38 |

| Custody Bank of Japan, Ltd. (Securities Investment Trust Unit) | 834,200 | 2.82 |

| Nomura Trust & Banking Co., Ltd. (Trust Unit 2052241) | 721,000 | 2.43 |

| JSR Corporation | 686,814 | 2.32 |

| SBI Securities Co., Ltd. | 638,774 | 2.16 |

| Senju Pharmaceutical Co., Ltd. | 555,200 | 1.87 |

| Koike Taro | 520,000 | 1.76 |

| Tsuda Makoto | 436,800 | 1.47 |

| Total | 16,550,370 | 55.87 |

Source : The Company annual report (FY2021/3)

Initiatives for SDGs

As shown in the figure above, the pursues contributions to the S (Social) by delivering new medical care.

Specifically, the company will maintain the health of children, families, and people in the local community while providing necessary therapeutic agents and treatments. It will continue healthy growth as an enterprise and contribute to maintaining the sustainable social security system.

To realize new medical care from the perspective of children, as expressed in the corporate slogan “Kids Well, All Well”, the company provides inexpensive and high-quality medical services by biosimilar business and reduces medical expenses for the elderly. The reduced costs can be allocated to pediatric diseases that tend to be neglected. This enhances pediatric disease medical care. Young stem cells that many children, including those saved by the improved medical care, can provide new medical care for intractable diseases that people of all ages could suffer. In its new company name, Kidswell Bio puts its wish to save children responsible for tomorrow by maintaining this cycle, and this is in addition to the wish to provide therapies for intractable and rare diseases, which the company has been chasing since its inception. The company is decided to contribute to developing new medicines and cures by making full use of its biotechnology nurtured up to now.