NanoCarrier

| Securities Code |

| TYO : 4571 |

| Market Capitalization |

| 21,563 million yen |

| Industry |

| Healthcare |

Conclusion

The company’s drug discovery pipeline has undergone major changes over the last few years. This is the result of the new management firmly bedding down the reconstructed strategic platform. The shares’ year-to-date outperformance over the biomedical sector should be a reflection of positive ratings by investors. The remarkably better drug pipeline is thought to increase the corporate value as estimated by a DCF method. Nevertheless, we do not instantly understand why the share price has not moved that much.

Total Shareholder Return

| 1M | 3M | 6M | YTD | 1Y | 3Y | 5Y | 10Y | IPO (Mar 2008) | |

|---|---|---|---|---|---|---|---|---|---|

| 4571 | 6.2 | -1.6 | -3.5 | -2.5 | -21.8 | -14.2 | -19.9 | 3.4 | 2.6 |

| TOPIX | 7.0 | 7.2 | 8.4 | 17.2 | 30.6 | 9.1 | 12.3 | 13.0 | 11.8 |

Made by Omega Investment by various materials

Investment view

The company’s strategy is concentrated on early monetization of late-stage clinical development products, nucleic acid drug discovery development, and alliances and M&A. Management’s achievements influencing corporate value are the licensing-in of two late-stage clinical trial items, reconsideration of development priorities of existing items and addition of three nucleic acid drug candidates to the pipeline. Enriched pipeline raises the present value of the business. Also, the newsflow from the bolstered pipeline will be much more than before and should be more interesting for shareholders.

Specifically, management is focusing on three late-stage clinical trial items to accelerate out-licensing and marketing approvals with an aim to monetize these by FY03/2024. In addition, the company has built a pipeline of nucleic acid drugs, which is regarded as a next-generation modality (method / means of drug development technology) at once. This was achieved by incorporating three items using nano-DDS technology in one shot by merging with AccuRna, Inc. in September 2020. The global market for nucleic acid drugs is growing rapidly. In May 2020, Nippon Shinyaku (4516) launched the first domestically produced nucleic acid drug, “viltolarsen,” and attracted a great deal of attention.

It has been many years since NanoCarrier was founded in 1996, but the revenue remains insignificant and the company has been losing money for the consecutive 20 fiscal years. Current revenues come from development milestones, the supply of cosmetics and their ingredients, and the trading of purchased medical devices. On the other hand, there has not been convincing information for investors to be fairly confident about the reality of monetization of late-stage products. The nucleic acid drug market is expanding rapidly, but with all NanoCarrier’s products being in the early stages, it is unclear what will happen to this particular drug pipeline. Fixed costs, most of which are R&D and labor costs, are enormous, so the deficit is structural. Therefore, the company relies on share rights and third-party allotment to finance the business almost every year, which dilutes the value as per share. The CY2013 global offering raised 8.6 billion yen, and BPS increased to 337 yen, but at the end of March 2021, it was 106 yen. Reflecting these, the company’s shares have underperformed TOPIX since the CY2008 IPO. It is no wonder that shares of a loss-making biomedical company perform poorly, but the company’s shares have also underperformed the biomedical sector for many years.

However, if investors value the share by DCF, the enhancement of the drug pipeline must raise the expected value of aggregate cash flow. If late-stage clinical trial products are to be monetized in three years, not only the terminal value but also the more reliable forecast of the cash flow for the first five years, which analysts usually produce manually, will be raised. There is no idea as to the likelihood of any of the candidates in the pipeline making success, and finance will continue to dilute BPS. Nonetheless, the fact that the visible pipeline improvement moved the share price very little makes us want to believe that the shares are overlooked.

Considering the success probability of a pipeline drug candidate, which is generally said to be 1/10 to 1/20, the company‘s pipeline of 5 clinical trial items is in short supply and looks inferior to those of other public biomedical companies. This should be what makes it difficult to value the company’s business. However, with the management being committed to M&A, alliances, and open innovation of drug development, this shortfall may well be compensated for early on, and, at the end of the day, may prove to be interesting. Also, the emotional barriers of investors who suffered bitter experiences in the past may be so large that they doubt the success of the two phase III items. in July 2016, the share price fell as the anticancer drug NK-105, which NanoCarrier licensed out to Nippon Kayaku (4272) at the initial stage, failed to gain approval because it did not survive the primary endpoint in the phase III study. As the pipeline expands further and as investors have better insights such as about the potential sales of key candidate drugs and the competitive landscape of the market, the shares should be valued more sensibly.

| Period | Revenue (mn. yen) | EBIT (mn. yen) | EPS (yen) | PER (X) | PBR (X) | ROE (%) |

|---|---|---|---|---|---|---|

| 3/18 | 259 | -1,802 | -125 | 0.0 | 7.2 | 0.0 |

| 3/19 | 497 | -1,106 | -37 | 0.0 | 3.6 | 0.0 |

| 3/20 | 553 | -1,303 | -30 | 0.0 | 1.8 | 0.0 |

| 3/21 | 313 | -1,800 | -41 | 0.0 | 2.9 | 0.0 |

Price, Ratios

|

2015 |

2016 |

2017 |

2018 |

2019 |

2020 |

2021 |

5Yr Avg (%) |

|

|

Price Change |

-29.1 |

-15.0 |

-27.4 |

-49.5 |

-14.4 |

13.3 |

-2.2 |

-18.6 |

|

vs TOPIX (%) |

-39.0 |

-13.2 |

-47.1 |

-31.7 |

-29.6 |

8.4 |

-17.9 |

-22.6 |

|

vs Industry (%) |

-64.5 |

-10.5 |

-41.0 |

-55.2 |

-41.4 |

-8.7 |

7.2 |

-31.4 |

|

Div Yield (%) |

– |

– |

– |

– |

– |

– |

– |

– |

|

3/2016 |

3/2017 |

3/2018 |

3/2019 |

3/2020 |

3/2021 |

3/2022CE |

5Yr CAGR (%) |

|

|

Sales (Y-mn) |

243 |

219 |

259 |

497 |

553 |

313 |

200 |

5.2 |

|

EBITDA |

-2,053 |

-2,690 |

-5,324 |

-1,792 |

-1,104 |

-1,300 |

– |

– |

|

EBIT |

-2,083 |

-2,712 |

-5,351 |

-1,802 |

-1,106 |

-1,303 |

-1,800 |

– |

|

Net Inc |

-2,537 |

-2,676 |

-5,417 |

-1,809 |

-2,010 |

-2,836 |

-1,800 |

– |

|

EPS (Dil) (Y) |

-59.5 |

-62.1 |

-125.4 |

-39.1 |

-32.7 |

-41.5 |

-25.8 |

– |

|

Divs PS (Y) |

0.00 |

0.00 |

0.00 |

0.00 |

0.00 |

0.00 |

0.00 |

– |

|

Shs Out (Dil) |

43 |

43 |

43 |

46 |

62 |

68 |

– |

9.9 |

|

BPS |

285 |

233 |

108 |

119 |

133 |

107 |

– |

-17.7 |

|

Cash&ST Inv (Y-mn) |

13,760 |

11,769 |

6,408 |

6,567 |

7,471 |

6,402 |

– |

-14.2 |

|

Assets |

15,386 |

12,939 |

7,627 |

8,568 |

8,945 |

7,821 |

– |

-12.7 |

|

Working Capital |

14,085 |

12,073 |

6,391 |

6,808 |

7,772 |

6,637 |

– |

-14.0 |

|

LT Debt |

3,000 |

2,475 |

2,475 |

2,475 |

0 |

0 |

– |

– |

|

Net OP CF |

-1,971 |

-2,527 |

-4,928 |

-2,037 |

-1,139 |

-1,247 |

– |

– |

|

Capex |

-89 |

-177 |

-64 |

-7 |

-0 |

0 |

– |

– |

|

FCF |

-2,048 |

-2,702 |

-4,988 |

-2,043 |

-1,139 |

-1,274 |

– |

– |

|

3/2016 |

3/2017 |

3/2018 |

3/2019 |

3/2020 |

3/2021 |

3/2022CE |

5Yr Avg (%) |

|

|

Gross Margin % |

86.0 |

71.8 |

73.8 |

83.9 |

85.9 |

87.7 |

– |

80.6 |

|

EBITDA Margin % |

-843.9 |

-1,229.9 |

-2,054.7 |

-360.8 |

-199.6 |

-414.9 |

– |

-852.0 |

|

EBIT Margin % |

-856.0 |

-1,240.1 |

-2,065.4 |

-362.9 |

-200.0 |

-415.9 |

-900 |

-856.8 |

|

Net Margin % |

-1,042.8 |

-1,223.6 |

-2,090.6 |

-364.1 |

-363.4 |

-905.1 |

-900 |

-989.4 |

|

ROA % |

-16.9 |

-18.9 |

-52.7 |

-22.3 |

-23.0 |

-33.8 |

– |

-30.1 |

|

ROE % |

-19.1 |

-24.1 |

-73.6 |

-34.3 |

-27.4 |

-34.9 |

– |

-38.9 |

|

Asset Turnover |

0.0 |

0.0 |

0.0 |

0.1 |

0.1 |

0.0 |

– |

0.0 |

|

Assets/Equity |

1.3 |

1.3 |

1.6 |

1.5 |

1.0 |

1.0 |

– |

1.3 |

|

Current Ratio |

61.7 |

33.7 |

15.2 |

39.2 |

53.4 |

26.0 |

– |

33.5 |

|

Quick Ratio |

61.1 |

32.9 |

14.8 |

39.0 |

52.9 |

25.5 |

– |

33.0 |

Made by Omega Investment by various materials. CE: Company guidance

Current Ratio = Current Assets / Current Liabilities

Quick Ratio = (Cash&ST Inv + Accounts Receivables) / Current Liabilities

Business

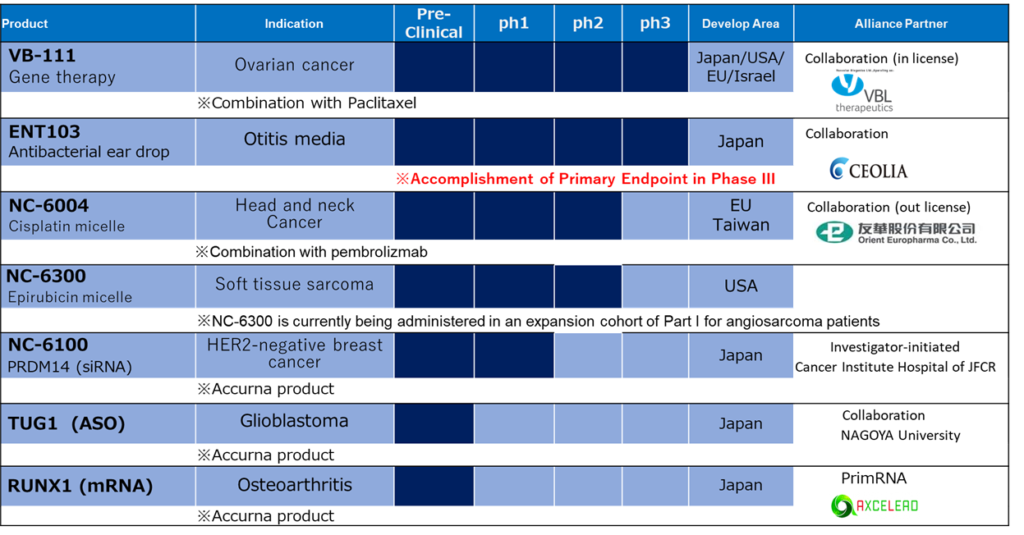

The company is a drug discovery venture that develops anti-cancer drugs using its own DDS (Drug Delivery System) technology, which applies nanotechnology. It also develops nucleic acid drugs, which is expected to become a new modality. Currently five products are included in the clinical trial pipeline; VB-111 (ovarian cancer), ENT103 (otitis media), NC-6004 (head and neck cancer), NC-6300 (soft tissue sarcoma) and nucleic acid drug NC-6100 (breast cancer). In the preclinical trial stage, there are two nucleic acid drug candidates, TUG1 (glioblastoma) and RUNX1 (gonarthrosis). In addition to drug development, the company jointly develops cosmetics, supplies ingredients, develops and sells hair restorers, and trades medical equipment.

The company was established in 1996 with the aim of developing pharmaceuticals using micelle nanoparticle technology, which had been studied by Professor Kazunori Kataoka of the University of Tokyo and Professor Teruo Okano of Tokyo Women’s Medical University. Professor Kataoka currently serves as an external director and participates in drug development and business management as chairman of the Scientific Advisory Board, which was established in December 2019. He holds 317,350 shares (0.45% of the outstanding shares) and is the 14th largest shareholder.

The company is developing anti-cancer drugs using its own DDS technology. The company’s DDS is a mechanism that uses nanocapsules to carry the drug to the lesion and release the drug intensively there. The core technology that makes this mechanism possible is the company’s micellar nanoparticle technology. It is a technology that creates nano-sized capsules from polyethylene glycol and polyamino acids that are compatible with the human body, and encloses various substances inside them. Various block copolymers are modified to produce micelle nanoparticles, and organic and inorganic substances are encapsulated in micelle particles. The company owns this technology as intellectual property such as patents. The company is developing anti-cancer drugs that utilise this technology because it is expected to improve the therapeutic effect and reduce side effects.

The company entered the development of nucleic acid drugs through the merger with AccuRna, Inc. in September 2020, thereby starting to utilise its own DDS technology in the field of regenerative medicine. AccuRna is a drug discovery venture company founded in December 2015 to supply nano-DDS technology for nucleic acid drugs.

Nucleic acid drugs are drugs whose basic skeleton is nucleotides and their derivatives, which are constituents of deoxyribonucleic acid (DNA) and ribonucleic acid (RNA) present in the human cell nucleus. The greatest feature of nucleic acid drugs is that they can broadly target intracellular molecules that could not be targeted by small molecule drugs and antibody drugs. For this reason, it is regarded as the third-generation drug after small molecule drugs and antibody drugs, and is expected to become an innovative next-generation therapeutic drug that cures diseases difficult to treat with conventional drugs. In addition, nucleic acid drugs are chemically synthesized in the same way as small molecule drugs, so manufacturing costs are lower than antibody drugs.

Nucleic acid drugs are highly hydrophobic and difficult to be taken up into cells, and are easily decomposed by enzymes in the body. Therefore, DDS technology that transports the drug to the target and the technology for stabilising the nucleic acid structure are important. It is expected that the use of NanoCarrier’s DDS technology will improve blood stability, increase the effectiveness of nucleic acid drugs, and realize treatment with less burden on patients.

Typical nucleic acid drugs include antisense oligo (ASO), siRNA, aptamer, decoy, and mRNA. Of these, the company is using ASO, siRNA and mRNA to conduct research on nucleic acid DDS preparations.

By 2013, only three nucleic acid drugs were approved in Japan, the US, and Europe. Nine items have been approved in the five years since 2016. Currently, more than 100 items are in the development stage, attracting broad attention. In 2020, Nippon Shinyaku launched the first domestically produced nucleic acid drug “viltolarsen” to treat muscular dystrophy. The nucleic acid drug market was small until 2015, but it grew quite rapidly with the introduction of Spinraza in 2016. Market research firms predict that the market will grow at an annual rate of nearly 20% after 2019, reaching 700 billion yen in 2025 and over 2 trillion yen in 2030.

Nucleic acid is an acidic substance that exists in the cell nucleus at the center of each of 37 trillion cells that form the human body. There are two types of nucleic acids: deoxyribonucleic acid (DNA) and ribonucleic acid (RNA). DNA functions as the body of a gene, and RNA synthesizes proteins based on the information in DNA.

Bull

- •The addition to the drug pipeline of licensed-in late-stage products and the nucleic acid drug candidates through merger with AccuRna is a big plus for corporate value. The company aims to monetize those late-stage clinical trial products by FY03/2024 through approval or sales of VB-111 and ENT103 and licensing out NC-6004. As per the nucleic acid drug pipeline, any success could significantly drive the company’s bottom-line profit.

- The newsflow is expected to become more interesting going forward. The volume of newsflow emanating from the drug pipeline that includes hot nucleic acid drug development and the three late-stage clinical trial items should increase, and the share price could move interestingly with more occasional spikes. In fact, the news about the development progress of the late-stage NC-6004 and VB-111, which were released one after another from the end of August 2021, sent the share price higher with considerable trading volume. It must have presented a good opportunity for some investors to make money.

- It is possible that management will eventually announce a revenue roadmap before long. The guess is that the timing is when the out-licensing or marketing approval for any of the late-stage clinical trial products is decided. However, this is nothing more than a hunch based on what tended to happen at other companies.

- The management proved results by the strategy to promote M&A and alliances, and their quality is highly rated. Most of the directors are shareholders. Mr. Matsuyama, who became president in October 2019, has been active in various companies after working for Mitsubishi Corporation (8058). In June 2015, he joined NanoCarrier to be CFO and head of president’s office. Mr. Akinaga, Director and GM of the Research and Development Division, was engaged in research and development at Kyowa Kirin (4151) for a long time. After serving as President of AccuRna, he became a director of NanoCarrier in September 2020 following the merger. Mr. Matsuyama owns 17,700 shares and Mr. Akiyama owns 29,250 shares. The shareholding of all the 11 directors is 0.99%. 8 of them are shareholders; this ownership is high.

- Inception of Scientific Advisory Board. The company has decided not to expand new pipelines only by itself, but by open innovation. The Scientific Advisory Board leverages its members’ global network and knowledge to make recommendations to the board of directors and does so about business operations. Employees and board members discuss directly to determine the direction of development and direct clinical research so that it integrates with licensing and application efforts. This aims to speed up development. The board was founded in December 2019, and the chairman is Kazunori Kataoka, a professor emeritus at the University of Tokyo, who is the inventor of micelle nanoparticles and founding member of NanoCarrier. The other members are two external directors, i.e., Teruo Okano, Professor Emeritus of Tokyo Women’s Medical University, Professor of Faculty of Pharmaceutical Sciences at the University of Utah and Director of Cell Sheet Regenerative Medicine Center, and Akira Ohashi, who is a medical doctor.

Bear

- None of the company’s pipeline drugs have been launched so far in its history. Due to limited revenue sources, the deficit will continue for the foreseeable future. Finance in the equities market should dilute the value per share. Current revenues include development milestones, cosmetics and the ingredients, and trading of medical equipment for PRP (Platelet-rich Plasma) therapy business.

- The company’s seven-item drug pipeline including preclinical trials is lacking in volume and does not look favourable to other listed biomedical companies. It is generally said that the probability of successful drug development is 1/10 to 1/20. The low success probability of the pipeline should weigh on the corporate value estimation.

- It is difficult to identify competing products because the company is developing new technologies for both late-stage clinical trial products and nucleic acid drugs. This makes it extremely difficult to predict at what odds the drug pipeline becomes successful. It is not possible to anticipate whether the company will grow to be a business that satisfies demanding shareholders.

- The uniqueness of the company’s DDS technology using nanoparticle technology is interesting, but on the other hand, the landscape of DDS technology competition in the world is unknown. Regarding the utilisation for nucleic acid drugs, the progress of nucleic acid stabilization technology can be a competition, but it is unclear.

- Management will continue to run M&A as one of its primary strategies, and investors should bear in mind the risk that someday there could suddenly be one-off but large losses associated with mergers and acquisitions. Although the pipeline got better, the number of candidate drugs is small, and the development stage is not well-balanced. To reinforce this point, it is quite possible that the management will take aggressive expansion measures. In fact, management booked lump-sum goodwill amortisation loss of 1,553 million yen generated by the merger with AccuRna in FY03/2021 and inflated the bottom-line deficit considerably.

- The company owns 1 million Kidswell Bio (4584) shares at a book value of 504 yen per share. If those shares collapse, there will be large devaluation losses. At the end of March 2019, the company had a securities portfolio consisting mainly of equities of just under 1.4 billion yen. Due to the subsequent decline in share prices, a total of 951 million yen was recorded as an extraordinary loss in FY03/2020 due to devaluation and loss-making sales. As of the end of March 2021, the book value of investment securities was 686 million yen, 70% of which was Kidswell Bio shares, which are strategically held. As Kidswell Bio shares shot up, NanoCarrier currently sits on an unrealized gain on those shares. In addition, it holds 488,250 shares of Lumosa Therapeutics Co., Ltd(TT6535), which is listed on the Taiwan Stock Exchange, at a book value of 68,123 thousand yen.

Pipeline

Several research reports describe the company’s pipeline very well, but the company’s own commentary is good. This being the latest primary information, it should be worth the first read of investors. Also, the pipeline table in the handout of the analyst meeting is very easy to see. Therefore, in this article, let us share some facts from the latest annual report published in June 2021. Such that, the views presented here are those of NanoCarrier. Notes are provided by Omega Investment.

(i) VB-111 (Licensed-in product)

A genetic therapy product licensed from Vascular Biogenics Ltd of Israel for domestic development and marketing rights in 2017. It destroys tumor blood vessels. However, it has two effects of inducing tumor immunity as well as attacking cancer. It is expected to be an innovative therapeutic drug for ovarian cancer that has become resistant to platinum preparations for which there is no cure. Since it is a late stage product, we can expect early monetization.

(Notes) Vascular Biogenics Ltd (VBLT, NasdaqGM) https://www.vblrx.com/

(ii) ENT103 (Licensed-in product)

Jointly developed with Ceoria Pharma Co., Ltd. This is an antibacterial ear drops for middle ear inflammation. It will be a full-scale clinical study conducted in the otologic field for the first time in a quarter of a century, and it is expected that a new therapeutic drug will be introduced. Like VB-111, we can expect early monetization.

(Notes) Licensed-in is 2018.

Ceoria Pharma Co., Ltd. (Not listed) https://www.ceolia.co.jp/ https://www.ceolia.co.jp/en/

(iii) NC- 6004 (Cisplatin micelle: licensed-out product)

Cisplatin is a central drug in cancer chemotherapy in various fields due to its effectiveness, and in recent years, expectations are very high as a combination drug of immune checkpoint inhibitors. On the other hand, cisplatin’s renal dysfunction, neuropathy and emetic effects are extremely strong, which causes the discontinuation of cancer treatment and significantly reduces the treatment and quality of life (QOL). We are promoting clinical development in combination with anti-PD-1 antibody, aiming for a new drug that can reduce these side effects of cisplatin by micellarisation and can be expected to enhance the effect.

(Notes) In order to concentrate investments and human resources on the three late-stage clinical trial products and realize early profitability, the company will develop NC-6004 for head and neck cancer after FY03/2021 to centre on phase II clinical trials.

(iv) NC-6300 (Epirubicin micelle)

Epirubicin is an anthracycline anticancer drug that is widely used worldwide for indications such as breast cancer, ovarian cancer, and gastric cancer, but it causes heart disease when administered repeatedly. Therefore, its use is restricted. We have added the function of releasing epirubicin at once in response to changes in intracellular pH when micelle nanoparticles are taken up into cancer cells. Through this, we are promoting clinical development with the aim of creating a new drug that can be expected to reduce the side effects of epirubicin and enhance its efficacy.

(Notes) This drug aims to reduce the side effects of epirubicin. In 2011, the company signed a license and joint development contract with Kowa Company, Ltd. (private) and added this to the pipeline. Afterwards, the contract was canceled in October 2016 due to Kowa’s strategic change, so NanoCarrier inherited the test results of Kowa and is continuing development.

“The function of releasing epirubicin at once” is a pH-responsive micelle, which is a technology that further improves the therapeutic effect, i.e., it is a drug carrier that releases drugs intensively inside cells in response to pH. Cancer cells are in a lower pH environment than normal cells. The pH-responsive micelles release the drug contained in the micelles in a concentrated manner only inside the cells as the pH environment, which is an external stimulus, decreases. This is expected to improve the therapeutic effect.

(v) NC-6100

This is an siRNA drug that uses the unique nucleic acid DDS technology and is expected to suppress the growth of cancer stem cells. By targeting the target molecule PRDM14, which was not possible with conventional drugs, we expect to bring new treatment options to the type of breast cancer for which there is currently no cure. A doctor-initiated phase I clinical trial has been started at The Cancer Institute Ariake Hospital for recurrent breast cancer with curative unresectable or distant metastasis. It is an siRNA drug that uses a unique nucleic acid delivery technology and is expected to suppress the growth of cancer stem cells.

(Notes) This is the first administration to humans in a doctor-led clinical trial (phase I). PRDM14 molecule is expressed in about 50% of breast cancer patients, but it is difficult to develop small molecule drugs and antibody drugs for them, and there are high expectations for nucleic acid drugs. It is a candidate product that was added to the pipeline due to the merger with AccuRna, Inc. in September 2020.

We are promoting the following research and development as candidates for the next pipeline following the above-mentioned pipeline in the clinical development stage.

(i) TUG1 (ASO)

An antisense oligo (ASO) drug consisting of nucleic acid DDS technology, which is a joint research project with Tokai National Higher Education and Research System Nagoya University. By suppressing TUG1, which is highly expressed in glioblastoma, by ASO, cancer cells lead to cell death. It has been adopted by the Japan Agency for Medical Research and Development (AMED) as an innovative cancer medical practical application research project, and non-clinical trials are being promoted.

(Notes) This candidate product was added to the pipeline due to the merger with AccuRna, Inc. in September 2020.

(ii) RUNX1 (mRNA)

This is a messenger RNA (mRNA) drug consisting of a unique nucleic acid DDS technology and will be developed as a regenerative drug for knee osteoarthritis by RUNX1 mRNA that induces cartilage regeneration. This was adopted by AMED for the medical research and development innovation platform creation project, and PrimRNA Co., Ltd., which we jointly established with Axcelead Inc., will take the lead in promoting research and development. In this project, we plan to carry out up to phase I clinical trials.

(Notes) This is another candidate product added to the pipeline due to the merger with AccuRna, Inc. in September 2020. Although mRNA is a young drug discovery platform, it has drawn attention with the advent of Pfizer and Moderna’s COVID vaccines. Since the Japanese government lost in the 1992 vaccine side effect class action lawsuit, few new vaccines have been approved in Japan. Pharmaceutical companies have deemphaised vaccine development, and fewer researchers have been involved. On the other hand, AccuRna, Inc., which was a leader in nucleic acid drug development, had accumulated knowledge and information from mRNA research and development, which NanoCarrier inherited.

Axcelead Inc. is a holding company centered on the drug discovery platform business, which was established in April 2020 by the Drug Discovery and Restoration Investment Limited Partnership, of which Whiz Partners, which will be described later in this write-up, is the General Partner. PrimRNA was established in April 2021 with a capital of 1 million yen. The stakes of NanoCarrier and Axcelead are not disclosed. It is NanoCarrier’s subsidiary but is not included in the consolidated accounts.

Share price spike

Previously, we mentioned that the share price will likely be more interesting going forward thanks to the enhanced pipeline. In fact, the company’s share price spikes since the IPO are not that speculative; almost all are due to newsflow. To confirm this, we have picked up the company announcements that are thought to have moved the share price significantly.

March 2013 – In October 2012, Shin-Etsu Chemical (4063) announced that it would cooperate with the company in the acquisition of 12,000 shares through a third-party allotment to become the largest shareholder and support the company’s drug development. The share price formed a big uptrend and rose 28 times higher in half a year.

March 2016 – The company invested in AccuRna. NanoCarrier signed an exclusive license agreement with AccuRna, Inc. (Bunkyo-ku, Tokyo) for the development of pharmaceutical products that apply the gene delivery technology that it is currently working on. In addition to the lump-sum contract payment, it will receive certain royalties and milestones associated with commercialisation. At the same time, NanoCarrier has decided to invest in the company in order to strengthen the relationship of trust and cooperation with the company.

July 2016 – Share price fell. Nippon Kayaku announced that paclitaxel-encapsulated anticancer drug NK-105, which NanoCarrier developed its drug delivery system (DDS) technology and licensed out to Nippon Kayaku, could not achieve the primary endpoint in the phase III trial.

January 2018 – VBL announced the start of phase III trial of platinum-resistant ovarian cancer and first patient enrollment. VBL Therapeutics (Headquarters: Israel), which signed license agreement with NanoCarrier in November, began a phase III trial (OVAL trial) to support the application for approval of platinum-resistant ovarian cancer for its gene therapy drug VB-111. The registration of the first patient was announced.

February 2019 – NanoCarrier announced US clinical development plan for gene therapy drug VB-111. It announced a development plan in the US being undertaken by VBL (Israel), from whom the company licensed that in.

June 2020 – Press release about 4 June announcement by Professor Kazunori Kataoka about the development of a new coronavirus vaccine using the micellar nano-emulsion technology. NanoCarrier will back up through AccuRna, Inc. Professor Kataoka said that joint research and development between Innovation Center of NanoMedicine (iCONM) and the Tokyo Metropolitan Institute of Medical Science will be able to achieve optimization of mRNA vaccine formulations within six months, and that subsequent clinical development must be carried out fast by companies such as AccuRna, Inc. to put it to practical use.

August 2021 – The company reported good progress on the phase Iib clinical trial of NC-6004.

September 2021 – The company announced that ENT103 has achieved its primary endpoint in a domestic phase III clinical trial.

Shareholder activities

The company’s major shareholders are domestic venture capitals and individual investors. Major institutional investors and business partners have either gone or reduced their investment.

Whiz Partners Inc. reports a large holding of 23.92% as of May 10, 2021. Previously its stake was 10.61% as of March 26, 2020. The company is an independent investment management company established in 2010 and is engaged in value-up and finance of listed companies, and hedge funds and private equities investment centering on healthcare. They say they have a high degree of expertise in healthcare PE. The shares of NanoCarrier are held in healthcare funds managed by Mr.Tomoyuki Fujisawa, a director and CIO. He was formerly a researcher at Takeda Pharmaceutical (4502)’s Pharmaceutical Research Division. Other investment include SymBio (4582), FRONTEO (2158), Kids Wellness (4584), CellSeed (7776), NanoDex (not listed), MEDINET (2370), Immunobiological Research Institute Co., Ltd. (antibody reagent development), Ribomic (4591), MEDRx (4586), Forte Bioscience (NASDAQ FBRS), WHILL Co., Ltd. (electric chair, not listed), etc. As mentioned above it is a shareholder of PrimRNA, which was jointly established with NanoCarrier in April 2020 to run development of RUNX1. PrimRNA is a non-consolidated subsidiary of NanoCarrier, whose shareholder stakes are not disclosed.

A venture capital named Incubation Platform for the University of Tokyo (IPC) owns 1.73%, and another venture capital Fast Track Initiative (FTI) owns 2.22%. FTI is an investor dedicated to biotech and health tech, with Dr. Tomohiro Anzai, Ph.D. in Life Sciences, as a representative partner. He went to the graduate school of the University of Tokyo, has experience in management consulting, and seems to have been involved in the management strategy and R&D strategy of biotechnology companies.

The investment of listed business companies has decreased significantly and is negligible. Shin-Etsu Chemical (4063) reduced its stake by 40% in 2020. Noritsu Koki (7744) also sold half of its stake in the same year, and Chugai Pharmaceutical (4519) sold all its stake.

According to the Shikiho, the foreign ownership ratio as of the end of March 2021 is 2.86%. Previously, JP Morgan Asset and Baillie Gifford were two major foreign institutional shareholders. Both have disposed of their positions from late 2020 to the present. JP owned 1.86 million shares and BG owned 1.23 million shares. This left few foreign institutional shareholders. State Street Global Advisors has been buying moderately over the last six months, but theirs is not a big position.