Chiome Bioscience (Company Note 3Q update)

| Share price(11/29) | ¥211 | PER(12/21 CE) | – X |

| 52 weeks high/low | ¥386/176 | PBR(12/20 act) | 3.53 X |

| ADVT (¥ mn, monthly) | ¥55 mn | ROE(12/20 act) | -45.6% |

| Shrs out | 40.305 mn shrs | Mkt cap | ¥8.5 bn |

| Listed market | TSE Mothers | Shr eqty ratio (6/21) | 81.6% |

| Click here for the PDF version of this page |

| 4583CBS2021Q3_EN211130 |

Various clinical trials are progressing smoothly.

Extension of contract period with Chugai Pharmaceutical Group for drug discovery support.

◇ Key points for the financial results for 3Q of FY 12/2021

- In the drug discovery and development business, clinical trials and clinical trial preparations for two items (CBA-1205 and CBA-1535) progressed steadily in the clinical development stage. As for out-licensed products, the company started joint development of ADCT-701 with the National Cancer Institute in the United States, showing steady progress.

- Sales of the drug discovery support business, which is currently the primary source of earnings, are strong, rising from 140 million yen in 1Q to 130 million yen in 2Q to 150 million yen in 3Q. Agreed with an extension of the contract research period with the Chugai Pharmaceutical Group.

- As of the end of September 2021, cash and deposits were 2.07 billion yen. The company needs to spend about 1.2 billion yen for R&D plus other SG&A expenses, so the company will likely procure funds next fiscal year.

◇ Financial results for 3Q of FY 12/2021: Sales increased by 73% year-on-year, and loss shrank.

For 3Q of FY 12/2021, the company posted net sales of 541 million yen (up 73% year-on-year), an operating loss of 850 million yen (an operating loss of 1,080 million yen in the same period of the previous year), an ordinary loss of 843 million yen (an ordinary loss of 1,087 million yen in the same period of the last year) and a net loss of 842 million yen (a net loss of 1,087 million yen in the same period of the previous year).

In the drug discovery and development business, a lump-sum payment for the license agreement for LIV-2008 / 2008b was recorded in 1Q, resulting in sales of 103 million yen (1 million yen in the previous fiscal year). Sales of the drug discovery support business are 438 million yen. Stable transactions with existing customers, mainly domestic pharmaceutical companies, continued, increasing sales by 128 million yen. R&D expenses are 860 million yen. Although the cost for manufacturing the investigational drug CBA-1535, etc., is recorded, it decreased by 90 million yen from the previous term.

In BS, cash and deposits at the end of September 2021 were 2,071 million yen. It decreased by 615 million yen from the end of December 2020. Total assets were 2,950 million yen (3,494 million yen at the end of December 2020). The equity ratio fell 6.6 points from 88.2% at the end of December 2020 to 81.6%.

|

JPY, mn, % |

Net sales |

YoY % |

Oper. profit |

YoY % |

Ord. profit |

YoY % |

Profit ATOP |

YoY % |

EPS (¥) |

|

2017/12 |

259 |

3.0 |

-887 |

– |

-883 |

– |

-882 |

– |

-33.48 |

|

2018/12 |

212 |

-18.1 |

-1,539 |

– |

-1,533 |

– |

-1,533 |

– |

-57.26 |

|

2019/12 |

447 |

110.3 |

-1,401 |

– |

-1,410 |

– |

-1,403 |

– |

-44.61 |

|

2020/12 |

480 |

7.4 |

-1,283 |

– |

-1,291 |

– |

-1,293 |

– |

-39.06 |

|

2021/12 (CE) |

– |

– |

– |

– |

– |

– |

– |

– |

– |

|

2020/12 3Q |

312 |

10.5 |

-1,080 |

– |

-1,087 |

– |

-1,087 |

– |

-31.33 |

|

2021/12 3Q |

541 |

73.5 |

-850 |

– |

-843 |

– |

-842 |

– |

-20.94 |

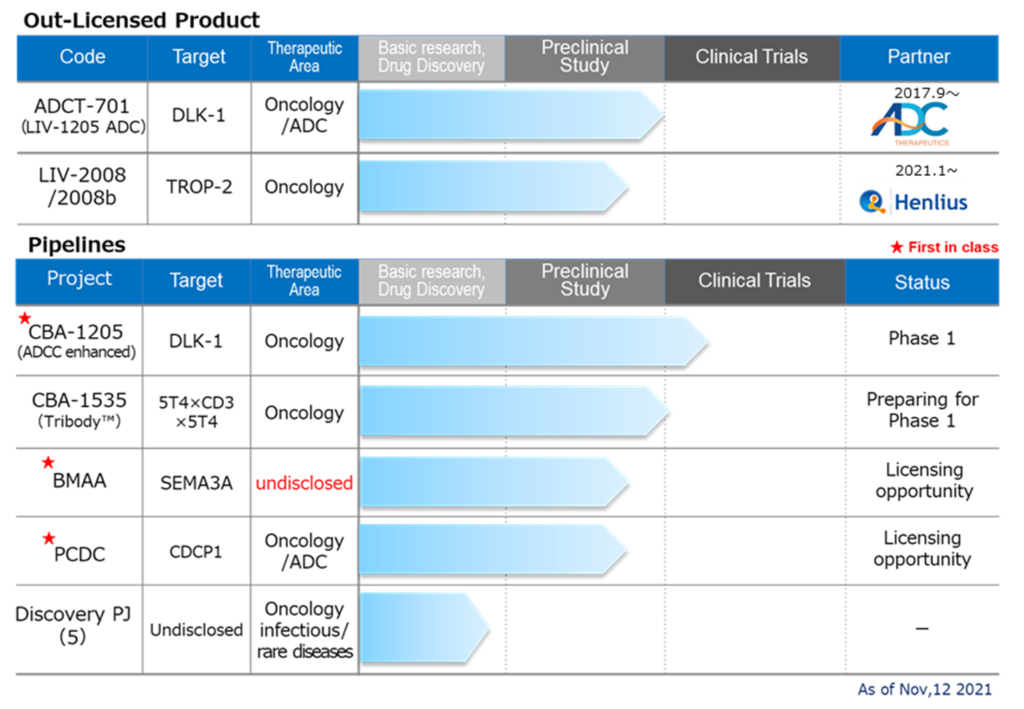

◇Pipeline progress

Drug discovery and development business – pipeline

*CBA-1205; The first half of the Phase I trial at the National Cancer Center is proceeding smoothly. The company changed the development plan and acquired a larger amount of safety data than originally planned. As previously reported, the second half of the Phase 1 trial is the initial evaluation of efficacy in patients with hepatocellular carcinoma, and the company aims to conduct it at the end of 2021 or the first half of 2022.

*CBA-1205; The first half of the Phase I trial at the National Cancer Center is proceeding smoothly. The company changed the development plan and acquired more safety data than initially planned. As previously reported, the second half of the Phase 1 trial is the initial evaluation of efficacy in patients with hepatocellular carcinoma. The company aims to conduct it at the end of 2021 or the first half of 2022.

*BMAA; With the termination of the option contract with SemaThera in May 2021, the company secured its business opportunities. It promoted joint research aimed at curing diseases involving semaphorin 3A with overseas research institutes.

*PCDC; PCDC; The company promoted out-licensing activities centred on ADC applications and implemented additional animal tests. In July 2021, the management released the patent information collected by the World Intellectual Property Organization. The target molecule is CDCP1, a first-in-class antibody targeting solid cancers (lung cancer, head and neck cancer, oesophagal cancer, colon cancer, cervical cancer, etc.).

*5 drug discovery research projects; for those other than the above, the company is considering out-licensing and development plans for priority projects to enrich the pipeline. The company is considering revising and abolishing existing projects to launch new projects, and preparations are underway for new basic applications.

*ADCT-701; ADCT announced collaborative development with the National Cancer Institute for ADCT-701, an already-out-licensed product. Preparations are underway for the IND application and clinical trials in 2022.

◇ Progress of drug discovery support business: Extension of contract research with Chugai Pharmaceutical Group

The company signed drug discovery support contracts with major pharmaceutical companies in Japan but has extended the periods of commissioned research contracts with its early customers: Chugai Pharmaceutical and Chugai Pharmabody Research. The company will extend the contract period with Chugai Pharmaceutical for three years until December 31, 2024. It will extend the contract period with Chugai Pharmabody Research for five years until December 31, 2026.

◇ Utilization and improvement of ADLib®︎ system

The company continued to utilize and improve the ADLib®︎ system, which is its core technology. The library of the human ADLib®︎ system in Europe and the replacement/acquisition method of the ADLib ®︎ system in Japan acquired a patent. It should enhance the drug discovery pipeline developed in-house while improving the technology related to the drug discovery support business.

Financial data

| JPY, mn |

2019/12 |

2020/12 |

2021/12 |

||||||||

|

1Q |

2Q |

3Q |

4Q |

1Q |

2Q |

3Q |

4Q |

1Q |

2Q |

3Q |

|

|

[Statements of income] |

|||||||||||

|

Net sales |

64 |

77 |

142 |

165 |

91 |

82 |

139 |

169 |

246 |

139 |

157 |

|

Drug Discovery and Development Business |

0 |

1 |

1 |

28 |

1 |

1 |

0 |

1 |

103 |

0 |

0 |

|

Drug Discovery Support Business |

63 |

76 |

142 |

137 |

90 |

82 |

138 |

168 |

143 |

138 |

157 |

|

Cost of sales |

27 |

26 |

58 |

52 |

61 |

46 |

59 |

70 |

64 |

62 |

78 |

|

Gross profit |

37 |

51 |

84 |

113 |

30 |

36 |

80 |

99 |

182 |

77 |

79 |

|

SG&A expenses |

464 |

374 |

503 |

346 |

456 |

346 |

424 |

303 |

337 |

337 |

515 |

|

R&D expenses |

363 |

273 |

407 |

256 |

343 |

266 |

342 |

206 |

216 |

243 |

401 |

|

Operating loss |

-426 |

-324 |

-419 |

-233 |

-426 |

-310 |

-344 |

-204 |

-155 |

-260 |

-436 |

|

Non-operating income |

0 |

1 |

4 |

0 |

2 |

0 |

3 |

0 |

7 |

0 |

2 |

|

Non-operating expenses |

6 |

4 |

4 |

0 |

0 |

2 |

10 |

1 |

1 |

0 |

1 |

|

Ordinary loss |

-432 |

-327 |

-418 |

-233 |

-425 |

-311 |

-351 |

-205 |

-150 |

-259 |

-434 |

|

Extraordinary income |

2 |

1 |

6 |

0 |

0 |

0 |

|||||

|

Extraordinary expenses |

|||||||||||

|

Loss before income taxes |

-430 |

-326 |

-412 |

-233 |

-425 |

-310 |

-351 |

-205 |

-150 |

-247 |

-433 |

|

Total income taxes |

1 |

0 |

1 |

0 |

1 |

0 |

1 |

1 |

11 |

1 |

1 |

|

Net loss |

-431 |

-326 |

-413 |

-234 |

-425 |

-311 |

-352 |

-206 |

-161 |

-248 |

-434 |

|

[Balance Sheets] |

|||||||||||

|

Current assets |

3,048 |

3,206 |

2,807 |

2,561 |

2,309 |

2,805 |

3,316 |

3,249 |

3,294 |

3,088 |

2,675 |

|

Cash and deposits |

2,776 |

2,899 |

2,469 |

2,106 |

1,967 |

2,472 |

2,881 |

2,686 |

2,580 |

2,302 |

2,071 |

|

Non-current assets |

219 |

217 |

242 |

247 |

247 |

249 |

249 |

246 |

244 |

241 |

274 |

|

Tangible assets |

15 |

14 |

12 |

11 |

10 |

9 |

8 |

7 |

6 |

6 |

4 |

|

Investments and other assets |

204 |

204 |

230 |

236 |

237 |

240 |

241 |

238 |

237 |

235 |

269 |

|

Total assets |

3,267 |

3,423 |

3,049 |

2,808 |

2,556 |

3,054 |

3,566 |

3,495 |

3,537 |

3,329 |

2,950 |

|

Current liabilities |

177 |

207 |

154 |

145 |

315 |

427 |

378 |

343 |

378 |

428 |

468 |

|

Short-term borrowings |

142 |

199 |

199 |

180 |

180 |

190 |

199 |

||||

|

Non-current liabilities |

41 |

41 |

41 |

41 |

42 |

42 |

42 |

42 |

42 |

42 |

53 |

|

Total liabilities |

219 |

248 |

196 |

187 |

357 |

469 |

420 |

385 |

420 |

470 |

522 |

|

Total net assets |

3,048 |

3,175 |

2,853 |

2,622 |

2,199 |

2,585 |

3,146 |

3,110 |

3,118 |

2,859 |

2,428 |

|

Total shareholders’ equity |

3,048 |

3,175 |

2,853 |

2,622 |

2,199 |

2,585 |

3,146 |

3,110 |

3,118 |

2,859 |

2,428 |

|

Capital stock |

5,856 |

6,084 |

6,132 |

6,132 |

6,133 |

846 |

1,303 |

1,388 |

1,471 |

1,471 |

1,472 |

|

Legal capital reserve |

5,846 |

6,074 |

6,122 |

6,122 |

6,123 |

2,446 |

2,903 |

2,987 |

3,071 |

3,071 |

3,072 |

|

Retained earnings |

-8,682 |

-9,008 |

-9,421 |

-9,655 |

-10,080 |

-736 |

-1,088 |

-1,294 |

-1,455 |

-1,703 |

-2,136 |

|

Subscription rights to shares |

28 |

26 |

20 |

22 |

24 |

30 |

28 |

29 |

30 |

19 |

19 |

|

Total liabilities and net assets |

3,267 |

3,423 |

3,049 |

2,808 |

2,556 |

3,054 |

3,566 |

3,495 |

3,537 |

3,329 |

2,950 |

|

[Statements of cash flows] |

|||||||||||

|

Cash flow from operating activities |

-677 |

-1,537 |

-528 |

-1,360 |

-560 |

||||||

|

Loss before income taxes |

-755 |

-1,401 |

-734 |

-1,290 |

-396 |

||||||

|

Cash flow from investing activities |

– |

-26 |

– |

3 |

– |

||||||

|

Purchase of investment securities |

– |

– |

– |

– |

– |

||||||

|

Cash flow from financing activities |

1,248 |

1,341 |

894 |

1,944 |

176 |

||||||

|

Proceeds from issuance of common shares |

1,249 |

1,345 |

697 |

1,769 |

166 |

||||||

|

Net increase in cash and cash equiv. |

570 |

-222 |

366 |

580 |

-384 |

||||||

|

Cash and cash equiv. at beginning of period |

2,328 |

2,328 |

2,105 |

2,105 |

2,686 |

||||||

|

Cash and cash equiv. at end of period |

2,899 |

2,105 |

2,472 |

2,686 |

2,301 |

Note) For the cash flow statement, Q2 is the cumulative of Q1 to Q2, and Q4 is the cumulative of Q1 to Q4. Therefore, the beginning balance will be the beginning balance of Q1 for both Q2 and Q4.

Source: Omega Investment from Company materials.