Sportsfield (Price Discovery)

| Securities Code |

| TYO:7080 |

| Market Capitalization |

| 3,904 million yen |

| Industry |

| Service |

Profile

Sportsfield provides employment information and support services for new graduates belonging to athletic associations. Specifically, it plans and operates the Sponavi Shop, provides athlete recruitment consulting, grant consulting, and runs and manages the Sponavi Web Portal, which provides education and training services.

Stock Hunter’s View

Raised full-year forecasts again. Profitability is increasing, and the corporate demand for graduate recruitment is strong.

Sportsfield (7080) provides employment support services specialising in sports human resources.

Sports human resources refer to working people with sports experience and former professional and amateur athletes, particularly new graduates who belong to sports clubs and club teams. The business has three pillars: events for new graduates, human resources introductions for new graduates and human resources introductions for graduates.

In July, the company revised its full-year forecasts for the year ending in December 2022 upwards, with profit expected to significantly exceed its record high posted in FY12/2019. On 20 October, it further increased these forecasts. Sales were raised from 2.65 billion yen to 2.88 billion yen (up 31.8% yoy), and operating profit from 400 million yen to 578 million yen (compared with a loss of 32 million yen in the previous year).

Companies’ appetite for recruiting students graduating in March 2023 and 2024 is strong, and progress on orders for events scheduled in 4Q is also substantial. The demand for new graduates’ events is expected to break the billion yen mark for the first time. The contract rate for both fresh graduates and graduates is also improving. The government-led revision of the job-hunting rules (earlier and year-round job-hunting) is expected to increase business opportunities and reduce seasonal fluctuations in performance.

The share price looks to rise closer to the high of the year (2,706 yen), reached in August. Buying interests should grow if the 3Q results announcement on 14 November comes in nicely.

Investor’s View

Interesting timing to meet up with the management

10.6x the earnings is cheap, but the entry should be carefully considered

Upward revisions in July and October this year sent the share price to triple in the short time since April. Despite strong sales, the company failed to turn a profit last year and the year before, and the earnings expectations for the company were low. Then there was a significant earnings revision and a report of solid profit generation. Management explained that the upward revision was due to a pick-up in demand for event exhibitions and graduate recruitment; the company’s forecast EPS for December 2022 is 206 yen, which puts PER at 10.6x. Cautious multiple indicates that the share price has corrected to discount track performance, but investor expectations remain low. Therefore, there is further upside over the next 10-12 months if the company continues to deliver solid profit growth. Many investors should be reluctant to chase the rally from here. However, it now presents an entry opportunity for investors who are not bound by psychological resistance and are interested in building medium/long-term earnings forecasts.

Earnings visibility is low

However, being volatile, the earnings are difficult to forecast, so one should not buy a low PER if this is the case. Sales look likely to be strong in the near term due to a favourable external environment, increased awareness of the company in the job-hunting market and an improved employment situation. However, it is impossible to predict how costs, which have stopped growing at the moment, will develop. The sudden profit generation is thought to be a one-off if this was because sales have risen far above the break-even levels, estimated to be in the region of 2 billion yen, due to an improved environment while costs are being controlled. The company will need to expand expenses in various ways to grow top-line sales. Therefore, one cannot optimistically forecast secular earnings, basing their projections on this year’s solid performance.

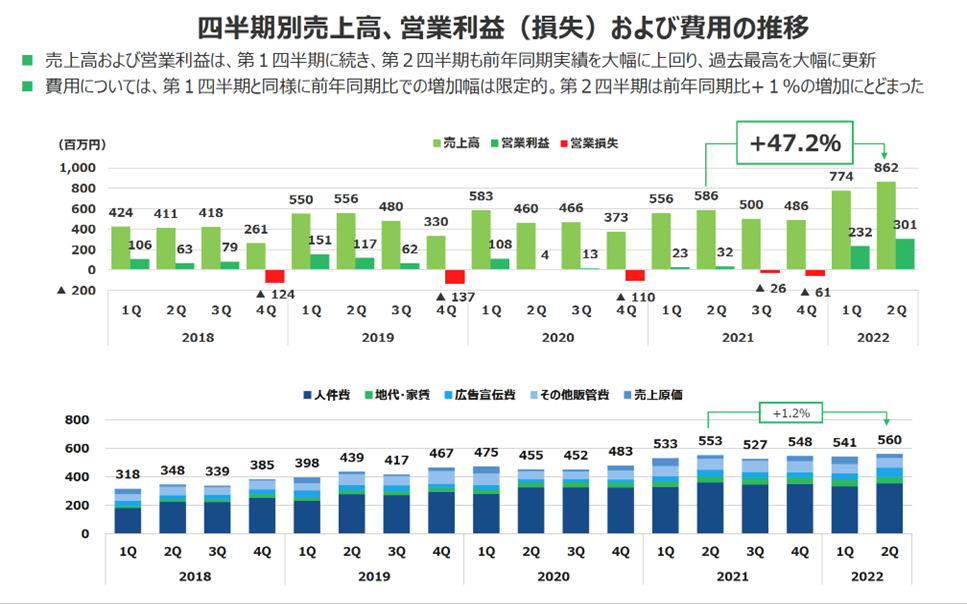

Quarterly sales, operating profit and costs

Good opportunity for discussions with management – DCF estimates positive

Building good earnings forecasts based on disclosed IR materials is difficult. Nonetheless, it would be nice to sit for individual discussions with management to ascertain whether this is a turning point in earnings, produce a reliable earnings model, and calculate fair value. Discounted by 5.0%, the fair value of the shares would be well over 3,000 yen a share, assuming sales and EBIT growth of +7% and +10%, respectively, after the company achieves its targets for the current FY2022. It is also encouraging that Hikari Tsushin made a position in the fourth quarter of last year and is on the list of shareholders with a 1.9% stake. The company runs a portfolio of listed Japanese companies that generate recurring income and hold them long-term. Currently, Hikari Tsushin appears to hold 280 stocks. The entry in Sportsfield was timely and has been a brilliant investment.

Link to Company material quoted in the report