S-Pool (Price Discovery)

| Securities Code |

| TYO:2471 |

| Market Capitalization |

| 74,346 million yen |

| Industry |

| Service |

Company Profile

The company dispatches staff to call centres and other facilities. It also operates a farm business to support the employment of people with disabilities. The former is the Human Resource Solutions Segment, and the latter is the mainstay of the Business Solutions Segment.

Stock Hunter’s View

Strong support for the employment of persons with disabilities. Expectations for special demand related to My Number Card.

The company’s 3Q results from June to August announced on 4 October, showed a 5.1% operating profit decline due to a struggle in its temporary staffing services. This disappointed investors, and the share price fell to an all-time low (864 yen) on 12 October. The share price, however, has since recovered on the back of a series of positive incentives and is currently in a recovery trend.

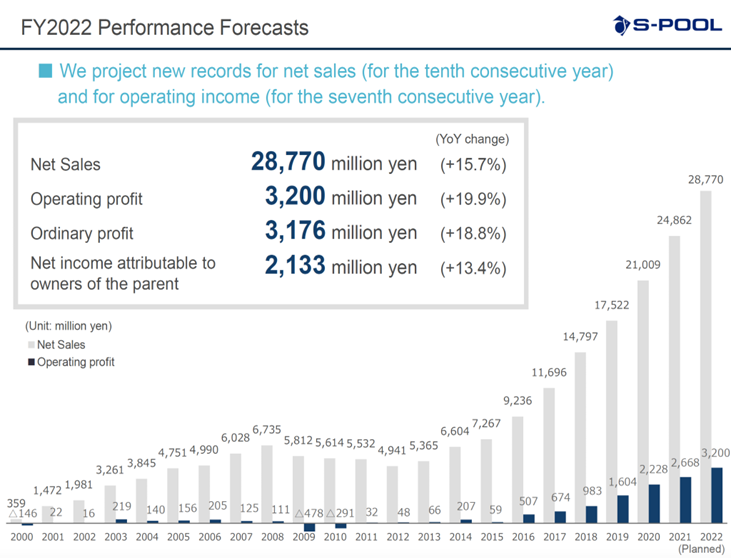

The Business Solutions Segment offset the decline in temporary staffing, and the company maintained an increase in profit, posting OP of 2,274 million yen, or +17.7% yoy, in the first nine months of FY2022. The business’s mainstay employment support for people with disabilities steadily built up management income, boosting earnings. Sales in the lead-up to the busy 4Q were strong, with a large order backlog for equipment sales.

Special demand related to My Number Card is expected in the future. In the medium term, the government’s recent cabinet decision to revise the Comprehensive Support for Persons with Disabilities Act is also likely to be a positive factor. In the near term, new shared BPO centres are being established rapidly, where the same work is contracted out from several neighbouring municipalities on an aggregated basis. The investment in otta inc., which is developing a smart watch-over platform, is an opportunity for the company to further capture demand for DX services from wide-area municipalities.

Investor’s View

There is a good upside for the share price over the next 10-12 months.

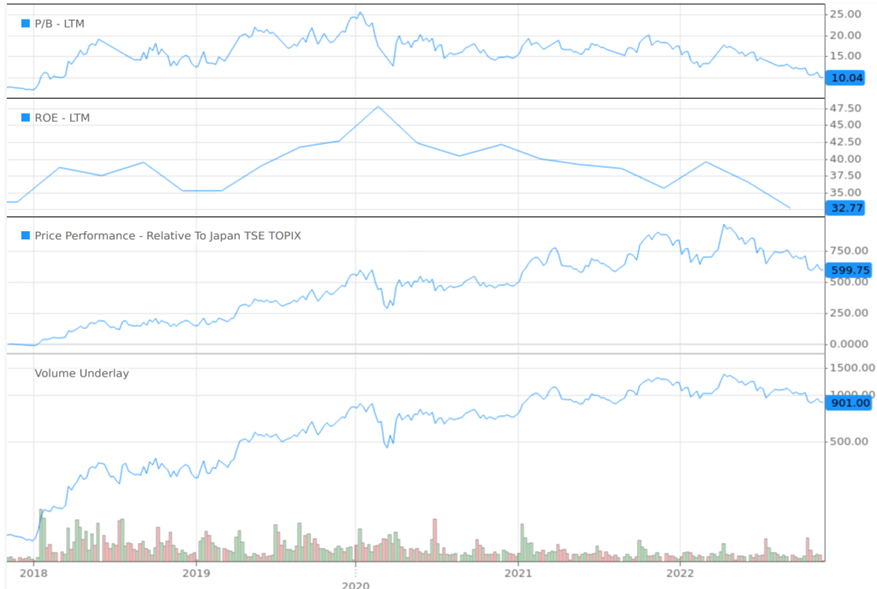

The premium attached to the shares remains high although declining due to lowering ROE

The share price rose robustly from 2016 until April this year and delivered excellent performance, significantly outperforming TOPIX. However, the downward trend since April is becoming more evident. The shares outperformed TOPIX by 50% last year but have underperformed by 23% YTD.

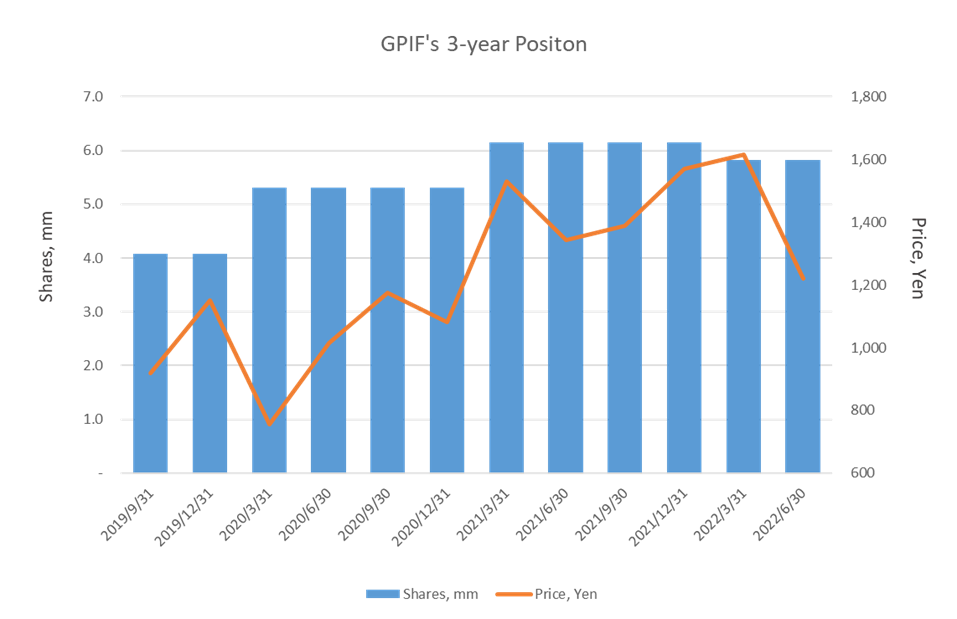

The current PBR is 10x, a high premium to the shares. One reason for the high premium must be the company’s high ESG profile, which is probably why GPIF has become the largest shareholder with a 7.4% ownership.

PBR, ROE, relative share price, share price

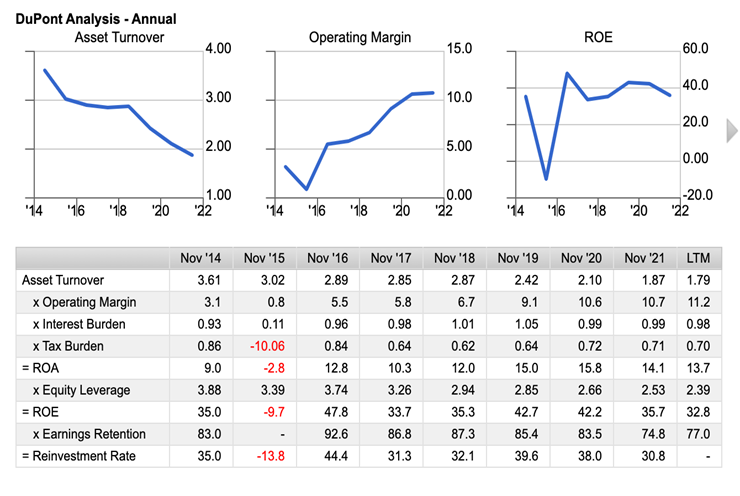

PBR peaked at 25x at the beginning of 2020 and has been declining, with the deviation from the five-year average of 16x only widening. This is thought to be a reflection of the declining ROE from 2020. The downward pressure on ROE is due to a decline in asset turnover. The main reason is the rapid build-up of assets due to increasing farm facilities rented to customers of the employment support business for people with disabilities.

What are investors’ concerns?

The rapid growth in the sales of the Business Solutions Segment has led to a remarkable increase in profit margins, which has offset the deterioration in asset turnover. Thanks to this, ROE has remained at around 40%, an excellent level that ranks in the top 100 of all listed stocks in Japan. Profit margins in the staffing business (Human Resource Solutions Segment) are largely static at around 10%. Business Solutions’ operating profit margin has reached just under 30%, generating 60% of company-wide operating profit, but the impressive rise in profit margins over many years has ceased. Investors must be concerned that going forward, the risk to ROE may be on the downside.

Some factors have pushed share prices down over a short period

In addition, factors that are thought to have weighed on share prices in the short term include: 1) investors’ short-term earnings expectations being stripped away by the decline in the staffing business, as pointed out by Stock Hunter; 2) the decline in the present value of shares as the era of ultra-low interest rates ends and the terminal rate increases; 3) GPIF (Government Pension Investment Fund, owns 7.4% of S-Pool) and Coupland Cardiff Asset Management (3.0%), the top two holding funds, have sold some of their positions.

GPIF positions

The shares may well be revalued after declining over a short period

Despite the decline in ROE from 2020, the market cap continued to increase due to the slower reduction in PBR (CAGR -26%) relative to the fast growth of shareholders’ equity (CAGR +33%) over the three years.

In a stock market hit by Ukraine, Covid-19 and inflation, investors are looking for shares in companies that continue to grow sales, improve profitability and generate good cash flow. While S-Pool may no longer meet the profitability criteria, it is one of the rare companies rated highly for an excellent ESG, and its high ROE is also attractive. A reasonable view of the share price should be to assume that the equity premium will continue to erode but at a slower rate and that the market capitalisation will continue to grow steadily thanks to high equity capital growth. Investors should remain keen to price in the company’s strong earnings growth driven by the Business Solution business, which will likely grow fast backed by structural factors. Therefore, we anticipate a significant upside to the share price over the next 10-12 months following a significant short-term fall.

Structural factors behind high growth in the Business Solution Segment

Support for the employment of persons with disabilities, which is growing at 30%-40% per annum, is the core business of this segment. The drivers are the Japanese companies not making progress in employing people with disabilities and the statutory obligation to hire persons with disabilities. In Japan, all companies with 44 or more employees must employ 2.3% of disabled persons. However, employment stands at 15% (580,000 people) against 3.87 million disabled people aged 18-64. 44% of people with physical disabilities, who account for 26% of the disabled population, are employed. In comparison, 95% of people with intellectual and mental disabilities, who account for 74% of the disabled population, are not employed because there are few suitable jobs.

In fact, companies are struggling to employ persons with disabilities, and turnover is high. S-Pool rents out artificial plantations to enterprises as part of its solution business and receives management income. Those companies grow vegetables by employing disabled people and use the harvest for company welfare and other purposes. Currently, 374 companies, mainly large corporations, are the customers and employ 2,238 people. The retention rate of employees is very high at 92%. There is no administrative risk as the company operates on company fees without government subsidies. The legal employment rate has increased in the last ten years, and there are discussions to raise it further to 2.5% in two years. In Europe, the rate is already over 5%, so there is a lot of scope for increasing the employment rate in Japan, which is behind the rest of the world.

Fair values on DCF suggest overvaluation

Assuming growth rates of +15% for sales and +20% for EBIT and using a WACC of 5.5%, the fair value of the shares will be a little over 500 yen a share. The fair value assuming sales and EBIT growth rates of the past five years (sales +22% and EBIT +40%) is 1,100 yen, which matches the share price at the beginning of this year. So far, we have yet to discuss how appropriate the level of PBR itself is. Hence, we have noted the DCF outcomes here to suggest the risk of how overvalued the shares are in terms of cash flow. Of course, most portfolio managers would not care about DCF calculations by someone they do not know who uses his/her assumptions.

Management’s medium-term earnings targets do not convince

Management forecasts sales of 41 billion yen and OP of 5 billion yen in 2025. Without specific actions, these numbers are no more than ambition. Currently, 2,200 people are employed on 30 farms. In the future, 60 farms are expected to employ 5,000 people.

Link to company material

https://ssl4.eir-parts.net/doc/2471/ir_material_for_fiscal_ym5/124347/00.pdf