Ricksoft (Price Discovery)

| Securities Code |

| TYO:4429 |

| Market Capitalization |

| 8,517 million yen |

| Industry |

| Information / Communication |

Profile

A developer and distributor of business software packages, mainly from the Australian company Atlassian. Provides operational support. Also develops its own software.

Stock Hunter’s View

Oversold share price to correct. Sales growth at a record level.

On 14 October, Ricksoft announced 2Q results for the current fiscal year ending in February 2023, showing a 40% increase in sales and a 75% increase in operating profit yoy. Despite the positive results, the company’s share price sank to a limit-low. The share price bottomed out at the low of 1,670 yen on the 21st and began recovering.

The company supports the introduction of Australian company Atlassian’s products and develops applications that add useful functions to these products. In 2Q, licence and in-house software development sales grew by more than 40%, the highest level ever, and recurring fee revenues are expanding. The company has achieved an operating profit progress rate of 62% vs its full-year target and is likely to revise up in due course.

In February 2024, Atlassian will no longer support the server version of the software. The positive impact on Ricksoft’s sales is expected to increase gradually over the next few years through customer migration to the Atlassian Cloud and Data Centre versions.

Most recently, the company has developed an app for project management tools and attracted attention with the announcement of a training and consulting service for business agility.

Investor’s View

Fine share price for an entry

Why the volatile share price?

As noted by Stock Hunter, there were no upward revisions in the 2Q results announced on 14 October, and the share price fell 20%, hitting a limit-low. The 2H operating profit forecast, which is the full-year forecast minus actual results, is back to the level of three years ago. Investors thought that even if the decline is not to that extent, the fact that the company left its guidance unchanged despite strong results indicates the earnings will stall for some reason. Hence the share price declined significantly. Small float – less than 20% of the shares outstanding – was also a factor. Before that, in July, the share price went up sharply, driven by positive earnings expectations after the share price’s consistent decline since the IPO, and hit the upper daily price limit.

Now that speculative expectations have peeled off, it is a nice time to reconsider the intrinsic value of the shares

It should be noted that the change in accounting treatment will result in a slight reduction in sales and profits for the current financial year. Actual sales for the first half are approximately 10% lower than under the previous treatment, with an apple-to-apple yoy comparison of +53%, compared to a nominal value rise of +40%. The progress rate of 1H operating profit against the full-year target is 62%. Given the current strong earnings, the company should comfortably beat its full-year guidance and revise up at some point. Now that the share price is clear of speculative expectations that created volatility in the short term, it is a nice time to sit back and take a closer look at the value of the shares again. In addition, the changes in accounting treatment will level out quarterly earnings fluctuations. This will make it easier to read the secular trends in the earnings. It is a plus for earnings visibility, which is one of the critical factors in considering the PER premium.

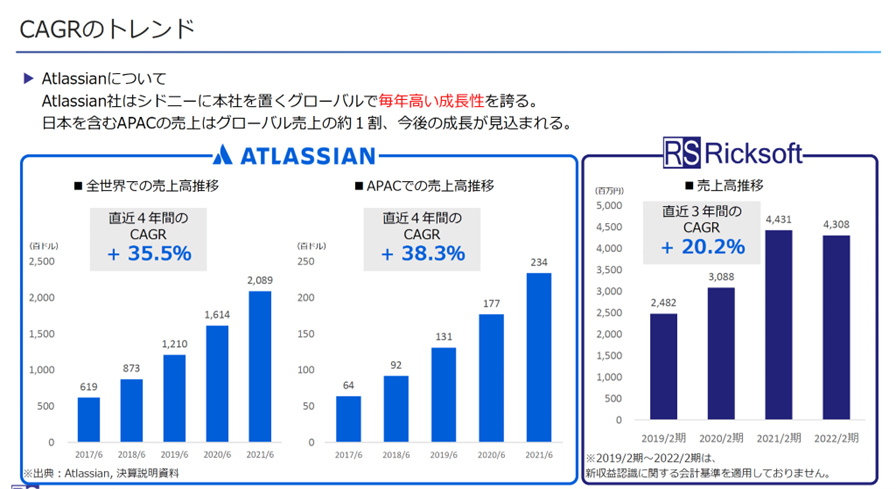

Atlassian licensing is high-growth

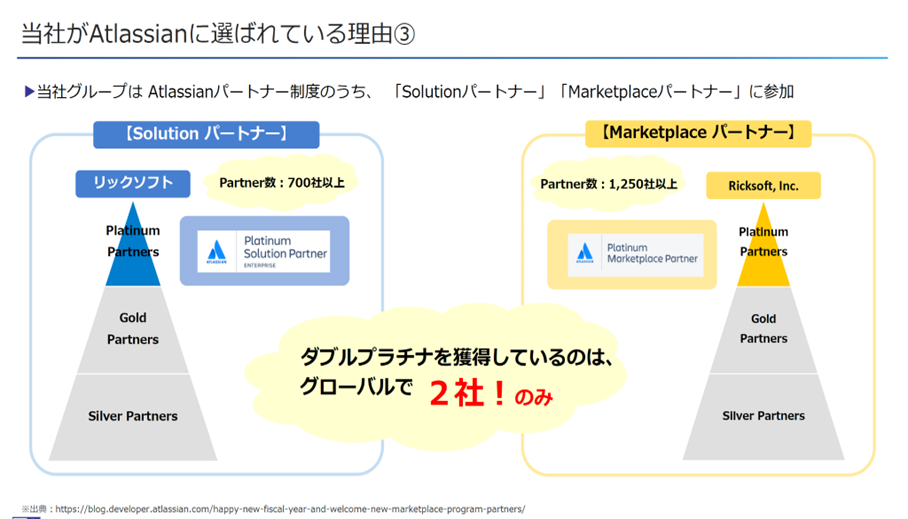

Atlassian licensing accounts for more than 60% of sales. Atlassian continues to grow phenomenally, with sales growing 48% yoy in FY2021 to June 2022. The global support for Atlassian products appears unquestionable. Cloud sales acceleration is a primary driver, and significant growth should continue even in anticipation of some degree of the recessionary economy next year. Atlassian’s management expects the company’s cloud sales to grow by about 50% yoy every year for the next two years.

Naturally, Atlassian’s growth will be reflected in the performance of Ricksoft, which Atlassian has selected as one of its most trusted partners.

Little concern about top-line growth

Nominal yoy 1H sales growth was +54% for Atlassian licensing and +18% for in-house products and services. Although the growth rate of in-house products and services is lower than Atlassian’s, there is little concern about the overall top-line growth. The background to the strong performance of in-house products and services could be more precise, but judging from the strong results, this business appears fine.

Revenue by business segment (Altassiona license in dark blue)

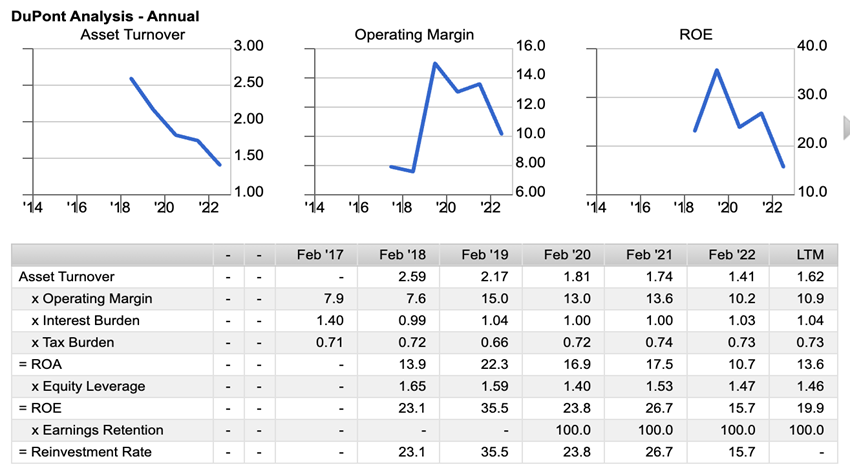

A balance between growth and return on capital is key to the shares’ valuation

The most important key question at this stage to consider a long-term investment in the shares of Ricksoft is whether the company can successfully run on a balance between high growth and high ROE. The top-line growth prospects are good. Combining an ROE of around 16% with a P/B ratio of 3.6x, and President Onuki’s stated top-line target of a CAGR of 20-25%, together with the current sales growth rate of 50% in real terms and a P/E ratio of 24x, entry at the current share price seems reasonable. On the other hand, there are concerns about the asset turnover ratio, which has been declining and is a drag on ROE. The company has yet to tell investors how PL’s profitability will change.

Share price outlook in the first half of next year

The shares may perform well in the first half of next year if the market favours tech and quality. Currently, the biggest question in the equity market is at what point the Fed pivots and when to factor in the expectation that the Fed-led global tightening cycle will end. If there is a substantial market for growth stocks, the shares of Ricksoft should play on it. Recession slows enterprise demand for cloud, as seen in Amazon’s AWS slowdown. However, a bull market under a recessionary economy is a possible scenario. The shares of Ricksoft are undersized, and their three-year raw beta of 1.17 is not so high. On the other hand, the business is resilient, ROE is high, and operating cash flow is plentiful, so the quality is high.