TSUBURAYA FIELDS HOLDINGS (Price Discovery)

| Securities Code |

| TYO:2767 |

| Market Capitalization |

| 64,750 million yen |

| Industry |

| Wholesale business |

Stock Hunter’s View

Transformation into a global IP holder. Pachislot and pachinko industry environment improving.

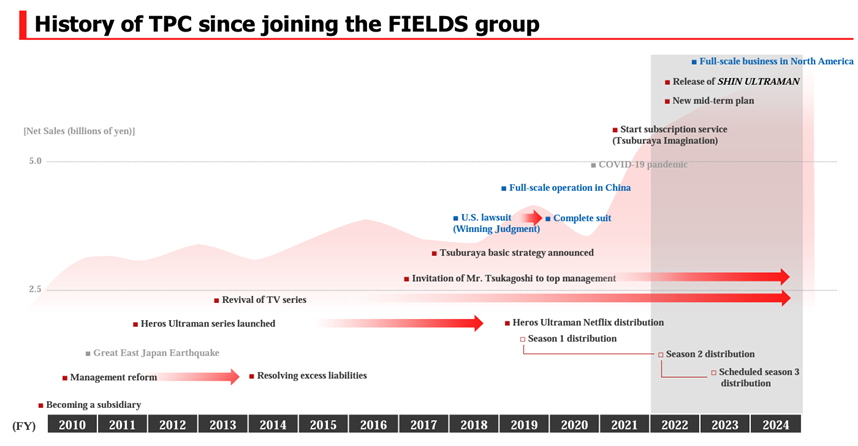

Tsuburaya Fields Holdings (2767) achieved a significant return to profitability in the previous FY2021 that ended in March 2022. The company expects an operating profit of 4 billion yen (+16.1% yoy) in the current financial year. The recovery is being driven by the Content & Digital business. The company made Tsuburaya Productions, known for Ultraman, a subsidiary in 2010, and in recent years the use of Ultraman films and licences has expanded.

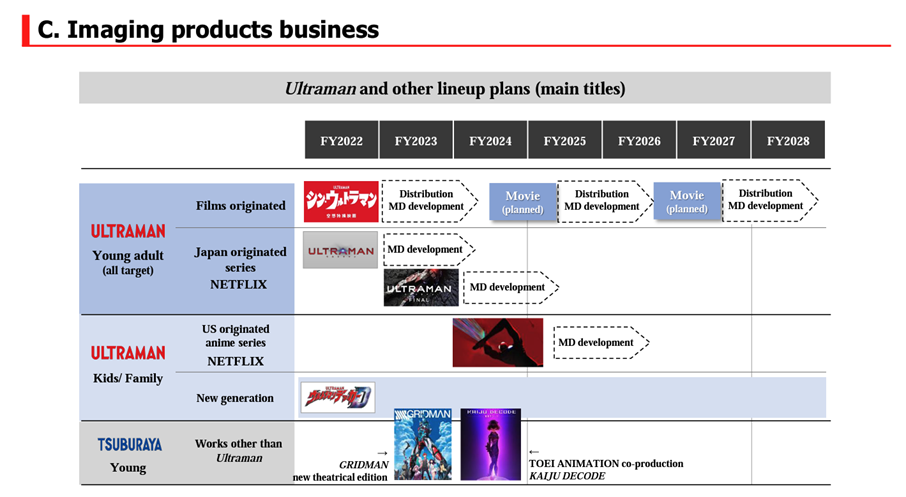

In Japan, the film Shin Ultraman, released in May, was a huge hit, earning over 4.3 billion yen at the box office (as of June) and successfully attracting new fans across a wide range of demographics. Overseas, the business in China is performing well, and the company will continue to develop the business in other Asian countries. Furthermore, the company won a lawsuit filed in North America in 2018, giving it a chance to enter the market. It plans to strengthen Ultraman as a global brand and develop the business in the US and Europe. The company aims to achieve an operating profit of 3 billion yen (average annual growth rate of 60%) in the Contents & Digital Business in FY2024.

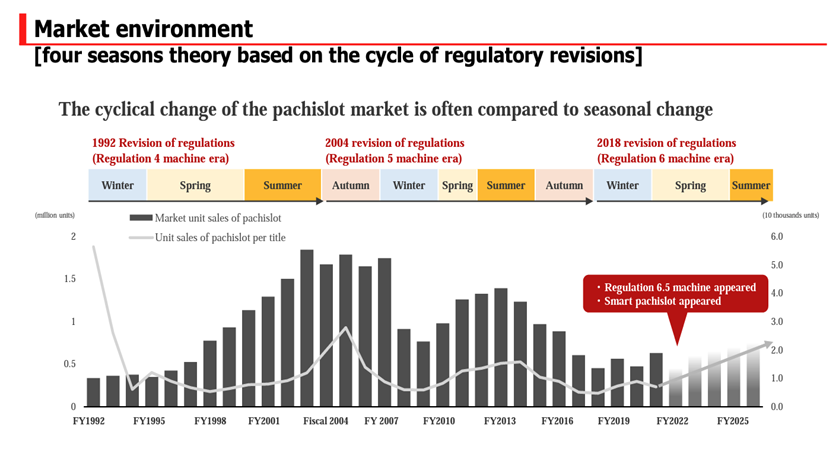

The domestic pachislot and pachinko machine industry has been in a challenging environment for a long time. The industry entered the era of new regulation machines after the deadline for removing old regulation machines at the end of January 2022. Pachislot machines 6.5 compliant with the new regulations are currently enjoying popularity.

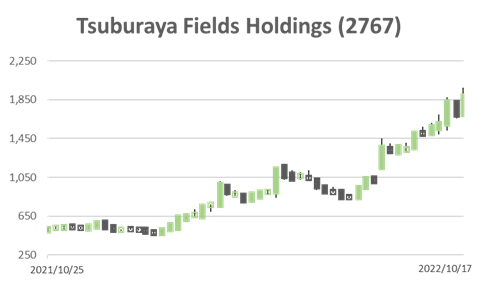

The share price has been rising fast on the back of these positive factors and has surpassed the 2,000 yen mark for the first time since February 2016.

Investor’s View

Sell on strength as amusement equipment could eventually disappoint. Buy if you think the contents business may well take a leap beyond expectations.

Should we chase the rising share price or sell off? From a fundamental perspective, the risk of chasing this upside seems very high. Conservative holders should therefore consider taking profits. This must be a boring view for institutional investors. Perhaps, many people think this way but are not making any significant moves. It remains a buy for investors with a strong view on the contents business. How accurately can we predict the future of a world we know so little about from past data and achievements?

Share price soars threefold, reflecting boosting earnings

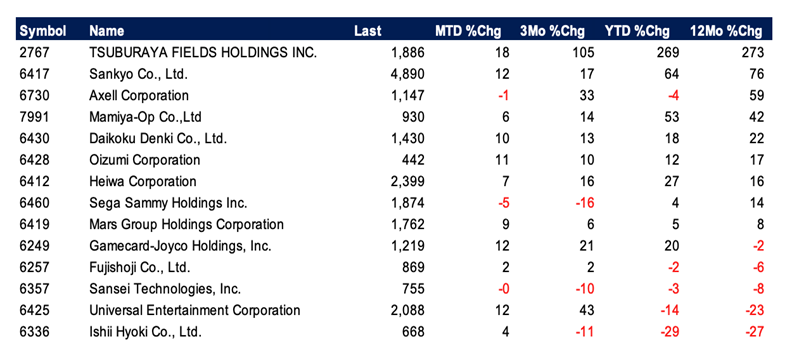

Share prices have tripled year-to-date after seven years of persistent decline from 2016 to 2022. The technical momentum remains strong. A sharp improvement in the earnings underpins the share price surge: sales in FY2021 were 2.5 times higher than a year earlier, and operating profit improved sharply from a loss of 2.2 billion to a gain of 3.6 billion. This is because sales of amusement machines have bottomed out visibly for the first time in five years. Among the 14 companies,which we categorise as amusement machine equipment peers, the more significant the earnings improvement, the better the performance of their share prices.

The share price performance of amusement equipment stocks

Reasons for the particularly solid performance of Tsuburaya Fields HGS shares

This is thought to be due to the rapid expansion of the Content and Digital business segment’s performance being synchronised with the recovery in demand for amusement equipment. In addition, the stock’s valuation must have been raised by the view that the Ultra Series MD business may be growing structurally. A key feature of other companies’ MD businesses is that their ROEs are exceptionally high, and their top-line growth tends to prove surprisingly sustainable.

The remarkable contribution of subsidiary Tsuburaya Productions

The bulk of the Content Digital division consists of the video revenues of the subsidiary Tsuburaya Productions and MD licence revenues. The company is renowned for its Ultra series, which started back in 1966 and became a national hit. Tsuburaya Productions’ management has undergone various changes over the years, as it has suffered from chronic unprofitability due to high production costs in the pursuit of high quality. The company made Tsuburaya Productions a subsidiary in 2010 and held 51% of its shares. Namco Bandai has the remaining 49%.

It is positive that the company has ongoing plans for the Ultra series and MD launches. Investors should look forward to the progression of earnings over the medium to long term.

Amusement equipment could disappoint eventually

The amusement equipment market is difficult to predict. Market demand has fluctuated over many years between the authorities’ regulations to reduce gambling and the attractiveness of new amusement machine models. The current rebound should be considered a temporary recovery from the unusual decline caused by the corona infection and the termination of the extended deadline for removing old regulation machines. Given the historical tightening of regulations by the authorities and the shrinking of the pachinko-related industry, the market should continue to scale down in volume terms. The ‘regulatory revision cycle’ presented by the company appears reasonable, but there is no logical basis for predicting a recovery in the future. Earnings are likely to take a significant hit depending on sales volume fluctuations, and holders of the shares should research carefully so that they can liquidate their positions before terrible news pops in.

Difficult to have confidence in the management’s medium-term targets

While there are high expectations for MD growth, the amusement equipment business is difficult to forecast and does not offer long-term growth attraction. If the company’s targets of 113 billion yen in sales and 7 billion yen in operating profit in FY2024 are to be achieved, the share price would look undervalued in spite of the rise. At present, however, these prospects are less convincing. The intrinsic value of the Ultra series is probably very high and sustainable, and the management’s ability to unfold that value is highly rated. The growth of the content business is exciting. However, it is undeniable that the amusement equipment business could eventually prove a significant drag on it.

Medium-term company forecasts (in billions of yen)

*Reference material: Financial presentation for the fiscal year ended March 31, 2022 and medium-term management plan (FY2022 – FY2024)