Chiome Bioscience (Price Discovery)

| Securities Code |

| TYO:4583 |

| Market Capitalization |

| 6,220 million yen |

| Industry |

| Healthcare |

Soon to enter the profitable phase; to become profitable in a single year between 2023 and 2025

Stock Hunter’s View

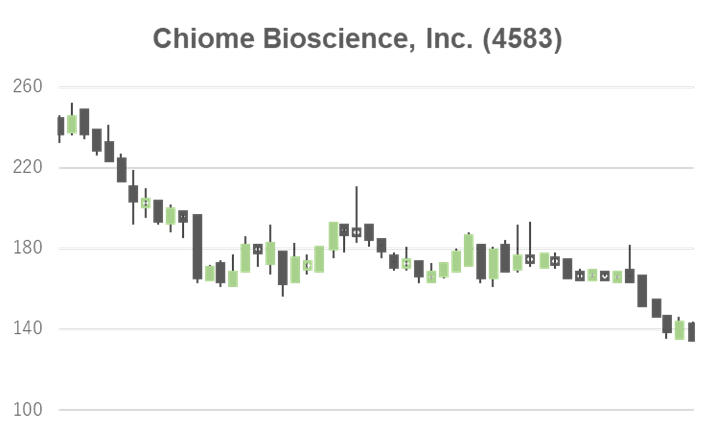

Chiome Bioscience (4583) is a drug discovery venture with proprietary antibody generation technology strengths. The share price fell sharply in September, affected by the turbulence in the equities market, but finally stopped falling at the historic low price recorded on 28 September (135 yen). There are signs of a bottoming out and reversal.

Although the company has been in an operating loss for a long time, it plans to achieve a single-year profit in 2023-25 through out-licensing, receipt of milestones and steady growth in the drug discovery support business. The company believes that achieving a profit in a single year is possible by obtaining upfront payments in the first half of the double-digit oku yen.

Currently, the two most promising candidates are CBA-1205 and PCDC, both in clinical development in-house. CBA-1205 is presently in the second half of Phase I clinical trials for patients with hepatocellular carcinoma and is scheduled to be completed at the end of 2023. PCDC is currently promoting out-licensing activities focusing on applications for ADC (solid tumours).

The growth story will then shift to a profitable phase, when milestones for ADCT-701 and LIV-2008, which have already been out-licensed, will be available, in addition to the out-licensing of CBA-1535. ADCT-701 is expected to enter clinical trials in the US later this year.

Investor’s View

Potential for significant share price appreciation

The company is difficult to invest in for reasonably-minded institutional investors. However, the most crucial argument that upsets all the negatives listed below should be stated first. That is, in reality, the share price will soar the moment investors anticipate that Chiome will become profitable in the not-too-distant future and the moment they show evidence to boost investors’ confidence. This undeniable possibility is the greatest opportunity of investing in the company’s shares. It is not a strategy of choice for institutional investors who cannot predict the probability and timing of a turnaround. However, it makes a sensible investment for investors with the capital and good research skills to allow this strategy.

Share price slumped, but DCF stands neutral

Our DCF estimates suggest that current share prices do not necessarily incorporate excessive pessimism. Based on Stock Hunter’s assumptions, we assumed a deficit of the current level for three years, a small operating profit in 2025 and a deficit again in the following year. Discounting by 5%, the implied long-term earnings expectation of the current share price is calculated to be an operating profit of around 200 million yen each year. Of course, research and development costs will fluctuate with the out-licensing. If this is ignored, sales of approximately 2 billion yen would be required each year to generate this operating profit. Even if the company is temporarily profitable by 2025 due to the receipt of milestone payments and out-licensing fees, will it be able to generate continuous profits like Sosei Group (4565) and Peptidream (4587)? Management needs to explain this to investors.

The drug discovery pipeline is short of scale

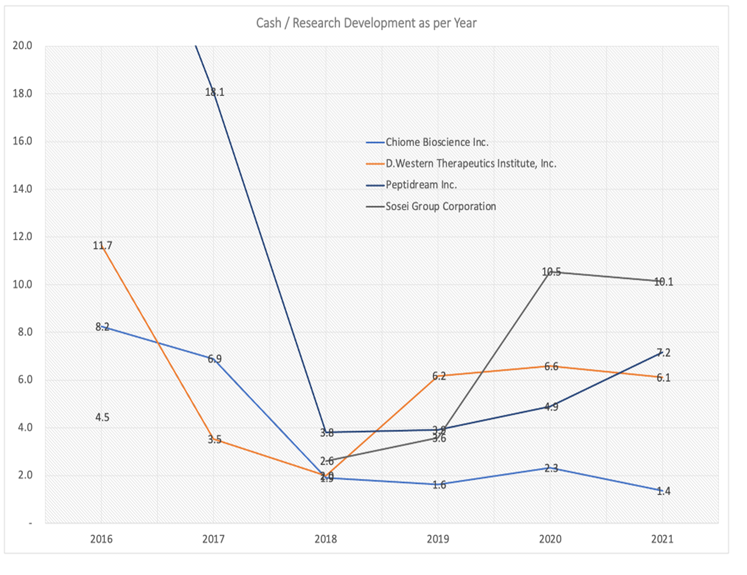

Second, the company’s development pipeline is not substantial enough to inspire investor confidence. With a pipeline of more than a dozen drugs, two of which are in clinical trials, there is a risk that none of them will succeed. Pipeline expansion requires cash. However, the company’s cash is limited to just enough to cover one and a half years of research and development costs. This is a very tight situation compared to Sosei and Peptide, which can afford to invest more money in basic research, equipment and pipeline development.

Annual Cash to R&D Expense

BPS declines

Third, BPS declines year on year. This is the same for other loss-making biotech companies, and it is due to years of losses and dilution from the exercise of share rights. Chiome’s BPS has shrunk by an average of 24% per year over the past five years, slightly faster than other loss-making biotech companies. New shares issued through the exercise of the share rights in September represented less than 2% of the shares outstanding. If the unexercised balance is exercised, there will be a further 7% dilution. Looking at PBR, currently, shareholders pay a premium of 4x the book, which compares to the five-year average of 2.8x. In other words, the share price has fallen significantly, but investor expectations have not been that bad.