Confidence (Price Discovery)

| Securities Code |

| TYO:7374 |

| Market Capitalization |

| 8,316 million yen |

| Industry |

| Service |

A laggard in the games-related industry

Stock Hunter’s View

Concerns about rising US interest rates and economic recession have led to a reassessment of gaming-related stocks, which are less susceptible to the external environment. We would highlight Confidence (7374), a temporary staffing and placement agency specialising in the games industry. The share price is lagging behind those of its peers, i.e., Creek&River (4763), Extreme (6033) and Silicon Studio (3907). The company’s share price could move up to correct.

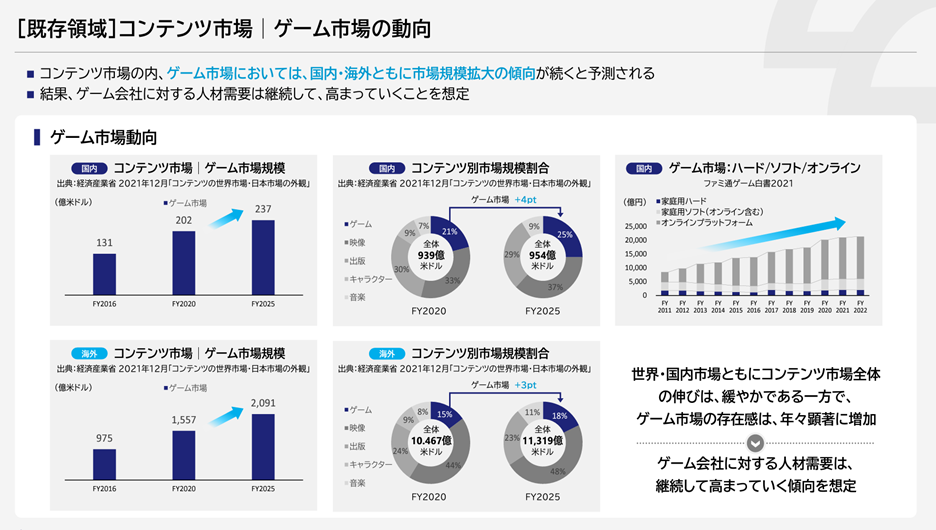

Demand for personnel in the games industry remains strong. In addition to developing new clients in the mainstay temporary staffing business, the company is also working with existing clients to create new clients by department and title. Currently, the major clients include Bandai Namco (3907), Sega Sammy Holdings (6460) and Cygames (private). The company’s growth strategy at the time of listing was to expand into regions other than the Tokyo metropolitan area (Osaka, Fukuoka, Sapporo, etc.) by 2024 and recently opened a branch in Osaka Prefecture.

Focusing on the recent prosperity of the IP (Intellectual Property) business in the entertainment content industry, the company plans to enter the animation field in the future. It also looks at developing in new markets, such as metaverse and Web 3.0.

Investor’s View

Interesting laggard – agreeing to the stock hunter

The downside of the shares is protected by solid earnings growth

The company’s core business is the dispatch of IT personnel to gaming companies. The attractions of the company business are an impressively high ROE of around 40% and a robust top-line revenue, which is growing at +20%. Despite being a growth stock, the shares have fallen only 1% since the beginning of the year, outperforming the 132-company Factset Commercial Services sector by 25% and the TOPIX by 4%, respectively. Current uncertainties in the stock market are Fed monetary policy, inflation and corporate earnings. Of these, the company has much less concern about the earnings outlook. This is considered to be the reason for the good share price performance. Nonetheless, it should be noted that the shares are lagging far behind those of the peers listed above.

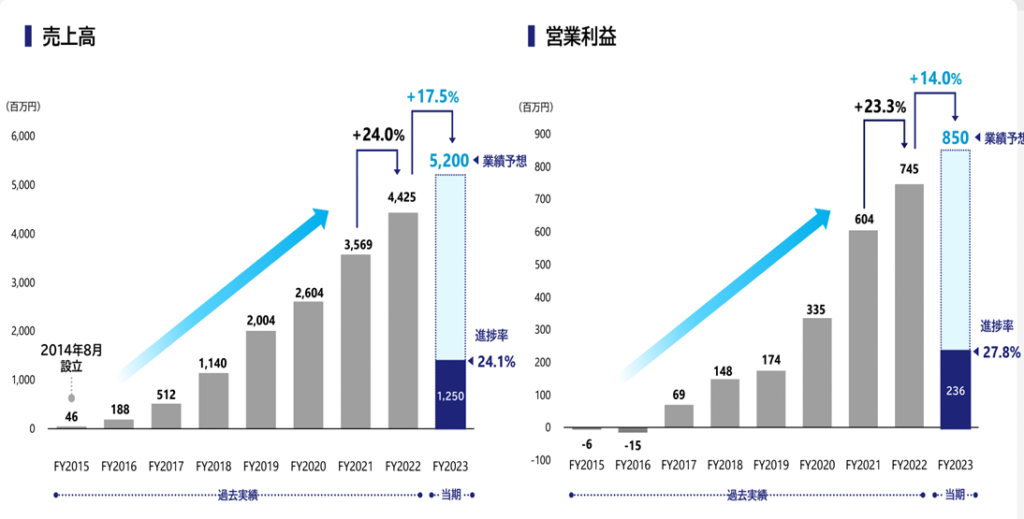

Fig 1. Sales and OP

Growth drivers are clear

The growth drivers are the tight IT labour market and the global competitiveness of Japanese entertainment contents. Furthermore, the fact that few temporary staffing companies specialise in the games industry makes the stock interesting. The company’s temporary staff has increased five-fold in five years, and the utilisation rate runs close to 100%, demonstrating the company’s ability to match people with the right job.

Fig 2. Gaming Market Forecasts

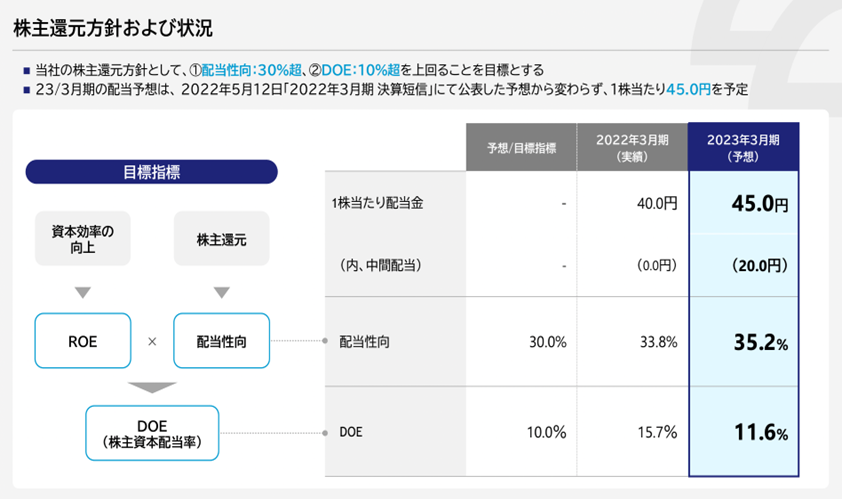

Dividend policy is sensible

Regarding shareholder returns, determining dividends by balancing DOE and dividend payout ratio makes perfect sense to shareholders. Reasonable shareholder returns should be determined under the business life stages in future. When significant investment opportunities arise, an acceptable return to shareholders will also be considered.

Fig 3. Dividend formulae

Investment opportunity

The company’s shares are no different from others in that they would rise with a favourable inflation outlook and the Fed’s monetary policy pivot. In that case, stocks with higher betas and blue-chip stocks that have been sold off should generate significant returns. However, downside risk lingers with high volatility remaining in the equities market. If one believes that the downside of the company’s share price is supported by solid earnings growth, then a position in Confidence, Inc. is a safe bet. As a small-cap stock, the potential for considerably high performance can be considered in the event of a stock market upturn.

Long-term upside

Even if the gaming market continues to grow at a high rate, it isn’t easy to forecast how much growth the company will achieve over the long term. The company’s medium- to long-term strategy of aiming to become the number one temporary staffing provider in the games industry and then moving away from just focusing on the games industry to expand into new markets, such as Web 3.0 and Metaverse, is still a pipe dream. It remains to be seen how the management team will prove this to investors. Based on a conservative 15% annual sales growth and 20% EBIT growth, a DCF calculation using a discount rate of 5% produce the shares’ fair value of well over 3,000 yen a share. The attraction of the company’s shares compared to those of mature companies that generate stable earnings is that they have a structurally high return on capital, and if earnings growth continues over a long time, the upside to the share price is tremendous.