Tenpo Innovation (Investment View)

| Securities Code |

| TYO : 3484 |

| Market Capitalization |

| 17,180 million yen |

| Industry |

| Real estate business |

| PDF version of this page |

| PDF Version |

Conclusion

Overweight. Earnings are solid, and management’s ambitious long-term business plan looks realistic. On the other hand, the inflating BS is diluting return on equity, and the premium attached to the shares is stripping away to reflect this. This leads us to think that market capitalisation will continue to rise but only moderately relative to profit growth. We feel comfortable with the company’s prospects for scaling up its business. If management moves to balance the speed of business expansion with return on equity, the share price should become interesting.

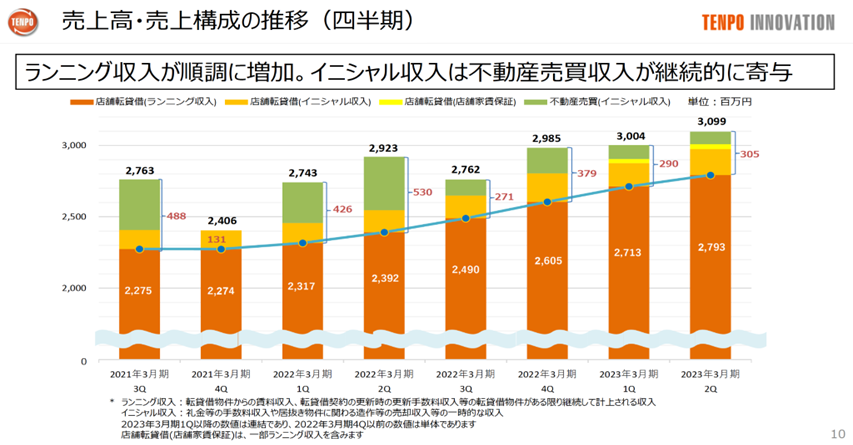

Business is growing steadily

The number of subleased properties is steadily building up, and earnings are strong. Management reported that the seventh wave of COVID-19 did not impact the number of subleases. Management’s explanation is convincing: there is strong demand for new restaurants in good locations in Tokyo, and the small size and low rents of the company’s unoccupied properties meet the needs of new tenants. Recurring income is positive with a steady increase.

Management’s forecast for FY2023/3 is +14% subleasing properties and +11% sales to mark the 11th consecutive year of growth, with operating profit up +17% yoy. These should be achieved comfortably, and strong results are expected to be revealed in the 3Q earnings report on 2 February 2023. The shares have outperformed TOPIX by 6.3% year-to-date after losing 4.5% to it last year; TOPIX benchmark investors should be happy.

A clear focus on scale-up

The management’s long-term approach to increasing corporate value by maximising the number of sub-leased properties and maximising rental margins is clear and very to the point. To achieve this, the company will remain dedicated to the restaurant sub-leasing business while extending the know-how essential for this business and spreading it to every corner of the company. All these are plausible. The short-term actions appear to be well-prepared, which include actively purchasing properties, restructuring the sales organisation, spreading sales know-how, strengthening Inukitenpo.com, improving the quality of management and stabilising property sales.

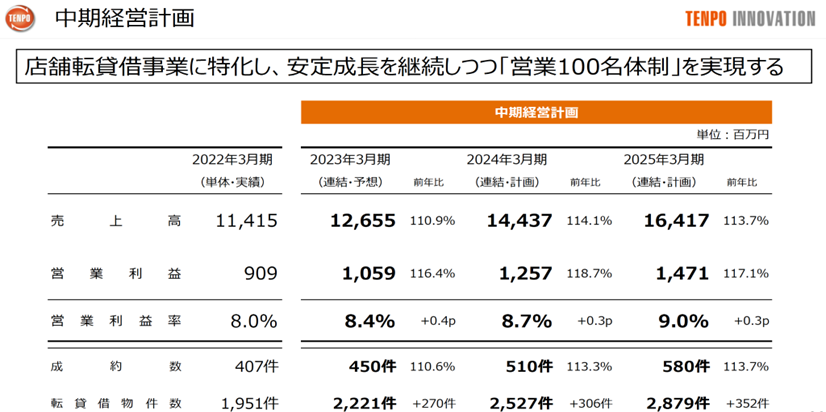

Management’s earnings targets are ambitious

Management expects an operating profit of approximately 1.5 times this year’s forecast of 1.5 billion yen in three years and then triple that to around 3 billion yen in FY2029/3, with sales of about 30 billion yen. This would be attractive growth if achieved. Management’s calculations are based on acquiring 5% of the 110,000 properties available to the company in the metropolitan area and achieving 5,500 properties eventually.

How the shares are rated

From the above, the earnings visibility, profit growth and quality of the management team, which are essential in estimating the fair value of the shares, are highly rated. However, the ratings on the balance sheet, shareholder awareness and business strategy are low. These are opportunities for the company to challenge itself and, if improved, could make the share price more attractive.

The premium attached to the shares is declining

As we predicted in August last year, the equity premium is slowly declining. PBR stood at 6.8x in February 2021, fell to 4.3x in June 2022 and has since recovered but currently stands at 4.8x. PER is only a short-term indicator and swings widely, but it has declined to 23x from 34x in the same period. The eroding multiples despite solid earnings make us concerned.

The prospects for business model evolution are lacklustre

One of the reasons for the eroding multiples is that, while the company’s earnings growth highly reassures us, we cannot envision any exciting future developments of the company’s business model. Innovation and renovation still need to be added to the management plan. Prospects for business expansion are good, but the evolution of an exciting business model that could exceed investors’ expectations has yet to sprout.

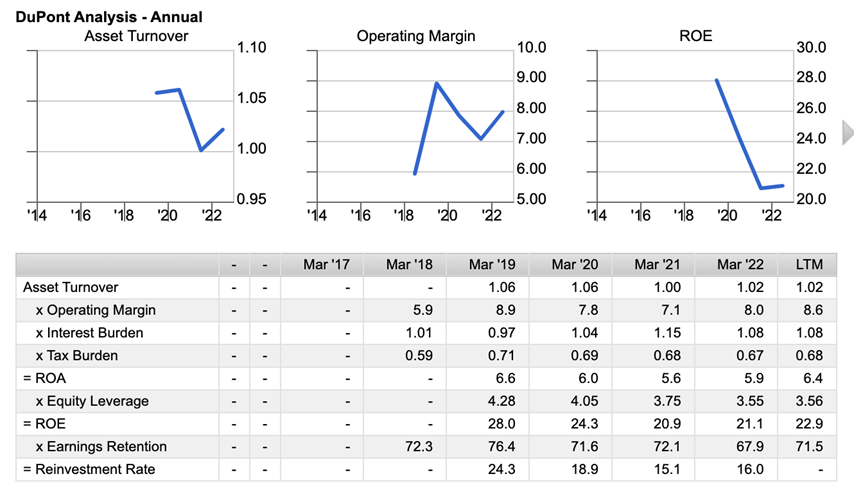

ROE is on the decline

Another primary reason is the structural decline in ROE. The current ROE is as high as 20%, but it has declined from 28% in 2019 and is below the five-year average on a downward trend. If management does not take action on BS and cash flow, ROE will decline further.

The decline in ROE is due to the falling equity leverage. The ability to increase profits and improve operating margins while maintaining an asset turnover at about 1x is a significant attraction of the company. However, no active reinvestment exists, and the growing cash is weighing on the efficiency of BS. Economic value creation is also restrained; ROIC is high at around 20%, but there is no borrowing, and the only invested capital is equity.

Bottom-line profit growth is overwhelming at a four-year CAGR of +30%, but the dividend is a drag on the reinvestment rate, so equity growth is stuck at a CAGR of 20%. Dividends are determined with a payout ratio of around 30% in mind. If ROE is to decline further, shareholder equity growth will also slow down.

Where the upside of the share price resides

BS is inflating. Management should find opportunities for reinvestment to use cash flow and, if not, return it to shareholders. On the other hand, the share price would respond immediately if the company were to consider financial measures such as buybacks to return shareholders’ equity to a leaner position and if it were to take a radical financial review, such as using borrowing to cover working capital. Management has many choices, but a BS adjustment, such as suspending dividends for a few years and using all surplus cash flow to buy back shares, would be very popular with investors and should positively affect the share price. However, the probability of the current management team, which appears solid but conservative, deciding on such a measure is extremely low. If this is the case, the return on equity will continue to decline, and the loss of share premium will not stop unless there is an enormous improvement in business profitability. We expect market capitalisation to grow but at a slower rate. Our investment view is, therefore, mildly positive.