IPS, Inc. (Price Discovery)

| Securities Code |

| TYO:4390 |

| Market Capitalization |

| 35,384 million yen |

| Industry |

| Information / Communication |

Profile

IPS’s Philippine operations generate 63% of its sales and 51% of its operating profit. The company operates in four segments:

- Overseas Telecommunications: provision of international telecommunications lines to CATV operators and others in the Philippines.

- Philippine Domestic Telecommunications: provision of ISP for corporate clients in the Philippines.

- Domestic telecommunications: provision of telecommunications services in Japan.

- Medical and Beauty: medical and beauty services in the Philippines.

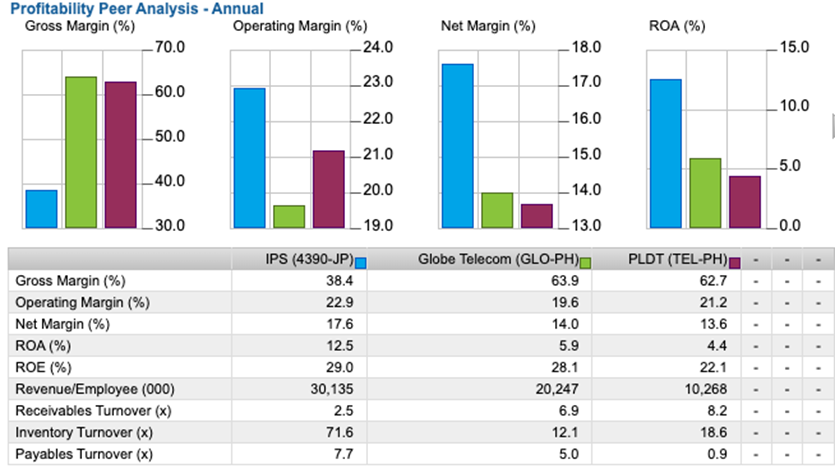

In May 2020, the company acquired part of the rights to use the international submarine cable (C2C line) linking Manila with Hong Kong and Singapore from Australia’s largest telecommunications operator. The company started providing the line in October of the same year. As a result, it became the third international data carrier in the Philippines. In terms of profitability, it is comparable to the top two telecom companies in the Philippines, but the difference in size is significant.

Stock Hunter’s View

A stock worth attention in the spotlight for good business performance. Taking off in the Philippine telecom market.

The stock of IPS (4390) is on a recovery path after a 20% adjustment from its high in November last year. The company will announce 3Q results (Apr-Dec 2022) on 10 February, making it an excellent time to draw attention to a stock backed by solid business performance.

The company operates Overseas Telecommunications business that provides international data communication lines using submarine cables to CATV operators in the Philippines and a Philippine Domestic Telecommunications business that provides ISP (internet service provider) services to corporations, mainly in the Manila metropolitan area. The Overseas Telecommunications business has recently achieved high growth and is driving the expansion of business results.

In November last year, the company revised up its full-year OP forecast. In 2Q, the Philippine Domestic Telecommunications business posted declines in both revenue and profit due to upfront investments such as capital expenditure and an increase in sales staff. However, the Overseas Telecommunications business achieved significant increases in both revenue and profit due to the steady sales expansion of C2C lines and the booking of IRU(*) contract revenue. In the second half of the year, in addition to an increase in the number of lease contracts, the company plans to record income from the lump-sum payment of IRU contract projects.

The Domestic Telecommunications business, which provides services for call centres, and the Medical & Beauty business, which operates cosmetic dermatology and myopia correction surgery (LASIK) clinics in the Philippines, also performed well. In the latter, the company aims to enter the field of preventive medicine by opening physical examination and health check-up centres.

IRU(*) : The company acquires or leases long-term, stable telecommunications line usage rights from telecommunications carriers for around 15 years and subleases the long-term usage rights to CATV operators, thereby earning subleasing income during the contract period.

Investor’s View

Liberalisation of Philippine telecoms is a significant concern, but it is way too early to be afraid of it.

The Philippine economy, which is growing at around 8%, is expected to get back on a high growth trajectory, although inflation and the slowdown in the global economy, especially in China, will slow it down to around 5% for some time. The rapid expansion of demand for broadband internet access on the back of economic growth, combined with the leading position of the company’s Philippine subsidiary InfiniVAN, makes the company’s growth attractive and exciting. Mobile has saturated in the Philippine telecoms sector, but residential broadband penetration is in its development phase. President Marcos also attaches importance to the expansion of telecoms infrastructure.

Removal of foreign investment restrictions on the Philippine telecom sector poses a threat

Meanwhile, foreign investment restrictions were abolished in March 2022, allowing foreign companies to own 100% of public service projects. Intensifying competition significantly increases concerns over the survival of IPS, which is inferior in size. The company’s revenues have been solid, with a remarkable turnaround from FY2021 due to the acquisition of long-term rights to use international submarine cables. However, it should eventually face an uphill battle in an era of increased competition due to the liberalisation of the telecommunications business by foreign investment. If we look back on what happened in Japan, for example, after companies had been profitable for a while, pressure from the government to reduce prices made competition much harsher. The market had followed a path where some players withdrew, suffering huge losses, and then entered a period of low growth and stability.

The company’s current edges will unlikely last

Although IPS is the Philippines’ third telecommunications company, Globe Telecom and PDTL, the top-ranking companies, have market cap of JPY 1.6 trillion and JPY 800 billion, respectively, and there is a clear difference in strength between them and IPS with a market cap of just JPY 37 billion. Companies backed by capital and technology from foreign capital or leading foreign companies are to enter the market. President Miyashita, the founder of IPS, lists four strengths, all of which will be at risk in the long term under free competition:

- The superiority of subsidiary InfiniVAN due to barriers to entry.

- Low prices are achieved by concentrating on high-profit markets and a direct sales structure.

- Experience gained in Japan, including backbone circuits that utilise the railway network to ensure a constant state of connectivity.

- Low customer churn rates and stable growth through developing low-cost, reliable services.

However, if the company can continue to expand its performance in a healthy niche market, this would be positive for the long-term share price. We have yet to know where it is.

The bear market rally is coming to an end, but there is upside to the shares of IPS in the short to medium term

First it should be noted that the current bear market rally may be ending soon, although the technical indicators for the shares of IPS are not too bad. As per the investment view on the shares over the next few years, we expect short- to medium-term earnings growth to boost the share price before the risk of the company’s survival due to increased competition becomes apparent. We expect downward pressure remains on the share price multiples. However, a PER of 12x and PBR of 3.6x against an ROE of close to 30% and EBIT growth of close to 40% at a five-year CAGR are considered evidence that risks are discounted to a large extent. Therefore we expect the decline in the equity premium to be gradual in the near term. The speed of profit and BPS growth should outpace the reduction in the premium attached to the shares, so the upside of a fair value may still be significant. Investors should not under-rate short- to medium-term earnings growth too early for fear of the company’s gloomy long-term outlook, which has little chance of winning a competition from big capital.

Possibility of industrial consolidation and subsidiary listings

Furthermore, the possibility that other companies in the same industry may be interested in acquiring the shares of IPS is undeniable. EBITDA of 10x is not too expensive for an industry boom phase. In addition, due to the then-existing law requiring foreign operators to list on the Philippine stock exchange within five years as a condition for obtaining a telecom licence, the company is expected to list its Philippine subsidiary, InfiniteVAN, locally within the next few years. In addition, Shinagawa Lasik & Aesthetics Center Corporation, which provides medical aesthetics services in the Philippines with a focus on LASIK, is also considering a local listing at the request of the owner of Shinagawa Cosmetic Surgery, which holds a 50% stake. While this write-up does not undertake calculations on the impact on the share value, these can be positive catalysts for the share price.

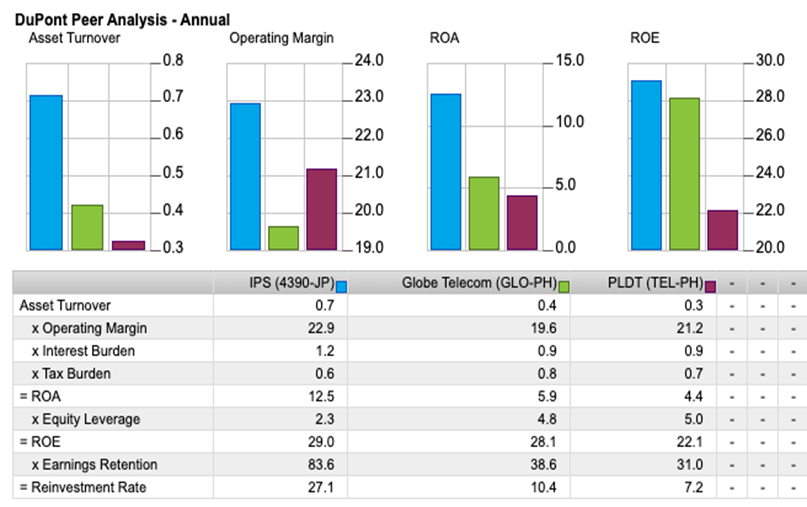

Proactive reinvestment is highly rated, and ROE should remain attractive

We have a neutral view on where the company’s ROE will go. Over the long term, asset turnover and profit margins will trend lower due to asset expansion from investment in telecoms, pressure on profitability due to competition and higher depreciation charges and operating costs. On the other hand, equity leverage will increase due to aggressive CF recycling and increased borrowing, and an ROE of over 20% can be maintained without difficulty for the foreseeable future. Hence, the company is expected to maintain an ROE comparable to that of Globe Telecom and PDTL. The company is actively reinvesting CF into its core business, which runs on a high ROE. It does this as this is the only way to survive. Still, it is the right financial strategy for shareholders and is highly rated.

Dupont Model

The October 2021 IR material on the company’s telecommunications business in the Philippines is very useful. There is no translation, but it being well-written, non-japanese investors are recommended to consider DeepL translation.