Okinawa Cellular Telephone Company (Price Discovery)

| Securities Code |

| TYO:9436 |

| Market Capitalization |

| 168,524 million yen |

| Industry |

| Information / Communication |

Profile

A 52.4% owned subsidiary of KDDI. Operates mobile phone business in Okinawa Prefecture, marketing multiple brands, mainly “au”, which is the same as KDDI’s. Entered the fibre-optic fixed-line telecommunications business with the acquisition of Okinawa Telecommunications Network in 2010. Sales are developing using set discounts for fibre-optic lines and smartphones.

Stock Hunter’s View

The mobile phone business is recovering while the profitability of the power generation business is improving. Earnings should turn around in the next fiscal year from April 2023.

Okinawa Cellular Telephone Co, a subsidiary of KDDI, is a comprehensive communications company with a 50% share of the mobile phone market in Okinawa Prefecture. With an expected turnaround in performance in FY2023, the share price is expected to continue to rise, albeit with some adjustments.

The most recently announced results for the 3Q of FY3/2023 (Apr-Dec 2022) show revenue of JPY57.8 billion (+5.3% YoY) and OP of JPY13.0 billion (-4.4% YoY). Full-year revenues were revised upwards to JPY 77 billion (+4.9% YoY), up JPY 3 billion from the previous forecast, in light of rate revisions in the electricity business (au Denki).

Mobile net additions are recovering from 2Q, which was poor due to voluntary restraint on sales due to communication disruptions. Although telecoms ARPU revenue continued to decline, it was only down 0.6% YoY in 3Q. The company plans to reverse the revenue and bottom out next year by attracting a broad customer base by offering three brands (au, UQ and povo).

The electricity business saw a temporary increase in cancellations following the removal of the cap on fuel cost adjustments. However, this has gradually declined since November and appears to be slowing down. 4Q (Jan-Mar 2023) will see the company’s share of the excess over the cap on adjustments reach zero, and profitability is expected to improve over the next fiscal year.

The company’s medium-term management plan (announced in October last year) targets EPS of JPY228 for FY3/2025. Still, at the time of the 3Q results announcement, the maximum share buyback amount was increased from JPY 3 billion to 4 billion, so it is expected to exceed the planned figure.

Investor’s View

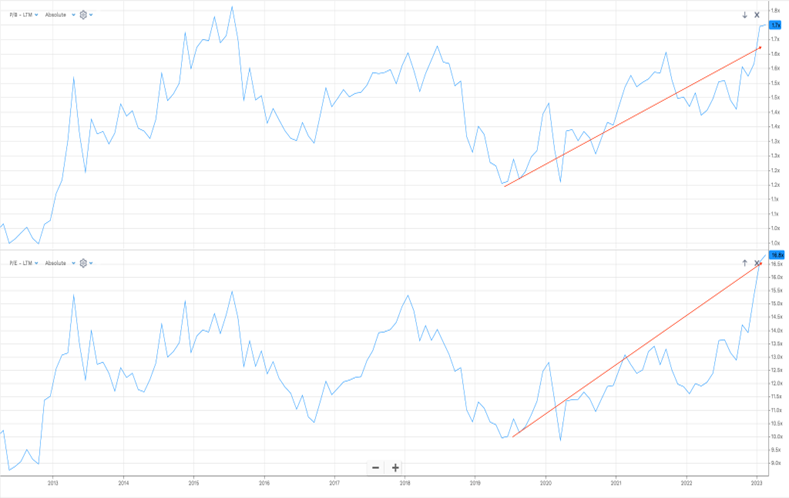

A good company but the shares are priced up. Long-term investors should wait for a significant share price weakness. With valuations exceeding previous peak 2018 levels, there is downside risk to the near-term share price after a significant rally.

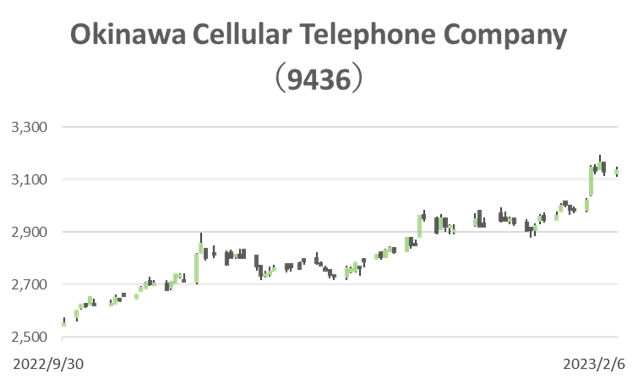

PBR, PER

The share price has risen further YTD because of solid earnings performance and accelerated shareholder returns. The share price has increased by 7.8% per annum over the five years. Although the shares are notably low-beta, 0.4 over both three and five years (but R2 is not high enough), they have outperformed the TOPIX by nearly 20% and beaten the five-year average by 6% as the share price rose by 14% in a Japanese stock market that fell last year. Will good performance continue further?

The share price is almost at fair value based on our DCF estimates. Also, the potentially high ROE, shielded by inefficient BS and KDDI-controlled governance, is not expected to rerate the share price multiple as it will not materialise. On the other hand, the wildcards are a) management accelerating shareholder returns even further and b) the emergence of hostile activists.

Stocks are rich in attractions

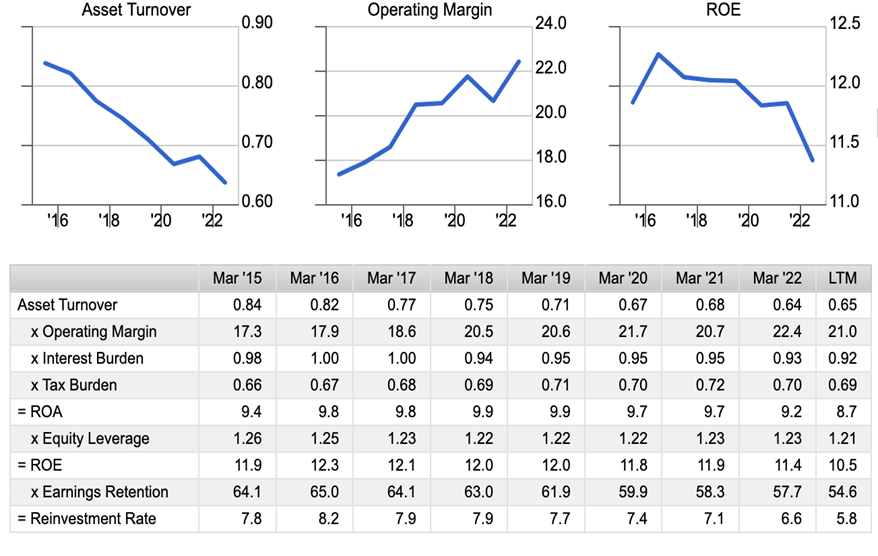

At a glance, the attractions of Okinawa Cellular shares are 1) ROE and its stability, backed by high OPM and good ROA; 2) long-term stable profit generation and rich operating CF; 3) management’s policy of using surplus funds after investment and working capital needs for shareholder returns, such as increased dividends and share buybacks, and 4) a dividend yield that currently stands at 4.1%.

The company has a 50% share of the mobile phone market in Okinawa and a strong BS. Parent company KDDI (9433), which holds 52.4% of the company’s shares, is a giant with a market capitalisation of over JPY 9 trillion. Although profit growth is saturated, its CF generation is abundant. Solid KDDI is a strong backup for Okinawa Cellular. Therefore, 5) when KDDI conducts a TOB to eliminate its double listing, a premium on the takeover bid price that is satisfactory to a wide range of shareholders will probably be taken into account. Furthermore, 6) the inability of a good company to achieve an inherently high return on equity due to its governance structure is a call for hostile activists.

Investor frustration is high

The inefficient BS, which prevents investors from enjoying potentially high ROEs frustrates them. The company loans JPY 32.3 billion to parent company KDDI. Hence, effectively 30% of its assets are in cash. The company’s BS with an equity ratio of 80% is unacceptable to investors, given its ample and stable CF. If the equity ratio could be adjusted to 30%, the nominal ROE of around 12% would exceed 30%, and the market capitalisation of the shares would increase due to a multiplying PBR expansion. Minority shareholders would, of course, support this logic, but the governance of KDDI’s control would prevent them from effortlessly passing the proposal. KDDI would not want to buy Okinawa Cellular after its price had risen, given the possibility of eliminating its dual listing. The inefficiencies of BS due to governance structure have probably kept many foreign institutional investors from the shares despite their attractions. Many investors may concur that a stock with an ROE of around 12% deserves a PBR of no more than 2x.

Dupont Model

The factors behind the steady increase in OPM, which is a significant factor supporting ROE, are unclear from company documents. We speculate that this may be due to cost control and an improved product mix due to increased au smartphone penetration. However, we have no proof. The lack of clarity makes us conservative in thinking about the investment idea in this write-up.

The top two foreign investors have sold bulky shares

Although figures vary from database to database, the latest data shows that the top two foreign institutional investors, who have been very long-term, have significantly reduced their stakes over the past six months or so. The main reason for this must be redemption for equity fund cancellations. Still, the share price advance to approach the fair value and repositioning may also have been decisive in taking a profit.

Schroder Investment Management (Japan) has a record of positions since 2006; it was a 4.8% shareholder in 2018 but disposed of 60% in the 3Q last year. Its current stake is estimated to be 0.93%. Fidelity Management & Research has a record since 2007; it has been a notable buyer since 2018, quintupling its position from less than 1%. It disposed of about two-thirds of its equity in 4Q last year and is now seen as a 1.77% shareholder. The five-year TSR of Okinawa Cellular’s shares is +11.6%, well above the TOPIX average of 3.5%. Both investors must have achieved a significant alpha since they started positions. These are brilliant investments that can be regarded as exemplars of long-term investment.