Raccoon Holdings (Price Discovery)

| Securities Code |

| TYO:3031 |

| Market Capitalization |

| 25,421 million yen |

| Industry |

| Information / Communication |

Profile

The company’s main business is BtoB EC trading for apparel and general merchandise and fund settlement services. It targets small businesses.

Stock Hunter’s View

The wholesale market is now in its DX phase. COVID-19’s impact has run its course, entering a new growth stage.

RACCOON HD continues to post double-digit growth in sales and operating profit as the impact of the COVID-19 pandemic has run its course. The full-scale DX in the wholesale and retail industry triggered by the pandemic disaster supports earnings growth.

The mainstay EC business is Super Delivery, a wholesale and procurement site that connects manufacturers and wholesalers, mainly of apparel and general merchandise, with retailers, restaurants, beauty salons and other businesses, and SD export, a BtoB cross-border EC site. In addition, the Financial business provides business-to-business post-payment settlement ‘Paid’, accounts receivable guarantee ‘URIHO’ and rent guarantee ‘Raccoon Rate’ to customers of the EC business.

Increased expenses due to strategic investments were absorbed by increased revenues, and the company’s financial results for 2Q (May-October) of the current financial year to April 2023 ended in an OP of 607 million yen (+20.4% YoY). In the EC business, in addition to sustained growth in distribution value and higher sales per customer, there was a solid conversion of first-time buyers to repeat buyers in the previous quarter. In terms of distribution value, the environment in Japan improved due to increased economic activity. As per overseas, Taiwan and Hong Kong, which account for a high proportion of sales, saw a decline in the number of customers due to COVID-19, but North America, where the company is focusing, achieved double-digit growth.

Credit control works well in the financial business, and the COGS ratio remains lower than pre-pandemic levels. Paid also benefited from a tailwind from the DXing of billing operations. In the next financial results (to be announced on 28 February), attention will be focused on the number of URIHO subscribers, for which the company has been trying to offer a new scheme since September last year.

Investor’s View

There is still scope for stock derating to progress. The management team with good shareholder awareness is highly rated, but earnings targets look quite challenging.

The share price has been falling since April 2021, when it hit a historic high of 3,320 yen, and is currently 65% down. The share was underperforming last year and the year before, with the price down around 20% each. There was speculative share price formation in the process of doubling EBIT in the three years from 4/2019, with the shares trading at a PBR of nearly 13x and a PER of 90x. The background to this was the accelerated expansion of BtoB EC trading triggered by COVID-19 and the rapid earnings contribution of the Financial business. Investor expectations of a sharp rise in EBIT margins and ROE were overdone. The share price decline to date is a natural correction of this speculative price buildup.

Price, PBR, PER – 5 year

Share price premium could decline further

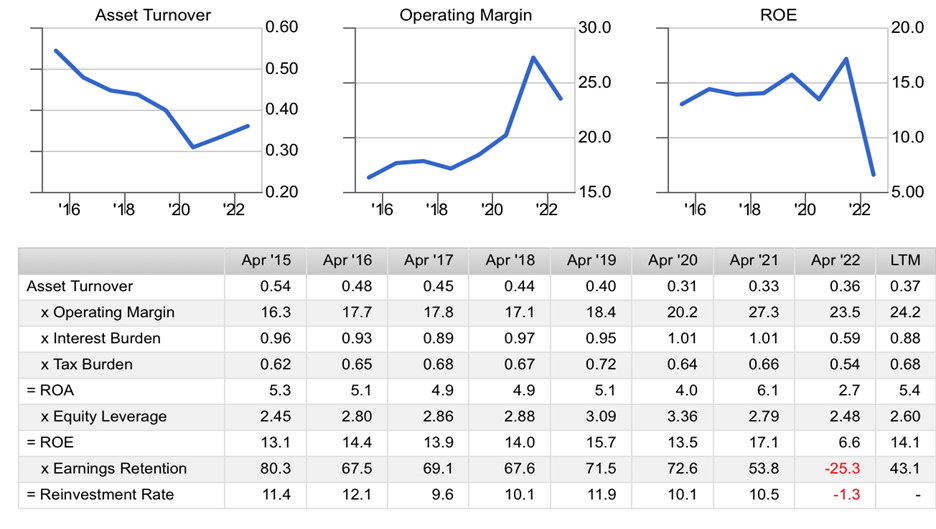

The share price has risen by 8% YTD after a significant adjustment of price multiples over a few years and has outperformed TOPIX, albeit only moderately. However, it appears the premium adjustment has not been fully completed and could progress further. The secular ROE is estimated to be around 13%, making the current PBR of under 5x look a little too generous. ROA is not attractive at around 4% to 5% due to a significantly low asset turnover. This is attributable to an astonishing BS structure where 82% of the BS is cash (38%) and accounts receivable and payable (44%). It is the result of purchasing large volumes of goods and the practice of customer credit-buying. This is difficult for Raccoon to control and is a structural weakness from a return on capital perspective. Nevertheless, the company is able to sustain ROE well in excess of 10% because of its high PL profit margin and financial leverage. These decipher the company’s return on capital.

Dupont Model

Despite strong earnings, the near-term share price could err on the downside

The PER has fallen to 35x but is still felt to be generous. Consensus is for EBIT growth of 13% CAGR over the next two years, a slight slowdown from the previous five-year average of 15%. Short-term technical indicators are not supportive. However, as Stock Hunter noted, the current OP growth of around 20% should support the share price in the near term. All put together, we expect the share price to be soft.

Uncertainty over competition and market growth is a concern

Our medium- and long-term concerns are a) competition in the company’s target market and b) uncertainty about where the EC rate saturates in the target market. The company has no dominance, with a market share of 0.8% in its target market. It is natural to assume that if this market is not a blue ocean, the company will have to raise the operating cost burden structurally to win out the competition. Many investors may have wondered how the increased burden of advertising costs reported in the recent financial results bode for the future.

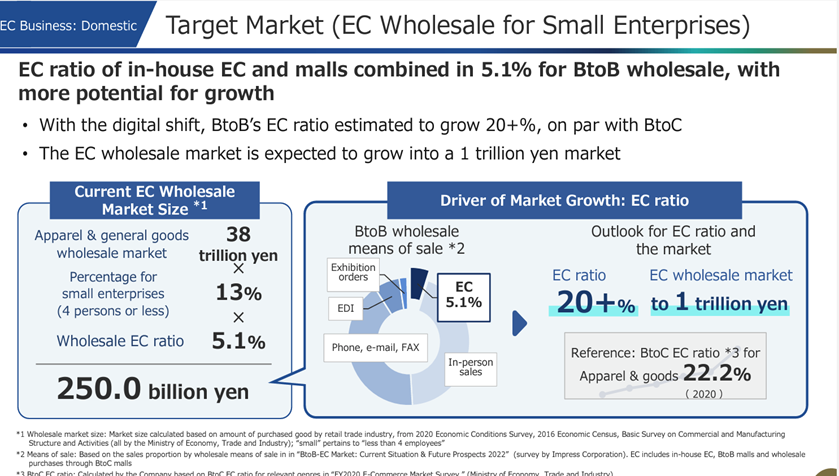

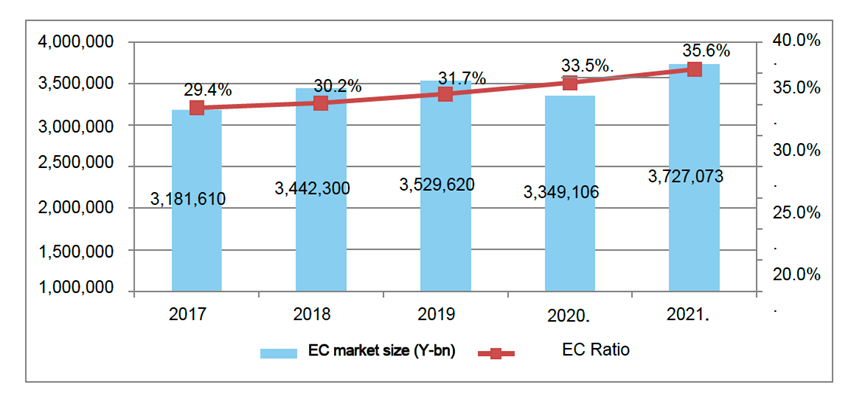

As for b), the management’s growth story is that the EC rate in the apparel and general merchandise BtoB market, which was 5% in 2020, will rise to 20%, the same as the BtoC market, so the market size will expand to 1 trillion yen. According to the Ministry of Economy, Trade and Industry (METI), the BtoB market in 2022 was 370 trillion yen, with an EC rate of 36%. Hence, the slow progression of the EC rate in Raccoon’s target market is noteworthy. Without an understanding of the factors involved, one cannot easily agree to a jump in logic that the EC rate will reach 20%, comparable to that of the BtoC market. If COVID-19 accelerated the rise in EC rates, it is unsurprising that the EC rate increase may slow down during the post-corona years.

Japan’s BtoB EC market size

(Source) METI(2022)

Management’s shareholder awareness is highly commendable

Management has set a target of 25% ROE for FY04/2025. Expansion of the OP margin to 30% and active shareholder returns are measures to achieve this. The explanation for the expansion of OP margins is that sales of the company, which runs on high marginal margins, will grow at a CAGR of +17%. As a result, OP is expected to grow at a CAGR of +27%. With regard to the latter, the dividend payout ratio is set at 45%-50%, and share buy-backs will be carried out whenever deemed appropriate. Both sales and profit targets are quite challenging. Nonetheless, the management’s willingness to share high targets with investors, with ROE as the primary objective, is to be commended, which is positive for the upside of the share price. The management team’s willingness to take measures to achieve high investment performance through dialogue with investors is quite encouraging.