Premium Group (Price Discovery)

| Securities Code |

| TYO:7199 |

| Market Capitalization |

| 62,849 million yen |

| Industry |

| Other financial services |

Profile

The company offers used car credit, breakdown warranty, and auto-mobility services (e.g. auto parts sales, wholesale, and software sales). Nearly 80% of profits are generated from financing.

Stock Hunter’s View

Strong performance despite headwinds. New businesses continue to be a focus of attention. A slight share price weakness should be an excellent opportunity to purchase the shares.

The company offers credit and breakdown warranty services for used cars. Despite the headwind of declining used car distribution volume and rising prices due to stagnant new car production, the company’s 3Q results (Apr-Dec 2022) announced on 3 February showed a firm footing, with an operating profit of 3,536 million yen (+25.7% YoY) and the bottom-line profit of 3,498 million yen (+70.9% YoY). The mainstay credit business was successful in its measures to retain dealers as paying members. In the breakdown warranty business, the turnover of its products has grown significantly.

The development of two new businesses (Auto Mobility Service and Car Premier) is also going well. In July last year, marketing activities were launched to take the platform concept into full swing, including the launch of an information website for end-users. The Auto Mobility Services business achieved high growth with a 61.3% increase in sales, with software sales to Premier member shops and wholesale vehicle sales contributing to sales growth. The Car Premier business also made progress in building the Car Premier Club, a fee-based membership organisation for car dealerships and maintenance shops. It achieved a pre-tax black ink on a non-consolidated basis in 3Q.

Investor’s View

Concurring with Stock Hunter. The current softness in the share price offers a timely opportunity for long-term investors.

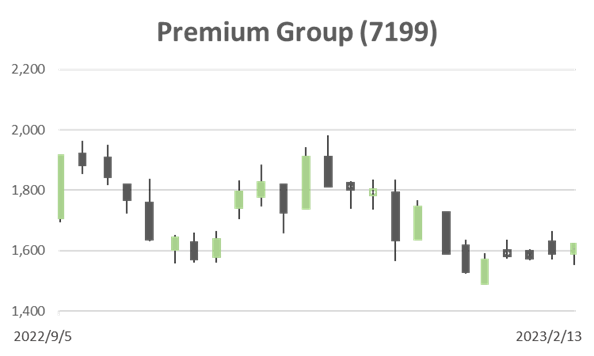

The share price is down 7% YTD, after a significant rise of 38% last year and 62% the year before. Current earnings are running robustly. Perhaps, the recent weakness in the share price is not due to a premium slide reflecting changing domestic interest rate environment and concerns over business fundamentals but rather an adjustment due to investors’ profit-taking, as was the case in CY2020. The domestic used car market is saturated, and the company’s growth is primarily organic. Long-term profit growth is, therefore, difficult to predict, but structurally ROE is likely to remain high.

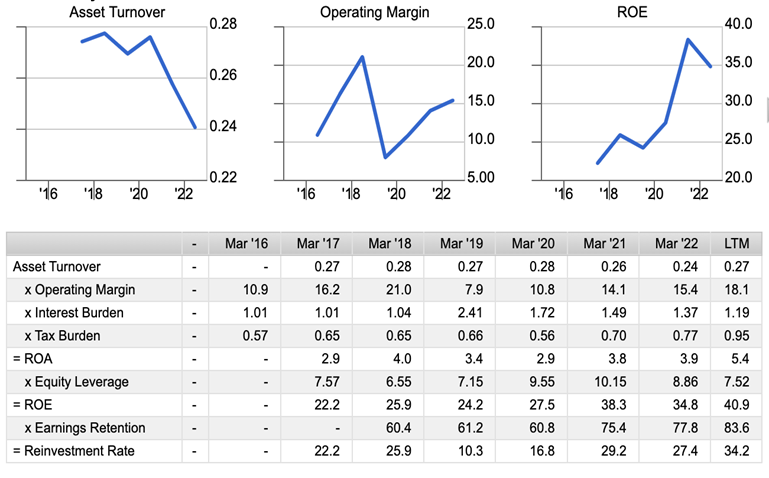

ROE will remain attractively high

Asset turnover is significantly low due to the predominance of the finance business. This is compensated for by a high operating margin to deliver a ROA of around 4%, which has no attraction. However, the overwhelmingly high leverage generates an ROE well above 30%. On the asset side, nearly 70% are financial assets. For example, in the captive finance business of Toyota (7203), financial assets account for almost 80% of the assets; similarly, the ROA is around 4%. The low ROA of finance businesses could be a better structure. On the other hand, the structure of high PL margins and leverage is expected to stay the same, and high ROE should be expected to continue.

Healthy consumers are an attraction for Japanese auto finance sector investment

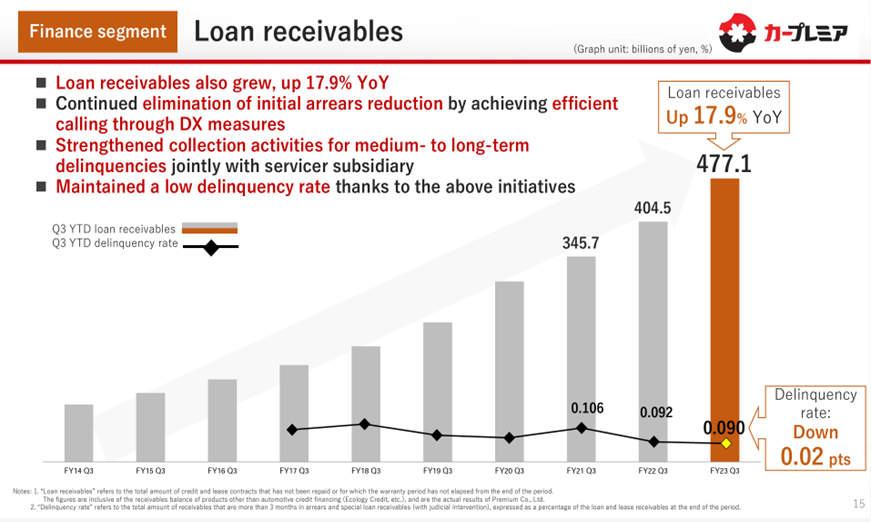

Despite a decline in used car registrations, partly due to the impact of COVID-19, the company’s credit volume continued to grow at a high rate, recording +17% in the nine months to 3Q. This was accompanied by an increase of +18% in the balance of credit receivables. In the same period, used car registrations were down 6% YoY. The balance of overdue receivables is low at 0.90%, suggesting a build-up of high-quality receivables. Consumers’ financial health is one of the main reasons to invest in Japan’s car finance sector. Deferred income, the future income, stood at 41.5 billion yen at the end of 3Q, +21% YoY. The number of credit network stores also continued to increase, +6% in 3Q.

Low PER may be reflection of the unpredictability of growth

Domestic demand for used cars is expected to remain firm, but growth is not likely in the future. In that market, the company is building up credit receivables steadily. According to the management’s explanations, the critical factors for quantitative growth are the area of operation, the number of personnel and the number of credit network stores. The factors behind the company’s competitive advantage are unclear, but at the very least, the fact that credit receivables are growing continuously suggests that something is succeeding. The market is mature, and it is impossible to predict when the company’s volume growth will be saturated. There is also a fear that additional structural costs may be required to sustain top-line growth at some point in the future. This unpredictability of growth may be why PER has yet to expand despite EPS growth of +27% CAGR over the past five years. Buying into industry market booms, whether cyclical or structural, is far more secure than investing in companies whose growth is largely self-help.

PBR, PER

The EBIT margin has fluctuated yearly but has averaged around 15% over the past five years. It is expected to remain stable around this level for the next few years. Variable costs increase in non-finance businesses such as automobility, but operating expenses are under reasonable control.