Yamabiko Corporation (Price Discovery)

| Securities Code |

| TYO:6250 |

| Market Capitalization |

| 55,753 million yen |

| Industry |

| Machinery |

Profile

Sales are 60% in North America, 30% in Japan and 10% in Europe. The company sells and manufactures small outdoor power equipment (OPE), agricultural management machinery and general industrial machinery and has a production plant in the USA. The three divisions account for 73%, 15% and 10% of sales, respectively, with more than 90% of profits coming from OPE. OPE includes hand/shoulder-held small engine-powered machines for forest and green space management, such as chainsaws, brush cutters, power blowers and hedge trimmers. Agricultural management machinery includes pest control machinery for spraying agricultural chemicals in Japan and crop harvesting machinery for North America. General industrial machinery includes construction, civil engineering and ironworking machinery, such as generators, welding machines, floodlights, cutting machines and high-pressure cleaners.

Stock Hunter’s View

A blue-chip low PBR stock with a good track record. Overseas OPE is strong, and record profits are on the way.

Yamabiko surprised with its FY12/2023 earnings forecast, and the shares rallied sharply from their lows. They look likely to regain last year’s high (1,529 yen on 31 March).

Operating profit is expected to rise to ¥13.5 billion (+55.4% yoy) this year, a turnaround from the 6.9% decline in the previous year. The management plans to break the record high for FY12/2020 (¥9.643 billion).

The company’s mainstay small OPE is mainly used in North America, its largest market. In the previous fiscal year, sales to general users declined due to a loss of demand as the special demand from COVID-19 was gone and the stagnation in purchasing behaviour caused by rapid inflation in the middle of the year. On the other hand, demand in the professional user market, such as for green space managers (landscapers), continued to grow, particularly in North America and Europe.

Although sales of agricultural management machinery are expected to decline in the current fiscal year, OPE sales to professional users will continue to increase. General industrial machinery will benefit from increased demand for generators due to brisk infrastructure projects in the North American market.

The GX (Green Transformation) theme should also attract medium to long-term attention. Steady progress is being made in developing new businesses that could become future earnings drivers, such as power units for drones and environmentally friendly systems incorporating renewable energy.

In addition, TSE is urging structural reform of stocks with PBR below 1x, and low PBR stocks are coming in big favour of the stock market. The company’s shares may well be reassessed.

Investor’s View

Positive surprise is mostly discounted; it is risky to chase the rally.

Except for low PBR, there are few attractions of the shares. The business is solid, but secular ROE of 10% could be more attractive. The management has yet to go for proactive measures to improve ROE. The share price has already incorporated the positive guidance surprise of a 30% YoY increase in EPS in FY12/2023, and it would be risky to chase the share price rally. The share price has risen only 11% since the guidance was revealed on 13 February. The profit increase is primarily due to one-off factors and not a structural improvement in earnings. The degree of share price rise is, therefore, reasonable and meaningful expansion of the shares’ multiples looks unlikely. Management has yet to explain the results and the forecasts, and the factors behind the bullish earnings forecast are not detailed. The brief financial report cites the contribution of last year’s price increases and the optimisation of inventories built up due to logistics disruptions.

The North American market is the primary profit earner

The company earns more than 90% of its profits from OPEs. They are used for the maintenance of large residential properties and green areas. Overseas sales in this business account for 64% of the company’s total sales, of which 71% are in the North American market, mainly in the USA and Canada. This means that OPE in the North American market generates 45% of the company’s sales. Although profit margins by region are not disclosed, the profitability of the North American business is anticipated to be very high.

Consumer spending is the driver. There are many causes for concern.

While some analyses link the company’s performance to housing starts, crude oil and agricultural production, the driver of OPE sales should be seen as consumer spending in the North American market. Management reported that the strong sales performance in FY2021 was driven by overseas OPE sales, particularly in North America and Europe, under spreading stay-home practices due to COVID-19. However, as costs were not controlled well, FY2021 saw a declining profit on rising sales. Furthermore, in FY2022, EPS fell by 16% YoY due to various factors, including a backlash following the inflated demand by COVID-19, inventory build-up due to logistics disruptions, and higher unrealised profits due to a weaker yen. Profits in FY2023 are expected to increase significantly, but inflationary costs, North American consumption trends, a backlash of special demand of COVID-19 and management’s cost control are concerns. The benefits of price revisions will likely be quickly muted by intense price pressure in the customer markets.

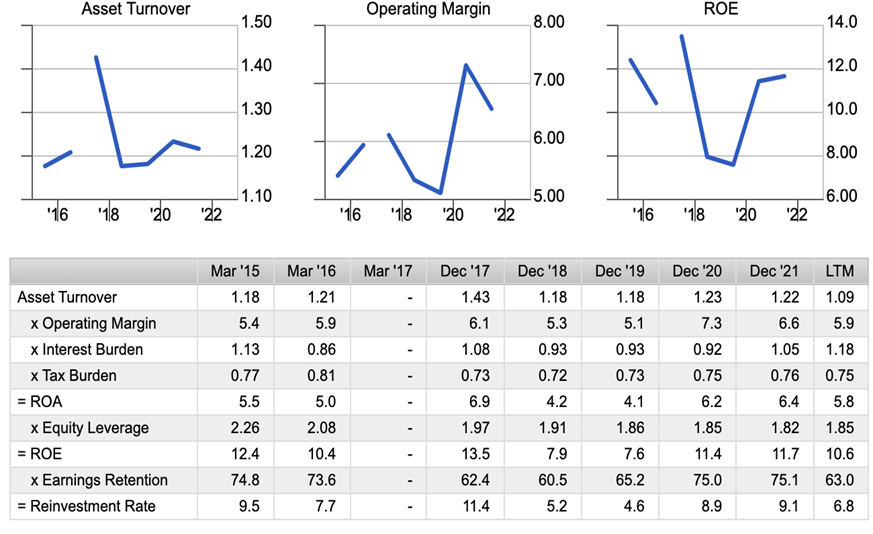

Outlook for ROE is lacklustre

Although the management identifies ROE as a critical management indicator, the recently announced target of only 10% in FY2025 in the new medium-term management plan disappointed. The company’s ROE averaged 9.4% over the past five years. The current TOPIX ROE is over 8%. In our estimate, the company needed to earn more ROIC to create economic value in the past, which will remain the same. This is thoughts to be one of the main reasons the price to book has been left low. Furthermore, for global investors who want exposure to North American consumer spending in their portfolios, there are plenty of stocks with ROEs of around 30% and a high North American regional component. Although the PBR of Yamabiko’s shares is very low, they would not want to dilute the ROE of their portfolio.

Stock Hunter pointed out that companies with PBR below book value will eventually come under pressure from TSE. However, it would be too early to factor that expectation into share prices. For over a decade, Yamabiko’s PER and PBR have failed to satisfy shareholders enormously. Such that the exciting thing about the shares is that market pressures can be extremely strong. The share price should become interesting when the management gets that right.

Dupont Model