AirTrip Corp (Price Discovery)

| Securities Code |

| TYO:6191 |

| Market Capitalization |

| 57,896 million yen |

| Industry |

| Service |

Profile

The company operates an online travel agency and information technology development businesses. It also runs CVC (corporate venture capital).

Stock Hunter’s View

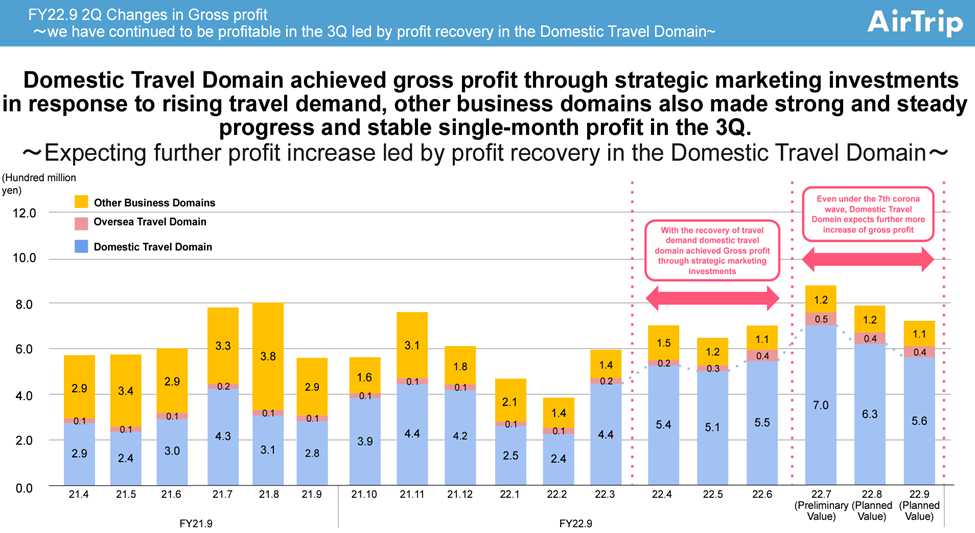

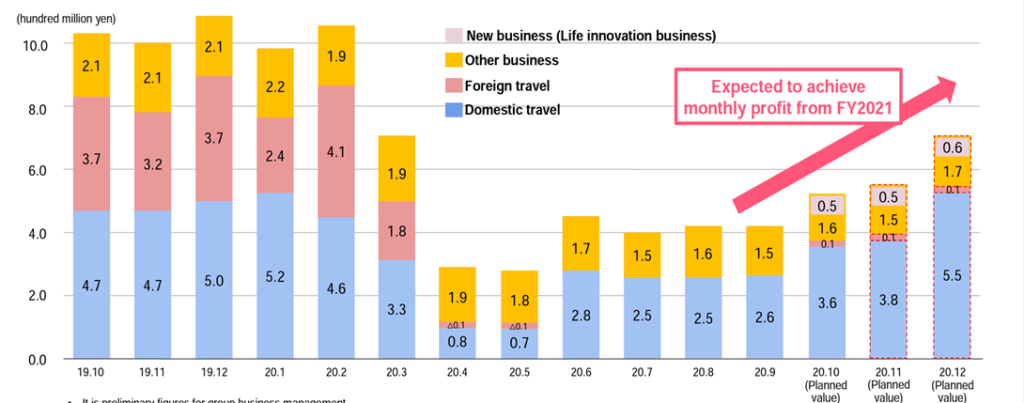

Revised company forecasts remain conservative. Recovery in domestic travel demand is strong

Border control measures targeting China have been eased since 1 March. A series of international flights have reopened at major domestic airports, which is expected to boost traffic to and from overseas.

A travel-related laggard to watch is airline ticket booking website AirTrip Corp, which on 1 March revised its earnings guidance for the year to September 2023 upwards, with sales revenue rising 2 billion above the previous guidance to 19 billion yen (up 39.8% YoY) and operating profit rising 600 million yen to 1.6 billion yen (down 28.6% YoY).

However, the company has left its conservative stance unchanged, which does not factor in upside factors such as the significant growth in domestic travel revenues due to the complete containment of COVID-19, the recovery in overseas travel revenues due to the relaxation of border control measures, and the contribution of the investment business, so the earnings may well err on the upside.

The previously announced Q1 (Oct-Dec) results confirmed a solid start to the new fiscal year, with the Airtri travel business leading the way, with both sales and profits increasing in real terms YoY. ‘Organic gross profit’ (gross profit from sales to customers via natural search and apps), the most critical factor in the business, achieved significant growth of 130% compared to 1Q2020 and 113% compared to 1Q2021, exceeding the pre-pandemic and GoTo Travel campaign periods. From Q2 onwards, demand in the domestic travel sector will increase further, driven by the continuation of national travel support, while the international travel sector also recovers.

Investor’s View

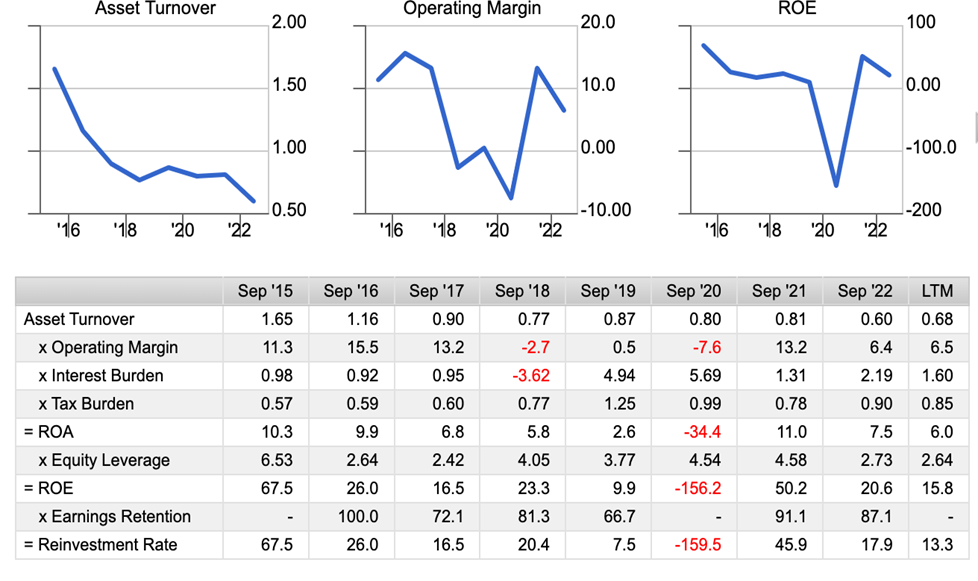

Buy the resilience of a high-ROE company

The company’s secular ROE is well above 20%, and the current turnaround momentum is strong due to the recovery in domestic travel demand. The key investment question at the moment is how much of the future recovery in demand has been factored into the share price. While we believe that the recovery in domestic travel demand has been factored into a large extent, that in overseas travel demand has yet to be discounted in the share price. The company’s overseas travel business has largely disappeared. However, it was around 70% of domestic travel sales before COVID, and it is more natural to assume there will be a recovery than to believe there will not. Once recovery starts, we expect it to be rapid. The company is still in the middle of an upward revision cycle, despite recently announcing a significant upward revision.

The market will look beyond valuations

The share price rose 8.8 times from a post-COVID low of 517 yen to 4,595 yen in October 2021 and is currently at 40% down from that high. Speculative money should have gone considerably. Nevertheless, a 6.2x book and a near-term PER of 30x are not cheap. However, the momentum of earnings improvement is so strong that investors are likely to look beyond valuations. The significant risk is that the BOJ, under new Governor Ueda, may soon halt its large-scale monetary easing policy, pushing up bond yields higher and weighing on Japanese equities. In which case, we would be a buyer on weakness.

The share price reacts quite well to the recovery in travel demand, as seen in the positive share price move on the recent earnings revisions. The significant share price recovery in 2021 was due to the impact of GoTo Travel. Government support for domestic travel was again continued but not scheduled to continue beyond April, and there was also downward pressure from profit-taking, which is thought to have caused the share price to fall by 20% in 2022. However, it is easily felt that there is still room for recovery in domestic travel demand if one walks around Japan.

CVC expansion makes the shares trade on cautious PBR

Management reports that the company is building a large CVC position and that progress is robust. They explain that investments in venture companies with IPO expectations amount to 3.7 billion yen, while investments in companies already listed or preparing for the listing amount to 3.4 billion yen, for a total of 7.1 billion yen. The former is valued at 6.7 billion yen and the latter at 12.7 billion yen. Therefore, the TVPI (Trade-In Value to Paid in Capital) for the 7.1 billion yen investment is 274%. In listed company investments, the company holds 70.7%, 28.3%, 9.8%, 2.2% and 1.1% of shares in Magmag (4059), Hybrid Technologies (4260), Ambition DX Holdings (3300), Star Flyer (9206) and Wagokoro (9271), respectively. The current market value of these shareholdings is 4,594 million yen.

There is some disclosure on private equity positions in the company materials explaining CVC. However, the market value of private equity is volatile, and its valuation is left to the company. Unless investors take the time to scrutinise them carefully, they cannot be confidently factored into their equity valuations.

In FY09/2021, the FVTPL in the BS was 5,361 million yen, accounting for 23% of total assets. Changes in the FVTPL result in investment gains/losses in the PL. These were only about 4% of the FVTPL balance last year and the year before, which is insignificant. However, investors who eliminate the highly unpredictable factor in valuations will look for other stocks. Management is keen to expand CVC, further increasing investor risk. Hence the shares are worth cautious PBR even if the company maintains a high ROE.

Dupont Model