Yasuda Logistics Corporation (Price Discovery)

| Securities Code |

| TYO:9324 |

| Market Capitalization |

| 30,542 million yen |

| Industry |

| Warehousing and transport-related industries |

Profile

PBR of 0.39x, the market cap of JPY 31bn vs securities holdings of JPY 44bn. NTM PER of 12.1x, 5-year average ROE of 3.9%. 88% of sales are logistics, and 12% real estate. Regarding OP, logistics 60%, and real estate 40%. The market cap of the 14 Japanese logistics companies is JPY 850 billion. Mitsubishi Logistics (9301), Sumitomo Warehouse (9303) and NIKKON Holdings (9072) stand out, with the three companies accounting for 75%. The Company is sixth, with 3.8%.

Stock Hunter’s View

“Correction of PBR below 1x” is a long-term theme. The Company’s stance on shareholder reward is highly regarded. The shares are also to be reassessed as a latent asset play.

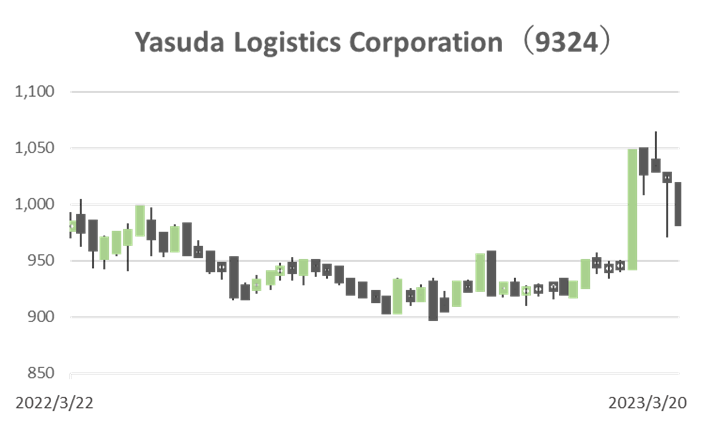

The popularity of low PBR triggered by the TSE’s “request for improvement” is expected to continue. Amidst selective buying, warehouse stocks are attracting growing interest as stocks with solid performance and latent assets. In particular, former zaibatsu-affiliated warehouse giant Yasuda Logistics has been praised for its proactive approach to shareholder returns, and the share price move has changed dramatically, reaching the ¥1,000 mark for the first time since March last year. The Company plans to pay a dividend of ¥25 for the current financial year. The Company had increased its dividend for four consecutive years until the previous year.

In 3Q (Apr-Dec), sales in the real estate business declined, while sales and profits in the logistics business increased due to the start of new transactions, increased transactions with existing customers, expansion of the transport and delivery network and an increase in international freight handling fees. The Company has recently stepped up its acquisition offensive, including acquiring a warehousing company in Kyoto and consolidating Eisai Distribution as a subsidiary. Profitability is expected to improve in FY3/2024 due to the expanded operation bases and increased transactions.

In March this year, a new warehousing company was established in Indonesia, which is enjoying remarkable economic growth. According to Indonesia’s Central Statistics Agency, the country’s GDP growth rate for 2022 will be 5.31%, the highest since 2014. By industry, transport and warehousing, in particular, is expected to see the highest growth, at 19.87%, and demand for warehousing is expected to expand.

Investor’s View

Buy. Depending on the management’s will, investments could yield significant returns. As Stockhunters points out, it is an interesting timing with the management increasing shareholder awareness.

PBR is incredibly cheap, around 330th among listed Japanese stocks. More problematic than the cheap PBR is that PBR has been below 1x for 20 years, except for three years from 2005 to 2008. Similarly, PER has been below the market average for almost 80% of the 20 years. The ‘request for improvement’ mentioned by Stock Hunters comes not just from the TSE but should also come from various directions putting significant pressure on the management. Hostile activists could emerge at any time. The management has a wealth of options, both in terms of BS and PL, to improve ROE, including reviewing capital expenditure and disposing of investment securities valued significantly higher than the Company’s market capitalisation. Their decisions will move the share price significantly.

20 year PBR, PER

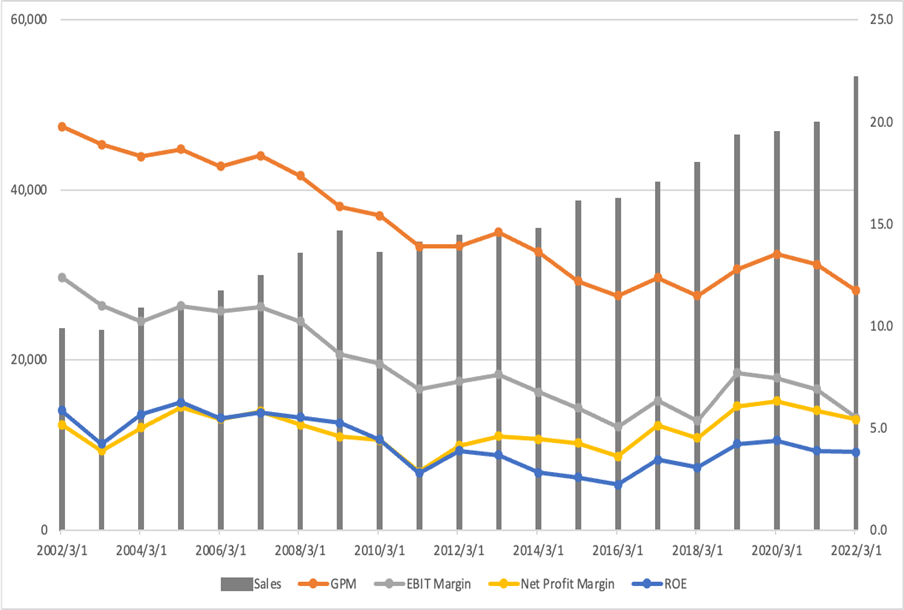

The Company’s ROE averaged 3.4% over the last ten years, which does not satisfy shareholders. The long-term performance chart clearly shows that profit margins have declined despite sales growth, and the ROE has stuck at a low level. This can be read as an indication of the fierce competition in the market and the lack of success of the Company’s investment.

20 year sales, margins, ROE

However, what is vital for investment at the moment is to consider whether there are no highlights for investors in the Company. Without highlights, the inevitable result will be a TOB exit from the market. If something is interesting, the management’s actions to make it happen will create investors’ positive expectations, and the share price multiple will rise. Fortunately, the quality of the business is good, with growing sales and stable operating CF generation.

The following are the attractions of the investment case.

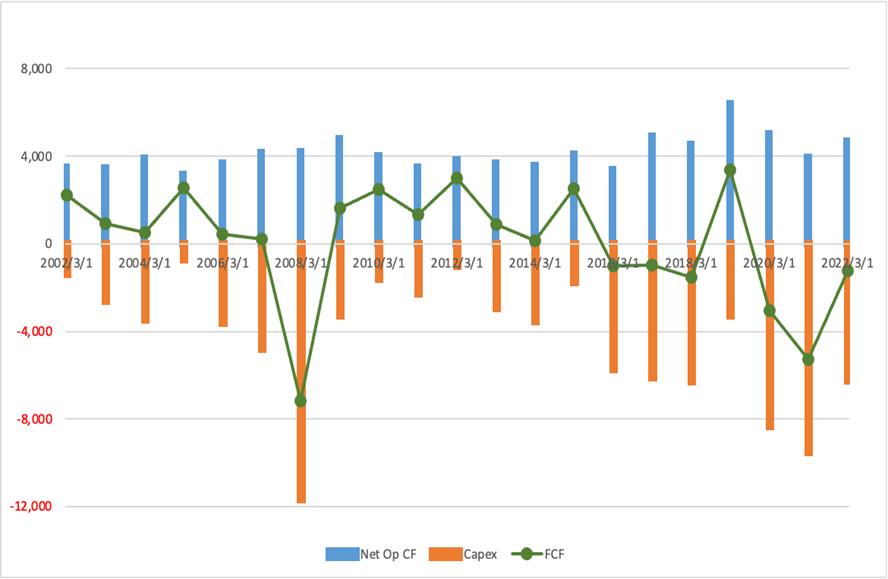

1) The potential for higher PL margins and ROA as management scrutinises the investment. It is highly rated that the management has always been keen on investment. However, the fact that ROE did not improve while investing JPY 90 billion against a total operating cash flow of JPY 87.6 billion earned over 20 years is a significant problem. While this may be due to fierce competition in the market, there is considerable scope to improve profitability through a thorough review of investment.

20 year cash flow

(2) The elimination of investment securities holdings will lead to a significant improvement in the BS and the realisation of more robust returns to shareholders, such as generous dividends and aggressive share buy-backs. Investment securities amounted to JPY 44.1 billion at the end of Q3, accounting for 28% of BS and significantly drag on BS efficiency.

(3) There is significant scope to reduce the equity ratio, which is close to 50%, which is not considered necessary for the Company, even given the impact on bank credit. ROE can easily be improved by lowering this ratio and increasing leverage.

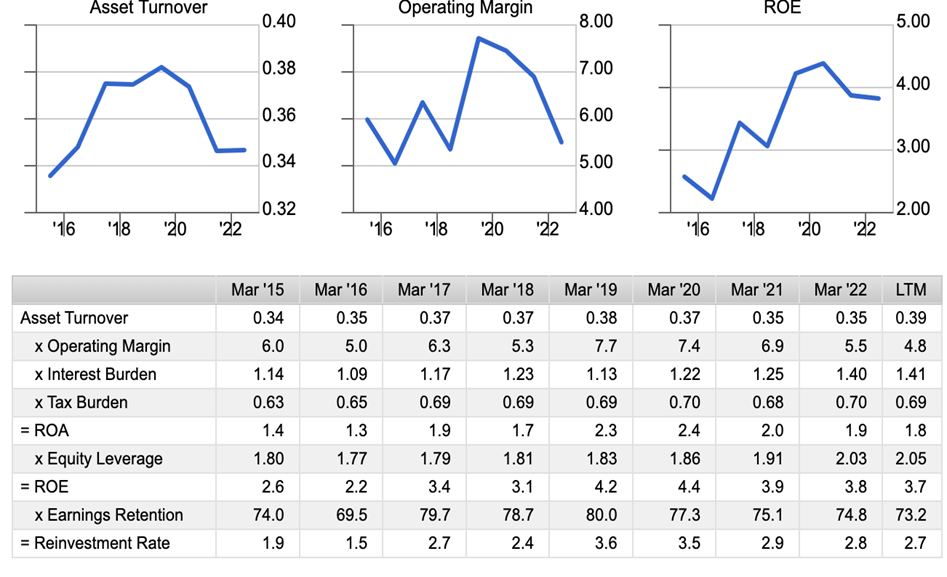

Dupont Model

(4) Management is keen on new business development using DX, robotics and AI. Logistics is seen as an area where it is easy to utilise these new technologies, and the potential for improved profitability is exciting.