Happinet Corporation(Price Discovery)

| Securities Code |

| TYO:7552 |

| Market Capitalization |

| 45,046 million yen |

| Industry |

| Wholesale business |

Profile

A long-established toy wholesaler in business for 50 years. Bandai Namco HDs (7582) holds 24.4% of the shares. Four divisions: Toys 37% (OPM 3%), Visual&Music 24% (1), Video Game 31% (2), and Amusement 9% (7), which operates capsule toy vending machines and kids’ card game machines.

Stock Hunter’s View

Enjoying the TCG (Trading Card Game) boom, record earnings, and more good news in FY3/2024.

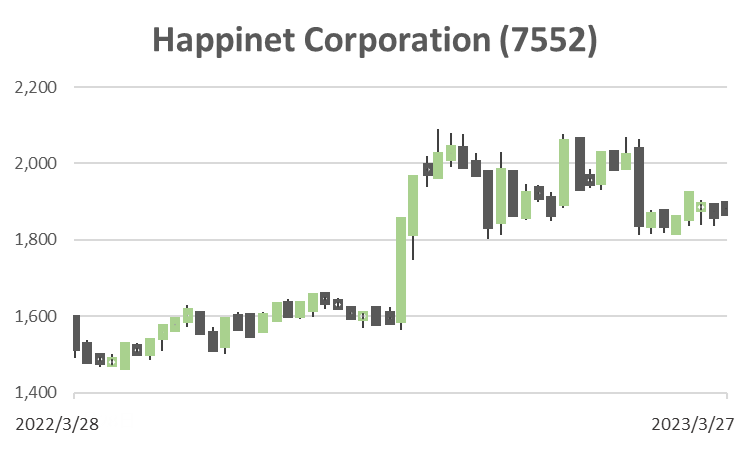

The stock of Happinet has been relatively resilient amidst the turbulent financial market originating in the US. It is an undervalued stock with a solid revenue base and is expected to continue attracting occasional reassessment and buying.

The company has a dominant presence in the domestic toy wholesale market, mainly through its IP strategy and strong relationship with the powerful Bandai Co, a wholly-owned subsidiary of Banda Namco HDs, that manufactures toys, models, apparel, and household goods. Currently, products for convenience stores such as Ichiban Kuji Lottery and the Pokemon Card Game are performing well. The company’s performance in FY3/2023 is expected to be a record high following the previous year, with sales of JPY 300 billion (+6.2% YoY) and operating profit of JPY 6 billion (+7.6% YoY), after two upward revisions to its initial forecasts of lower sales and profits YoY. The mainstay toy business is expected to reach JPY 2,024 billion by 2024 in sales.

The toy business is expected to maintain its strong performance in FY3/2024, and the expansion of capsule toy shops’ earnings, driven by inbound demand, is also likely to boost earnings. In the near term, Union Arena, a new TCG featuring many leading IPs, is scheduled to be launched on 24 March, and The company will launch a new Pokemon Card Game on 14 April. The latest title in the video game business in the popular The Legend of Zelda series (for Nintendo Switch) is scheduled for release on 12 May.

Investor’s View

BUY. Both near-term and long-term look interesting.

The company’s shares make substantial returns when near-term earnings momentum turns positive; the superior share price performance in 2017, 2020, and 2022 can be considered such moves. Share price tends to discount a robust earnings outlook 10-12 months in advance. Therefore, if FY3/2024 is strong, now would be a good opportunity to buy the shares. Investors should note that the share price could move up or down depending on the management’s new-year forecasts to be revealed on 12 May.

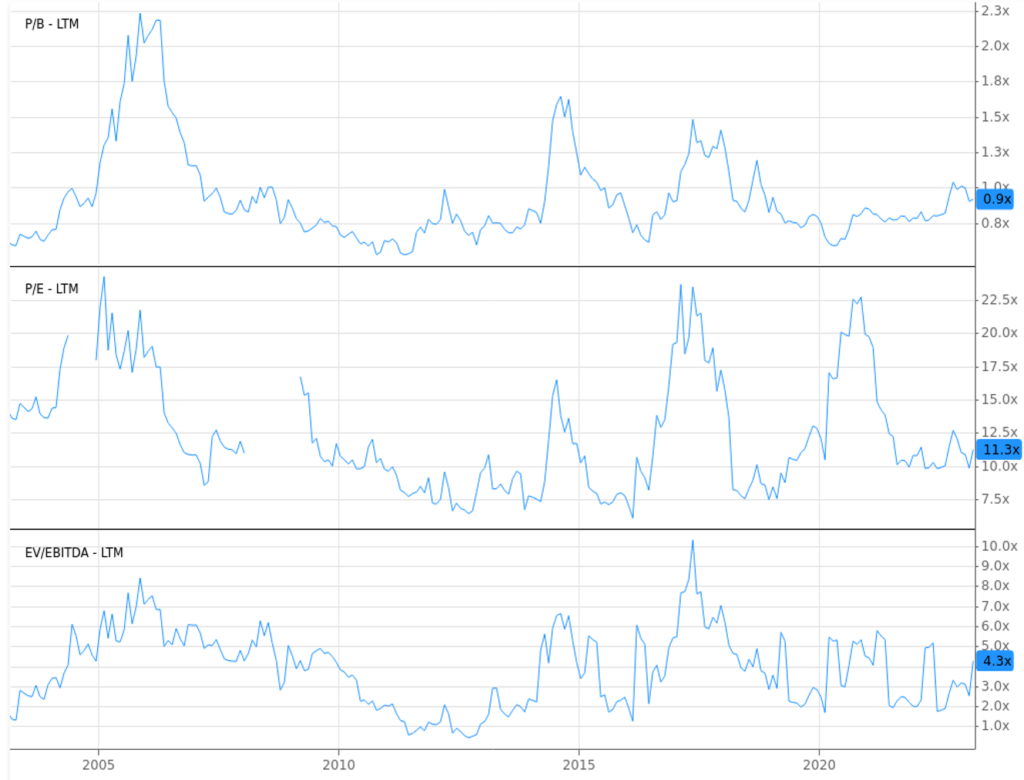

On the other hand, investors do not value the shares significantly except for the near-term earnings momentum, and the PBR is trending below 1x. Therefore, the TSE will likely provide guidance. The negligence of BS optimisation needs to be addressed, which has significantly impacted the share price over many years. In the future, this significant inefficiency will likely improve due to intense pressure from various quarters. Fortunately, there is substantial scope for improvement in the company’s return on equity. It can be, therefore, an exciting stock to hold for the long term.

20YR Valuations

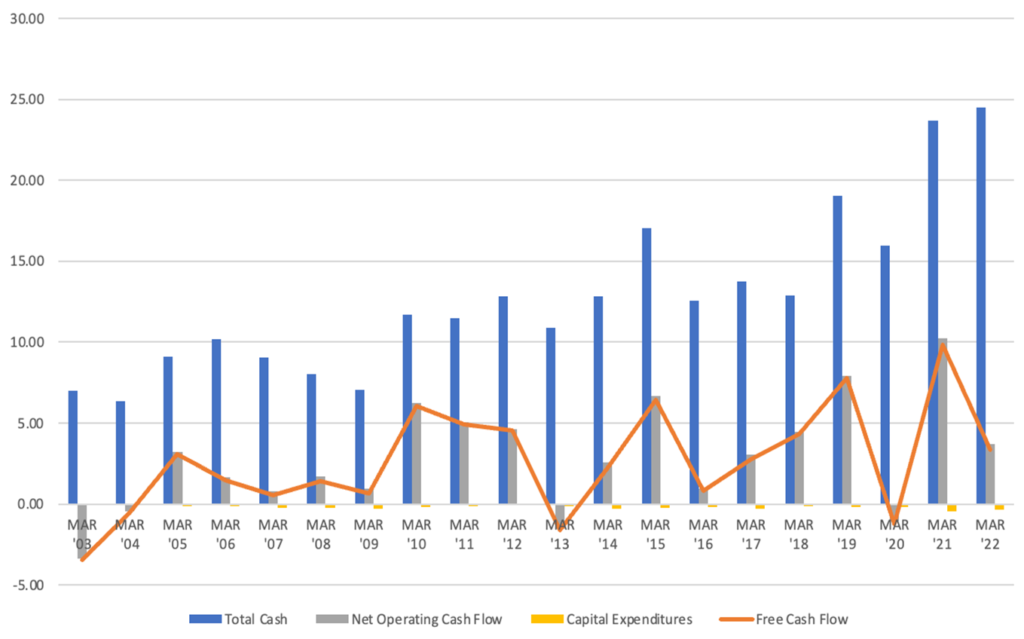

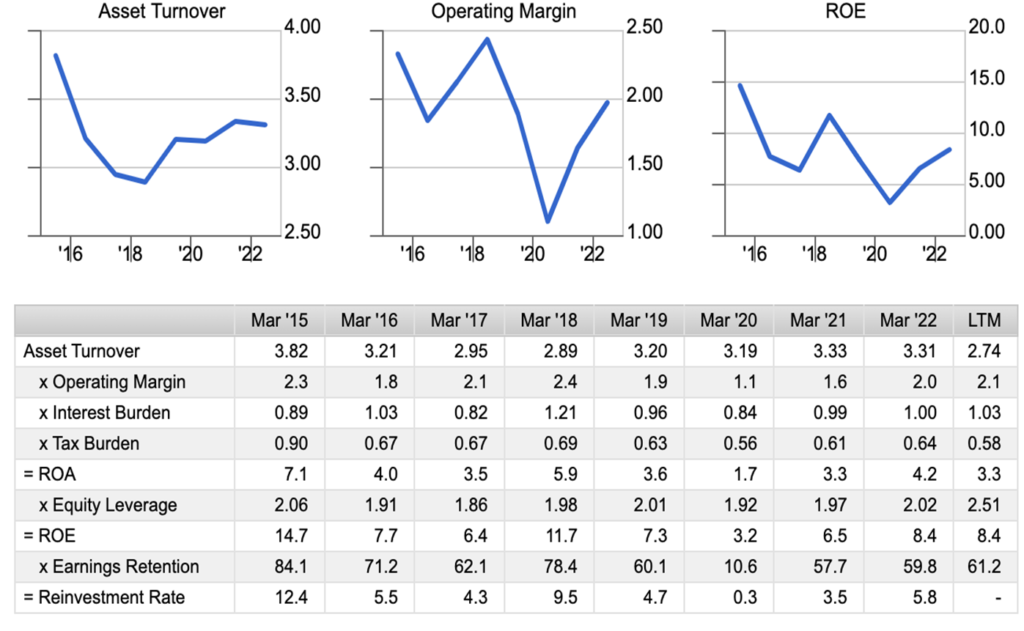

The company’s ability to generate steady cash flow is rated highly, and the asset turnover is good. However, the operating margin is consistently low. Considerable restructuring is needed to turn the company into an attractive ROA earner.

Dupont Model

The main problems for the shares’ value are cash, which amounts to 27% of BS in end-March 2022, and an equity ratio of 50%. The lack of improvement has led to mediocre ROE, averaging around 8%. PBR has been below 1x due to investors’ view that ROE will not improve. Management’s recent willingness to increase the dividend is commendable but unsurprising given the BS and CF and does not improve ROE. Cash will build up further. Management should first face up to BS inefficiencies and take action. There is significant scope for enhancing the value of the share by doing so. Existing shareholders must not be happy with management’s failure to make up for this obvious shortcoming. Meanwhile, external pressures on the company, such as the TSE and activists, will likely increase. Long-term investors should assume that the management team will actively steer the ship rather than not at some point in the future.

20YR Cash and Cash Flow (billion yen)