PIALA (Price Discovery)

| Securities Code |

| TYO:7044 |

| Market Capitalization |

| 4,385 million yen |

| Industry |

| Service |

Profile

EC marketing support company established in 2005. Specialising in beauty, health and food products. Mainstay services include RESULT, BeMattch, and Gibbons. Two consecutive fiscal years of operating losses due to changes in the D2C (Direct to Consumer) market environment.

Stock Hunter’s View

To be reorganised. First, the company will recover its record-high profits in one year.

PIALA provides performance-based marketing support to cosmetics, health foods, and other e-commerce businesses. Due to tightening regulations such as Act against Unjustifiable Premiums and Misleading Representations and Pharmaceutical and Medical Device Act, and the lockdown in China, the company has been in the red for two consecutive fiscal years.

Against this backdrop, the company announced a new medium-term management plan on 28 March 2023, outlining a roadmap for an early recovery in business performance. In Phase 1, the company aims to recover an operating income of 500 million yen or more, the record high for the past 20 years, during the one year from 3Q-2023 to 2Q-2024. Phase 2 aims to achieve an operating income of 1 billion yen to 1.5 billion yen in FY12/2025. The company has stated that it will “return to profitability in the second half of 2023 and achieve a V-shaped recovery.” Whether it can achieve this first will be the touchstone for measuring the seriousness of its efforts to recover business performance. The company reports going concern notes, so one could wait and see before purchasing its shares to confirm if the company’s earnings improve in the 3Q of the current fiscal year.

In addition to the early stabilisation of the two marketing businesses, the company envisions a scenario where profit growth will accelerate from the next fiscal year onward as new businesses enter the recovery phase. Among the new businesses, “Cyber Star,” an entertainment DX platform whose development has been delayed, is scheduled to open on 2 April. The platform will allow creators to consolidate their multiple links (SNS, blogs, e-commerce sites, etc.) into a single page. It will also benefit labels and IP content holders by increasing the number of potential users and monetisation points. The company is also looking for synergies with Sproot (the holding company for female idol groups HKT48 and NGT48), in which PIALA has a stake.

Investor’s View

Avoid. However, we would not stop speculative purchases on gut feeling. A microcap stock with a market cap of 4.6 billion yen is probably not investable for readers of this write-up.

The D2C business environment remains challenging

PIALA is an EC marketing support company specialising in beauty, health and food. It has been losing money for two consecutive fiscal years due to deteriorated market environment in the D2C market. Management attributed this to 1) restrictions on creatives (advertisements distributed on websites and apps) due to tighter regulations under the Pharmaceutical and Medical Device Act and the Act against Unjustifiable Premiums and Misleading Representations; 2) a decline in the retargeting ratio due to restrictions on third-party cookies; and 3) growth in ad placements, which drove up CPC (cost per click) and thus customer acquisition costs.

The main reason for the Company’s fall into the red was the tightening of laws and regulations started in August 2021, which restricted advertisements that deviate from their intended effects, such as “wrinkles will disappear” and “lose weight by 10 kg in 3 days”. The environment for D2C (Direct to Consumer) business remains challenging.

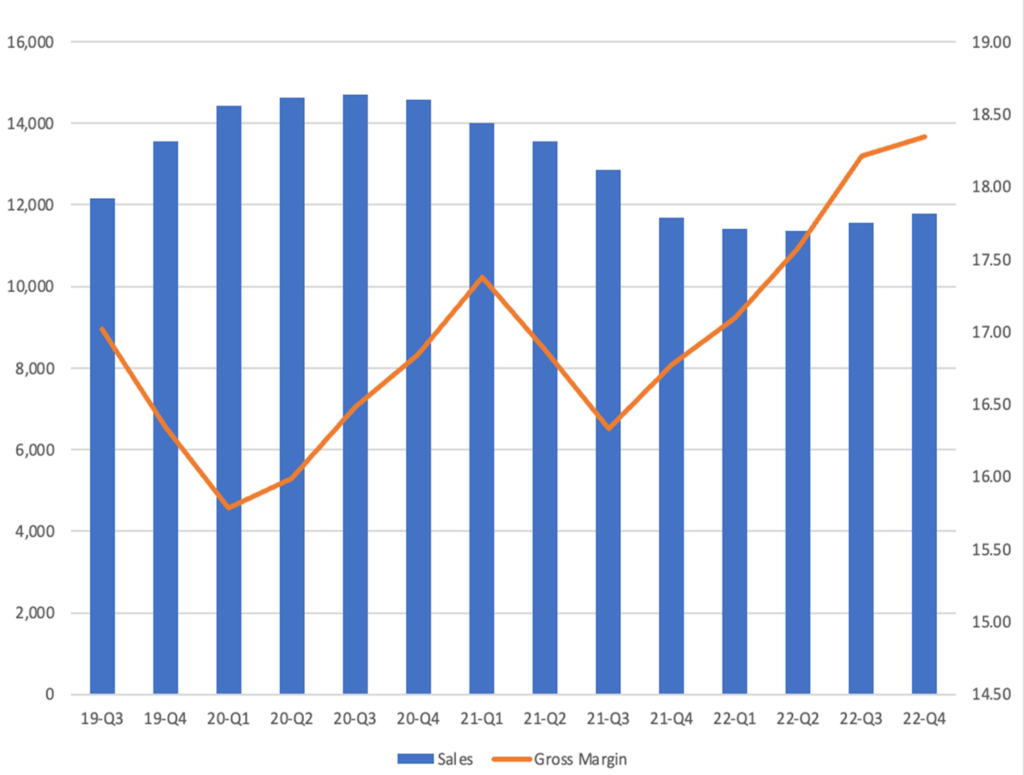

The medium-term plan does not persuade. However, the gross profit margin has already recovered in a V-shape.

In a nutshell, the recently announced medium-term management plan calls for a recovery of the business by rebuilding marketing DX, developing new clients in new fields such as real estate and human resource companies and expanding new businesses. The company is focusing on high-margin projects first, and its efforts are already paying off: TTM sales bottomed out in Q2 FY2022 and are rapidly turning around; the operating loss bottomed out in the same quarter; and the most noteworthy is the rapid recovery of TTM operating profit margin YoY after hitting bottom in Q1 FY2022. This is due to the V-shaped improvement in gross profit margin that preceded the sales recovery. The gross profit margin in 4Q-2022 was the highest since the company went public in 2018. These suggest that operating profit may get out of the red before long.

Sales (left axis, in million yen) and GPM (right axis, %) by quarter

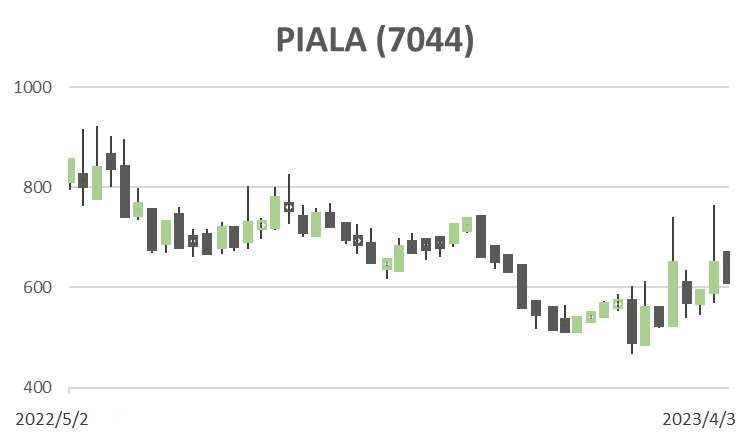

Not surprisingly, the stock price risk is high

It is too early for investors to determine whether the Company can realise the V-shaped earnings recovery envisioned by management within a few years. Any evidence that shows that the earnings recovery is on track should expand the premium of the shares and produce the expectation of an eventual return of ROE close to 20%. If earnings recovery fails, investors could lose their money.

Note the note of going concern risk

The Company noted in its latest annual report a “significant event regarding the premise of a going concern,” citing two consecutive fiscal years of operating losses as the reason. In Japan’s stock market, as of the end of February 2023, 140 public companies have noted “significant events regarding the premise of a going concern,” to which PIALA refers. Fifty-two public companies reported a more serious “Note regarding going concern assumption.” If earnings recover, they will be removed from the list, and Toshiba and Sharp are such examples. Investors will be at significant risk if the Company fails to recover its performance.

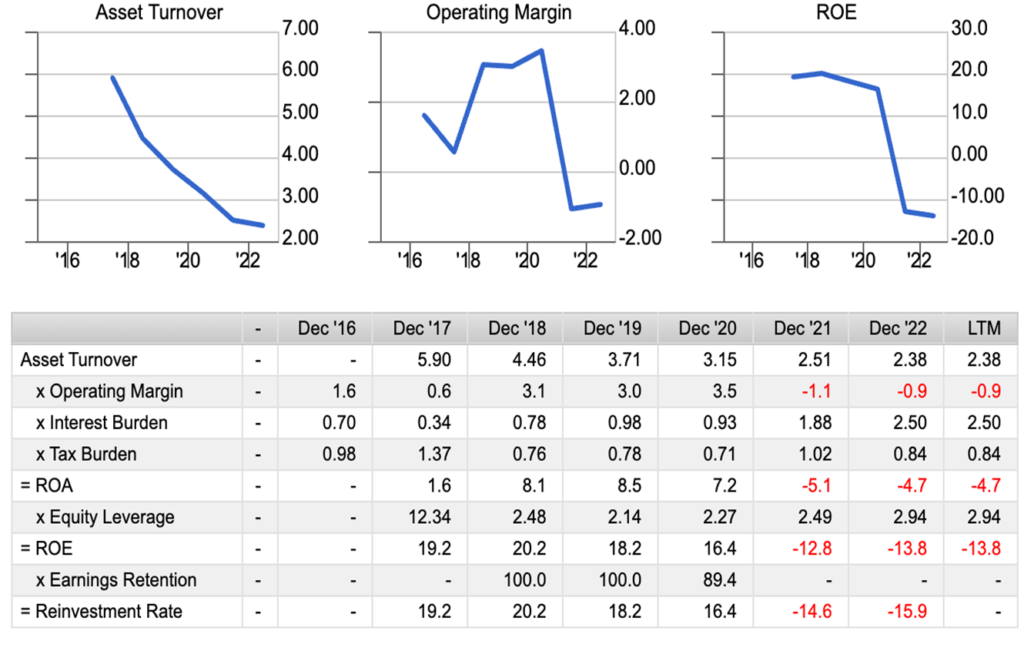

Dupont Model