Iino Kaiun Kaisha (Price Discovery)

| Securities Code |

| TYO:9119 |

| Market Capitalization |

| 110,969 million yen |

| Industry |

| Shipping industry |

Profile

Sales comprise Oceangoing Shipping 79% (OPM:3%), Domestic Shipping 9% (5), and Real Estate 12% (34). The shipping business operates tankers, chemical LPG, and bulk carriers. The company was founded in 1899. Real Estate division generates significant rental income from the Iida Building at the Tokyo headquarters.

Stock Hunter’s View

A shipping stock not dependent on the shipping market rises. There is also a decarbonisation-related interest.

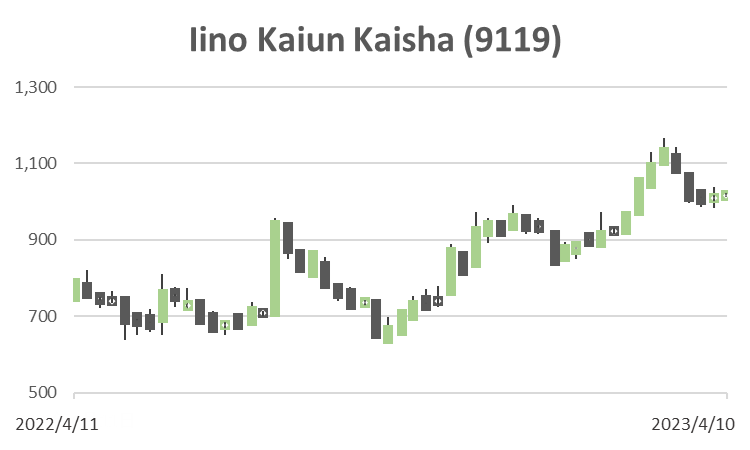

Marine transportation stocks were probing lower due to the ex-dividend of the March dividend. Still, on 5 April, they were the only stocks to rise amid a near all-out sell-off, indicating a strong appetite for buying on weakness.

Marine transportation companies are expected to see profits fall sharply and dividends cut in FY3/2023 due to the loss of special container demand. However, Iino Kaiun is expected to perform relatively well in the industry. While major shipping lines mainly operate container vessels, the company operates tankers, chemical vessels, LNG bulk carriers and other vessels. Another feature is that the real estate business, which accounts for about 56% of segment profits before COVID (FY2020), is the mainstay earnings. An undervalued stock with stable earnings that are not dependent on market conditions should be re-evaluated.

Operating profit for FY3/2023 is expected to be 18.6 billion yen (2.4 times the previous year’s), following an upward revision. Furthermore, the year-end dividend has been raised from the last forecast of 26 yen a share to 35 yen, bringing the annual dividend to 62 yen (36 yen in the previous two years). Commercial opportunities are expected in the medium to long term due to the rising demand for clean energy sources (hydrogen, ammonia, biofuels, etc.). Recently, the company announced the completion of a VLGC (large LPG/ammonia carrier) with an LPG dual-fuel main engine capable of carrying ammonia, attracting attention as a clean energy source.

Investor’s View

SELL. Do not overthink.

The 20-year track record shows that short-term earnings drive the company’s share price. When the earnings boost is significant, the investment returns are enormous. It is not unusual for a shipping company’s cyclical boost to be impressive, which sends share price amazingly high. The company earns a stable operating profit of around 4 billion yen from its real estate business, including rental income from buildings owned in city centres. However, the primary source of fluctuation in earnings is the shipping business. Shipping earnings are driven by shipping markets, which reflect global economic trends. Shipping markets are difficult to predict but will soon soften due to the receding global economies. The dry bulk market has already softened. The chemical tanker market, a major booster for the company’s earnings, should also peak sooner or later.

20-year share price (blue, RH in yen), EPS (green, LH in yen), PBR (lower chart)

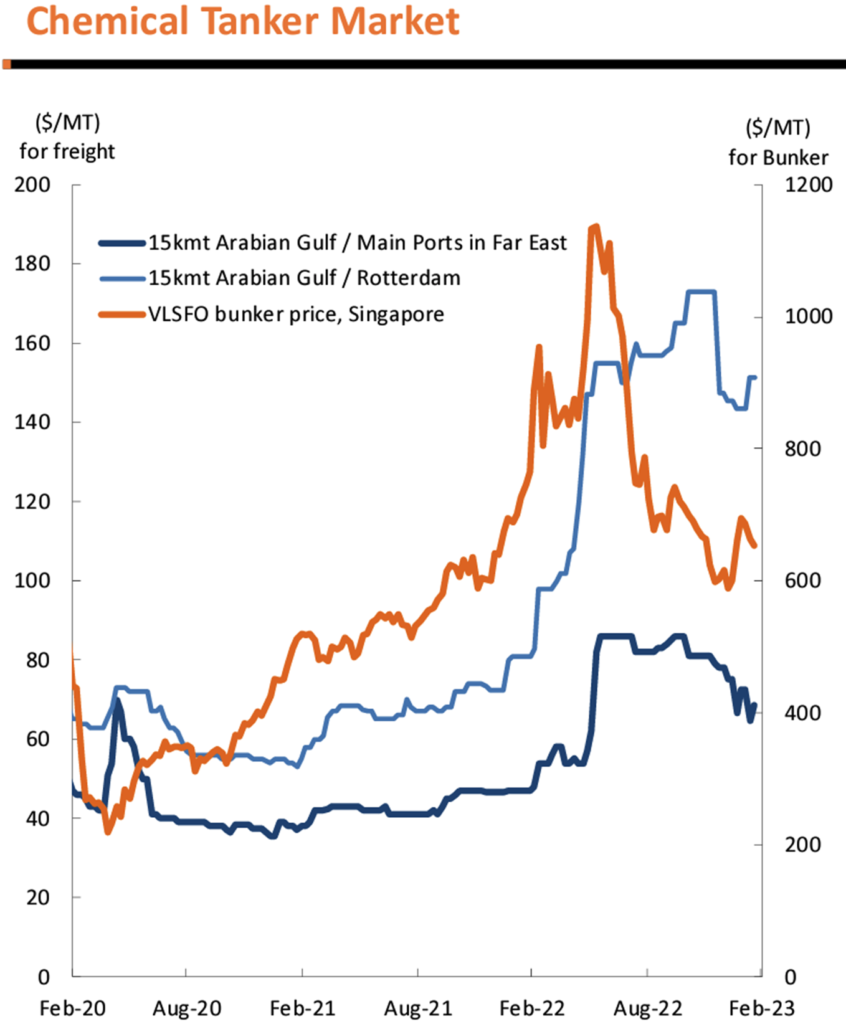

Chemical tanker market looks set to slide

The market for chemical tankers, a speciality of the company and a feature of the shipping business, is strong. Chemical tankers accounted for most of the YoY 3Q ship business profit increase, which doubled over the same quarter of last year. This was thanks to a rise in on-miles as Europe increased imports of petroleum and petrochemical products from the Middle East in the wake of the Ukrainian war. At the same time, the supply-demand balance for vessels tightened due to increased demand. Management stated at the beginning of November last year that the chemical tanker market would be strong for now but would settle down by the end of the year. As it turned out, the market peaked shortly afterwards and began to fall. Given the possibility of a global recession, investors should assume that the market will fall further. At the end of 3Q, the spot share of the company’s fleet was 23% for chemical tankers, 16% for LPG carriers and 45% for small and medium dry bulk carriers.

The shares already discount the top of the earnings in an unprecedentedly strong cycle.

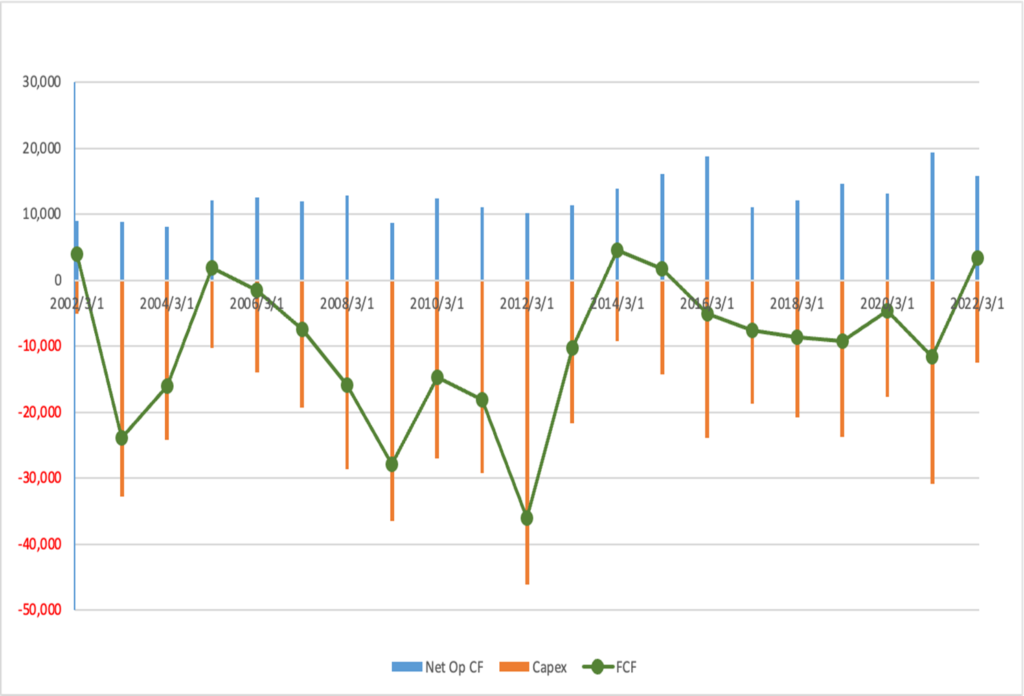

The current ROE is exceptionally high, but PBR remains low, and investors do not allow premiums to the share price. Price to book is well below 1x over the long term. Capital expenditure in the shipping business is significant every year, and FCF is usually in negative territory. Asset turnover is permanently low. Despite various efforts by management, it is difficult to override the earnings fluctuations caused by the shipping market cycle, and secular ROE is hard to revitalise. The management will announce a new medium-term plan in May, but it will only affect the share price if significant actions such as total business renovation are included.

20-year Free cash flow, Capex, Net operating cash flow (in million yen)