Glosel (Price Discovery)

| Securities Code |

| TYO:9995 |

| Market Capitalization |

| 12,224 million yen |

| Industry |

| Wholesale business |

Profile

GLOSEL Co., Ltd. is a semiconductor trading company that also manufactures electronic components. Its business is divided into several divisions: Integrated Circuits (63% of sales), Semiconductor Devices (15), Display Devices (2), and Others (19). The Integrated Circuit division provides microcomputers, logic circuits, and memory products, while the Semiconductor Device division offers transistors, diodes, and rectifier elements. The Display Device division is responsible for liquid crystal displays, and the Others division includes various general electronic components and devices. The company was established in 1954.

Stock Hunter’s View

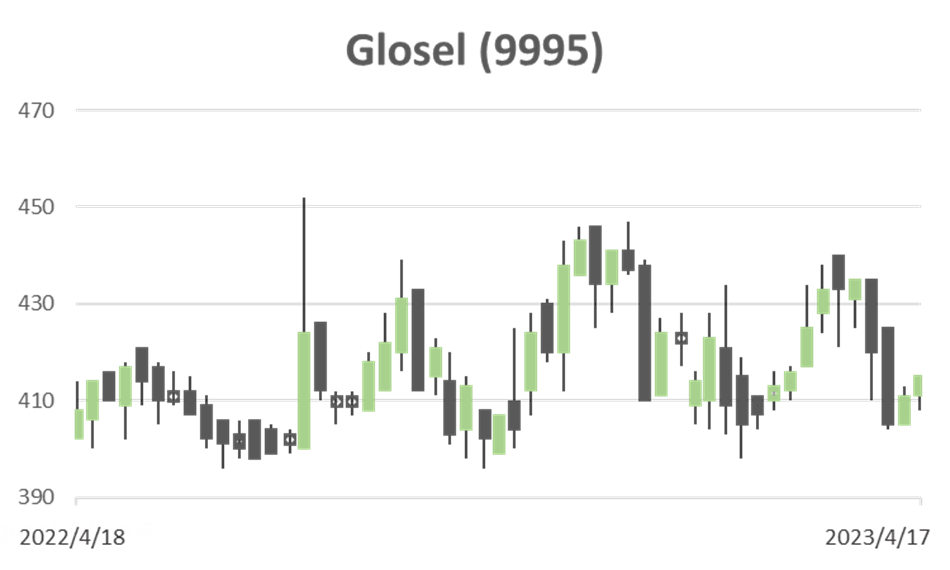

A semiconductor trading company with cheap valuations. The company has recovered from the pandemic, and the current share price weakness offers an excellent buying opportunity.

Grosel is a semiconductor trading company that also acts as a fab-less manufacturer, providing technical proposals from the initial stages of customer product development. Its business focuses on three pillars: primarily handling Renesas semiconductors, H&CSB (Hitachi products and new business products), and the semiconductor strain sensor “STREAL”. In recent years, STREAL, developed in-house, has gained momentum, further strengthening the company’s manufacturer profile.

Its earnings have been recovering since hitting bottom in FY3/2021, impacted by the pandemic. Despite the remaining effects of Renesas’ business transfer in FY3/2022, the company is expected to achieve an operating profit of 1.3 billion yen (+36.4% YoY) for FY3/2023 after two upward revisions. Automotive production is recovering, and there is expected to be mass production of large-scale projects for ADAS (Advanced Driving Assistance Systems) and EVs using Renesas products from 2025 onwards.

As per the medium-term management plan, the company has already achieved profits, operating profit margin, and ROE ahead of schedule for FY3/2024, making the plan highly likely to be reviewed soon. While the growth of STREAL has slowed down due to delays in some customer deliveries, full-scale production of torque sensors for collaborative robots is expected to begin in FY3/2024.

Investor’s View

Very short-term trading buy. From the perspective of long-term investment, the company faces many challenges, and it is difficult to find attraction in the shares.

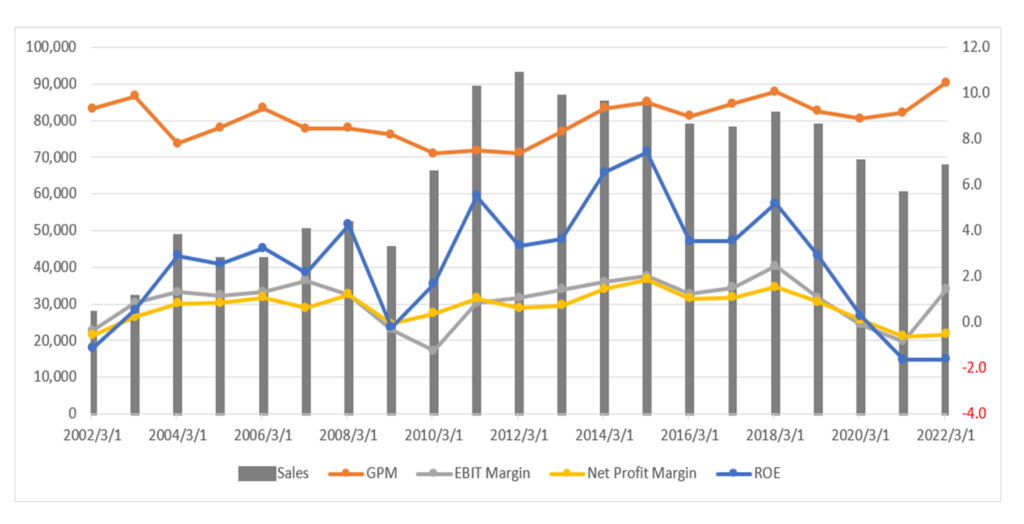

While the TOPIX 5-year TSR is +5.4%, the company’s performance has been -6.7%. For good reasons, the company’s shares have been trading below book value for 20 years. The PL profit margin is consistently low, and ROE does not satisfy shareholders. ROIC is also low, and economic value creation is estimated to be consistently negative over many years.

Sales (Y-mn, LHS), ROE (%, RHS), Profit margins (%, RHS)

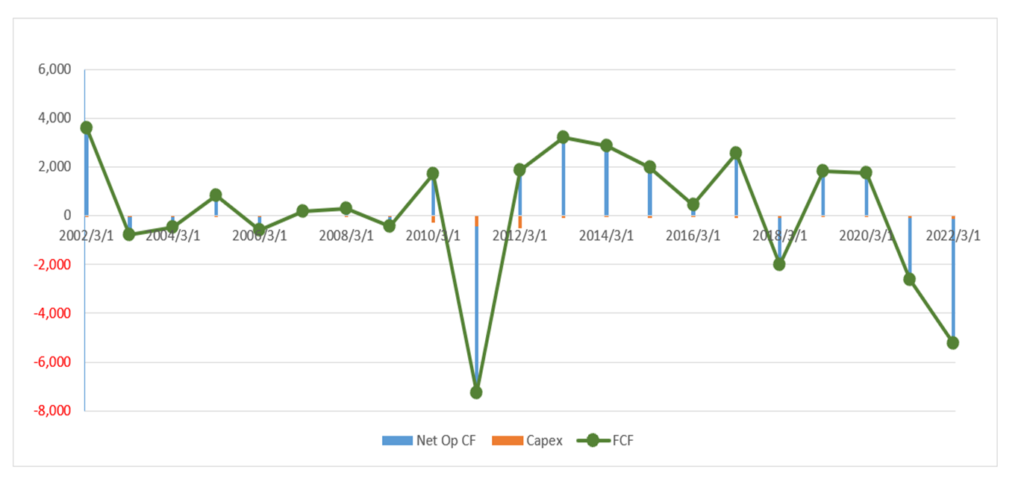

Although the company’s free cash flow is not so bad, with almost no burden of capital investment, it is used to refinance debt. With working capital set aside, the funds to enable active shareholder returns are not accumulated.

Net operating CF, Capex, Free cash flow – 20YR

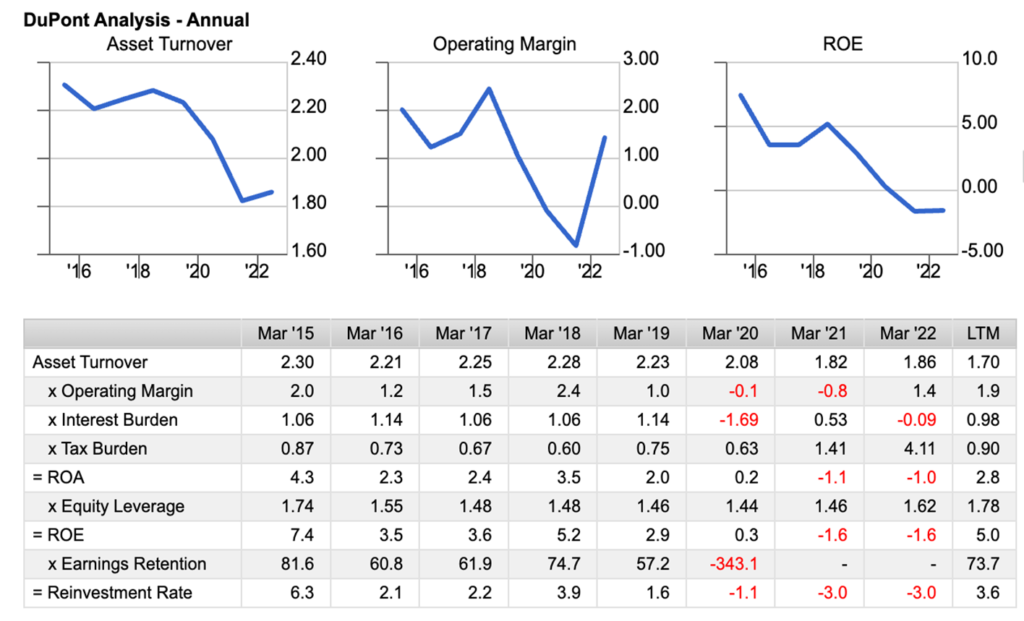

Improvements in asset turnover and OPM are needed, but improving the business structure will not be easy. The operating profit margin has not broken out of the 0% to 2% range over the past 20 years, and the recent asset turnover trend has been lacklustre.

While the management plan is ambitious, there still needs to be evidence of its realisation.

The company was listed on the TSE Prime Market in April 2022, but its market capitalisation of 9.3 billion yen for liquid shares fell short of the 10 billion yen threshold for listing maintenance standards. So it submitted a “plan towards compliance with listing maintenance standards” to the Tokyo Stock Exchange. The plan summarises revenue improvement measures, capital policy improvement measures, strengthening IR / PR activities, and a sustainability focus.

In summary, the management plan centres on promoting DI (Design-In) sales and expanding STREAL, and the goals are ambitious. However, there has yet to be evidence or signs for investors to have confidence in achieving these goals. STREAL aims to expand sales to robotics, railways, power generation, and healthcare, increasing sales from 2.8 billion yen in FY2022 to 15 billion yen in FY2026. At the same time, the company has set a goal of 8% ROE in FY2026. The operating profit margin is set at 3.0%, with a target of 3 billion yen in OP. The management’s forecast for this fiscal year is 2.0% and 1.3 billion yen, respectively.

Investors want to see the company turn a cyclical growth

As for ROE, the Japanese stock market average is already at 8%, so aiming for 8% as a target in a few years is not attractive. It depends on the market interest rate, but the economic value deficit should reduce somewhat as ROIC improves. The earnings inevitably fluctuate, driven by the semiconductor market. However, if investors recognise the company as cyclical growth, market capitalisation will increase, and the valuation will improve.

Recent requests from TSE to companies with book value deficits

It is inferred that TSE sent a letter of request to management at the end of March for “efforts towards achieving management that is conscious of capital costs and stock prices.” Before this, the company had already detailed management numerical targets and measures. Also, it stated a commitment to strengthening IR, so the management will unlikely take any additional actions in response to this request. However, TSE places great importance on continuous monitoring of results, so if they take some measures in the short term to produce visible results, the stock price may become interesting.

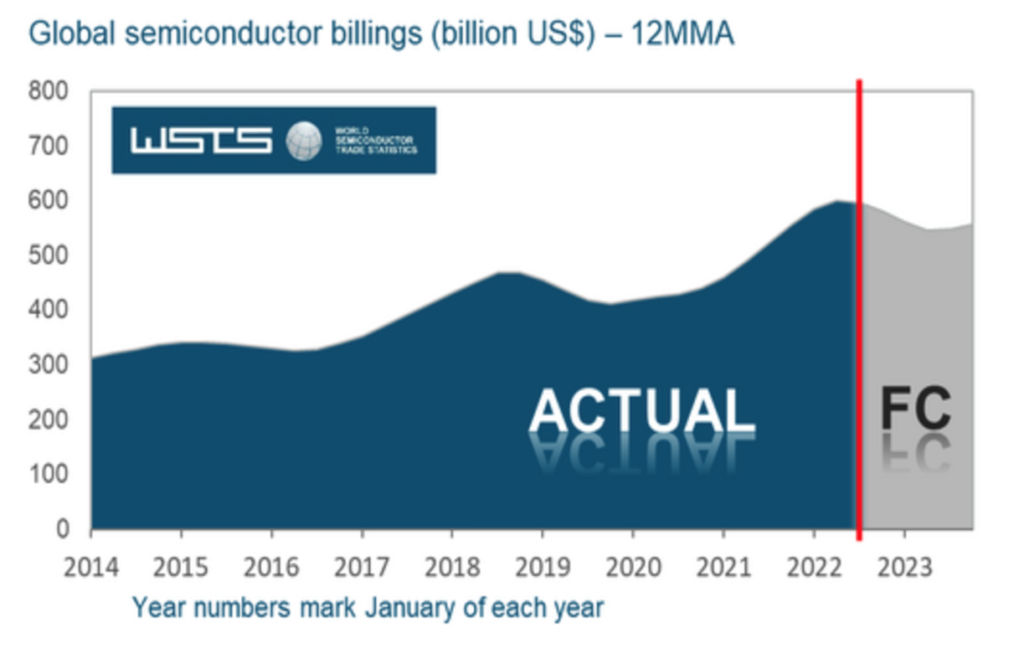

The shares are a very short-term Buy

Short-term technical indicators are positive, and the stock price may rise by about 10% in the next few weeks. However, the semiconductor market is at the top of its cycle, and a downturn is expected. The stock price could move significantly depending on the FY2023 guidance at the result announcement on May 15th. Investors are advised to take profit earlier than not.