Sportsfield (Company note – basic)

| Share price (4/27) | ¥1,512 | Dividend Yield (23/12 CE) | 0.0 % |

| 52weeks high/low | ¥1,690/290.5 | ROE(22/12) | 71.8 % |

| Avg Vol (3 month) | 62 thou shrs | Operating margin (22/12) | 22.1 % |

| Market Cap | ¥5.4 bn | Beta (5Y Monthly) | N/A |

| Enterprise Value | ¥4.6 bn | Shares Outstanding | 3.6 mn shrs |

| PER (23/12 CE) | 12.4 X | Listed market | TSE Growth |

| PBR (22/12 act) | 7.0 X |

| Click here for the PDF version of this page |

| PDF Version |

An industry leader that provides nationwide placement support services for sports human capital

Summary

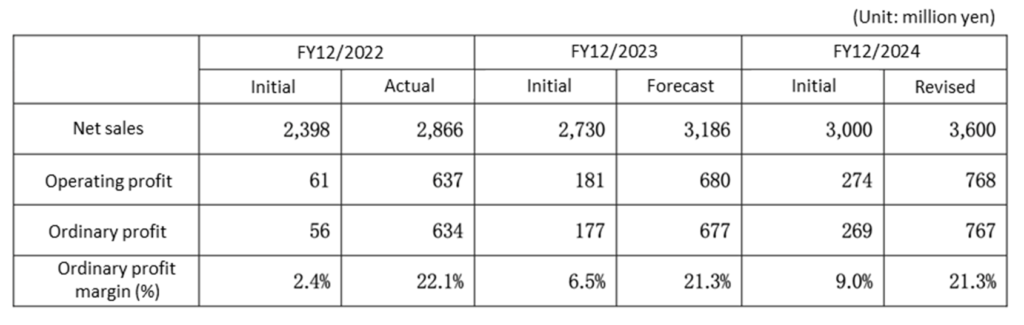

◇Sportsfield Corporation Ltd. provides placement-related services to sports human capital nationwide. It is listed on the TSE Growth Market. FY12/2022 results were sales of 2.87 billion yen and a recurring profit of 0.63 billion yen. The current medium-term management plan aims to achieve sales of 3.60 billion yen and a recurring profit of 0.77 billion yen in FY12/2024.

◇Specialised in recruiting sports talents and leading the market with a distinctive sales style: Sportsfield’s primary business is placement-related services for newly graduating sports students, particularly those belonging to college athletic teams. The market is estimated to be around 50,000 people nationwide per academic year. The company has established a system of analogue support provided by sales employees, most of whom have sports experience. The number of registered job seekers has grown to over 20,000 every year. The company also operates a well-established business with companies that wish to recruit sports human capital and is believed to be securing a leading position in a specific market.

◇Main business: Sales comprise 39% of New Graduate Events for new graduates belonging to college athletic teams (fees are received from exhibiting companies), 30% of New Graduate Placement Support business for newly graduating athletic students and students with other sports experience (provides employment counselling to students, introduces them to employing companies and receives a recruitment consulting fee from companies after a job offer is accepted), and Graduate Placement Support business (provides employment counselling to sports graduates, introduces them to employers and receives a placement fee from companies as a performance reward).

◇Returns to a growth trajectory: Immediately after the IPO in December 2019, sales remained without a significant dip as the company took countermeasures to the pandemic disease. However, PL deteriorated due to increased headcount and costs and posted recurring losses in FY12/2021. However, in FY2022, the recruitment market recovered while the company had bolstered its operating base, enabling it to recover to register record sales and profits quickly. The recurring profit margin reached 22.1%, worthy of an emerging growth company. ROE is also high.

◇Share price beginning to be revalued: The share price has moved to reflect a series of business results. It stagnated until May 2022 but picked up after confirming an earnings turnaround and has been edging up. Current shares trade on 10.4 times the management’s forecast EPS for FY2023, and PBR is 5.9 times. The share price is thought to be in a phase where it reflects the earnings straightforwardly.

◇Medium-term management plan and medium- to long-term strategy: In March 2021, the company announced a medium-term management plan for 2022-2024. In the plan’s first year, the company achieved close to its 2024 sales target and overachieved on recurring profit. The plan was therefore revised upwards in March 2023. The new targets are sales of 3.60 billion yen and a recurring profit of 0.77 billion yen for FY12/2024. This translates into a sales increase of about 12% per annum over the next two years whilst keeping the recurring profit margin at 21%. While the current main businesses will be the primary drivers, the foundation for sustainable growth is also expected to be strengthened by expanding new peripheral businesses simultaneously.

◇Positive expectations going forward: In addition to the growth potential and high capital efficiency of the current mainstay businesses realised by the company’s leading position in the new graduate sports human capital business, the company has unique business potential. This includes services for graduate sportspeople, recruitment support services for sports companies and athlete support services, utilising its distinctive customer base that combines job seekers and recruiting companies. If these materialise in the business performance and increase investors’ attention, we think there would be scope for the share price to be valued higher.

Table of contents

| Summary | 1 |

| Key financial data | 2 |

| Company profile | 3 |

| History | 4 |

| Business overview | 5 |

| Market environment for sports human capital | 5 |

| Strengths of the mainstay New Graduate Placement Support business | 7 |

| Business segment overview | 9 |

| Medium-term management plan (2022-2024) | 16 |

| Financial results | 19 |

| Share price trend | 23 |

| Equity stories and equity investors’ focus | 24 |

| Useful information | 26 |

Key financial data

| Fiscal Year | 2017/12 | 2018/12 | 2019/12 | 2020/12 | 2021/12 | 2022/12 | |

| Net sales | 1,106,727 | 1,516,370 | 1,917,813 | 1,883,269 | 2,130,256 | 2,866,214 | |

| Ordinary profit | 60,171 | 113,916 | 192,045 | 32,016 | -35,298 | 634,239 | |

| Net income | 41,031 | 72,809 | 132,965 | 17,055 | -79,133 | 412,318 | |

| Capital stock | 10,300 | 10,300 | 92,680 | 92,712 | 92,869 | 93,079 | |

| Total number of shares issued |

Ordinary shares (shares) Class A shares (shares) |

20,000 400 |

20,400 – |

881,600 – |

882,560 – |

897,400 – |

1,808,080 – |

| Net asset (Thousand yen) | 59,396 | 132,205 | 429,932 | 446,826 | 368,007 | 780,524 | |

| Total asset (Thousand yen) | 418,961 | 735,377 | 1,106,275 | 1,488,182 | 1,540,544 | 2,127,327 | |

| Book value per share*1 (Yen) | 36.39 | 81.01 | 243.84 | 253.16 | 205.06 | 431.73 | |

| EPS*1 (Yen) | 25.14 | 44.61 | 81.37 | 9.67 | -44.42 | 228.88 | |

| Equity to asset (%) | 14.2 | 18.0 | 38.9 | 30.0 | 23.9 | 36.7 | |

| ROE (%) | 100.6 | 76.0 | 47.3 | 3.9 | -19.4 | 71.8 | |

| Cash flow from operating activities | 108,208 | 82,994 | 198,181 | -88,974 | 53,789 | 609,537 | |

| Cash flow from investing activities | -32,962 | -75,085 | -24,984 | -32,077 | -67,943 | -7,100 | |

| Cash flow from financing activities | -82,366 | 191,526 | 149,891 | 396,399 | 18,139 | -120,077 | |

| Cash and cash equivalents at end of period | 163,792 | 363,227 | 686,315 | 961,663 | 965,648 | 1,448,007 | |

| Number of employees | 118 | 164 | 201 | 233 | 266 | 242 | |

*1:A 40-for-1 ordinary share split was carried out on 4 October 2019, and a 2-for-1 ordinary share split on 1 July 2022. Book value per share and EPS in the table are calculated assuming such splits were carried out at the beginning of the year ended 31 December 2017.

Source: Omega Investment from company materials.

Company profile

Sportsfield Corporation Ltd. provides human resource services to job seekers and employers concerning sports human capital, such as students belonging to college athletic teams.

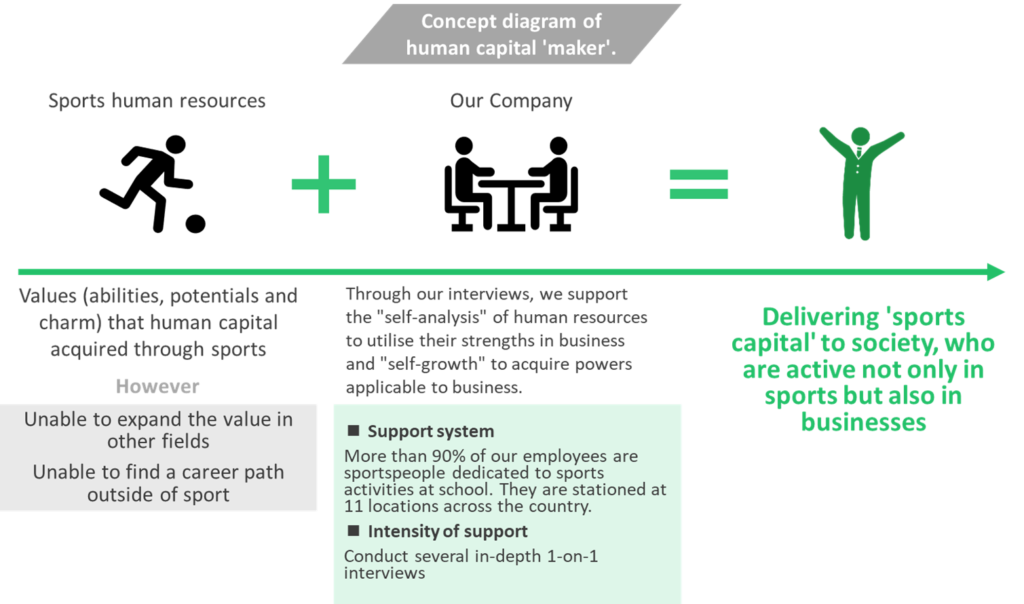

The company’s management philosophy is “to pursue the material and intellectual happiness of all employees, and at the same time, to utilise the potential of sport in various fields and contribute to the development of individuals, corporations, local communities and Japan”. It defines itself as “a human capital maker that transforms analogue relationships with sports capital into added value and provides nationwide employment and career change support.

Currently, the three main businesses are as follows.

- New Graduate Events: Organises nationwide job-hunting events for athletic students and receives event stall fees from exhibitors with job offers. Sales in FY2022 were 1.1 billion yen, accounting for 39% of the overall sales. Before and after lifting job hunting restrictions, the company holds events of various themes and sizes nationwide, both in person and online.

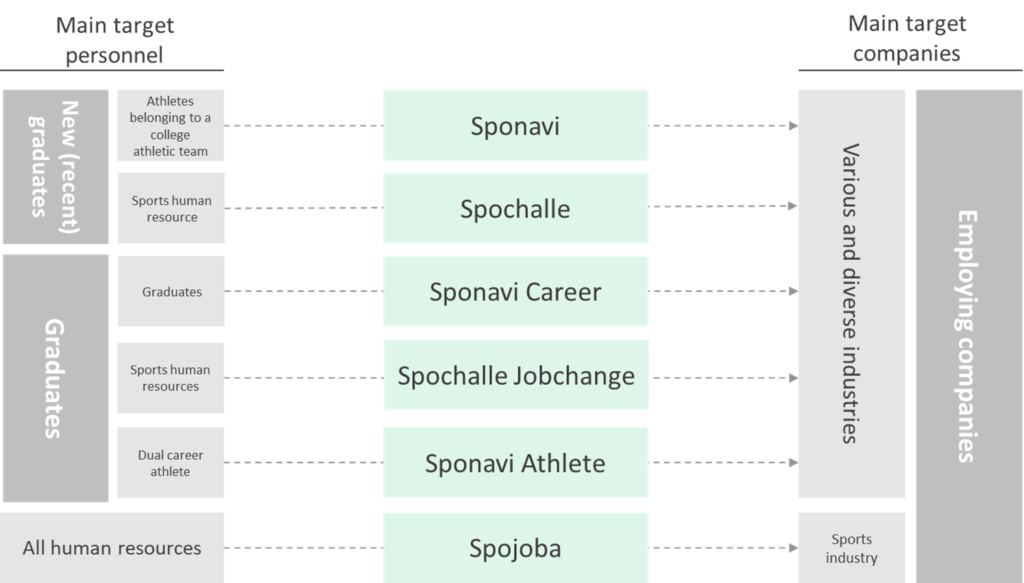

- New Graduate Placement Support: New graduates register on the Sponavi website if they belong to a college sports team and on the Spochalle website if they have experience in sports such as college athletic clubs. The company provides employment counselling to these registrants, introduces them to companies, and receives a recruitment consulting fee from them as a performance fee after students accept a job offer. This business accounted for 30% of the sales in FY2022.

- Graduate Placement Support: Provides employment counselling and introductions to employing companies for graduate sports personnel (including ‘second-time graduates’ – recent graduates looking to change jobs) and receives a placement fee from the company as a performance reward. Accounts for 27% of the sales in FY2022.

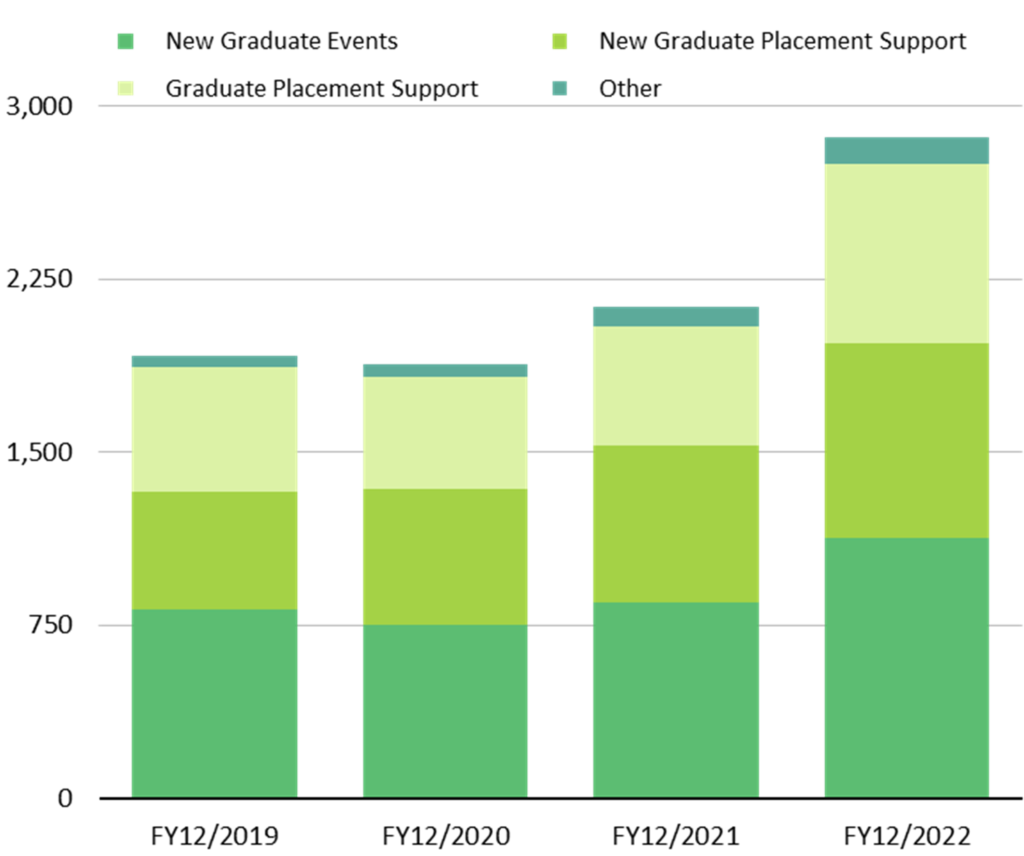

Sales and the segment compositions

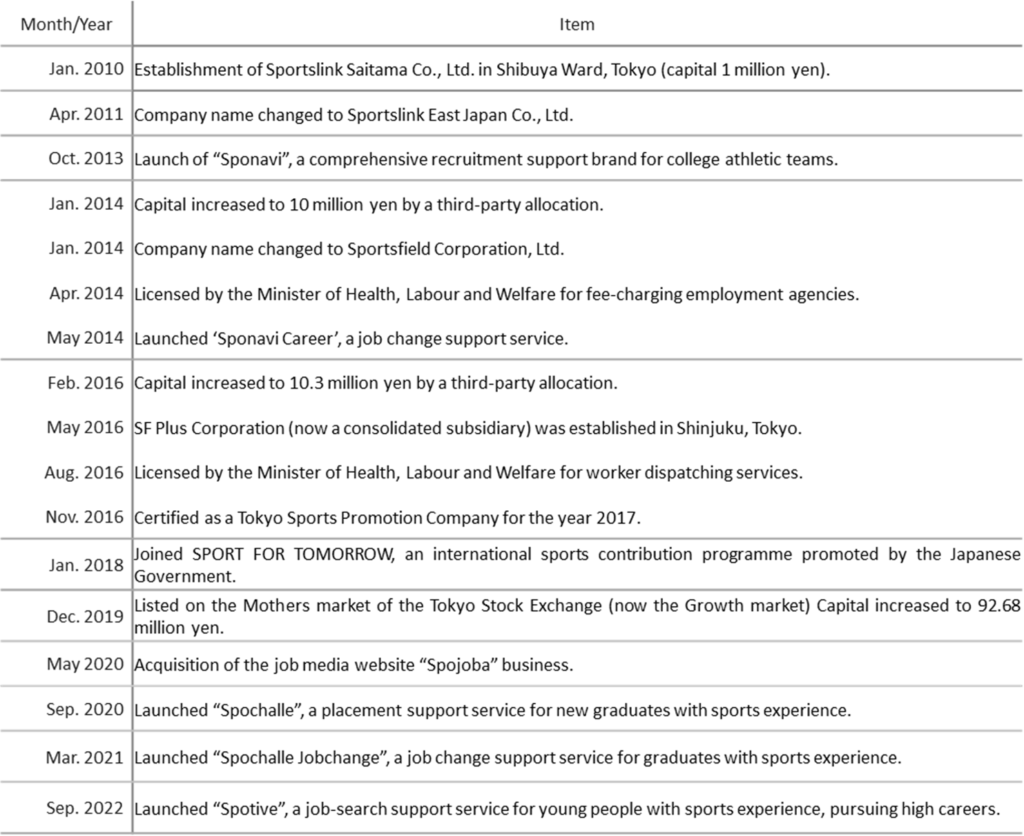

History

The company was founded in January 2010 as Sportslink Saitama Corporation (subsequently renamed Sportslink East Japan Corporation) in Shibuya Ward, Tokyo, to plan and sell recruitment-related products and provide placement and labour dispatch services. Subsequently, it changed its name to Sportsfield Corporation Ltd. in January 2014.

Regarding the licensing, the company received a licence for fee-charging employment agencies in 2014 and a licence for labour dispatch services in 2016, each from the Minister of Health, Labour and Welfare.

As per business development, the company launched “Sponavi”, a comprehensive employment support service for athletic students, in 2013. It opened offices in the Kansai, Tokai and Kyushu areas from the beginning of 2014, followed by the Tohoku and Hokkaido areas in 2016 and the Chugoku area in 2017, expanding nationwide.

To expand the business horizontally, the “Sponavi Career” job-change support service for graduates was launched in 2014, followed by the dispatch and employment placement dispatching business (currently the “Sponavi Athlete” business) in 2018 to provide dual career support for active athletes. The “Spochalle ” service in 2020 for new graduates with sports experience, and the “Spochalle Career”, a job-search support service for graduates with sports experience, in 2021. In 2022, the company started “Spotive”, a job-search support service for young graduates with sports experience pursuing a high career.

Furthermore, in 2020, the company took over “Spojoba”, a job and career information website specialising in sports-related companies.

In equity-related matters, shares were listed on the Mothers market of the Tokyo Stock Exchange (now the Growth market) in December 2019.

Business overview

Market environment for sports human capital

Young workers are expected to become scarce and more valuable in Japan, which faces a declining birthrate and an ageing population. On the other hand, the number of students entering university is expected to remain steady until 2030.

In this environment, college athletes and other sportspeople are seen to have different experiences and abilities from other students in terms of courtesy, communication, perseverance and teamwork. Employers will likely emphasise communication skills, cooperativeness, integrity and stress tolerance when recruiting new graduates.

As a result, various companies increasingly consider sportspeople a source of vitality and diversity for their workforce. Sports human capital can be regarded as a precious human resource amongst the young.

Despite the image of college athletic teams as an established route to employment based on close hierarchical relationships, these routes appear limited to a small proportion of the workforce. In addition, there is a growing trend among companies that do not have such ways to recruit sportspeople to activate existing employees.

These suggest stable supply and broad-based demand for new graduate sportspeople. Furthermore, a market for graduate sportspeople will likely emerge in the medium term.

Population forecast of 18-year-olds and the number of students entering university

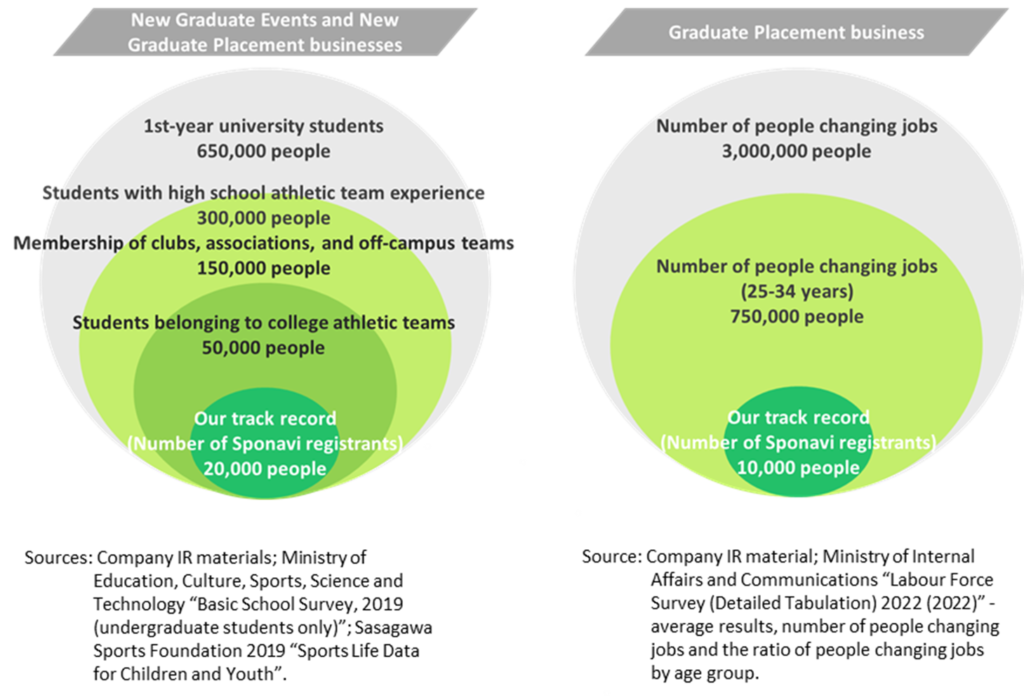

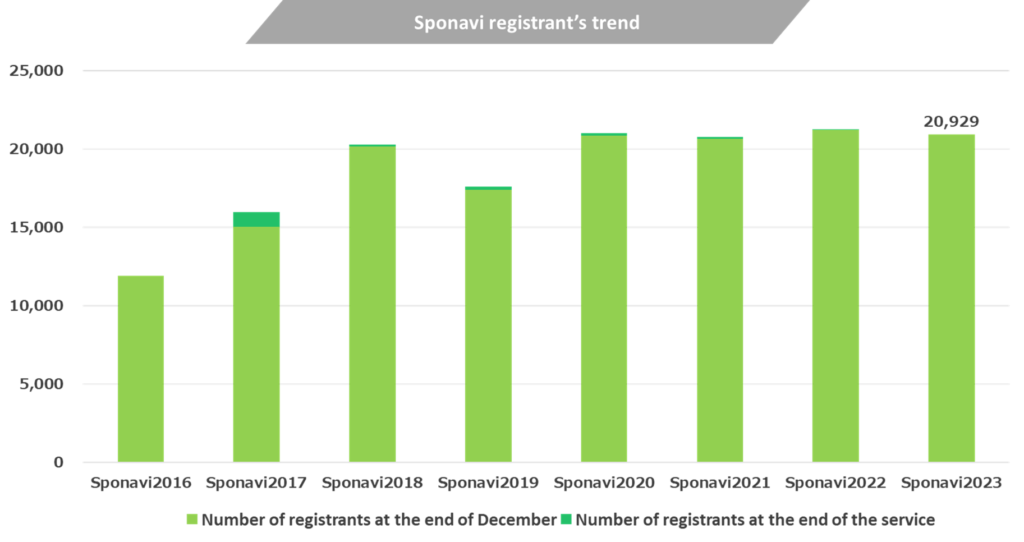

Next, let us look at the size of the company’s market in terms of the number of job seekers (students and others). Out of a total student population of approximately 650,000 for each university academic year, 50,000 students are estimated to belong to athletic teams, and 150,000-300,000 students are either involved in sports associations other than college athletic teams or experienced athletic team activities in high school days. In contrast, the number of students registered on Sponavi, which athletic students use to register for job hunting, is approximately 20,000 per academic year, indicating scope for marketing development.

About the graduate placement market, the number of people aged 25-34 changing jobs is estimated at 750,000, compared to 3 million people changing jobs annually nationwide (this is a macro figure that includes sports personnel).

Market size of the company’s main businesses.

Strengths of the core business, the new graduate sports human capital related business

As mentioned in the company profile and history section, the company’s core businesses are New Graduate Events and New Graduate Placement Support, which account for 70% of current sales.

We want to start by outlining the business strategy in this area, as this area leverages the company’s strengths and unique features, enabling it to take advantage of its first-mover benefits. Furthermore, it is expected to be a foundation for future medium- to long-term business performance, including business for graduates.

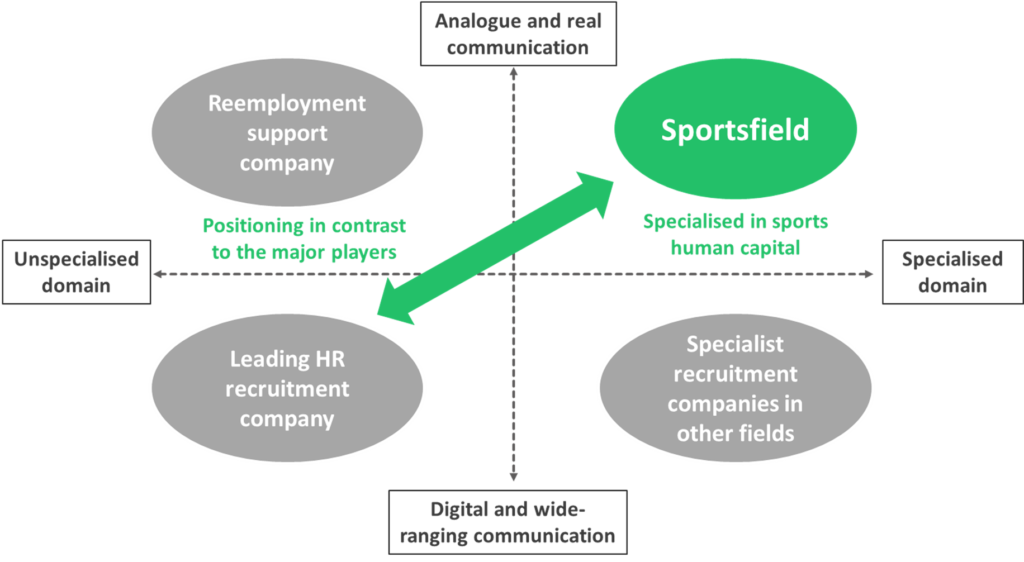

The key points are summarised as follows. The business is highly strategic, securing the top position in a specialised area and using it as a bridgehead for expansion into related businesses.

- Specialisation in the sports talent field: While other companies in the same industry with aspirations for nationwide expansion pursue a “wide and shallow” approach, the company focuses on sports talent and pursues a “narrow and deep” policy.

- Emphasis on analogue communication: The company’s marketing staff comprises professionals with sports experience. They proactively engage with students from an early stage, conduct one-on-one counselling and provide friendly support to job seekers. This is why the company declares itself a human capital ‘maker’.

- Entry barriers and efficiency: After about ten years of business, the company has established a strong sales base, which has resulted in job seekers being attracted via word of mouth. Employer evaluations are also considered well-established from the trend of event sales slots. These achievements become first-mover advantages and form entry barriers. Furthermore, they contribute to increasing the efficiency of marketing activities.

- Foothold in maximising the lifetime value of sports talent: The company is currently in a solidification stage of year-to-year business involving new graduate sportspeople. This could become an essential and unique customer base when future businesses related to graduate sportspeople emerge.

Positioning of HR businesses vs Sportsfield’s uniqueness

Analogue-oriented approach to new graduate sports personnel

Human capital ‘maker’

Overview of business segments

Following the overview of the company’s business environment, strategy, and features, the company’s individual businesses will be discussed.

The company’s business can be categorised into new graduate sports personnel, graduate sports personnel, and sports industry job matching. The company’s brands are sorted as follows.

List of Sportsfield’s operating brands

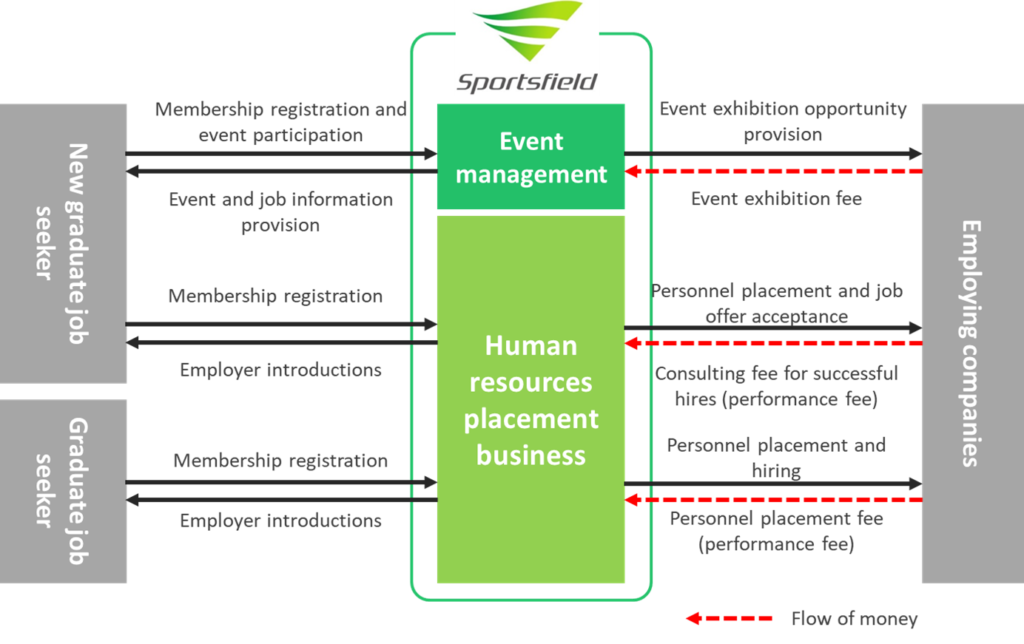

Sportsfield’s business is broadly classified into event management and human resource placement services. The following is the business flow and revenue stream based on this classification. Current revenues are generated mainly from employing companies.

Business flow and revenue streams

[New Graduate Events]

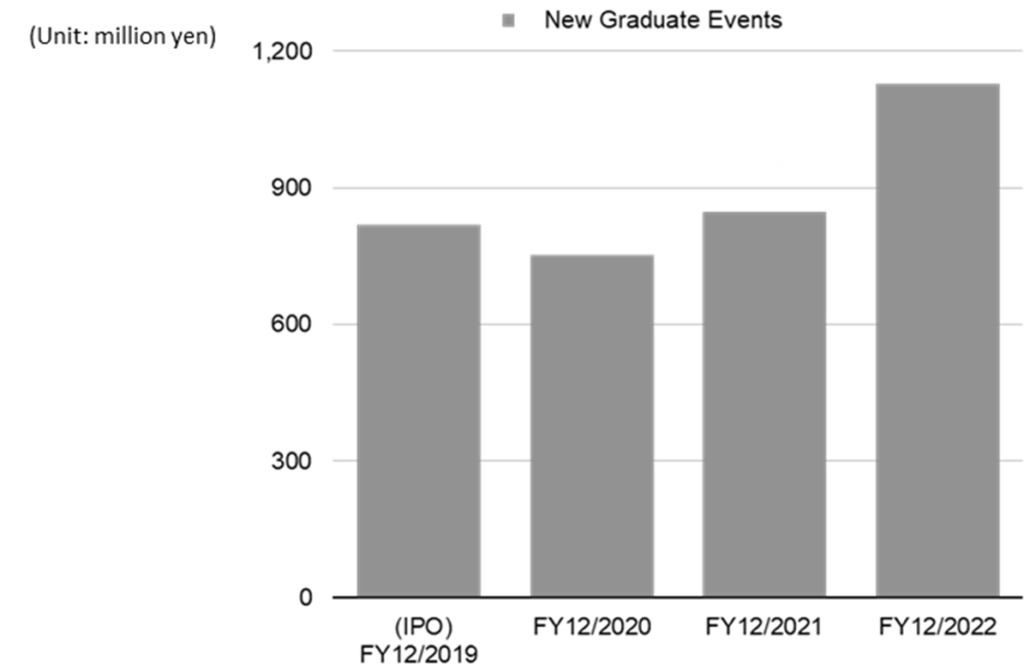

This business holds job-hunting events for college athletes nationwide and receives event booth fees from exhibiting companies offering jobs. In FY2022, the sales were 1.1 billion yen, accounting for 39% of the total company sales, rising by 34% YoY. The company holds events of various themes and sizes nationwide, in-person and online, before and after the job-hunting restrictions are lifted.

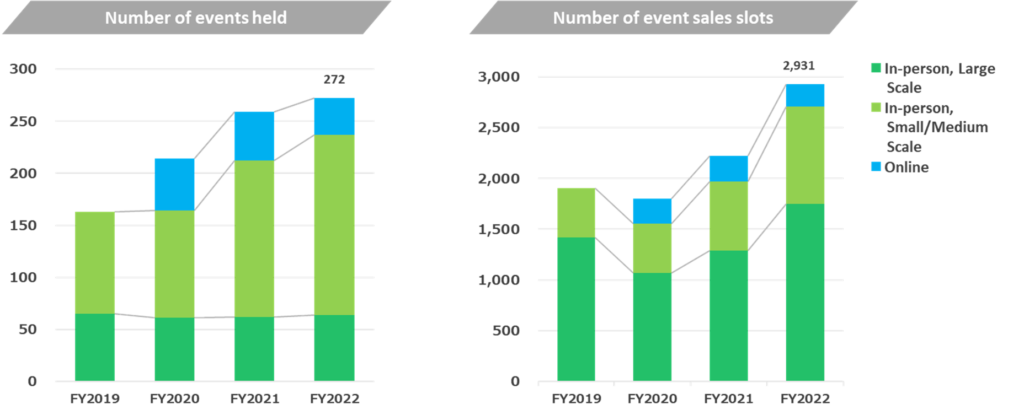

The KPIs are the number of events held and event slots sold. They are increasing steadily, along with sales, as shown below.

KPIs for New Graduate Events

Sales of New Graduate Events

[New Graduate Placement Support]

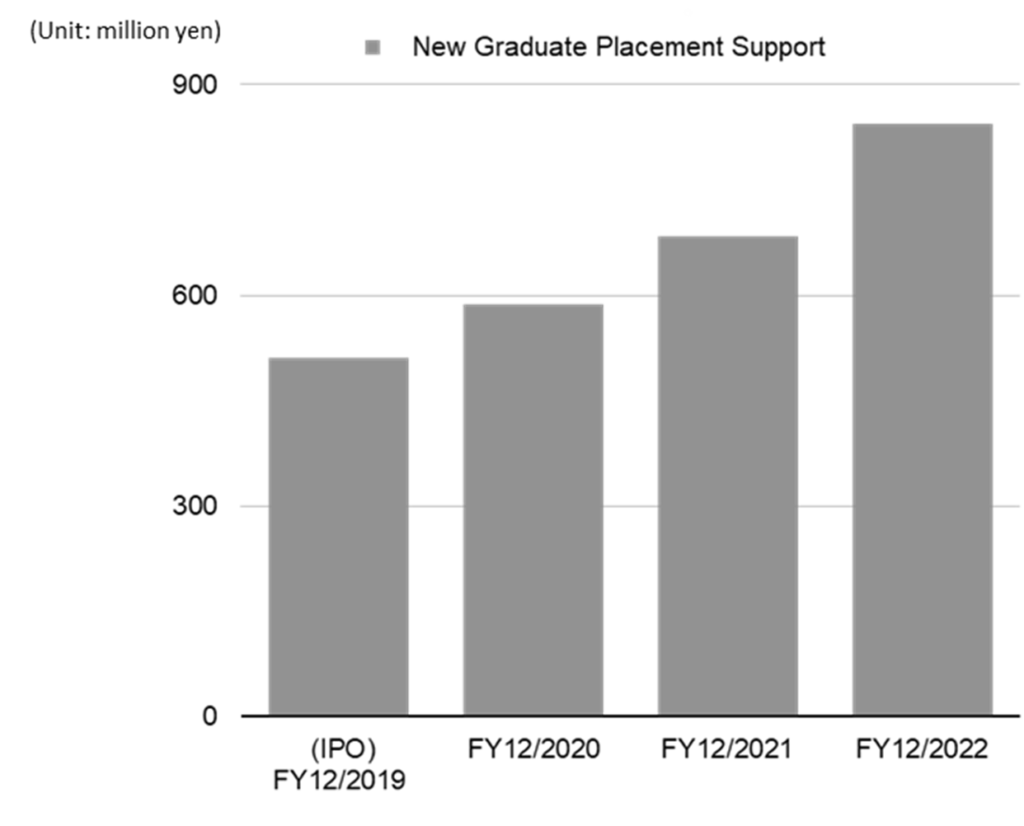

New graduate human resources register on the site “Sponavi” if they belong to a college sports team and on the site “Spochalle” if they have other sports experience, including university sports clubs and high school athletic teams. The company provides job-hunting counselling to these registrants, introduces them to prospective employers, and receives a recruitment consulting fee from companies as a performance fee after the job offer is accepted. In FY2022, it accounted for 30% of company sales, or up 23% YoY. 85% of this revenue is related to Sponavi for students belonging to college sports teams.

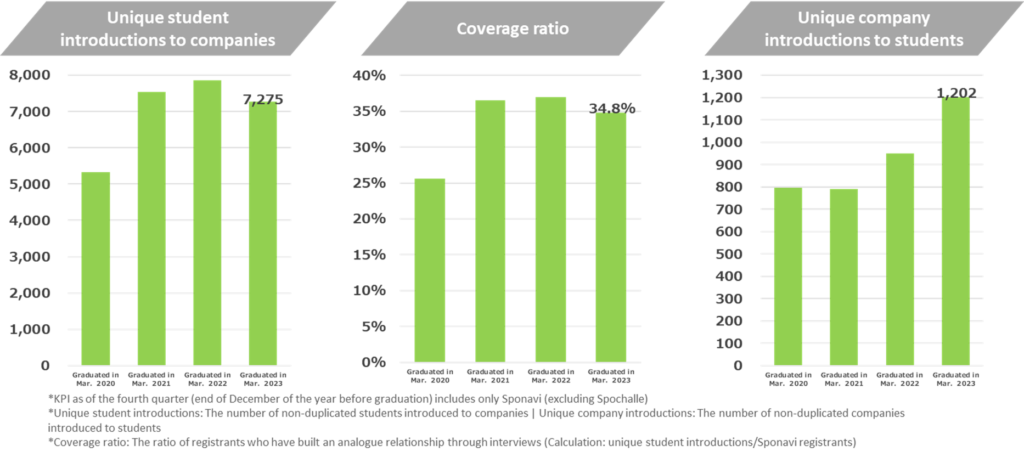

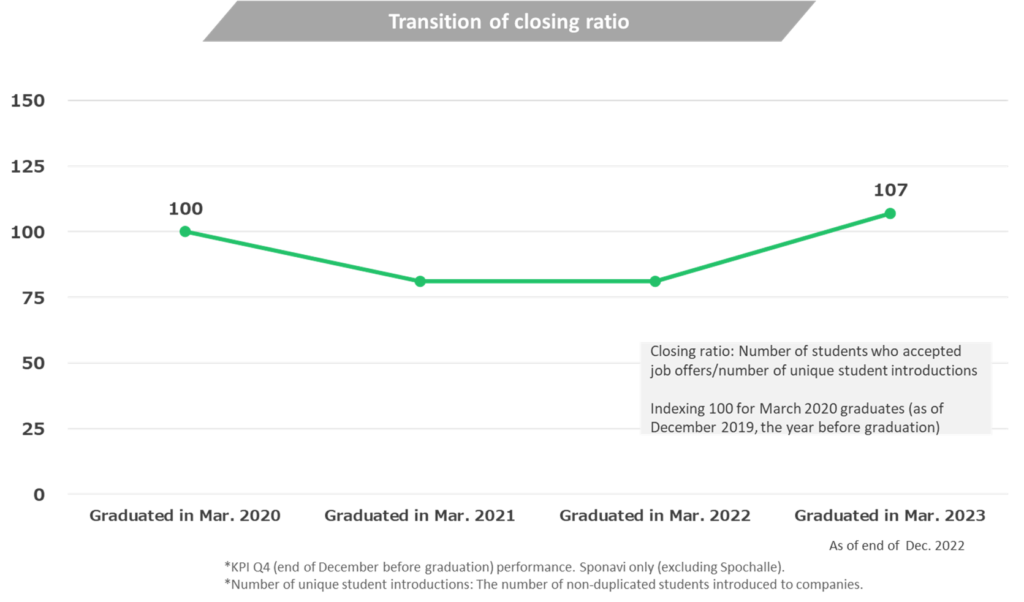

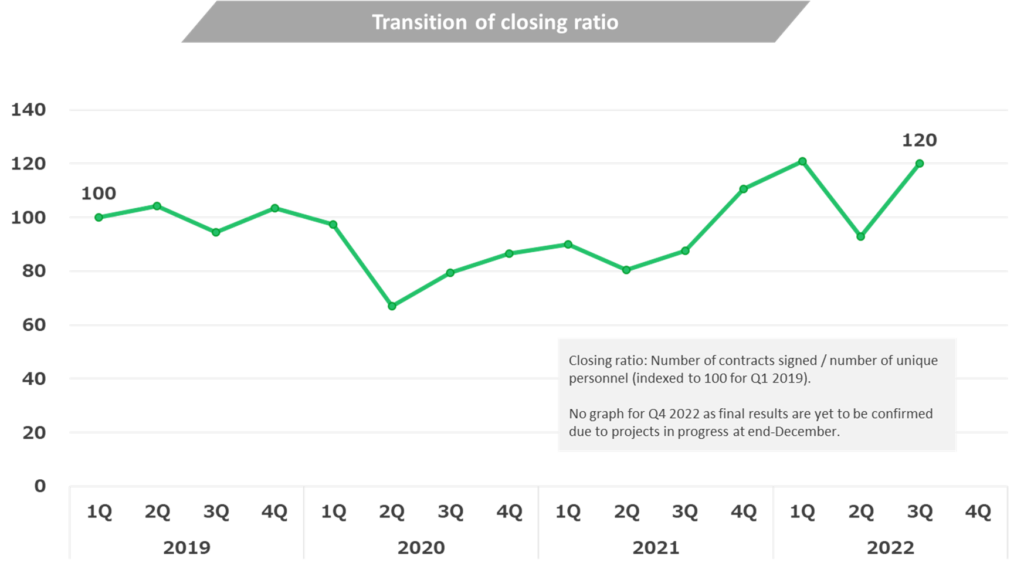

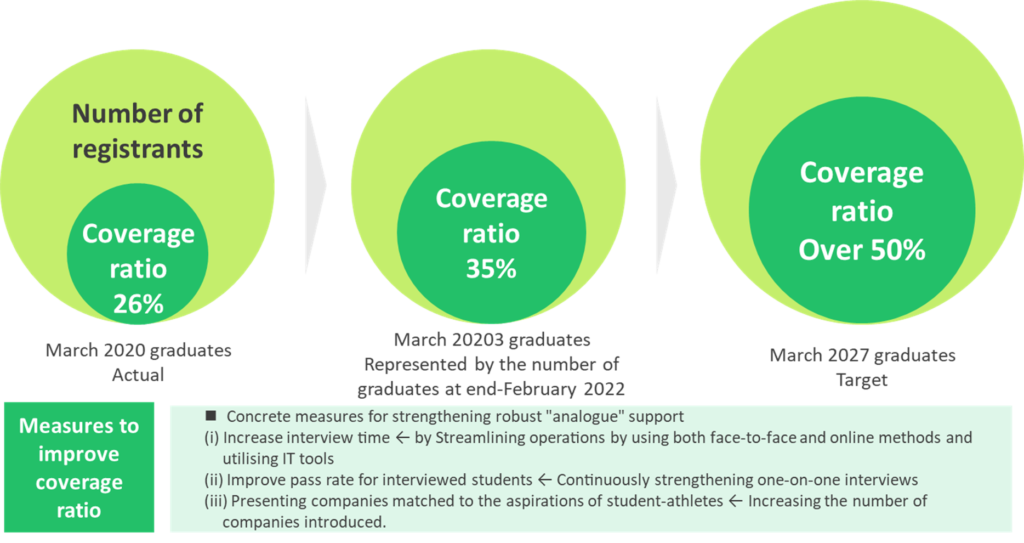

The KPIs are the number of Sponavi registrants (including Spochalle registrants), the number of unique student introductions (i.e. non-duplicated students introduced to companies), the number of unique company introductions (i.e. non-duplicated companies introduced to students), the coverage ratio (unique students divided by the number of Sponavi registrants), and the closing ratio (number of students who accepted job offers divided by the number of unique students).

The following graphics show the trends in these KPIs and sales. Steady sales growth is confirmed. However, some KPIs show sluggish growth, such as the number of Sponavi registrants, unique students, and coverage ratio. It is necessary to monitor the progress of the KPIs for each cascade.

KPIs for New Graduate Placement Support

KPIs for New Graduate Placement Support (contd)

Sales of New Graduate Placement Support

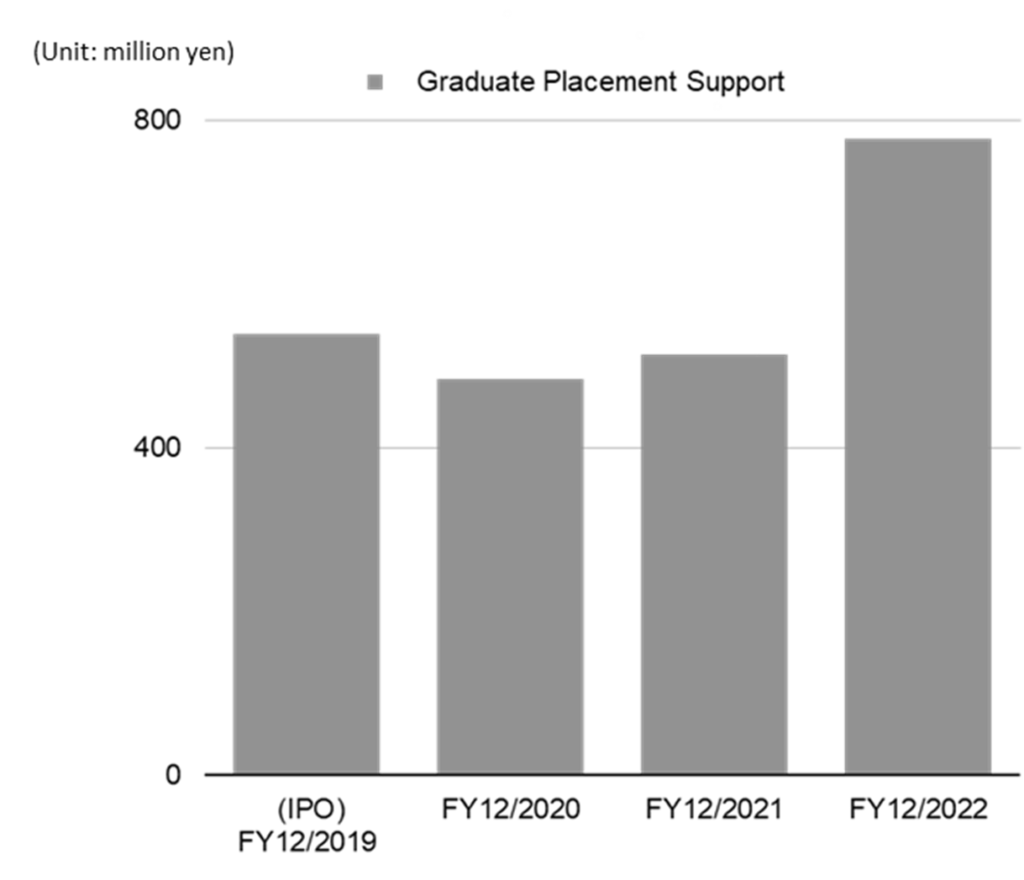

[Graduate Placement Support]

Provides employment counselling for graduate sportspeople (including second-time graduates) and receives an introduction fee from companies as a performance reward. It accounts for 27% of the total sales for FY2022.

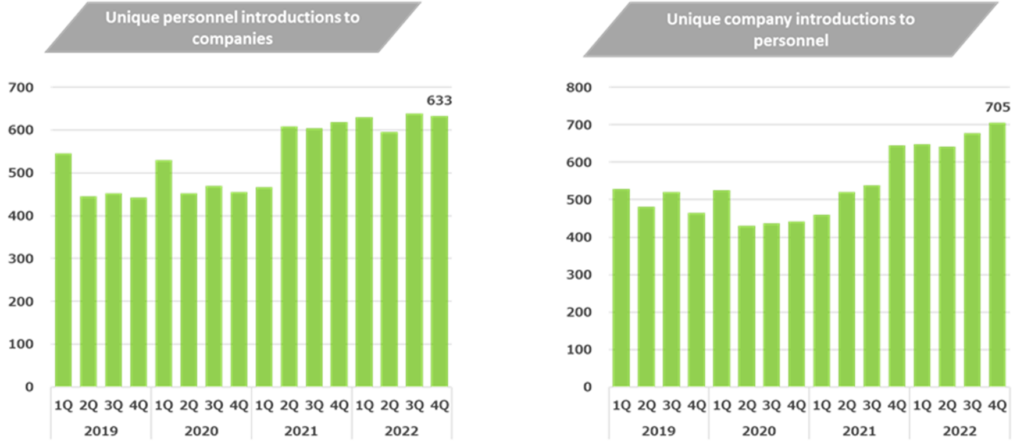

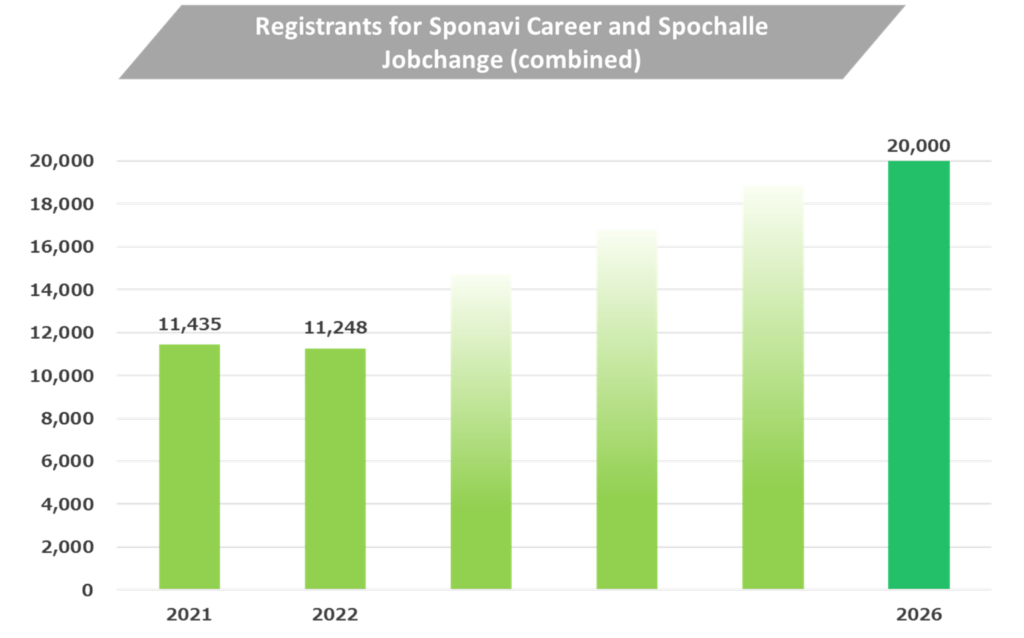

The KPIs are the number of registrants on Sponavi Career and Spochalle, the number of unique personnel introductions (i.e., non-duplicated personnel introduced to companies), the number of unique company introductions (i.e., non-duplicated companies introduced to job seekers), and the closing ratio (the number of personnel who accepted job offers divided by the number of unique personnel).

The graphics below illustrate the trends of KPIs and sales. The significant increase in sales in FY2022 is mainly due to the rise in personnel introductions, company introductions, and contract rates, driven by the increased hiring enthusiasm among companies amidst the rising number of registrants.

KPIs for Graduate Placement Support

KPIs for Graduate Placement Support (cont.)

Sales of Graduate Placement Support

[New business]

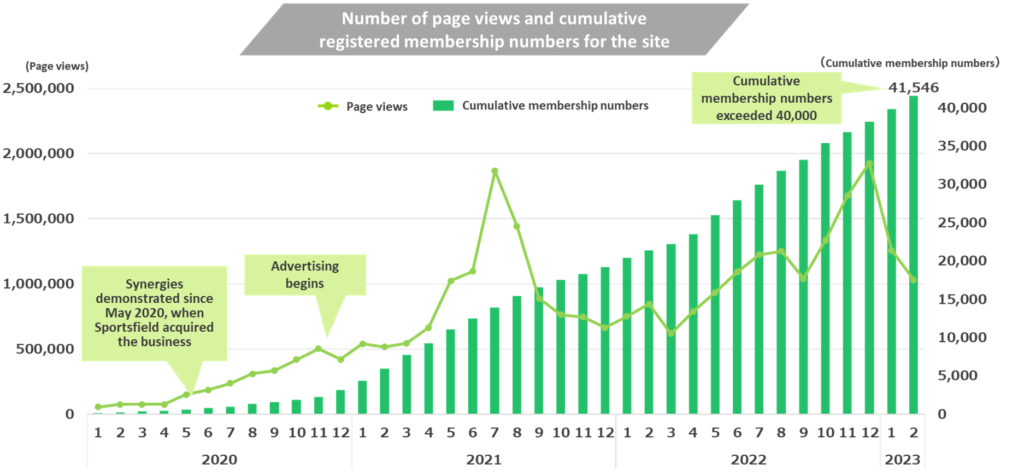

We will explain two new businesses, Spojoba and Sponavi Athlete (Dualcareer).

Spojoba

A job posting site business acquired in May 2020.

While the primary business specialises in sports-related personnel, emphasises analogue techniques, and introduces personnel to a wide range of companies, this business does not necessarily limit its registrants to sports personnel, whereas limiting its recruiting companies to sports-related companies and focuses mainly on online matching.

However, it is expected that the registrants and job-posting companies in the main business can be utilised as a foundation for this business. Although there are aspects that require attention, such as cannibalisation with existing businesses, this business could be a critical factor in achieving multilayered marketing channels, adding a web channel to the company’s existing marketing channels, and maintaining high profit margins in the medium to long term while continuing to grow.

There is no disclosure of revenue or earnings contributions, but the site’s PV (page views) and cumulative registered membership numbers are steadily increasing.

Spojoba KPI

Sponavi Athlete (Dualcarrier)

This business provides income opportunities such as temporary employment during an athlete’s career and second career opportunities such as full-time employment after retirement.

This business is expected to develop social infrastructure for continuing sports and activate student athletic team activities and other sports activities.

There is no sales or profit contribution disclosure, but the number of supported athletes is reportedly 394 as of the end of February 2023.

Medium-term management plan (2022-2024)

Upward revision of the medium-term management plan

The company announced a three-year medium-term management plan from December 2022 to December 2024 on March 18, 2022. However, the results for the plan’s first year, FY 2022, significantly exceeded the targets of the medium-term management plan, and the profit target for the plan’s final year was also greatly surpassed. Consequently, on March 20, 2023, the plan was revised upward. Hence, the following examines the revised medium-term management plan.

The revised medium-term management plan

Background and content of the revision

The background of this upward revision is that it is expected that the social impact of the COVID-19 pandemic will diminish and the employment situation will continue to pick up, and there will be steady growth in the demand for sports human resources.

Therefore, while maintaining the long-term management goals and strategic direction, the revised plan aims to take advantage of the tailwind of the employment situation in each of the main businesses, i.e., New Graduate Events, New Graduate Placement Support, and Graduate Placement Support, to solidify a leading position in specific markets and maintain and improve high profitability.

Of worth note is the plan to achieve a high sales growth rate in the +10% annual range while maintaining a recurring profit margin of over 20%.

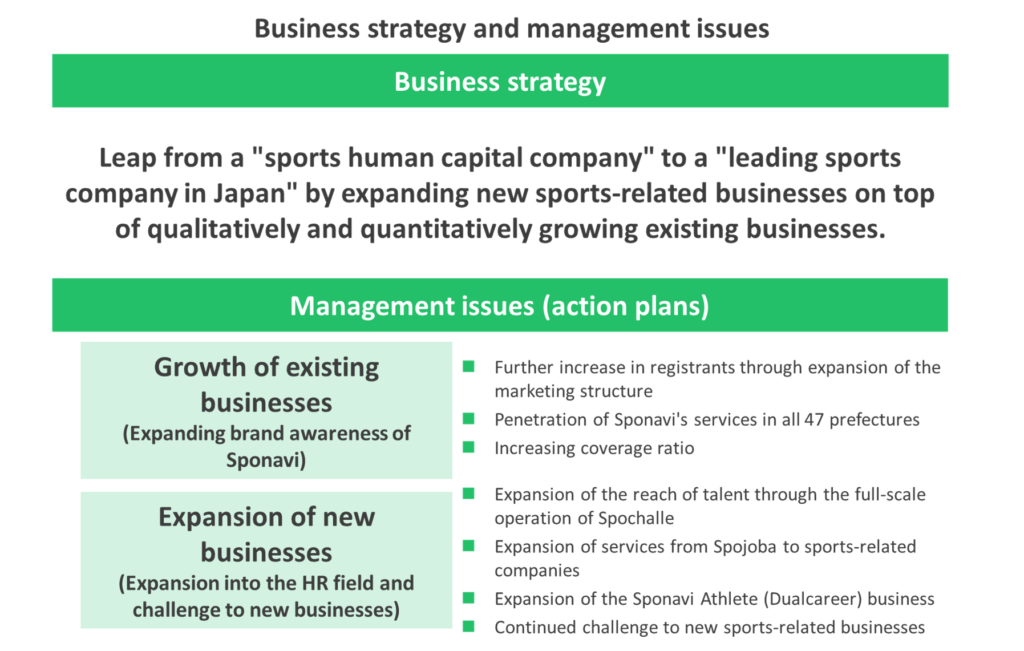

The essence of business strategy and management issues reconfirmed in the medium-term management plan

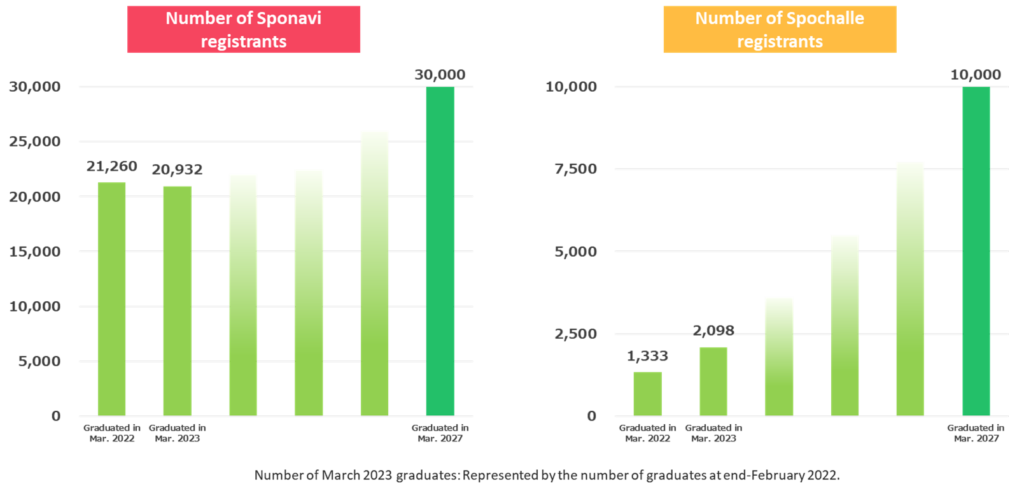

Forecast of main KPIs

The following section provides an overview of the main KPIs the company targets in the medium to long term.

- Sponavi registrants: Increase from just over 20,000 at present to 30,000 graduates by March 2027

- Spochalle registrants: Increase from just over 2,000 at present to 10,000 graduates by March 2027

- Coverage ratio (unique student introductions / Sponavi registrants): Raise from approximately 35% at present to 50% by March 2027

- Sponavi Career and Spochalle Jobchange registrants (combined): Increase from just over 11,000 at present to 20,000 by 2026.

Main KPI

Points to Consider Beyond KPIs

Above, we provided an overview of the revised medium-term management plan’s strategy, metrics, and KPIs. However, there are other points that investors should note that should have been covered so far.

First, the success or failure of strengthening the company’s human resources. It is assumed that enriching the quality and quantity of sales staff is essential to enhance the business related to new sports graduates, which will drive short-term financial metrics. The key to this effort will be its success or failure.

Second, the risk of going for a rigid cost structure. An increase in personnel can easily lead to a fixed cost structure. If the employment market, which is a face-to-face market, deteriorates abruptly, profit and loss could significantly worsen. Although this pain is inevitable during the growth process, the company’s management skills will be repeatedly tested as to whether it can continue to grow by managing the employment market’s fluctuations well.

Third, capital efficiency. Although the metrics target for the PL statement has been shown in this plan, targets for asset and capital efficiency, such as ROA and ROE, have yet to be explicitly stated. As the company is in the phase of strengthening the foundation of its core business, it is not necessary to impose excessive restrictions. Still, investors would like to see management keeping a high level of ROE (71.8% for FY2022 and a four-year average of 26%) in the future. It is vital to monitor whether the financial management satisfies investors in this regard.

Financial results

Full-year financial results

Financial period |

FY12/2019 |

FY12/2020 |

FY12/2021 |

FY12/2022 |

FY12/2023 |

FY12/2024 |

Consolidated, Japanese GAAP

|

(IPO) |

Company

|

Medium-term

|

|||

[Statements of income] |

||||||

Net sales |

1,918 |

1,883 |

2,130 |

2,866 |

3,186 |

3,600 |

Operating profit |

194 |

16 |

-32 |

637 |

680 |

768 |

Ordinary profit |

192 |

32 |

-35 |

634 |

677 |

767 |

Net profit before income taxes |

192 |

32 |

-81 |

634 |

||

Net profit attributable to

|

133 |

17 |

-79 |

412 |

440 |

|

[Balance Sheets] |

||||||

Total assets |

1,106 |

1,488 |

1,541 |

2,127 |

||

Total liabilities |

676 |

1,041 |

1,173 |

1,347 |

||

Total net assets |

430 |

447 |

368 |

781 |

||

Total borrowings |

334 |

731 |

749 |

630 |

||

[Statements of cash flows] |

||||||

Cash flow from operating activities |

198 |

-89 |

54 |

610 |

||

Cash flow from investing activities |

-25 |

-32 |

-68 |

-7 |

||

Cash flow from financing activities |

150 |

396 |

18 |

-120 |

||

Free cash flow |

173 |

-121 |

-14 |

602 |

||

Cash and cash equivalents

|

686 |

962 |

966 |

1,448 |

||

[Efficiency] |

||||||

Ratio of ordinary profit to sales |

10.0% |

1.7% |

-1.7% |

22.1% |

21.2% |

21.3% |

ROA |

14.4% |

1.3% |

-5.2% |

22.5% |

||

ROE |

47.3% |

3.9% |

-19.4% |

71.8% |

||

[Per-share] Unit : Yen |

||||||

EPS (Adjusted for stock splits, etc.) |

41 |

5 |

-22 |

114 |

122 |

|

BPS (Adjusted for stock splits, etc.) |

122 |

127 |

103 |

216 |

||

DPS (Adjusted for stock splits, etc.) |

0 |

0 |

0 |

0 |

0 |

|

[Number of employees] |

||||||

Number of consolidated employees |

201 |

233 |

266 |

242 |

Source: Omega Investment from company materials.The per-share indicators EPS and BPS are adjusted for the 1:2 share split carried out in March 2023.

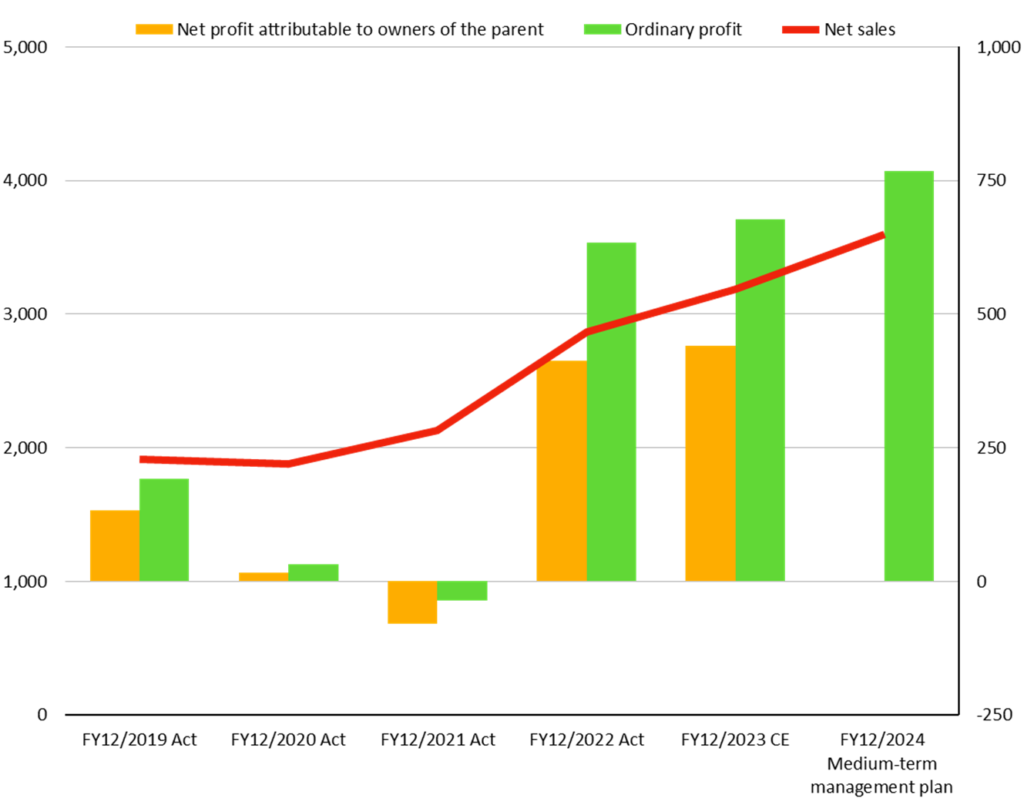

Key PL items

Unit: Million yen, Sales: Left axis,

Ordinary profit, net profit attributable to owner of parent: Right axis

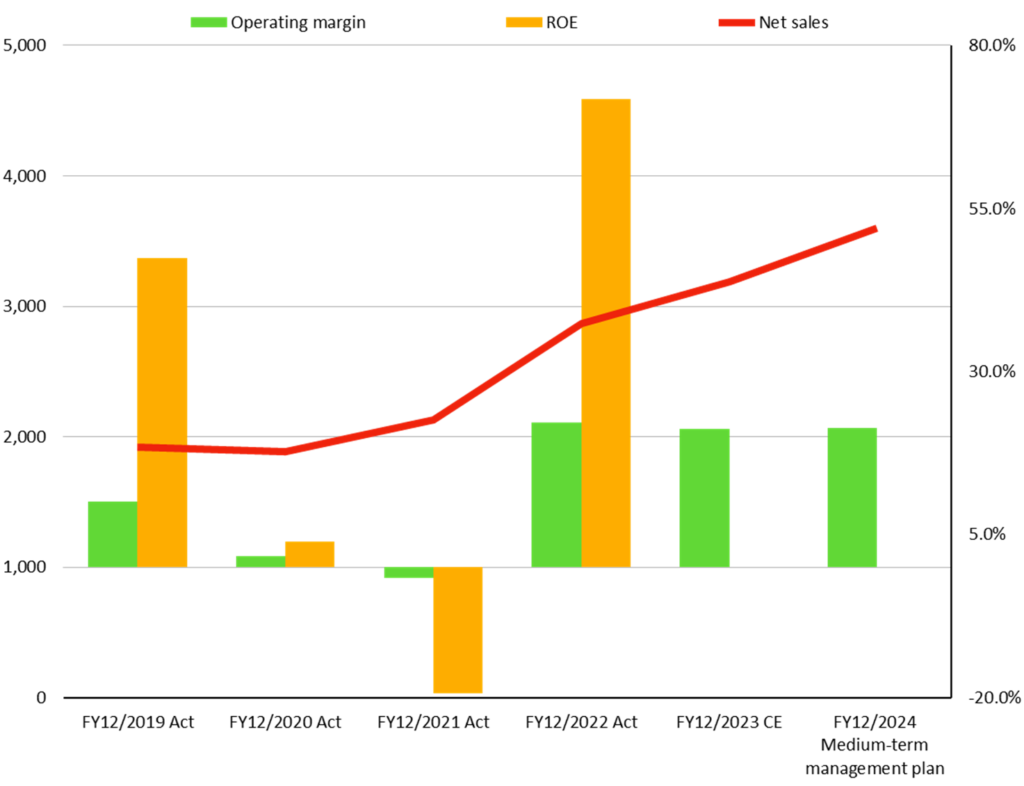

Sales, operating margin, and ROE

Sales: Left axis, Recurring profit margin, ROE: Right axis

Profit and loss to date

The company went public in December 2019. Sales in FY2019 were 1.9 billion yen, and the operating profit margin was 10%. This was a reasonably good result close to the landing forecast at the time of the IPO.

Shortly afterwards, however, the company expanded its marketing staff and office space in the middle of the unstable hiring environment amidst the influence of the COVID-19 pandemic. As a result, the sales were largely unscathed during FY2020 and FY2021. But profit-wise, the company posted significant declines in FY2020 and suffered small losses in operating profit, recurring profit, and net profit in FY2021, as it could not cover the cost rises.

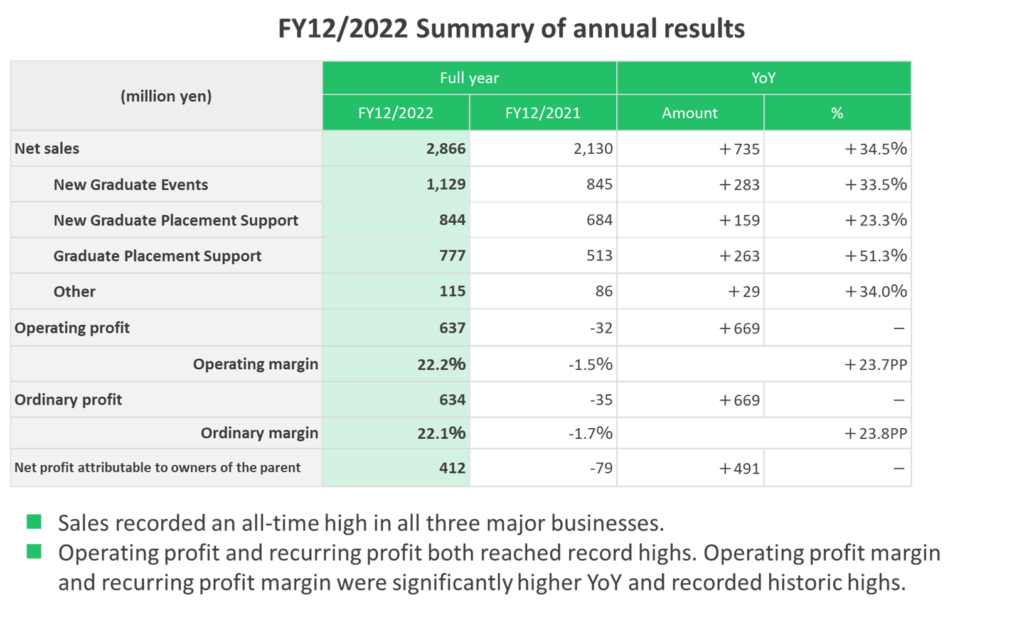

In FY 2022, the recruitment market began to recover, and the three main businesses achieved high sales growth. Meanwhile, COGS and SGAE increased only slightly, resulting in a significant turnaround in operating profit, from a loss of 35 million yen to a profit of 634 million yen.

Cash flow and balance sheet

The company business is asset-light and does not require tangible fixed assets much. Therefore the results of its operating activities are directly reflected in its operating cash flow, which is linked to its free cash flow.

In the balance sheet, the company is essentially debt-free (net cash), a structure where free cash flow is pooled as cash.

Asset efficiency

In summary, it can be said that FY2022 was a year in which the results of the efforts to strengthen the business infrastructure since IPO quickly materialised thanks to the improved recruitment market. The recurring profit margin on sales was 22.1%, ROA was 22.5%, and ROE registered 71.8%, the highest since going public. These figures are good both as a listed company and an emerging start-up company.

FY2022 Highlights

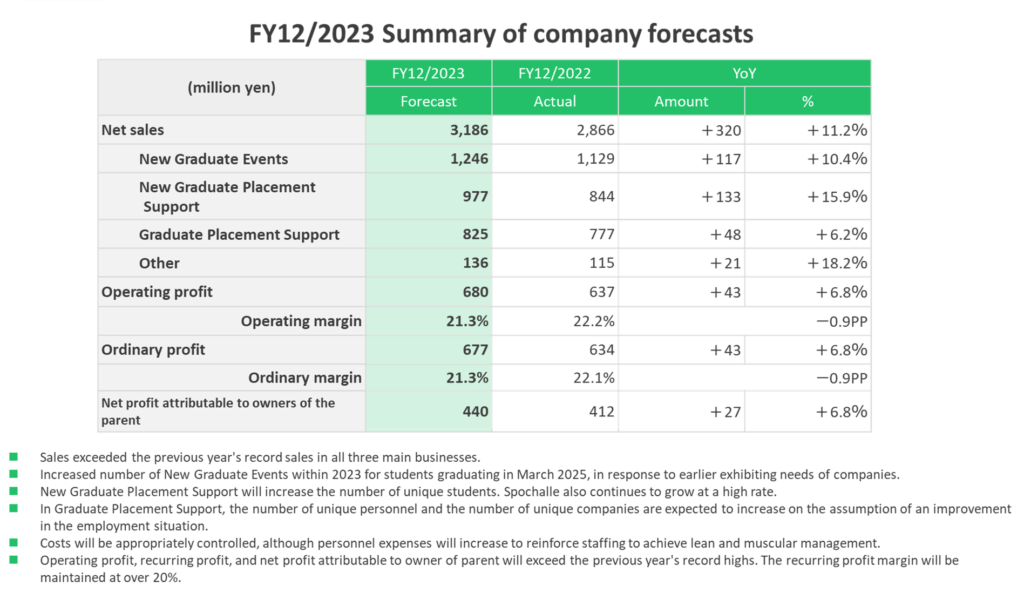

Company forecast for FY12/2023

Although previously mentioned in the current mid-term business plan overview, let’s look at the company forecast for December 2023. The company has only disclosed its full-year forecast for two consecutive years of sales and profit growth. The estimates are as follows: net sales of 3,186 million yen (+11% YoY), operating profit of 680 million yen (+7%), recurring profit of 677 million yen (+7%), net profit attributable to owner of parent of 440 million yen (+7%), EPS of 121.76 yen, and a plan to continue with no dividend payment.

Considering the improvement in the hiring environment, the net sales forecast looks reasonable. The plan is to expand performance mainly by the core businesses, New Graduate Events and New Graduate Placement Support.

If we were to raise a point of concern, it would be that the projected profit growth is smaller than the sales growth. According to the disclosed material, this is due to the assumption of increased personnel expenses and advertising and publicity expenses for growth. These are duly considered necessary given the company’s current position.

It may not be meaningful to dig deeper into the initial plan as some conservative considerations may have been embedded. However, as we advance, we want to see positive outcomes in quarterly results, not as “sales did not grow despite increased costs”, but as “our core business recorded steady sales (or overachieved targets) through efficient cost management, and we actively promoted forward-looking investment as a stepping stone to the future. Nevertheless, We have landed on our target of a 20% recurring profit margin”.

Note that the estimated ROE for FY12/2023 is 44%. Investors should keep an eye on whether the high ROE can be maintained.

Highlights of FY2023 Company plan

Share price trend

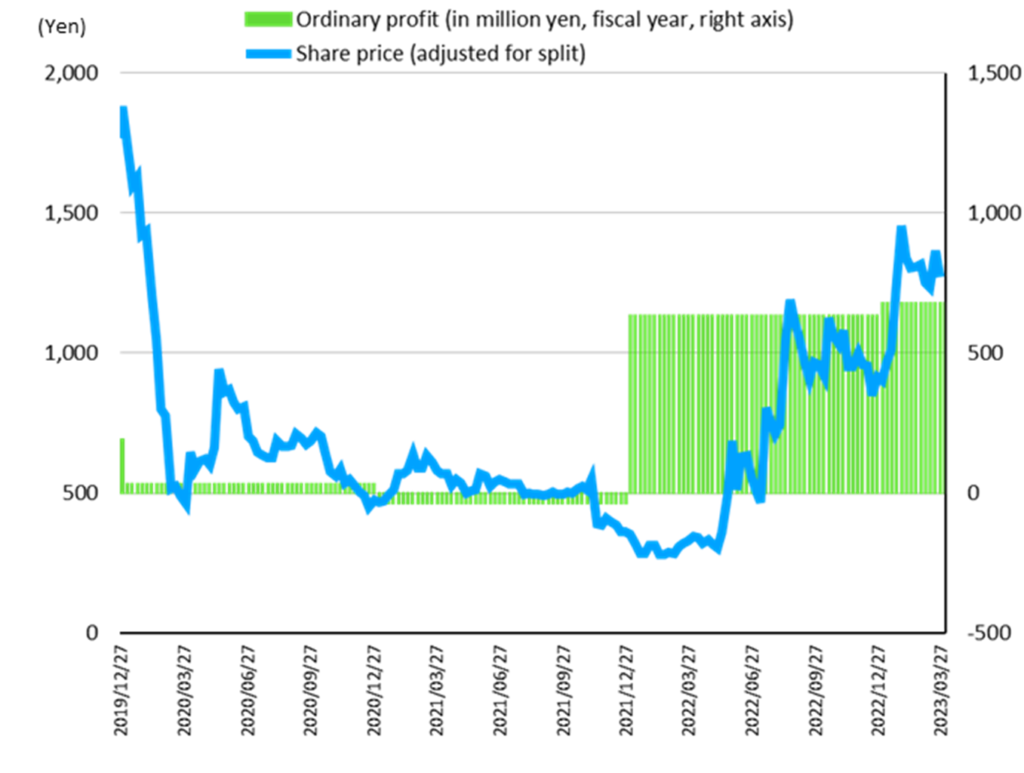

Sportsfield (7080) – Share price trends (since IPO, weekend close, adjusted for recent stock split)

The share price has entered a stage where it reflects financial performance straightforwardly.

The graph above shows the trend of the company’s share price (weekend closing prices, adjusted for recent stock splits) plotted on the left axis and the company’s annual recurring profit (actual records and company forecast for December 2023) plotted on the right axis.

Compared with the profit, the share price since the IPO is observed to have entered a stage where it discounts financial performance straightforwardly. Optimistic growth expectations often drive the share price at the time of listing. However, in the company’s case, such optimism was once dropped due to poor business performance caused by the COVID-19 pandemic.

As a result, the subsequent share price reflected business performance sensibly. Moreover, as the business environment improved and the earnings quickly recovered, the stock market began to evaluate the robustness of the company’s business model and the management strategy that proved right in a more orderly manner.

The current share price (closing price on April 27, 2023, at 1,512 yen) is 12.4 times the company’s expected EPS of 121.6 yen for the current fiscal year, indicating sensible pricing of the shares.

This sensible pricing is the groundwork for the share price to rise orderly in line with profit growth and growth potential in future, in other words, reflecting the company’s actual competence. This is likely to attract more and more investors.

For reference, the critical share prices are listed on a post-split basis.

IPO offer price 682.5 yen (pre-split price)

Initial listing price 2,125 yen (8,500 yen pre-split)

High 2,197.5 yen (8,790 yen pre-split)

Low 261.75 yen (1,047 yen pre-split)

The current share price is effectively double the IPO offer price. The initial listing price and the historic high are the share prices to be further exceeded.

Equity stories and equity investors’ focus

This section recapitulates investment opportunities from the perspective of equity investors and shareholders.

Equity story

This has been mentioned in the business overview section but will be reiterated.

- Specialisation in the sports talent field: The company provides human resource services by concentrating on new graduates, particularly sports students, who are highly rare and in high demand for company recruitment.

- Differentiated marketing strategy: Marketing staff, mainly professionals with sports experience, provide analogue support to students. The company appears to be expanding nationwide ahead of its competitors.

- Entry barriers and efficiency: After about ten years of business, the company has established a strong sales base, which has resulted in job seekers being attracted via word of mouth. Employer evaluations are also considered well-established from the trend of event sales slots. These achievements become first-mover advantages and form entry barriers. Furthermore, they contribute to increasing the efficiency of marketing activities.

- High profitability: The results of a robust revenue base manifested in the FY2022 financial results (record profits, recurring profit margin of 22.1%, ROA of 22.5% and ROE of 71.8%) when the recruitment market began to normalise.

- Asset-light, cash-flow-generating business structure: The company’s business assets lie in its employees and know-how, and the burden of capital spending etc., is extremely light. Operating cash flow links to free cash flow; simply put, the structure generates cash in line with profits. As a result, the company can generate earnings efficiently without depending on balance sheet inflation. This would increase the company’s financial flexibility for significant investments and enhanced shareholder returns.

- Growth potential in the targeted market: There is still scope for the company to increase its market penetration for sports-talent new graduates (see p17 for the number of Sponavi registrants and the coverage ratios). The number of companies introduced to these sports students has been steadily increasing.

- The groundwork for sustainable medium- to long-term growth: The company lays the groundwork for sustainable growth, such as supporting the job changes of not only new graduates belonging to college athletic teams but also new graduates with other sports experience, a job change for graduates with sports experience, employment support for athletes and web mediation for sports-related companies in their recruitment activities (see p. 9).

- A foothold in maximising the lifetime value of sports talent: If the company can develop a business that steadily stocks new graduates in the sports talent layer every year and supports maximising their lifetime value in the future, it could contribute to the company’s sustainable growth.

- Expectation for a step-up from TSE Growth Market: As the business expands with sustained growth, the company is expected to step up from the TSE Growth Market. The expansion of the investor layers will create a potential for increased demand for the company’s shares.

Valuation

As explained in the section on stock price trends, the current stock price (closing price on April 27, 2023, at 1,512 yen) is 12.4 times the company’s expected EPS of 121.6 yen for this fiscal year, indicating a sensible stock price formation.

If the revised medium-term management plan is steadily achieved, equity investors’ confidence increases, and the company’s potential described above could begin to be discounted in the share price. In that case, it should be noted that the shares’ multiples (e.g., PER) may well expand on top of EPS growth and generate high investment performance.

Investor focus and expectations on the company.

This section concludes with a summary of the key points that investors may have regarding the company.

• Rigidity of cost structure and dependence on the hiring market: Since the business model relies on marketing people generating revenue, employees are rigid fixed management assets of the company. Therefore, the decrease in hiring market activity can easily lead to a decline in profitability. This is an inevitable aspect of the business, which discounts the valuation of the shares. Investors would expect management to thoroughly manage costs and improve efficiency during challenging times, demonstrating better performance when hiring market activity recovers. They would like to see the company thrive as a cyclical growth company.

• Growth potential after the saturation of the new graduate athletes market: The company has already laid the groundwork for new businesses, such as recruitment support for recent college graduates with sports backgrounds, sportspeople who already graduated, athletes, and sports companies through web-based recruitment support. Investors would expect these new businesses to take off smoothly.

• Small market capitalisation and low liquidity of the shares: Market capitalisation is expected to improve as the share price rises as profits increase steadily. The company has conducted two consecutive stock splits of 1:2 in 2022 and 2023 to address low liquidity. Currently, individual shareholders are believed to be the prominent participants in the market, but it is expected that a variety of investors will become shareholders as market capitalisation increases. Hopefully, this should increase liquidity and make the pricing of the shares more mature. We hope that the company will steadily expand its business and that the main shareholders, including the president and other principals, will appropriately transfer their shareholdings when stepping up from the Growth Market and help the company to increase its liquidity.

• Dividends: Currently, the company does not pay dividends, which is typical for growth-stage companies. Nevertheless, Sportsfield has declared that it will consider starting dividends when its equity ratio exceeds 50% (36.7% in FY2022), and its net asset amount exceeds 1 billion yen (7.8 billion yen in FY2022). We expect the company to implement a shareholder return policy that also pays attention to ROA and ROE.

• Seasonality of quarterly earnings: In the past, profits in the fourth quarter tended to be lower than in other quarters. While some seasonality is unavoidable due to the nature of the business, shareholders expect the company to keep cost controls tight.

• Evolution of commitment to ESG and SDGs: We would like the company to promote social value in the human resource market proactively. We would also like to see the company expand the diversity of its management team.

Useful information

Principal shareholders

| Name | Number of shares owned |

Ratio of the number of shares owned to the total number of issued shares (%) |

| Katsushi Shinozaki | 409,000 | 22.62 |

| Kazuyoshi Ijichi | 209,600 | 11.59 |

| Tadashi Kaji | 209,600 | 11.59 |

| Shota Morimoto | 209,600 | 11.59 |

| Rakuten Securities, Inc. | 27,400 | 1.51 |

| Sportsfield Employee Stock Ownership Plan | 25,200 | 1.39 |

| Nomura Securities Co., Ltd. | 19,700 | 1.08 |

| Toyotaro Shigemori | 16,800 | 0.92 |

| NOMURA PB NOMINEES (Standing proxy: Nomura Securities Co., Ltd.) | 16,200 | 0.89 |

| Medical Corporation Takemujra Medical Nephro Clinic | 16,000 | 0.88 |

| Katsumi Takemura | 16,000 | 0.88 |

| Total | 1,175,100 | 64.99 |

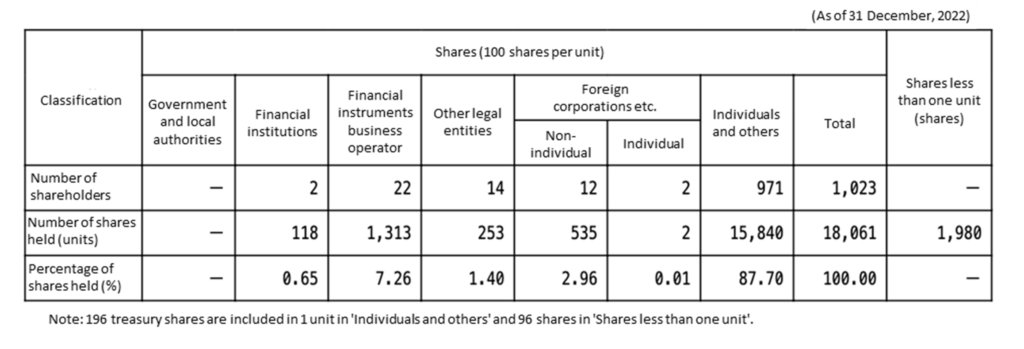

Shareholder composition