Nippon Parking Development (Price Discovery)

| Securities Code |

| TYO:2353 |

| Market Capitalization |

| 78,390 million yen |

| Industry |

| Real Estate |

Profile

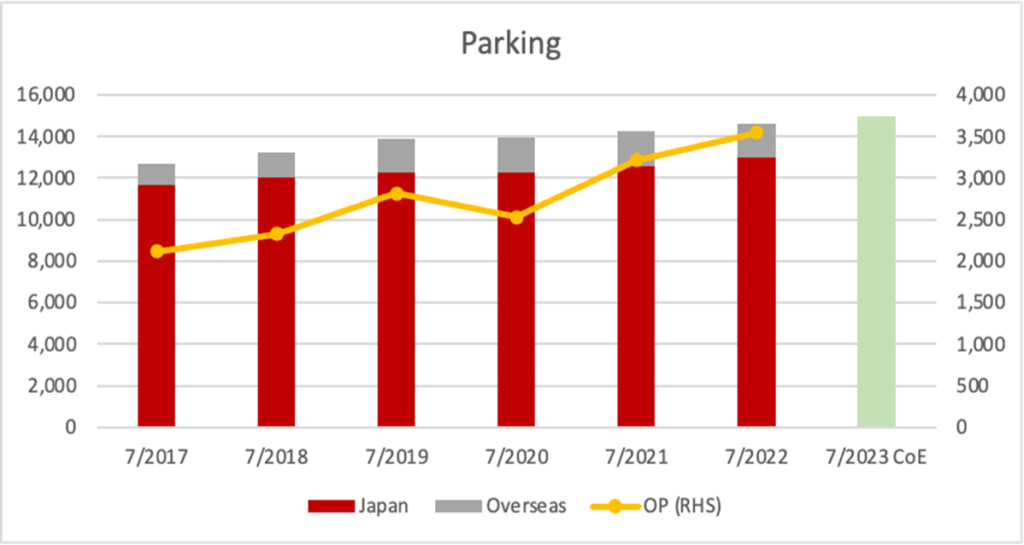

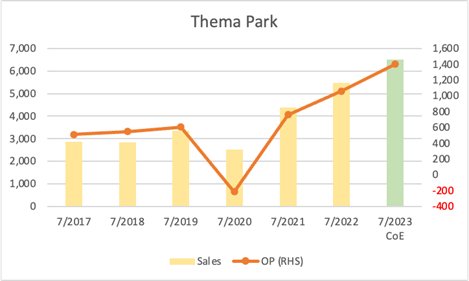

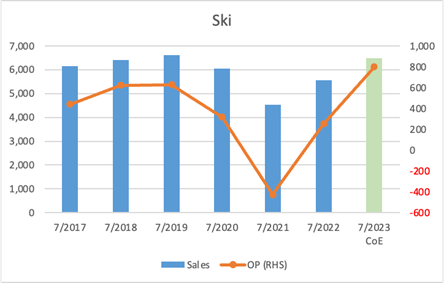

Monthly parking business for commercial and other facilities. The business splits into parking (55% of sales, OPM 24%), ski resorts (21/19), theme parks (21/5) and others (2/29). Others include education, healthcare and real estate.

Stock Hunter’s View

Clear recovery from COVID-19. Focus on growth in ski resorts and theme parks.

Nippon Parking Development, whose three main businesses are parking facilities, ski resorts and theme parks, plans an operating profit of 6.1 billion yen (+33.1% YoY) for FY7/2023, with 87.5% of progress made in the 3Q results (Aug 2022 – Apr 2023) announced on 9 June. Although the 4Q is inactive for the subsidiary Nippon Ski Resort Development, given the momentum up to the 3Q and the strong demand for mountain resorts in May (Golden Week Holiday), the full-year earnings will likely come in above the company guidance.

In the main parking business, the number of monthly enquiries has increased six-fold compared to March 2020 due to the improved profitability of existing properties due to DXing and the number of properties listed on the search website and enhanced property information. As a result, a large volume of monthly user data has become available, and combined proposals to owners based on this analysis have increased the number of new contracted properties. Furthermore, the speed and volume of matching have increased overwhelmingly, contributing to an increase in the number of contracts signed and an improvement in the contract rate.

The overseas parking business is also on a recovery trend. In Thailand and South Korea, office tenants returned due to the recovery in human flow, and earnings at existing properties improved. In Thailand, the company started providing parking facilities for sightseeing tours organised with travel companies and also operates parking facilities in large office buildings under new contracts.

Investor’s View

The quality of the business is high. Good entry timing to hold the shares long-term.

Parking, ski resorts, and theme parks are not fresh to investors. Top-line growth is stagnant, with a five-year CAGR of 4% to FY7/2022. Overseas parking business sales delivered +12% but have been flattish in recent years. It accounts for more than 10% of parking segment revenues, but profits are not disclosed. Presumably, profitability compares unfavourable to that of domestic operations.

The attraction of the business

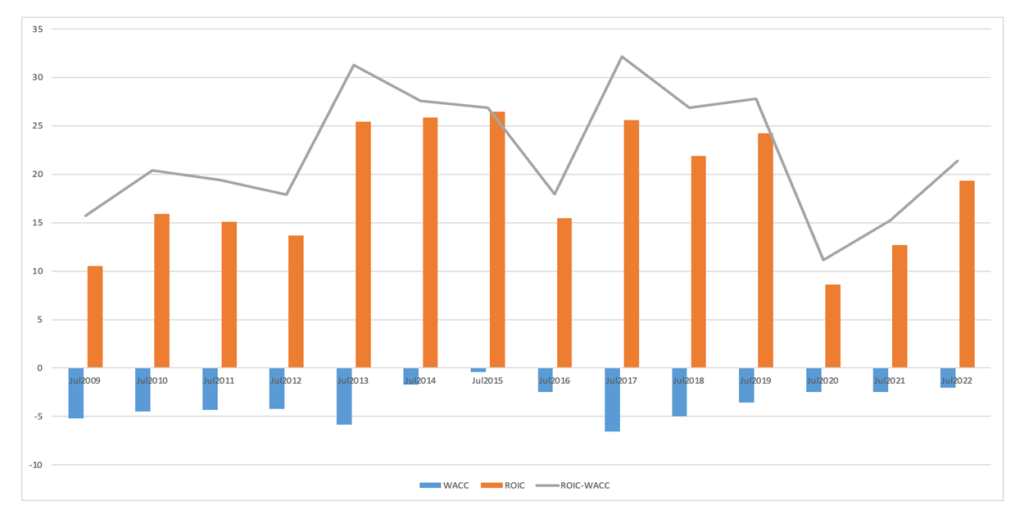

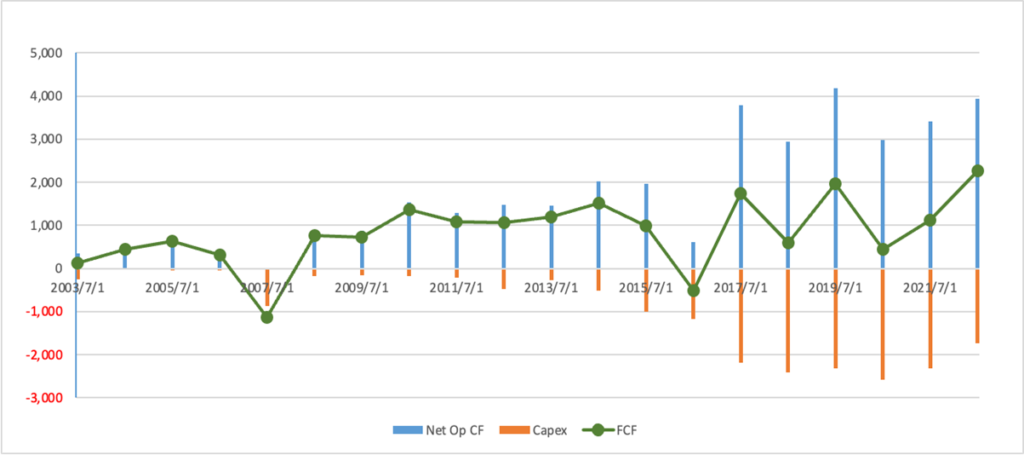

While there is a question mark over growth, the company’s management is felt to be good. This is exemplified by the company’s ability to generate CF, high ROE, attractive economic value creation and more than 50% shareholder returns. It is a good company for shareholders. With a high PBR of just over 6x, we think the shares are sensibly valued.

Sales and OP by segment

Units in million yen. 7/2023 numbers are company estimates (CoE), which do not include Japan/overseas breakdown and apple-to-apple OP forecast for Parking based on the numbers in the official financial report. However, the company expects a 5% YoY increase in the segment’s OP.

Omega Investment.

Operating Income by Segment

| (million yen) | 7/2013 | 7/2014 | 7/2015 | 7/2016 | 7/2017 | 7/2018 | 7/2019 | 7/2020 | 7/2021 | 7/2022 |

| Total | 2,021 | 2,335 | 3,480 | 2,548 | 3,686 | 4,118 | 4,675 | 3,087 | 3,644 | 4,983 |

| Parking | 2,169 | 2,359 | 2,589 | 2,393 | 2,733 | 2,912 | 3,332 | 2,947 | 3,218 | 3,546 |

| Theme Park | – | – | – | 45 | 512 | 548 | 603 | -218 | 761 | 1,061 |

| Ski Resort | 504 | 725 | 905 | 107 | 443 | 625 | 630 | 317 | -429 | 254 |

| Other | -652 | -749 | -14 | 3 | -3 | 34 | 110 | 40 | 94 | 121 |

Totals are before inter-segment adjustment.

Omega Investment.

Good for long-term accounts

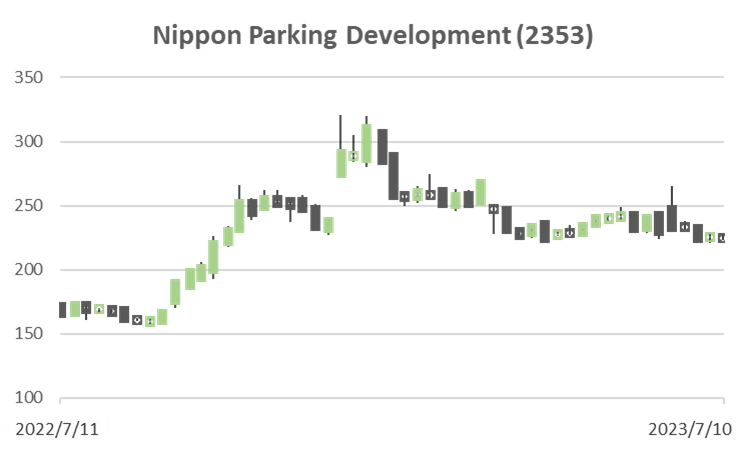

The share price doubled by the end of the last year from the result announcement in September 2022. This was due to the recovery of ski resorts and theme parks hit by the pandemic disease and bad weather. Since the beginning of this year, the share price overrun has been adjusted, and PER is close to its three-year low. If the results for FY7/2023, which are due to be announced on 8 September, confirm the good performance noted by Stock Hunter, and if a forecast for rising profit in the new fiscal year is revealed, the share price could rise interestingly. Return on capital, stable EPS growth to the tune of 7%-8% a year and excellent CF generation are attractive and make it a share to hold for the long term rather than sell for short-term gains.

ROIC – WACC(%)

Omega Investment。

Free Cash Flow (Y-mn)

Omega Investment。