Autobacs Seven (Price Discovery)

| Securities Code |

| TYO:9832 |

| Market Capitalization |

| 125,865 million yen |

| Industry |

| Wholesale business |

Profile

Largest auto accessory shop in Japan. It operates franchise shops that sell automotive accessories and provides automotive services. Services include installation, car sales and purchase, car maintenance and inspection, and body repair and painting. It also operates in Europe and Asia. Sales split into Domestic Autobacs 76% (OPM11%), Overseas 6 (-2), Dealer BtoB Online Alliance 17 (1) and Others 2 (-12).

Stock Hunter’s View

Good performance Is expected thanks to the recovery in new car sales, increased outing opportunities and maintenance demand. In the medium term, ETC replacement demand will benefit.

The impact of the semiconductor shortage has eased, and vehicle production is improving. The number of new cars sold in Japan in the first half of this year recovered strongly, up 17.4% YoY. This is a tailwind for Autobacs Seven, Japan’s largest car accessory shop.

In the previous FY3/2023, the company posted higher sales and profits YoY despite the new car production cuts and rising costs. The company plans sales of 243 billion yen (+2.9% YoY) and an operating profit of 12.3 billion yen (+4.9% YoY) for FY3/2024. In addition to an increase in demand for car electronics accessories due to a recovery in new car production and increased opportunities to go out, maintenance is expected to increase due to the longer life of vehicles.

Domestic same-store sales in June, the latest figures announced, were up 3.3% YoY, marking the 19th consecutive month of YoY growth. The dealer, BtoB and online alliance business, which is positioned as a growth driver, turned profitable in the previous year. The overseas business is also expected to turn profitable this year, and fine results are anticipated for Q1 (Apr-Jun 2023), which is scheduled to be announced on 31 July.

In the next FY3/2025, which will mark the 50th anniversary of the company’s founding, a commemorative dividend is expected to be paid, and, from a medium-term perspective, replacement demand for ETC systems is anticipated due to the ‘ETC 2030 problem’. This will result from changes in security standards, and models incompatible with the new standards will no longer be usable.

Investor’s View

Aggressive ROE improvement measures awaited.

A notable management policy of the company is its very proactive shareholder returns. The average dividend payout ratio over the past ten years is 97%; in the last five years, it is 85%. At the same time, the company has consistently repurchased its shares. As a result, the number of shares, net of treasury shares, has shrunk by 11% over the past ten years.

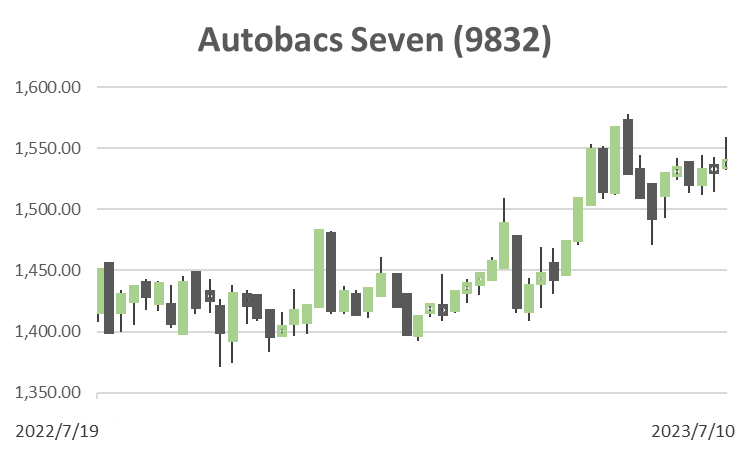

The share price has been lacklustre

However, the share price has been lacklustre. The share price fell from 2018 to 2021 and stopped to decline in 2022, outperforming TOPIX. Since the beginning of the year, the share price has risen by 7% but is still 12% behind TOPIX. PBR is still 0.9x.

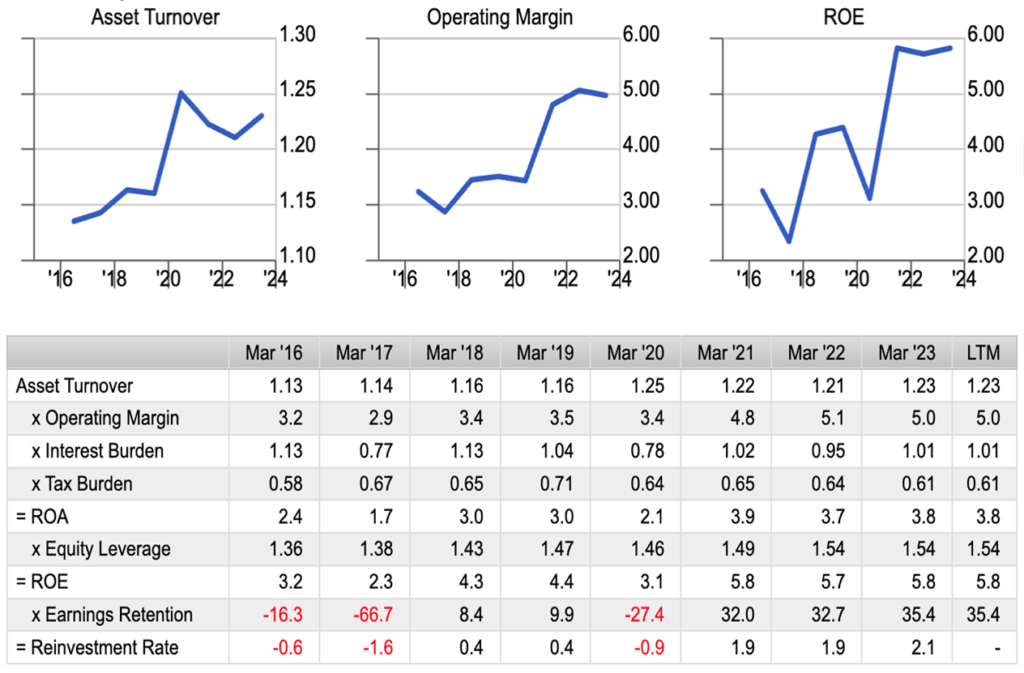

ROE is improving trend-wise, but far from good enough

Poor share price performance is perhaps due to the low level of ROE, which has averaged only 5% over the past five years. Management expects ROE to improve in FY2023, but at 5.8%, which is far below the average for TSE average of around 9%. ROE has been improving, mainly due to a sustained increase in operating margins since before COVID-19. However, it is still far from the level that would interest investors. JPX should have asked for management improvement. The possibility that some measures will be put in place in the medium-term management plan being drawn up is a positive factor for the share price.

Dupont Model

Consistent share buyback in the past above 1.0 x book muted BPS growth

Share buyback drove the company’s ROE. But until 2020, share buybacks were carried out at a price above PBR of 1.0, at the expense of BPS growth. Over the past five years, EPS has grown at a CAGR of +7% at a +2% sales growth, but BPS has remained flattish, rising a small +1% and did not contribute to market capitalisation growth. Although a higher ROE would have led to an increase in PBR, ROE was not high enough for investors, so the multiples did not expand as the share was out of investors’ favour.

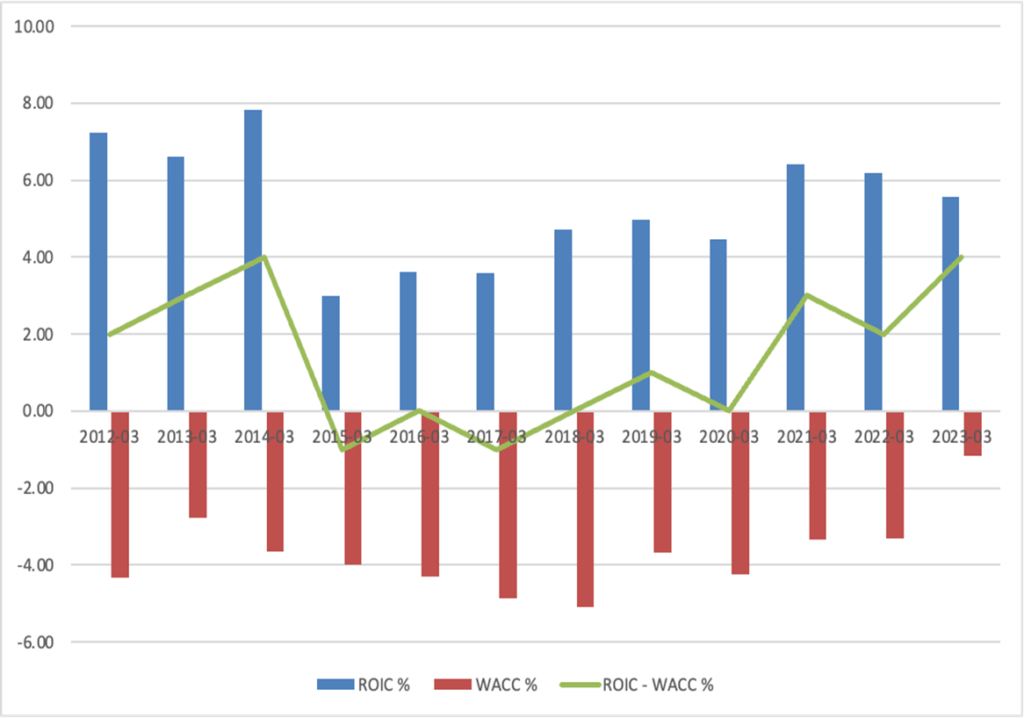

ROIC-focused management is highly rated

The company has been taking steps to manage the entire company by ROIC, which is advanced as a listed company in Japan. The company has steadily increased its ROIC spread over the last few years, getting out of a situation where it could not generate any economic value in the five years to 2020. This should be rated well.

ROIC-WACC

Opportunities for the shares’ upside lie in reassessing the use of CF

Management’s policy is to use CF for investment aggressively. Still, for the sake of the share price, a meaningful measure would be to shift the focus of shareholder returns from dividends to share buybacks and raise ROE close to 10%. Fortunately, the company’s CF generation is good. Management states it will invest 100 billion yen over ten years to double sales to 500 billion yen in 2032. At the moment, the feasibility of this is not predictable.