Towa Pharmaceutical (Price Discovery)

| Securities Code |

| TYO:4553 |

| Market Capitalization |

| 149,087 million yen |

| Industry |

| Healthcare |

Profile

One of Japan’s two leading generic drug manufacturers, the other being Sawai Group HD (4887). Provides more than 500 medicines for lifestyle-related diseases such as hypertension and diabetes, gastrointestinal diseases, neurological diseases, allergic diseases, vitamins and antibiotics. Direct sales are the mainstay, but wholesale is also expanding. Main plants in Osaka, Okayama and Yamagata. Established in 1951.

Stock Hunter’s View

Struggling to strengthen supply capacity. Prolonged shortages in the generic drug market

In the generic drug market, a series of manufacturing and quality control irregularities have been uncovered since around 2020, and many manufacturers have been forced to suspend their operations. The effect of this has been that medical institutions and pharmacies have been unable to secure sufficient supplies of medicines.

Against this background, new offers are concentrated on Towa Pharmaceutical, which in 1Q (Apr-Jun) increased sales by 18% YoY and operating profit by 2.3 times (both compared to the same period last year when the accounting periods of subsidiaries were combined with those of the parent company). Despite strong requests from medical institutions and others to increase production, the company has a policy of not producing more than planned for unprofitable limited-shipment products and prioritising the improvement of profit margins by expanding the production of core products.

On 21 July, Nichi-Iko (delisted in March 2023), a major generic company undergoing a management restructuring, announced that it had discontinued sales of 258 new products. This completes the selection process since March this year, bringing the total number of discontinued products to 578. Towa Pharmaceutical forecasts an 11.4% increase in sales and a 1.2% decrease in operating profit for the full year. Still, the company expects to improve its product mix in the year’s second half and beyond, leading to an upward revision of its operating profit forecast.

Some believe that it will take two to three years to resolve the supply shortage in the generic drug market, and the company’s presence in the market will be further enhanced by its aggressive capacity expansion. The company plans to construct a third solid dosage form building at its Yamagata plant by October this year to achieve a production capacity of 14.5 billion tablets from the next fiscal year. In addition, the Kanto Shipping Centre will start operations on 19 November to supplement shipping capacity in eastern Japan.

Investor’s View

BUY: The positive turnaround in the environment against the backdrop of a structural shortage of generic drug supply is still considered temporary. It would be premature to judge that medium- to long-term profitability and ROE will improve. The structure of the fundamentals are likely to remain unchanged. The quality of Towa’s underlying ROE is not that bad, but it is at risk of hinging on the government’s pharmaceutical administration. However, this is an interesting turning point in the generic drug industry and the company’s near-term earnings and newsflow would be positive. The stock is fine for 10-12 month investment.

As noted by Stock Hunter, various positives for the shares include

1) Shortages in the supply of the generics industry due to the drug fraud issue.

2) Expectations that government measures will be taken in response to this.

3) Towa has steadily expanded its production capacity and has a supply surplus.

4) Expectations that the NHI price revision in 2024 will increase the prices of generics giants with solid supply capacity.

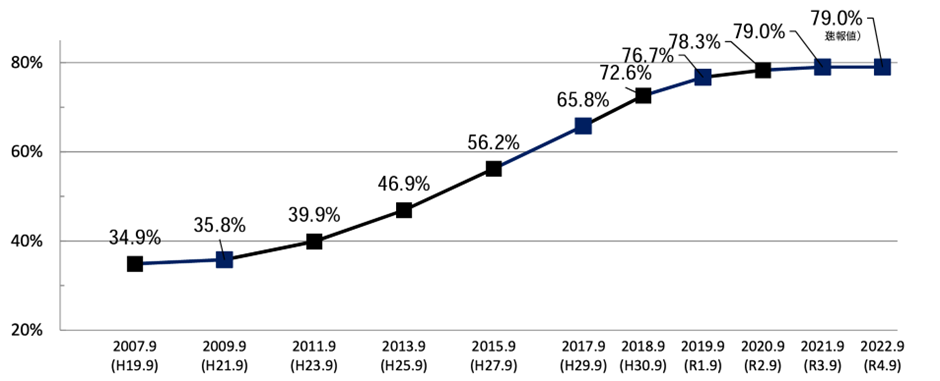

5) Observation that the Ministry of Health, Labour and Welfare (MHLW) will set a new target for generic drug penetration in monetary terms.

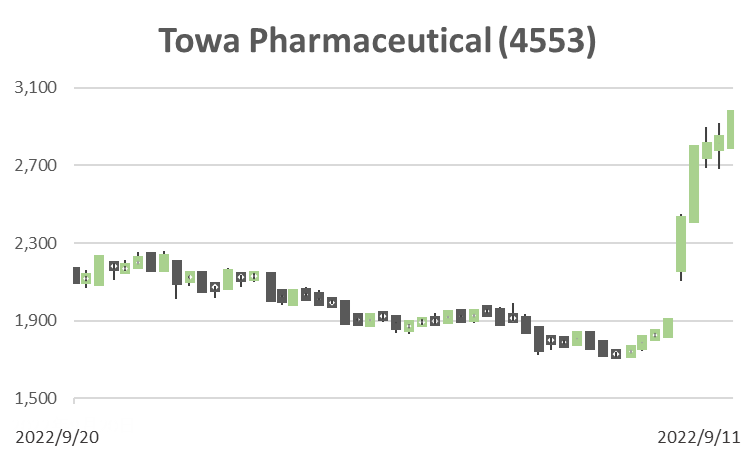

Strong 1Q results and simultaneous upgrades by brokers sent the stock price high. The surge was unusual, as the share price, which has risen by a simple average of +0.7% month-on-month over the past ten years, shot up by 55% in August. There will be a natural

near-term adjustment in share prices. However, quarterly results and newsflow going forward are expected to be positive for the share price.

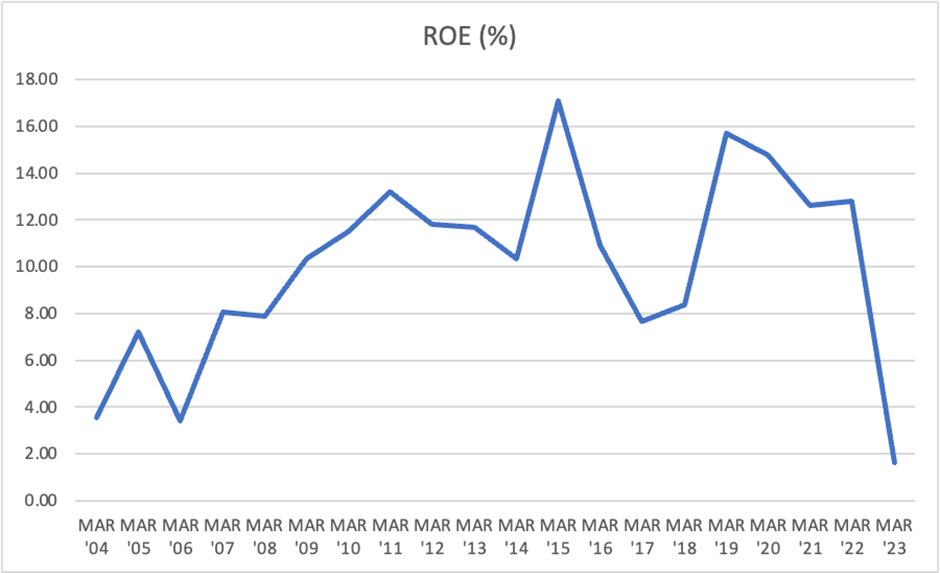

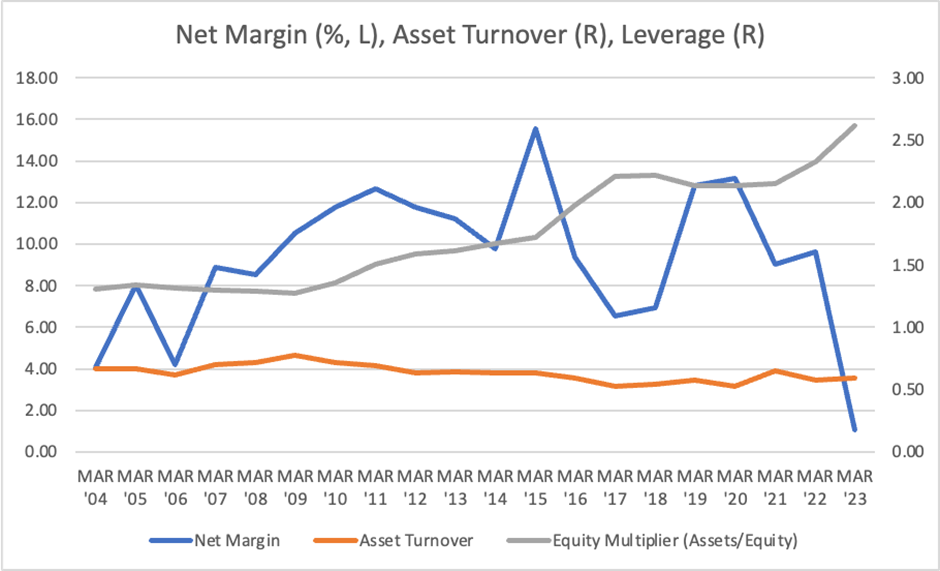

ROE depends on unpredictable net profit margins

Looking back at ROE over the long term, leverage is already quite effective, while asset turnover is extremely low. The volatility of profit margins is significant and difficult to predict as they are not cyclical; a structure can be seen where ROE is determined almost exclusively by the bottom-line profit margin.

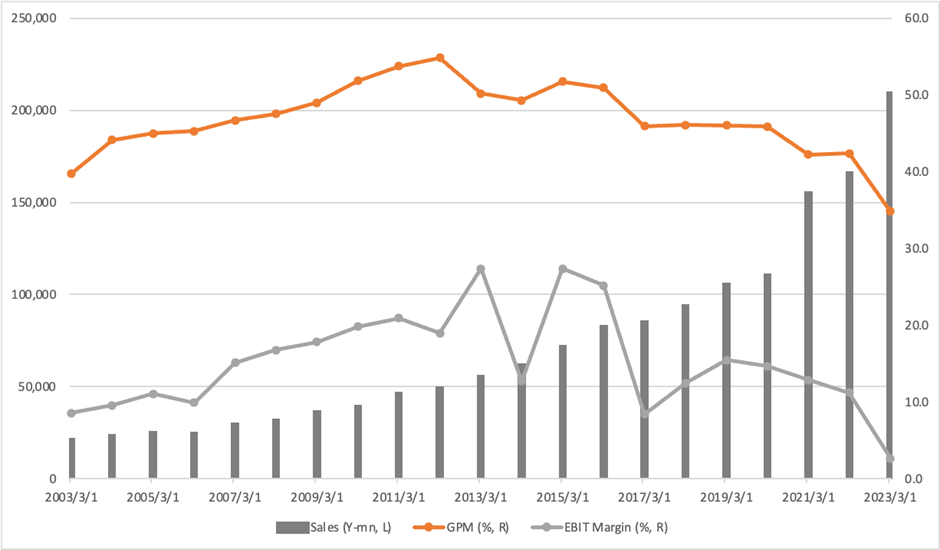

The gross margin trend is negative

Sales have grown enormously in recent years, but gross margins have fallen by an alarming 20 percentage points since peaking in FY3/2012. Through NHI prices and capital expenditure, the consequences of government policy are reflected in the company’s fundamentals.

Sales, GPM, EBIT Margin

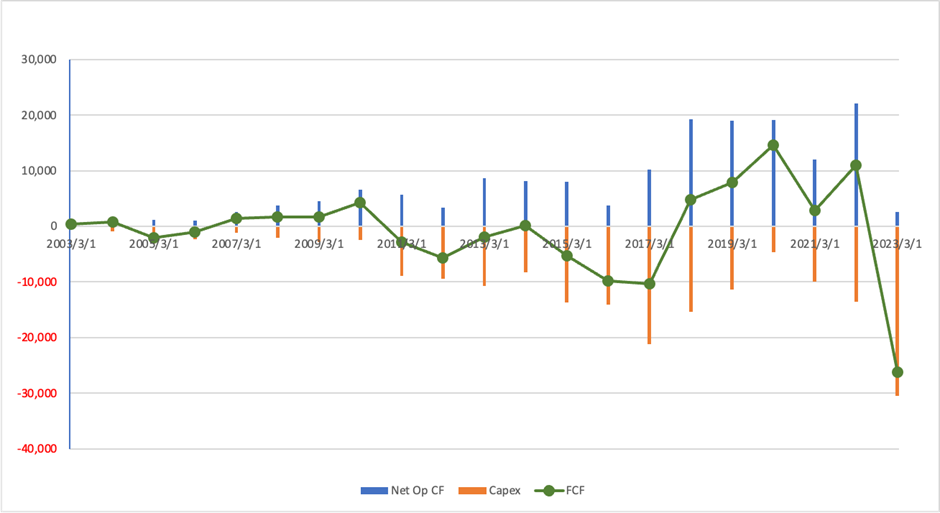

Cash flow consumed by capital expenditure

Operating cash flow is strong, but most of it has been spent on capex in recent years. The Government’s target of achieving a generic drug’s 80% volume share has largely been achieved, and the Government is likely to set a new target for generic penetration in value terms. The percentage of generics in terms of the value of pharmaceutical sales is 41% in 2021, which bodes well for Towa’s top-line revenue outlook, as there is likely to be considerable upside. On the other hand, the company’s capex burden to meet supply shortfalls is expected to remain unchanged, putting downward pressure on profit margins, and asset turnover is unlikely to improve visibly.

Net Operating CF, Capex, FCF

Trends in the proportion of generic drugs in use

(Ministry of Health, Labour and Welfare)