I-ne (Price Discovery)

| Securities Code |

| TYO:4933 |

| Market Capitalization |

| 53,307 million yen |

| Industry |

| Chemistry |

Profile

The company operates planning, opening, manufacturing and retail sales of cosmetics, beauty appliances and other beauty-related products. Its two main products are hair and body care ‘Botanist’ and beauty appliances ‘Salonia’. The company was established in 2007.

Stock Hunter’s View

Booming sales of hair care products. A string of hit products, a persuasive factor for medium- to long-term growth.

I-ne, a company involved in the planning and sale of beauty-related products, excels at creating hit products among fabless cosmetics companies. It has already launched several new brands in FY12/2023, and the future sales will be a point of investors’ interest.

1H (2Q, Jan-Jun) operating income was 42% above the company’s forecast. As a result, the full-year operating income forecast has been revised up from 4 billion yen to 4.3 billion yen (+32.9% YoY).

In addition to the growth of seasonal products under the mainstay BOTANIST brand, the operating income margin of the SALONIA beauty appliance brand improved significantly due to price increases on certain products. In addition, the nighttime beauty shampoo YOLU emerged as a big hit following Botanist. Sales have surged 2.2 times YoY in the first two quarters, driving earnings growth.

IPTOS, the company’s proprietary brand management system, is key to the reproducibility of hits. It uses a proprietary AI system to gather information from more than 20 million websites worldwide to develop new trends. Another strength of the system is its ability to realise commercialisation quickly, from idea to commercialisation, in about six months.

YOLU is another product born from IPTOS. The accumulation of such successful experiences will improve the accuracy of demand forecasting and increase the certainty of sustainable growth in the medium to long term.

Investor’s View

Trading Buy.

Personal consumption is closely linked to personal preferences and is difficult to predict. However, it is worthwhile for investors building long positions to consider whether the company will continue to be successful and where the valuations are.

Core brands appear to be in big favour of customers

Regarding market cap, the company ranks 17th in the Personal Products sub-segment bracket of 39 companies, led by Unicharm, Kao and Shiseido. Still, it comprises only 4% of the 1.3 trillion yen sub-sector market capitalisation. However, even giant household product companies started small. The company was founded in 2007 and has enjoyed rapid success, at least since 3Q2019, when financial data was readily available. What can be inferred from this is that BOTANIST and SALONIA, products that account for around 20% and 25% of sales, respectively, have a solid consumer following. The former is a hair care brand in its ninth year since launch, while the latter is a beauty product in its twelfth year.

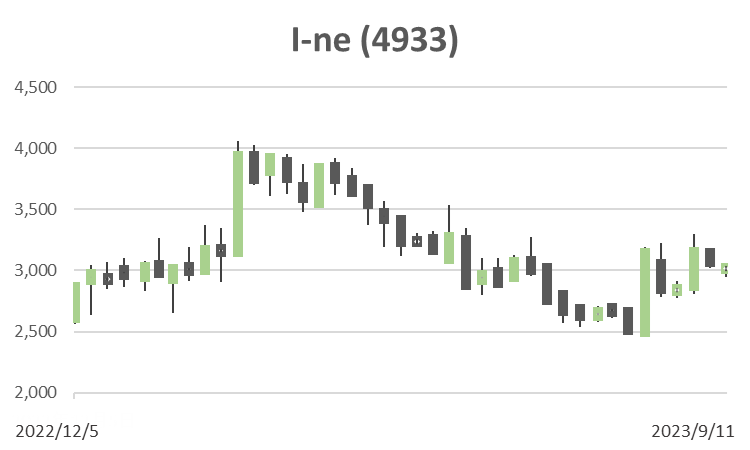

Net income lacks momentum, but the share price looks interesting in the short term

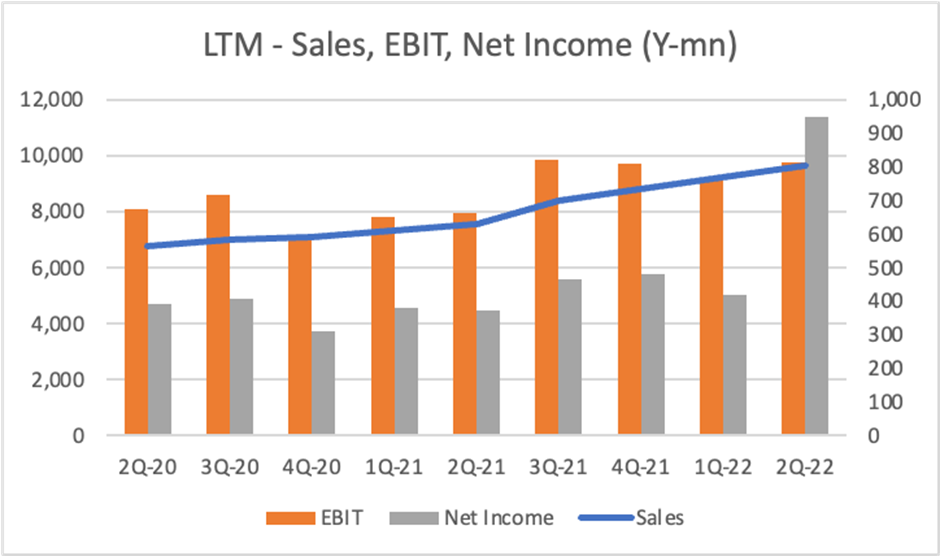

We looked at the quarterly results in LTM to further gauge various aspects. From this, we can see that sales growth is steady, EBIT has edged up, but net income is range-bound. The trend in net income without non-recurring factors is vitally important to investors. The poor earnings visibility and the lack of strength in the direction of bottom-line profit may be the reason for the stagnating share price multiple. However, the sluggish share price presents an interesting investment opportunity in view of the fact that the company has succeeded with the hit brand YOLU in the new field of night-time beauty shampoos and its financial performance is strong enough to raise its earnings forecast. The sale of an equity-method company will inflate this year’s final profit.

| LTM (million yen) | 2Q-20 | 3Q-20 | 4Q-20 | 1Q-21 | 2Q-21 | 3Q-21 | 4Q-21 | 1Q-22 | 2Q-22 |

| Sales | 6,760 | 7,002 | 7,077 | 7,333 | 7,559 | 8,367 | 8,817 | 9,227 | 9,647 |

| EBIT | 672 | 717 | 584 | 650 | 664 | 819 | 809 | 762 | 812 |

| Net Income | 390 | 409 | 311 | 380 | 372 | 466 | 482 | 419 | 947 |

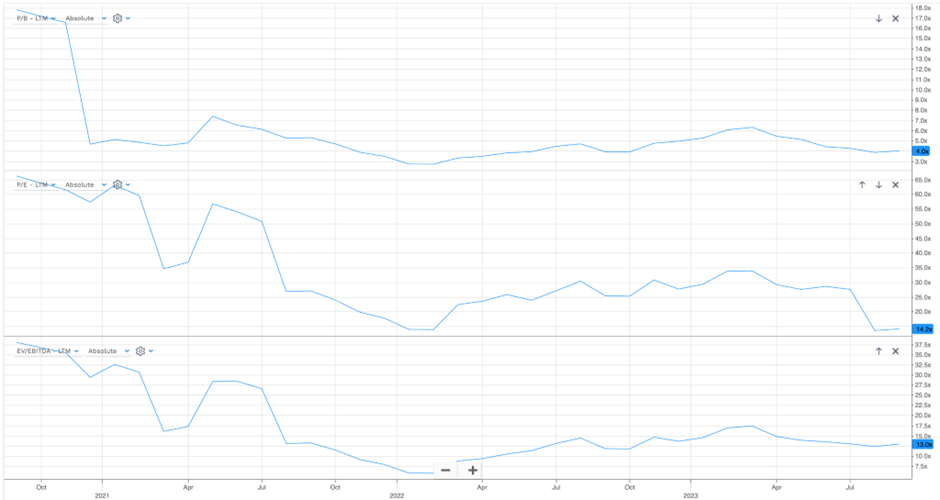

PBR, PER, EV/EBITDA

Concerns related to management’s proactive stance

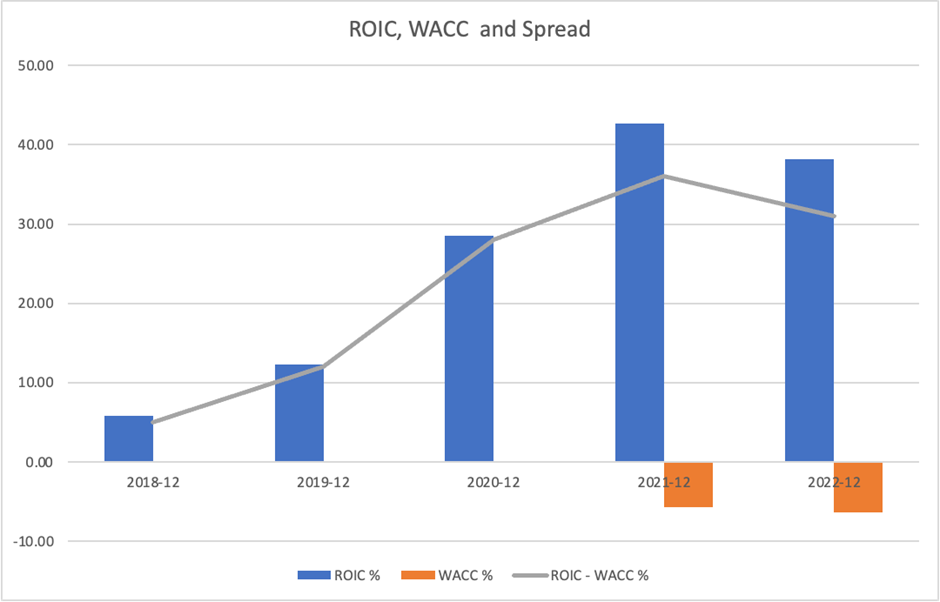

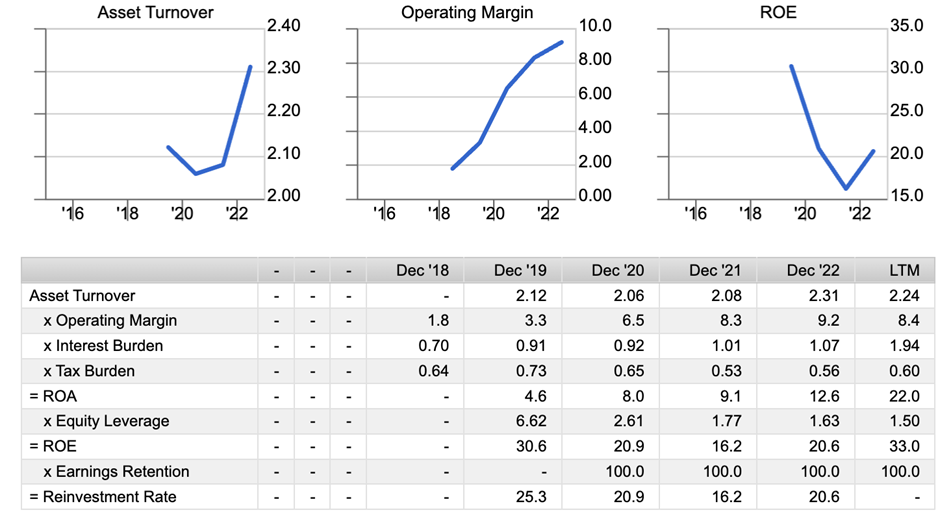

The company took over brands in 2022 for a sum of 1.8 billion yen, the details of which are unclear. This amounts to 10% of the assets. The aggressive use of ample cash is pleasing to investors. On the other hand, it is difficult for investors who are not insiders to assess the long-term benefits of intangible assets. President Onishi is also highly enthusiastic about mergers and acquisitions. While we appreciate management’s willingness to invest, we are also concerned about the use of cash and how it affects BS transparency. Being fabless, the company comfortably delivers a high return on capital. At the moment, asset growth is within the scope of top-line growth. The concern is that the company may get too aggressive in brand purchases and acquisitions, leading to an over-inflated BS and eventually pressure ROE.

Dupont model

Economic value creation