Hioki E.E.Corporation (Price Discovery)

| Securities Code |

| TYO:6866 |

| Market Capitalization |

| 105,744 million yen |

| Industry |

| Electronic equipment |

Profile

A medium-sized company that develops, manufactures and sells electrical measuring equipment, including PCB image inspection systems, PCB electrical inspection systems and CAD/CAM/CAT systems. The company was founded in 1935 by the Hioki family.

Stock Hunter’s View

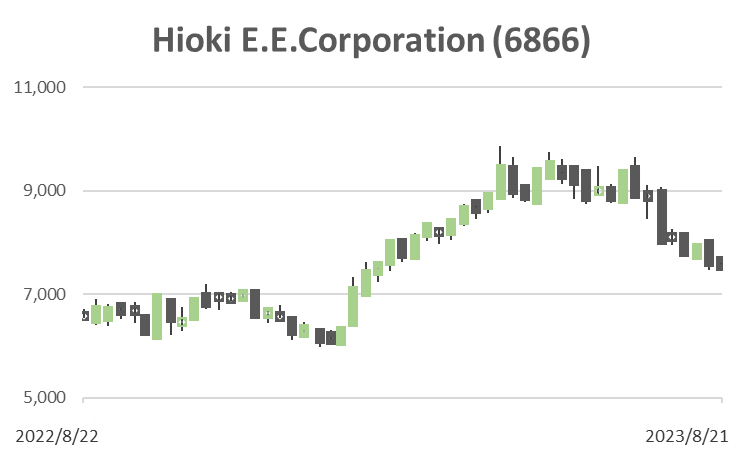

Look for the timing of the share price rebound after the sell-off on good incentives. Measuring equipment for EVs and renewable energies is performing well.

HIOKI provides a wide range of measuring equipment from upstream to downstream in battery production and utilisation, including measuring equipment for battery performance evaluation and electrical equipment inspection. Its financial performance has entered a period of rapid expansion from FY12/2021. In the medium to long term, efforts to deepen the battery market, such as strengthening the sales structure in South East Asia and commercialising EV battery residual evaluation services in China, are also noteworthy.

Operating profit in 2H (Jan-Jun) of FY2023 was 4.545 billion yen (+44.7% YoY), exceeding the company’s forecast of 3.97 billion yen. Sales and operating profit reached record highs for the third consecutive half-year. Demand for battery and energy market-related measuring equipment remains strong, driven by the global decarbonisation trend, and drives growth for the entire company.

In view of the rising cost of raw materials, the company has maintained its previous full-year forecasts of 38.9 billion yen (+13.2% YoY) in sales and 7.94 billion yen (+12.3% YoY) in operating profit. However, orders are firm, mainly from overseas markets. In the second half of the year, the profit margin is expected to improve further as the sales mix of products for growth markets rises, and there is room for an upward swing in the earnings forecast.

Investor’s View

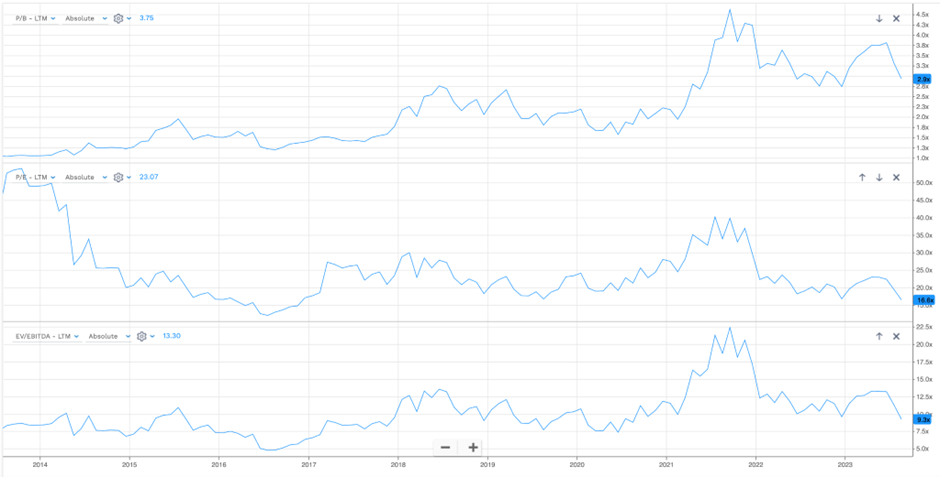

BUY: Very good company in a rapidly booming industry phase. The shares look undervalued, trading on PBR 2.9x and PER 16.6x, The share price weakness since July presents a buying opportunity. The discussion of the company’s capabilities in this report is only a bird’s-eye view. Investors will find much to like by meeting management in person and visiting the company’s highly efficient headquarter in Nagano, where manufacturing, development and sales are integrated. Management is keen on dialogue with investors, but of the 133 individual meetings in FY2022, only six were with foreign buy-side investors.

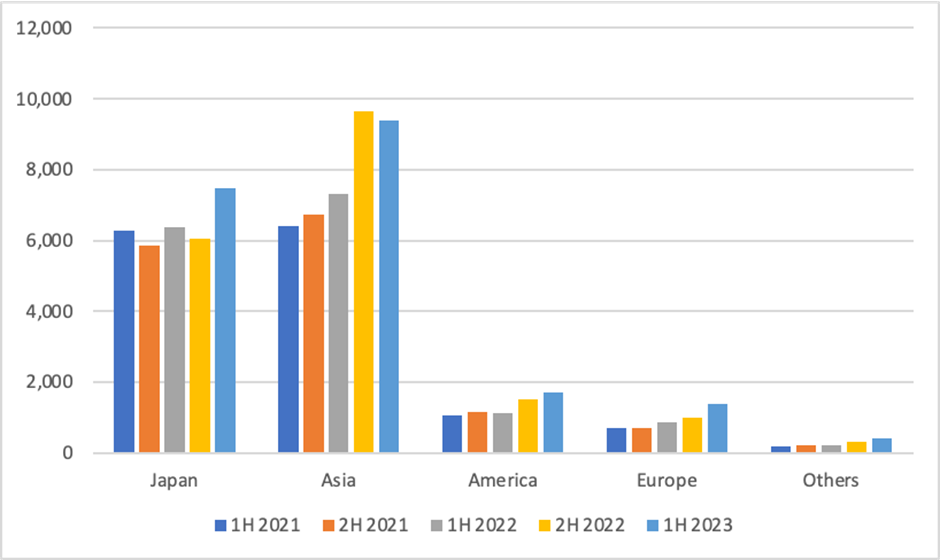

Geographical Sales (million yen)

Omega Investment from company handout

The trend of the world’s rapidly becoming an electrical energy-centric society is a perfect business environment for Hioki. Accurate electrical measurement in factories and buildings is directly linked to safety and security and is indispensable in industrial society, and has been the foundation of the company’s stable growth in the past. In addition to this base demand, in recent years, the battery and device energy market has become a growth driver for the company, driven by decarbonisation and growing EV sales. As a result, demand for electrical measuring equipment has been robust both domestically and internationally.

The business environment is favourable

Aggressive investments by battery manufacturers to increase production capacity, the rapid expansion of EV sales in the global market towards 2030 and decarbonisation are among the growth drivers for the company, particularly in batteries and energy overseas. The composition of overseas sales grew rapidly from more than 50% in 2020 to 63% in 2022. It is interesting to note that the company operate in the same close customer-facing style of marketing with its overseas clients as it does in Japan. In the meantime, a laboratory has been set up at the headquarter in Nagano to co-develop products with customers, mainly in the area of electrical energy, and product development is expected to progress in relation to hydrogen fuel cells, lithium-ion batteries, etc.

Management’s earnings targets look conservative

Management stated that decarbonisation is moving faster than anticipated. In its upwardly revised medium-term plan, management expects sales of 46.6 billion yen and an operating profit of 10.7 billion yen in 2025, representing CAGRs of +8% and +10%, respectively, over FY3/2022, and an operating profit margin increase from 20.5% to 22.9%. These look conservative.

Share price weakness is an opportunity to pick up the shares

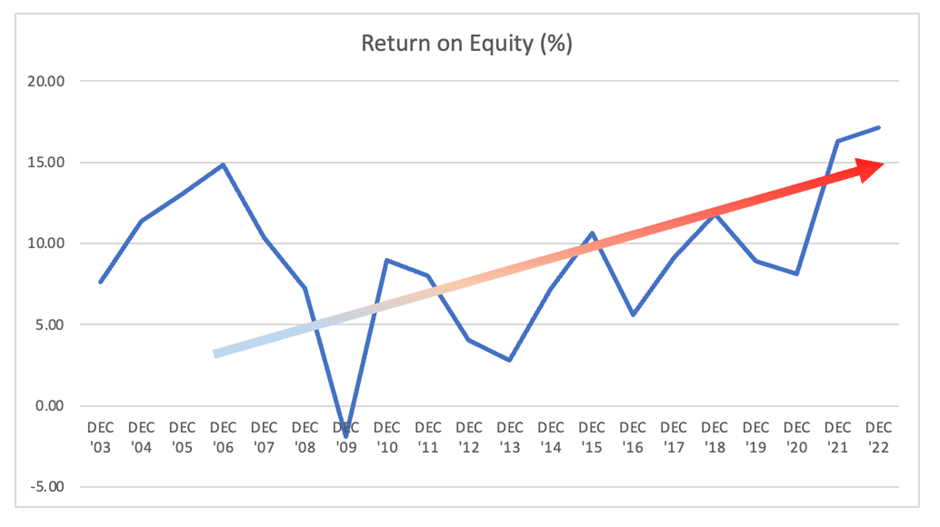

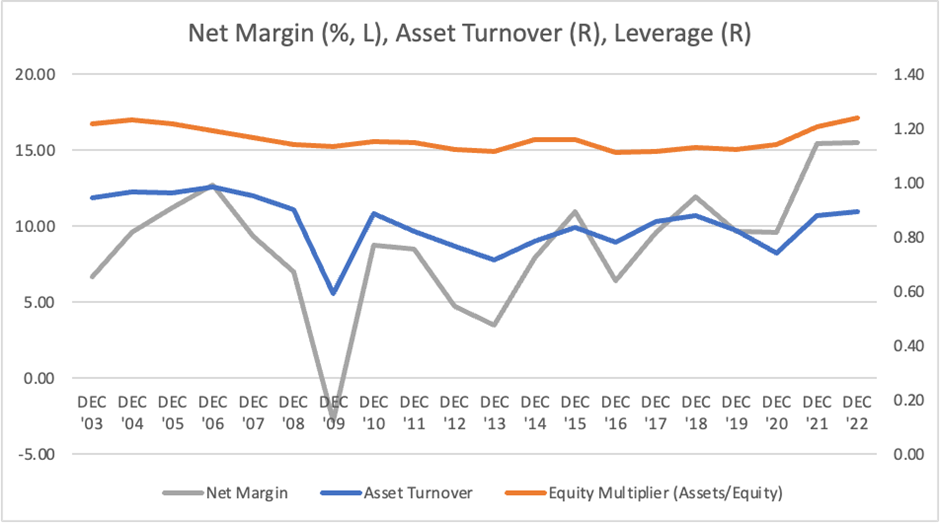

Management expects ROE to be 17.5% if the 2023 management plan is achieved. Asset turnover and leverage are largely stable, and the driver of ROE is the net profit margin. Although it is difficult to gauge how much upside there will be to the net profit margin, it is not unreasonable to assume that an ROE of around 20% will be maintained in the medium term. Considering these, a PBR of 2.9x and PER of 16.6x seems undervalued. We think it is nice to pick up the shares on the weakness since July.

20 Year ROE

20 Year Dupont Analysis

The use of CF is also rated well

The increase in capital expenditure from around 1 billion yen per year, about the depreciation charge, to 1.9 billion yen in 2022, and then to 3 billion yen in 2023, to invest in core businesses with a high return on capital, is encouraging for investors. At the same time, management’s target of a DOE of at least 2% and a dividend payout ratio of 40% is seen as a good blend of growth and shareholder returns and rated well.

10Year PBR, PER, EV/EBITDA