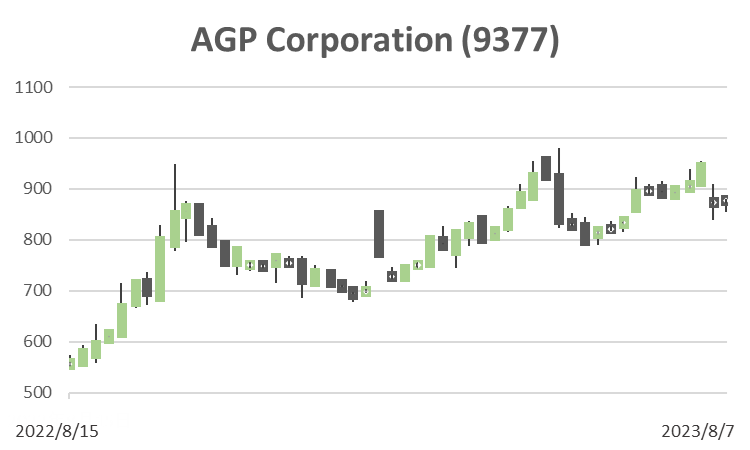

AGP Corporation (Price Discovery)

| Securities Code |

| TYO:9377 |

| Market Capitalization |

| 11,943 million yen |

| Industry |

| Warehousing and transport-related industries |

Profile

AGP Corp. supplies electricity to parked aircraft and maintains and manages airport facilities. Its business segments are Power, Engineering and Product Sales. The power business segment supplies power, heating and cooling air, and compressed air to aircraft parked at ten airports in Japan via ground power units (GPUs). The engineering business includes maintenance of special facilities at airports (passenger boarding bridges and baggage handling facilities), maintenance of buildings and facilities (aircraft hangars, in-flight catering plants, cargo terminals, cooling and heating supply facilities, extra high voltage substations, hotels, etc.) and security maintenance (baggage screening equipment, anti-hijacking equipment, etc.), business jet support services (e.g. hangar parking, aircraft cleaning); and maintenance of off-airport logistics systems. The product sales business includes the sale and maintenance of Ground Support Equipment (GSE), such as aircraft snowploughs (deicers), brake cooling carts, power supply vehicles (GPUs), air-conditioning and heating vehicles and electric ramp buses, and the development, production and sale of food carts. Sales mix % (OPM%) Power supply 39 (6), engineering 53 (22), product sales 8 (-5) (FY3/2023)

Stock Hunter’s View

Profitability improves significantly due to price revisions. More robust tailwind of aviation demand.

AGP supplies power (electricity, air-conditioning, etc.) to aircraft while on the ground, maintains the airport’s arrival and departure support facilities (passenger boarding bridges and baggage transfer equipment), and maintains and manages security equipment in and outside the airport. The company commands a near-monopoly at nine domestic airports.

The company’s results for the first quarter (Apr-Jun) of FY3/2024, announced on 28 July, showed a steady recovery, with sales of 2,856 million yen (+15.8% YoY) and an operating profit of 118 million yen (a loss of 60 million yen in the same period of the previous year). A steady recovery was confirmed.

In the power supply business, profits improved due to a recovery in the number of flights in operation and the start of price pass-on to power charges in response to fluctuations in the rising cost of raw materials. In the engineering business, the operating hours of special machinery and equipment increased in line with the recovery in aviation demand, and the volume of work in maintenance and servicing increased. At the same time, logistics maintenance services also recorded a double-digit increase in revenue.

Further improvement in aviation demand is expected in the coming summer holiday season. In addition, the facilities maintenance business has achieved revisions to various contracts, and the effects of improved unit prices are expected to surface from 2Q onwards. New revenue-generating business initiatives are also progressing well, including increased deployment of environmentally friendly base materials for regional airlines, progress in converting airport vehicles to EVs and an increase in overseas business negotiations.

Investor’s View

Trading buy: The near-term earnings momentum is strong, but the risk is that most of this may have been discounted in the share price.

Near-term earnings recovery momentum is strong; 1Q sales recovered 94% of FY2019. Profit is improving due to price pass-on of raw material price increases to power charges. Management stated in the results presentation that 1Q profits exceeded planned figures. Full-year guidance was left unchanged, but there is significant upside potential. 1Q sales in the power supply business increased by 31% YoY due to a recovery in the number of aircraft services and price revisions. Engineering business sales are also strong at +9.5% YoY.

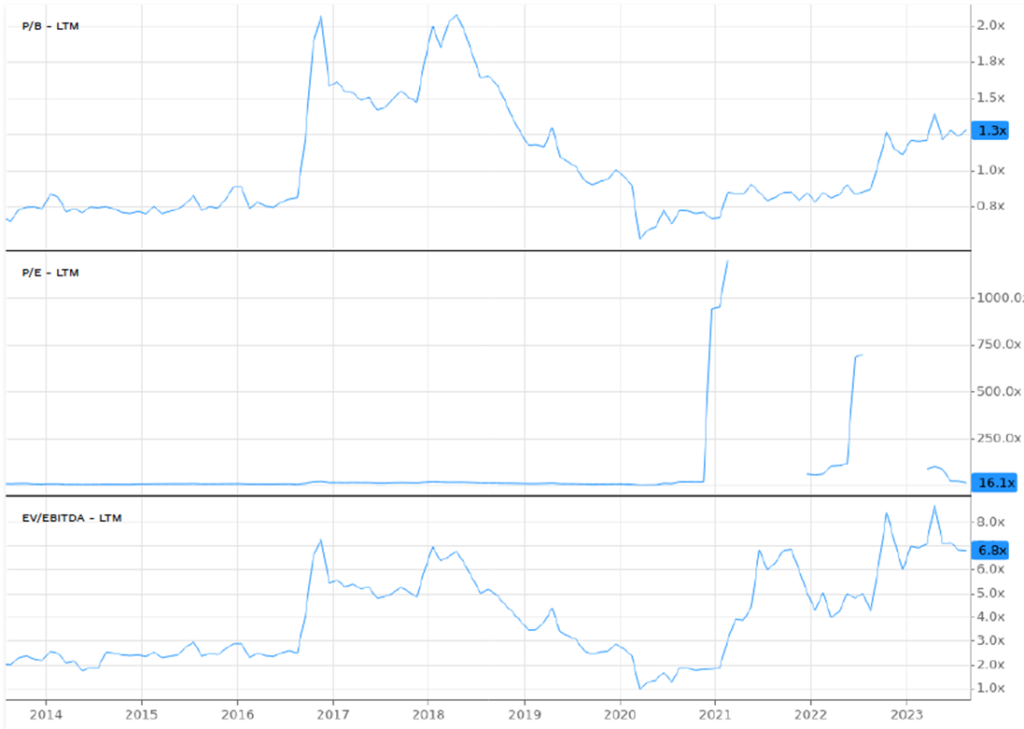

Valuations have recovered to FY2019 levels

The return of sales and profitability to pre-COVID FY 2019 levels is already on a good track and should be achieved without problems. The share price was strong last year and the year before, and the prospects for a recovery of the fundamentals to pre-pandemic levels should have been well factored in. PBR has expanded from a March 2020 bottom of 0.5x to 1.3x, already recovering to pre-COVID levels.

20 Year PBR, PER, EV/EBITDA

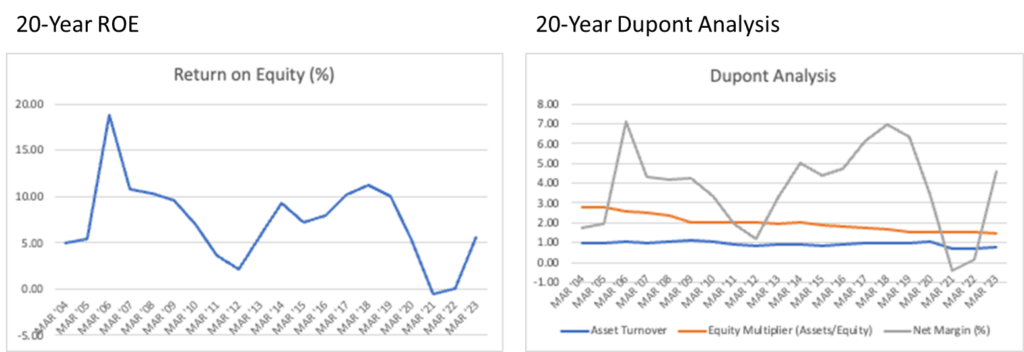

It is impossible to judge whether management’s target of achieving a 10% ROE in 2025 is realistic

The company’s ROE has averaged 7.2% over the past 20 years. PBR expanded to just under 2x in 2017 and 2018 when ROE overshot and reached 10%. In its medium-term management plan, management wants to achieve an ROE of 10% or more in 2025. However, management does not convince enough. ROE volatility is significant in the long term; the decisive driver is the net profit margin. Asset turnover is permanently low. This is due to the high fixed cost burden of the GPUs that power the aircraft through buried pipes beneath the airport, and there is unlikely any upside. Financial leverage has not changed significantly over the long term. There is no indication that management intends to increase leverage aggressively.

No sustained improvement in ROE and EPS is expected yet

It is also doubtful that sustainable growth in secular ROE and EPS will be achieved. In terms of growth, management’s strategy is to expand the top line by increasing the ratio of off-airport sales from the current 8% to more than 20% of all sales, an argument that investors are unlikely to factor into valuations at this time. While it is positive that the company aims to achieve a total shareholder revert ratio of more than 100% by 2025 through dividends and share buybacks, the long-term driver of the share price will be sustainable momentum in return on capital and EPS.