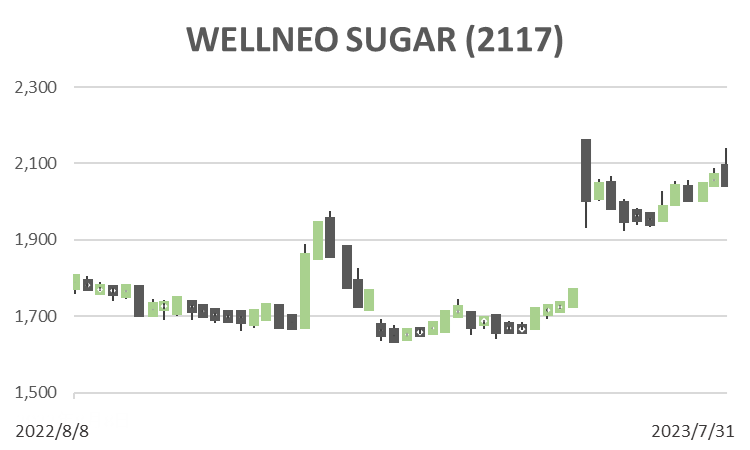

WELLNEO SUGAR (Price Discovery)

| Securities Code |

| TYO:2117 |

| Market Capitalization |

| 71,895 million yen |

| Industry |

| Foodstuff |

Profile

A sugar producer and distributor. Its businesses include manufacturing and selling sugar and other food products, processed sugar products and warehousing. It also operates healthcare and sports club management businesses. It merged with Itochu Sugar in January 2023 to become the second-largest sugar producer.

Stock Hunter’s View

Accelerated industry consolidation. Low PBR and high dividend yield.

WELLNEO SUGAR is a quasi-major sugar refiner under the CUP brand, with plans for a complete merger in October 2024, when the company will absorb Nissin Sugar and ITOCHU SUGAR CO., LTD. to create a more robust single-company structure from the previous three-company HD structure.

Nisshin Sugar is strong in the household sector, mainly in the Tohoku, Kanto and Kansai regions, while ITOCHU SUGAR is strong in the commercial sector, mainly in the Chubu and Kyushu regions. In recent years, consolidation in the sugar industry has accelerated, and the company is expected to strengthen its foundation in this trend further.

In FY3/2024, ITOCHU SUGAR will contribute fully, with revenue of 90 billion yen (+54.2% YoY) and operating profit of 5.1 billion yen (3.1 times YoY). Domestic wholesale sugar prices reached a 42-year high in July this year. Rising international raw sugar prices and the weakening of the yen have increased raw material prices, and the industry is increasingly shifting increased costs onto prices.

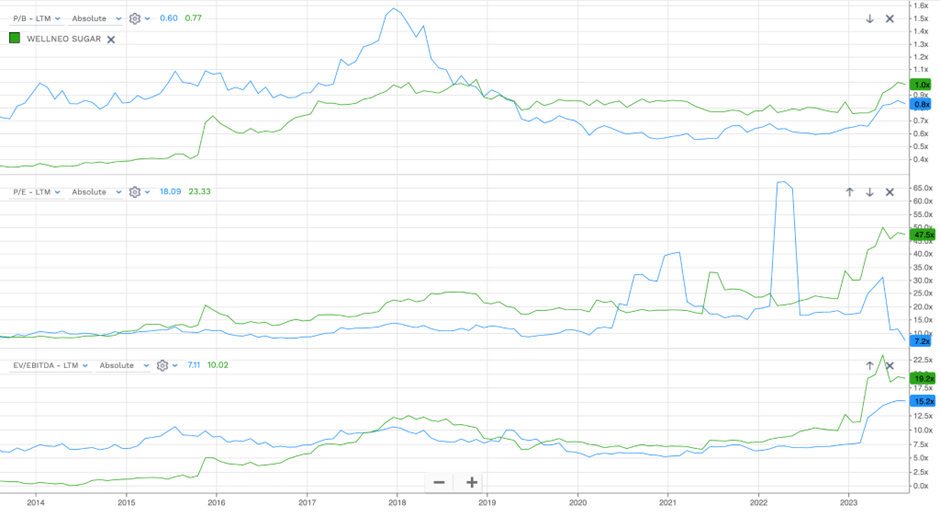

Earlier, Fuji Nihon Seito (2114), which is under the umbrella of Sojiz Corp (2768), announced good 1Q results, with net profit doubling, and the results of WELLNEO SUGAR to be announced on 7 August could also come in robust. It should be noted that sugar stocks, including the company’s, are a treasure trove of low PBR and high dividend yields. The company has also seen a dramatic change in its share price momentum around May as a stock with a PBR below 1.0 x.

Investor’s View

BUY: Share price drivers are near-term earnings and the momentum in ROE expansion.

The merger of the two companies into a holding company in January 2023 is a good fit in terms of production bases, distribution areas and sales channels. Itochu Corporation (8001) and Sumitomo Corporation (8053) hold 35.3% and 23.6% of the shares, respectively, and the new management team is a balanced appointment from each company. Among the various PMI issues, it is vital as to whether the integration of personnel will proceed smoothly throughout the company, but management has not touched on this point. However, there have been many subsidiary mergers between trading companies in the past, and this is not a significant concern.

ROE target falls short of investor satisfaction, but expansion momentum will likely be positive for the share price

Management is targeting an operating profit of 9.5 billion yen, a consolidated net profit of 7 billion yen and an ROE of 8% in FY3/2028. The net profit target of +9% CAGR is encouraging. On the other hand, an ROE of 8% is not attractive to investors. It will probably not reach the market average five years down the line. However, the significant momentum of improving return on equity should be positive for the share price. Already in May this year, PBR expanded from 0.8x to 1x. This is evidence that encouraging medium-term profit targets and expectations for improved return on equity have been factored in to some extent.

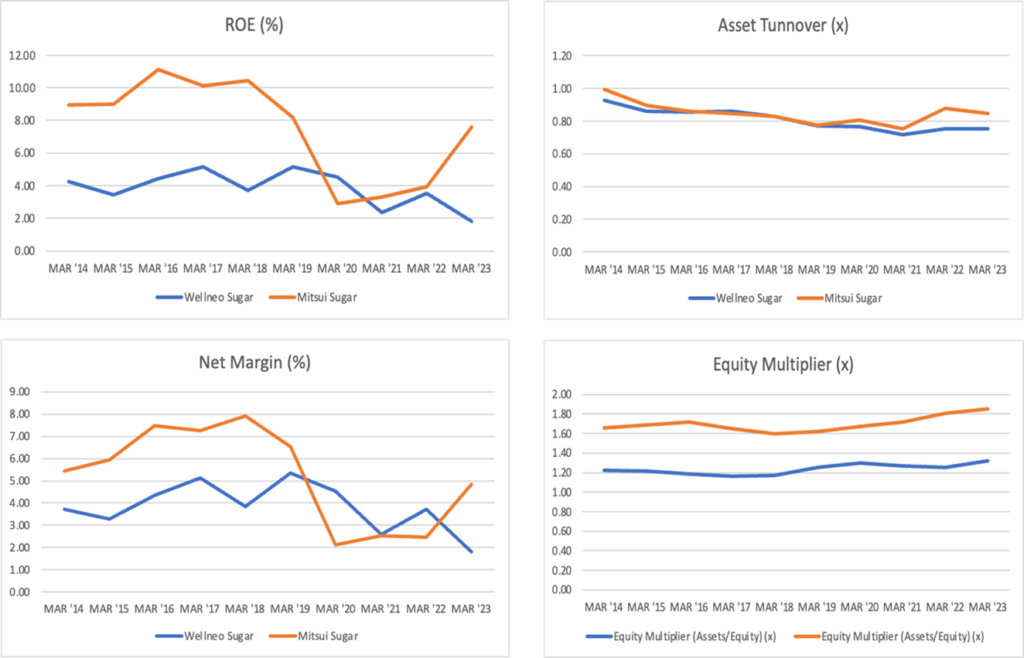

Asset turnover looks structurally poor

Post-merger results are only available for 4Q FY3/2023. The ROE for these three months was 1.53%, which can be factored into asset turnover of 1.05 x net profit margin of 1.1% x equity multiplier of 1.33. The 10-year average ROE of Nissin Sugar alone was 3.83%, broken down as 0.81 x 3.83 x 1.24. The financial figures for ITOCHU SUGAR, which was unlisted, are not clear. However, in general, the nature of the business appears to be that profit margins and low asset turnover are significant drags on the company’s ROE. The low asset turnover ratio is also evident in Mitsui Sugar, the industry’s number one supplier, and is presumed to be a characteristic of the industry.

10 Year Dupont analysis – Wellneo Sugar (Blue) and Mitsui Sugar (Red)

Omega Investment

Perhaps, there is an interesting upside in the net profit margin

On the other hand, Mitsui Sugar has achieved a relatively good net profit margin, which is linked to the disparity in ROE between the two companies. Therefore, it would be interesting if the company caught up in net profit margin. Management expects the net profit margin in the first year of the merger, FY3/2024, to be 5.6%, up dramatically from 1.8% in the previous year. In that case, ROE is expected to exceed 7%, which should significantly impact the share price. Incidentally, the valuation of Mitsui Sugar, which outperforms Wellneo in terms of ROE, is inferior to Wellneo’s. We will leave the discussion of the background to another article and only mention this fact in this report.

10 Year PBR, PER, EV/EBITDA

Proof of the successful corporate value expansion strategy remains to be confirmed

The growth strategy framework is clear from the president’s presentation in June. The current financial year is still the first year of the merger, and actual results are awaited. Going forward, the share price will be driven by expectations of how well management can drive growth and profitability while demonstrating positive performance. While the costs associated with the merger may temporarily weigh on earnings at some point in the future and be a negative surprise to investors, we feel that in the long term, there is significant scope for improvement in the company’s corporate value.