SAN-A (Price Discovery)

| Securities Code |

| TYO:2659 |

| Market Capitalization |

| 155,911 million yen |

| Industry |

| Retail trade |

Profile

SAN-A is the largest supermarket chain and shopping mall operator in Okinawa, established in 1950. Its business segments are retail and CVS. Retail includes supermarket chains and shopping malls. The CVS business is the Lawson franchise convenience store in Okinawa.

Stock Hunter’s View

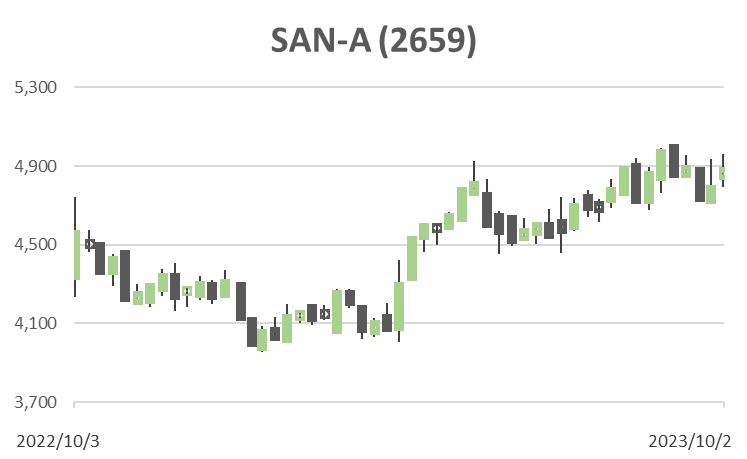

SAN-A will soon announce its results on 5 October and will be the focus of investors’ attention for its ‘Okinawa-related’ business as the island’s economy continues to recover.

SANEI will announce its financial results from 5 June to 5 August on 5 October. The company is ranked the top in sales in Okinawa Prefecture and operates mainstay supermarkets, restaurants and convenience stores.

In 1Q, the company enjoyed a favourable start with a 39.6% YoY increase in operating profit, driven by a recovery in the number of tourists entering the area. The company has absorbed the continuing high cost of purchasing goods, thanks to the contribution of large shops opened in the previous year and the effect of price increases. It should comfortably achieve its full-year forecasts of 4.1% growth in sales and 4.4% growth in operating profit.

As ‘tourism’ is Okinawa’s leading industry, its recovery will significantly impact the prefecture’s economy, and SANEI, the largest distributor in Okinawa, should also attract attention. In recent years, it has also become a popular winter destination, when prices are lower than in summer due to the off-season.

Okinawa’s tourism income in FY2022 will increase 2.4 times YoY to 701.3 billion yen, a V-shaped recovery to the pre-pandemic level. The government’s travel support measures have boosted the number of resort hotel guests with high spending power and the number of resort wedding guests. Tourism was under temporary downward pressure in July and August, as hotel occupancy rates fell due to typhoons, but the financial economy in the prefecture appears to be recovering fundamentally. The recovery is expected to continue in the coming months with the resumption of national travel support and the school travel season.

Investor’s View

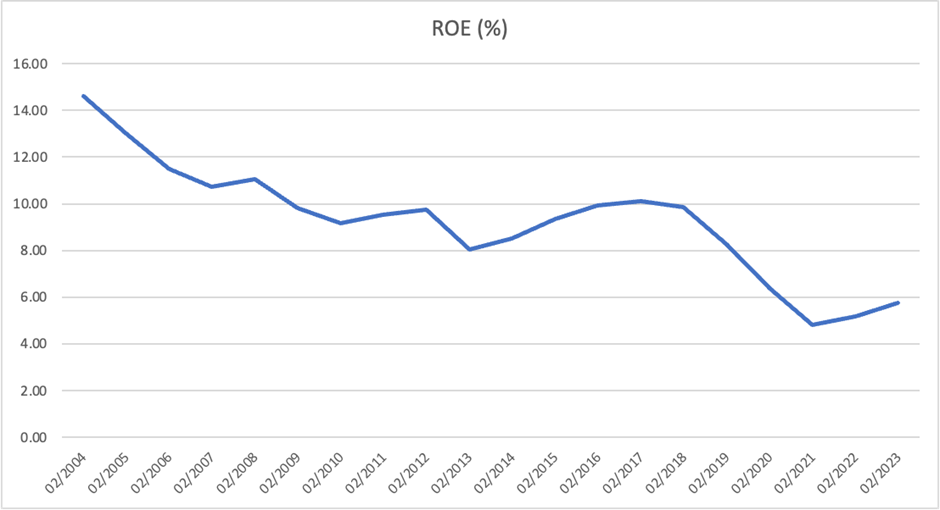

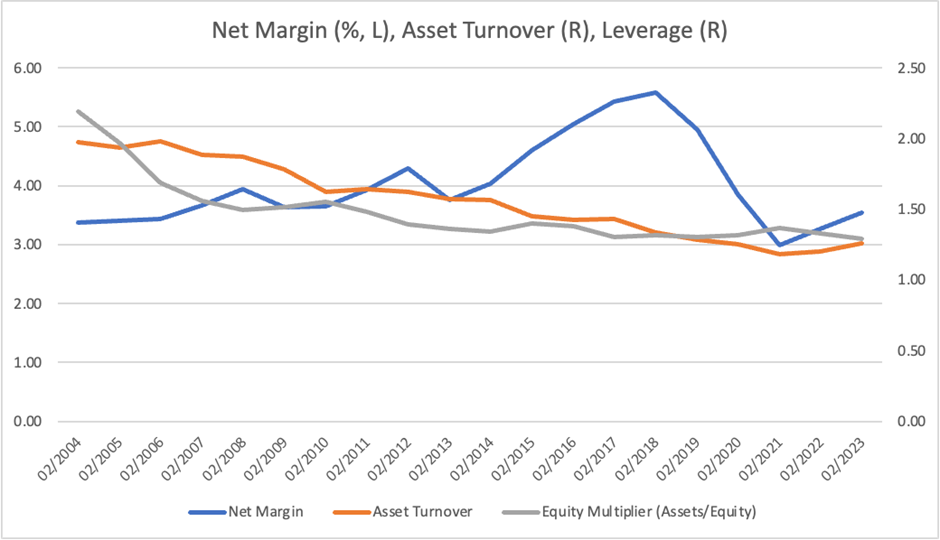

ROE is trending down, but management does not care much about this. A share price strength on near-term earnings would present opportunities to exit. There is plenty of scope for improving profitability on shareholders’ capital. The share price would become attractive if active shareholders emerged.

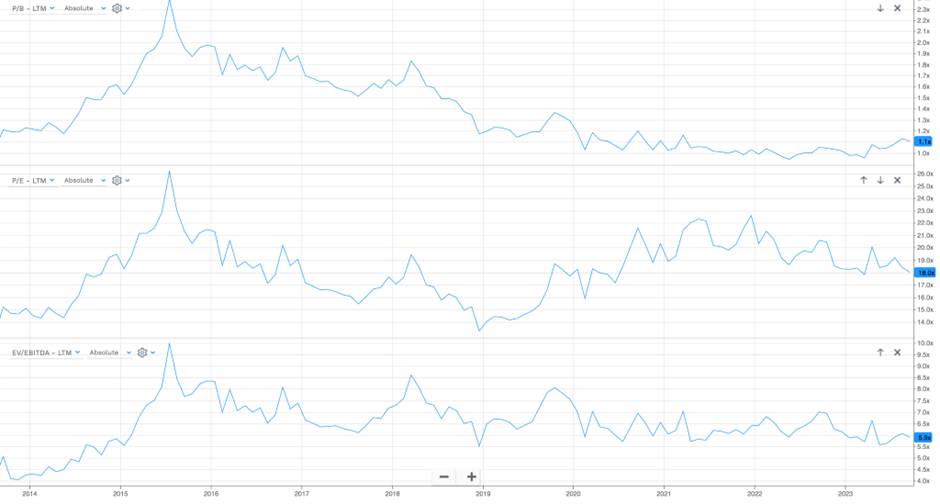

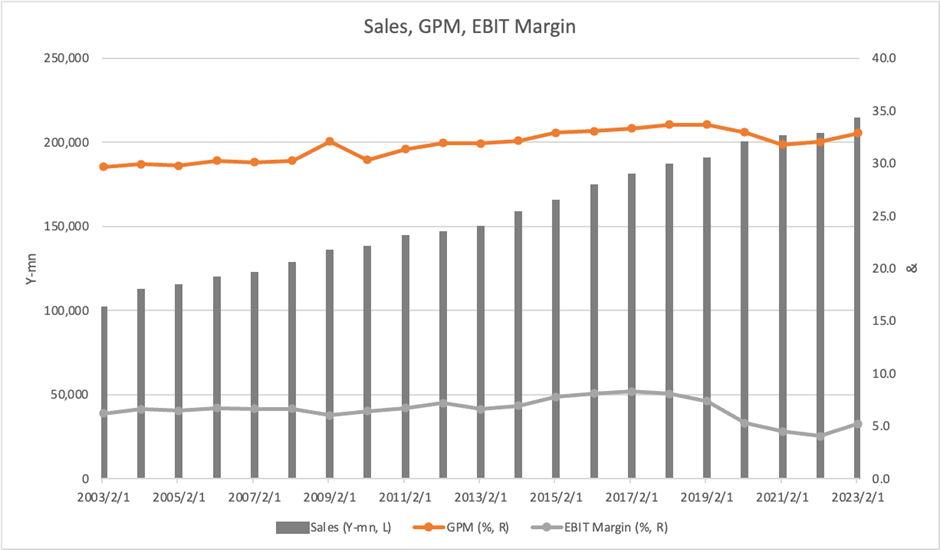

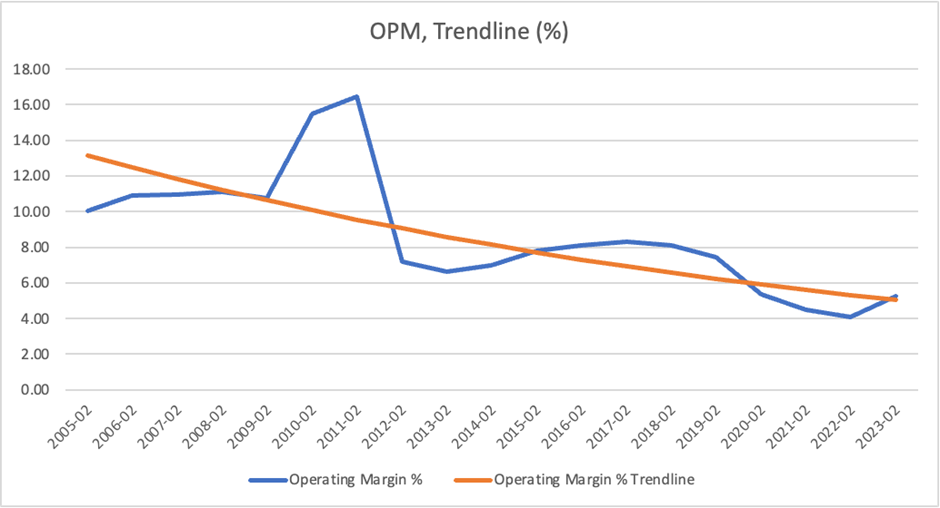

The recovery will be sustained, and there will be near-term earnings surprises. PBR and PER are near three-year lows. However, the long-term trends and management’s current interests do not spell good for investors looking for shares good to hold for the medium to long term. Sales are growing steadily, and the five-year CAGR is +3% despite the pandemic disease. However, ROE continues to fall, and the OPM trend is negative. Both are a reflection of the demanding business environment.

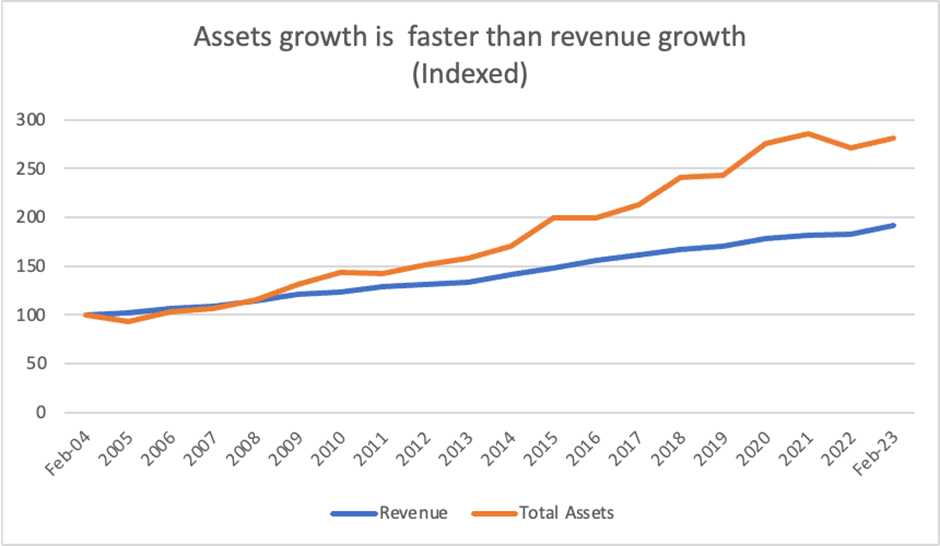

The most significant factor behind the trend decline in ROE is the BS, which continues to expand faster than sales growth.

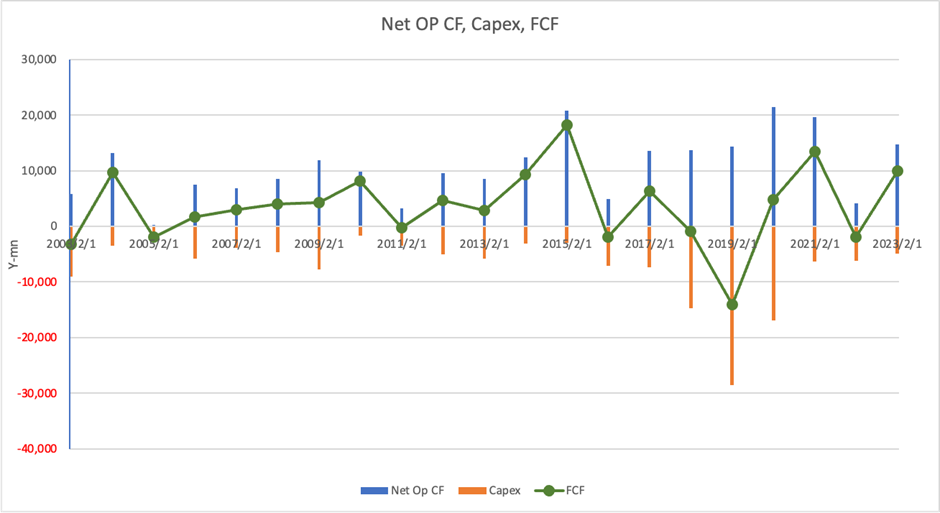

One of the factors contributing to the inflated BS is a net cash position of 38 billion yen, which amounts to 23% of total assets. However, regarding BS expansion, the main driver is property, plant and equipment. The CF chart reads negative as it shows that since 2016, the cost of maintaining and expanding the business has been high, and FCF generation has become less stable.

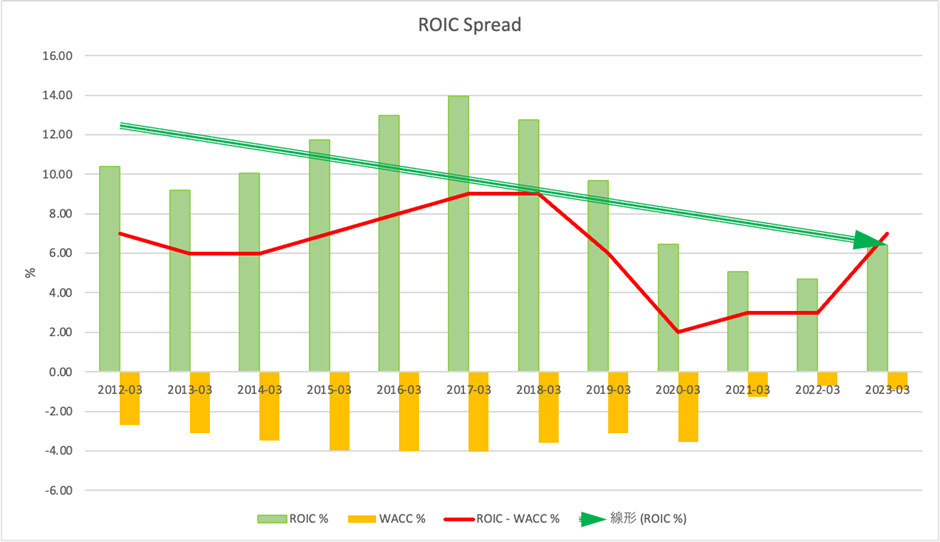

Almost all of the company’s invested capital is shareholders’ equity. The company has scope to improve its return on equity through increased leverage, share buybacks and revised dividend levels. Investors should note this as a potential positive factor for the share price. It is felt that management is not aware of this point. Although the ROIC spread has been recovering due to the recovering earnings, the long-term downtrend is a dissatisfaction of shareholders. The share price would become interesting if active investors emerged and engaged in a dialogue with management aggressively.

Valuations are all near their three-year bottoms. However, given the strong expectations of a declining ROE, it is difficult to read the PBR, which has consolidated at around 1x, as positive as it is unlikely to expand.