Daishinku (Price Discovery)

| Securities Code |

| TYO:6962 |

| Market Capitalization |

| 27,365 million yen |

| Industry |

| Electronic equipment |

Profile

Leading manufacturer of quartz devices. Integrated production from synthetic quartz crystals. Overseas sales account for 85% of total sales. Products include crystal units, crystal oscillators, monolithic crystal filters and hermetic seals. Established by Kazuo Hasegawa in 1959 and headquartered in Kakogawa City.

Stock Hunter’s View

Near-term results are challenging, but medium-term growth potential remains unchanged. Record highs for automotive applications are expected this year.

Daishinku is a crystal device manufacturer with strengths in integrated production from synthetic quartz crystal materials. It is one of the world’s leading manufacturers of crystal oscillators.

Operating profit in 1Q FY3/2024 (1Q, Apr-Jun) sank 68% YoY due to sluggish demand for Chinese smartphones and PCs. On the other hand, progress against the full-year company forecast was steady at 35%. The quartz device industry was undergoing inventory adjustment in the supply chain, and 1Q is seen at the bottom of the quarterly results.

Sales for automotive applications continue to be strong. They are expected to reach a new record high this year, driven by the development of ADAS (Advanced Driver Assistance Systems), the spread of electric vehicles and an increase in the number of cars equipped with such systems per vehicle.

A full-fledged earnings recovery is expected from FY3/2025 onwards, where the company’s original Arkh series and moulded-type products are expected to increase its market share for data centres and EVs. In addition, the telecommunications market is demanding higher-frequency crystals (photolithography products) due to the development of high-speed, high-capacity communications. The company expects to record its highest sales from FY3/2025 onwards, and the expansion of photolithography products will contribute to higher marginal margins.

Investor’s View

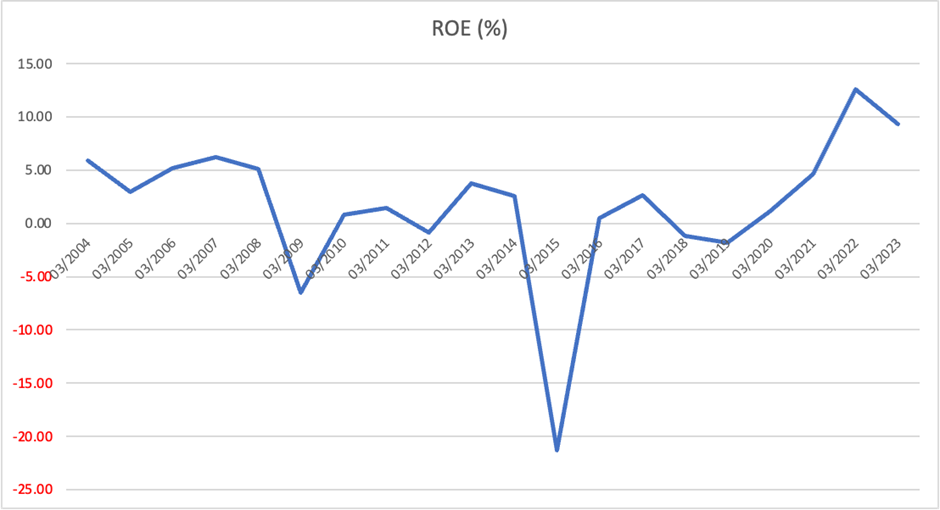

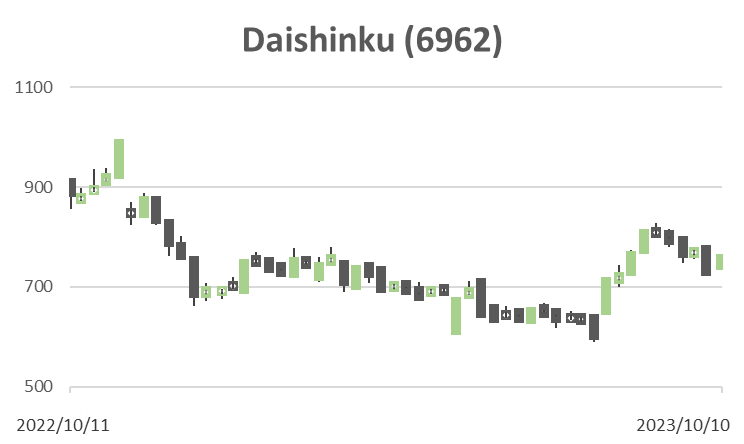

Buy on weakness – high risk. The share price is again trading at a low PBR of 0.6, having discounted long-term growth expectations and near-term risks. Secular ROE is poor, so the shares trade mostly at fair value, though they look cheap. The near-term decline in the share price is a buy if the company is expected to create economic value in the medium to long term. However, earnings visibility is poor; hence, a long position would be high risk.

Japan’s crystal industry excels globally

Quartz crystals are indispensable for electronic equipment. Stable frequencies are an essential feature of radio frequency equipment. Demand is driven by the IoT and the increase in electrical appliances, with 5G, ADAS and EVs being medium- to long-term themes. Due to the rise in radio towers, 5G will require many crystal devices. The same applies to radio receivers such as smartphones. Crystal devices are used in various parts of the car. Considering the stock’s liquidity, the best crystal-related stocks to invest in are the Company and Nihon Dempa Kogyo (6779), the world’s second-largest crystal device manufacturer. The latter is the leading company in the automotive crystal market, with a 55% global market share. Japanese companies excel in technologies that enable high frequencies in quartz, such as photolithography technology. On the other hand, attention should be paid to the risk of product substitution, such as MEMS crystals.

More than half of the company’s sales are products in growth areas

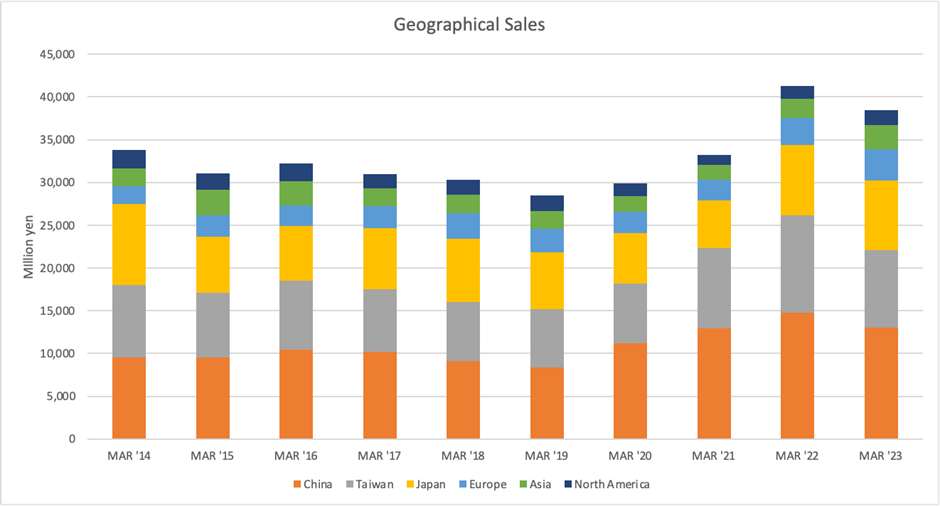

Trend growth is expected in automotive and telecommunications applications. Industrial and consumer equipment is estimated to remain cyclical low-growth. As per the company, industrial equipment, consumer electronics, automotive, and telecommunications accounted for 15%, 26%, 30% and 29% of sales in FY03/2023, so growth areas account for more than half of sales. Regional sales by application are not disclosed. China has had a significant impact on consumer applications, which is believed to have been a major factor in the sharp decline in 1Q earnings.

PBR, PER, EV/EBITDA

Near-term share price factors are negative

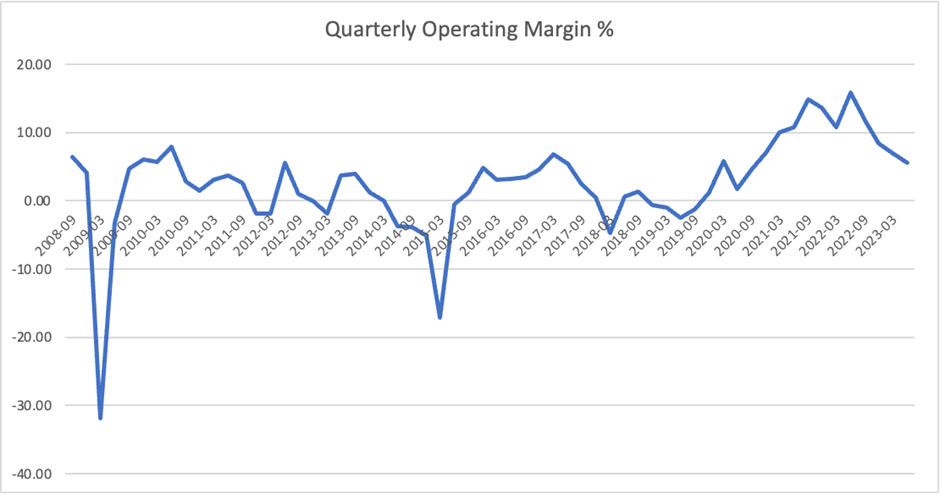

Operating margins are at a 15-year high level, but a declining trend is evident quarterly. This is an essential factor for the near-term share price. Given the demand situation in China and the immediate demand for consumer and industrial products, the short-term of the shares is on a negative watch.

Medium- to long-term share price factor is positive

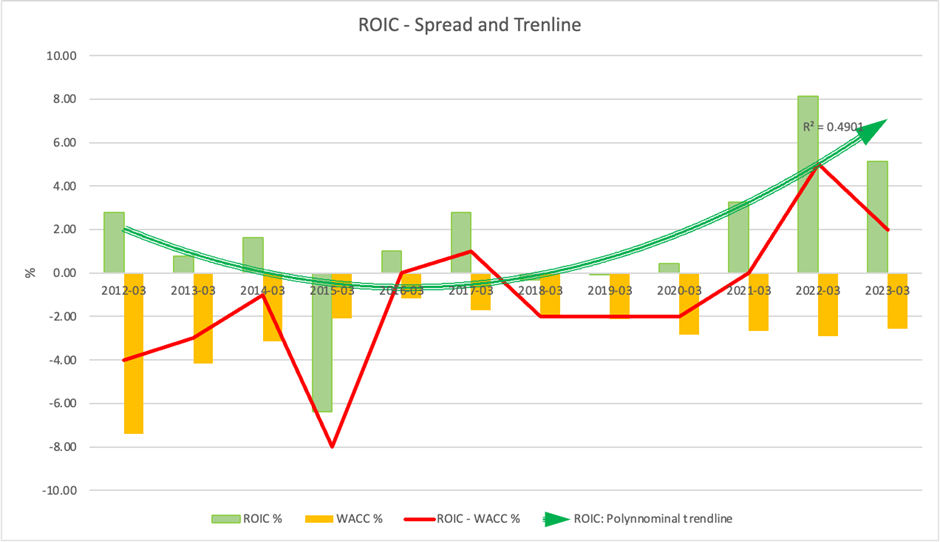

Regarding long-term share price, the key driver will be trends in economic value creation. After almost a decade of failure to create economic value, the company has started to create economic value since the year before last. Determining whether this is forming a medium- to long-term trend or simply a significant cyclical swing will be essential. This could prove positive, given that products in growth markets, i.e. automotive and telecommunication, account for more than half of sales and the prospect of higher profit margins from photolithography technology, which enables higher frequencies.

The share price has factored in long- and short-term expectations, leaving investor views neutral

Expectations of good earnings and growth market benefits were factored in when the share price traded from 700 yen to 1,600 yen from May 2021 to the end of 2022. China accounts for a third of the company’s sales, which is an immediate earnings concern. However, this is also considered factored in with a 14% share price underperformance since the beginning of the year.

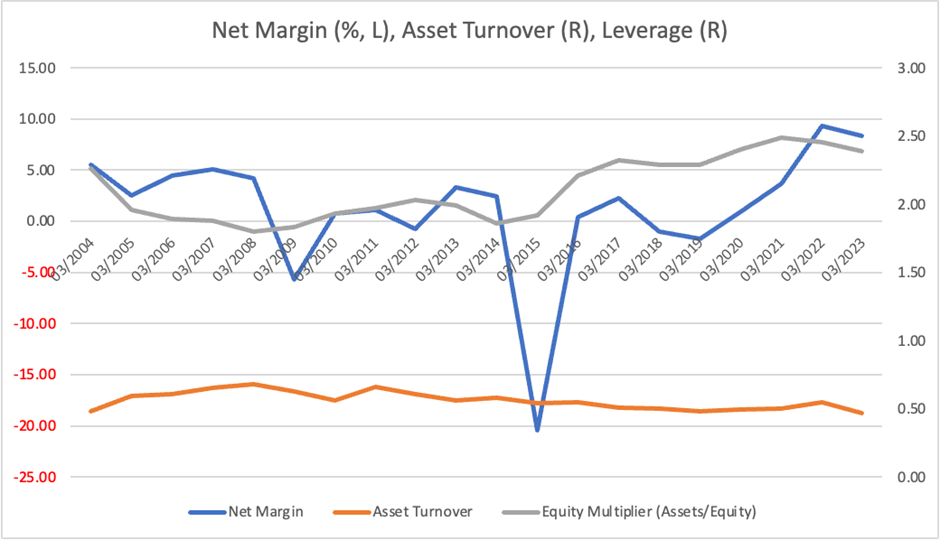

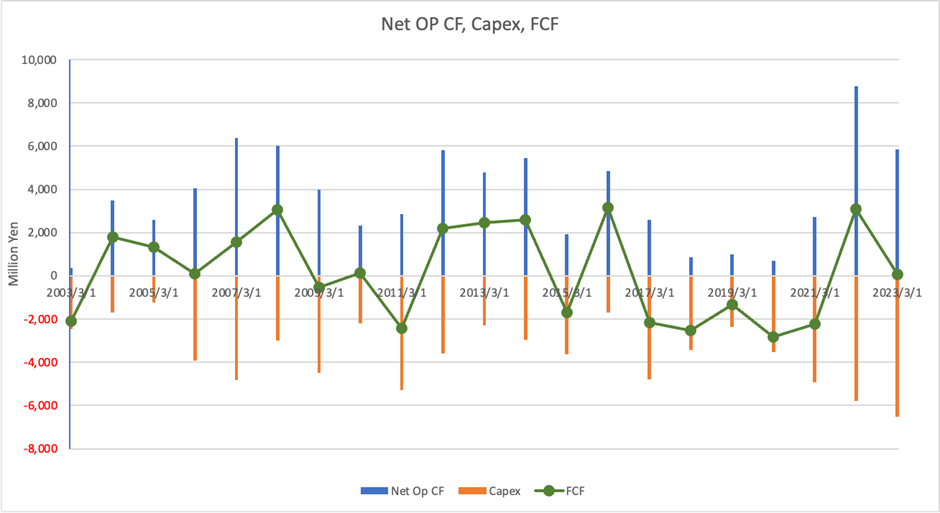

Improvement in secular ROE is not yet expected

The CF earned is spent on capex, and the company is not necessarily a FCF generator in the long term. It is a typical capital-intensive company with a heavy capex burden, with high barriers to entry but requiring a large amount of capital to maintain the business. As a result, the company’s asset turnover is significantly low, which we believe is permanent.

The company is highly leveraged and at a level where further expansion is impossible. Therefore, ROE hinges on the PL margin. However, there is insufficient evidence or argument to conclude that the underlying PL margin will improve; the company is hardly a predictable growth.