Shinagawa Refractories (Price Discovery)

| Securities Code |

| TYO:5351 |

| Market Capitalization |

| 66,571 million yen |

| Industry |

| Glass & Clay Products |

Profile

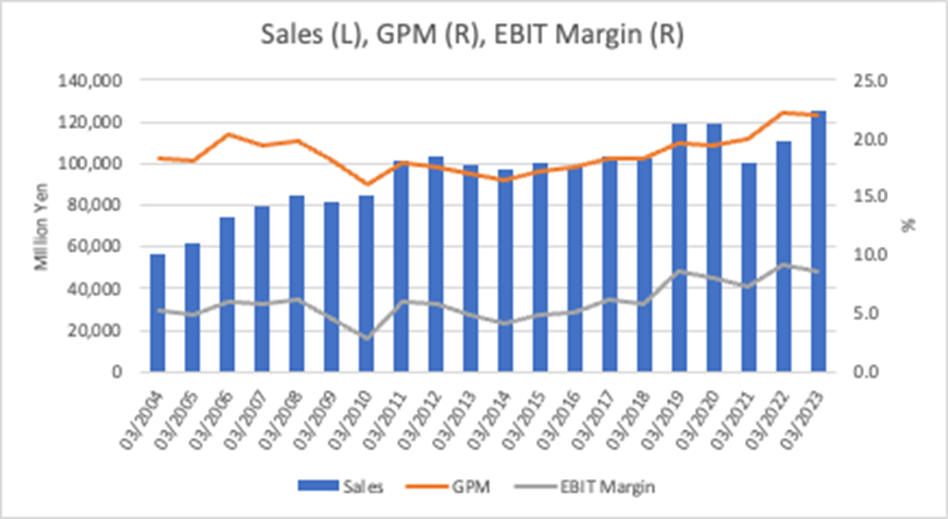

The company manufactures and sells refractories. Refractories are the blocks used in industrial kiln furnaces and high-temperature treatment processes in the blast furnace, electric furnace, cement, non-ferrous and other industrial furnace industries. The company is heavily influenced by JFE (5411), which holds a 33.7% shareholding. President Fujiwara came from JFE. Business segments include refractories, related products, engineering, real estate, and leisure. Overseas sales account for 22% of total sales.

Stock Hunter’s View

Overseas growth drives the earnings. High dividend stock with a dividend yield of over 4%.

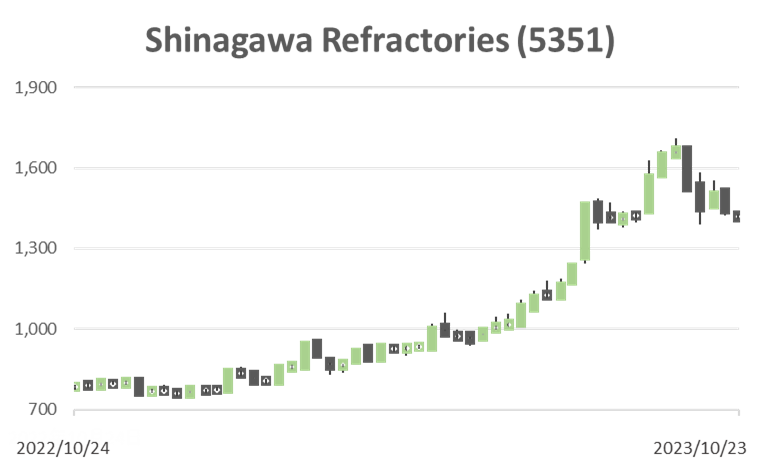

Shinagawa Refractories is a refractory manufacturer whose primary customer is JFE Steel. A high-dividend stock with solid financial performance. Its upcoming response to the issue of PBR below 1x and its undervaluation compared to competitor Krosaki Harima (5352) should also be noted. The 1-for-5 stock split at the end of September made it easier to buy the shares, which is also positive.

The company has announced two upward revisions for FY3/2024 and expects full-year sales of 145 billion yen (+16% YoY) and operating profit of 14.5 billion yen (+33.7% YoY). In addition, the annual dividend forecast on a pre-share-split basis is ¥340 a share (previous year: ¥200), an increase for the third consecutive year.

With aggressive investment, operating profit is expected to continue to renew record highs. The company has strengthened its overseas business at the core of its growth, with business acquisitions in Brazil and the US completed in 2022. It has secured production sites in all refractory and insulation markets in the Indo-Pacific region. As a result, overseas sales are expected to reach 42.4 billion yen, well above the mid-term management plan, and the overseas sales ratio is expected to reach 30%.

In Japan, the company entered the aluminium market by signing an exclusive domestic sales agreement with AMP, the world’s largest manufacturer of monolithic refractories for aluminium production. The company is initially aiming for sales of 2 billion yen in FY2028, and appears to be eyeing in-house production at some stage in the future.

Investor’s View

BUY: The equity market has undervalued the company for many years. The share price has soared but remains below book value, and the ROE adjusted for book value suggests a significant upside. Streamlining and facility consolidation at domestic and international basic materials customers should be considered a driver for the company to become more cost-competitive and broaden its operating domain globally.

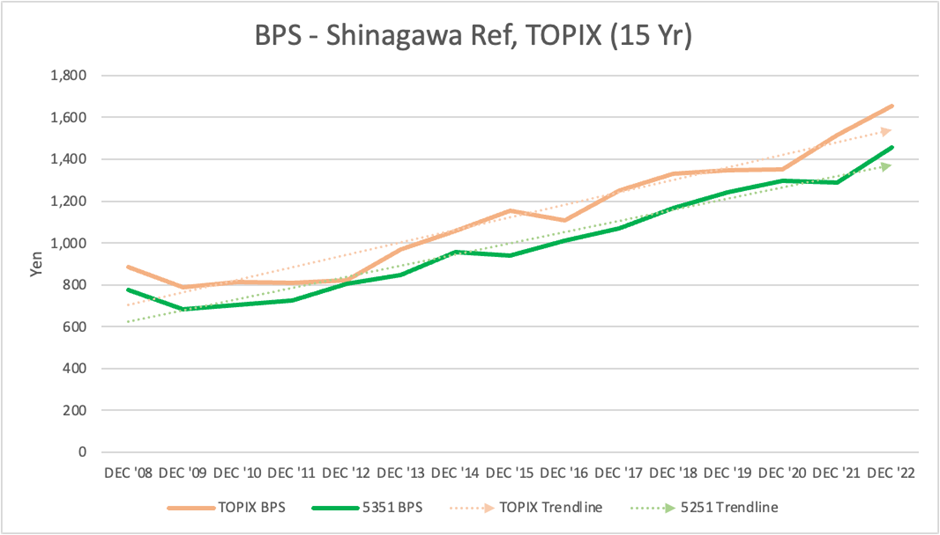

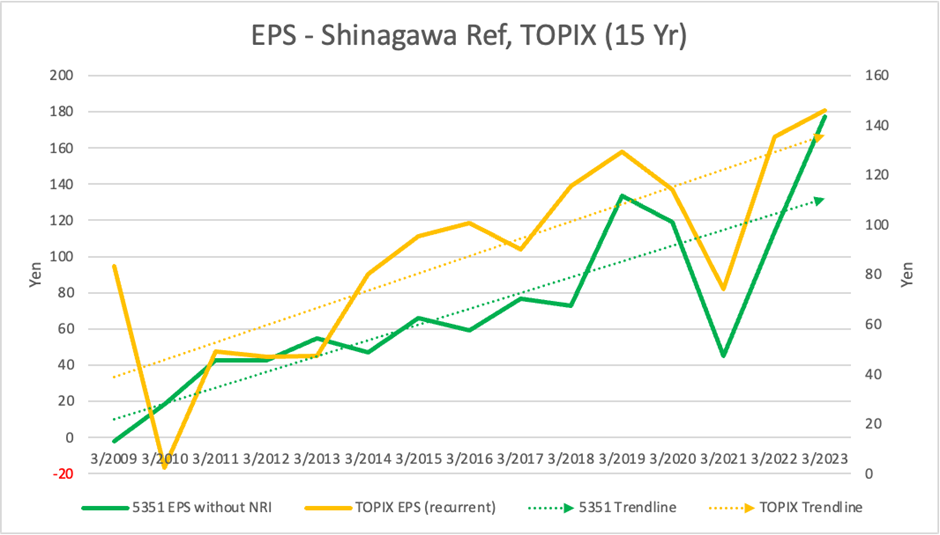

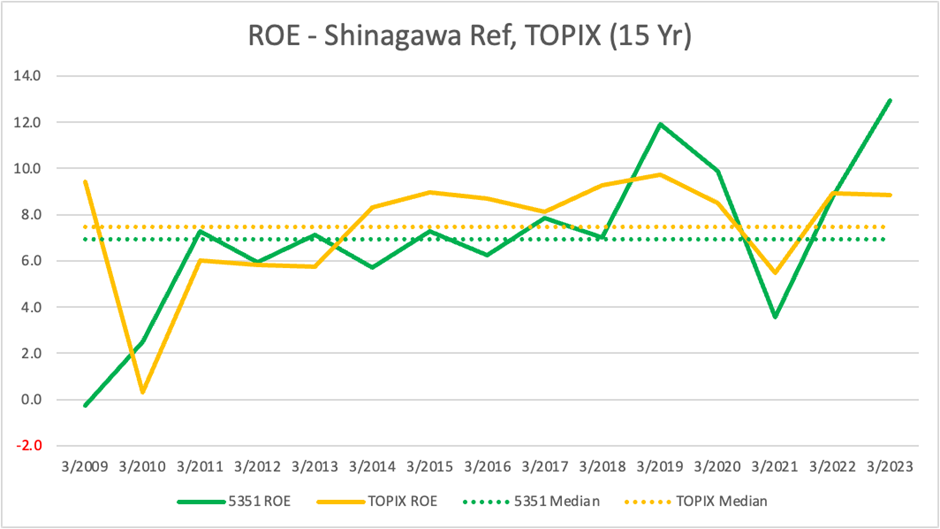

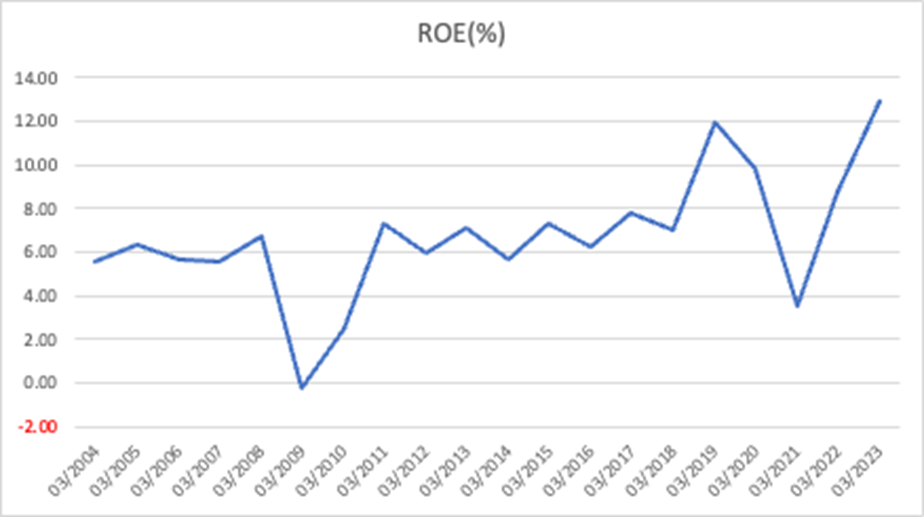

EPS, BPS and ROE steady over the long term

Over the long term, until FY3/2023, the growth trends of BPS and EPS kept pace well with TOPIX’s.

ROE is similar, although volatility is slightly higher than TOPIX’s. The 15-year averages are close at 6.9% for the company and 7.5% for TOPIX.

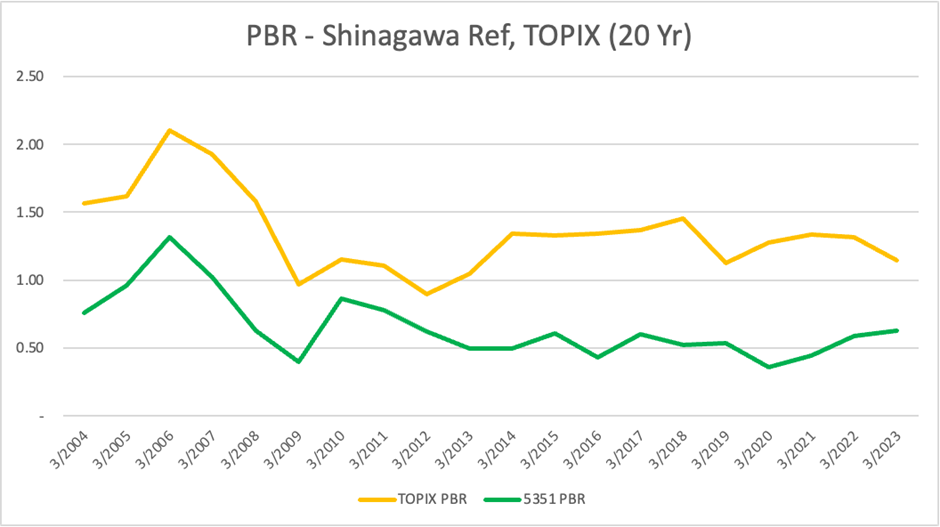

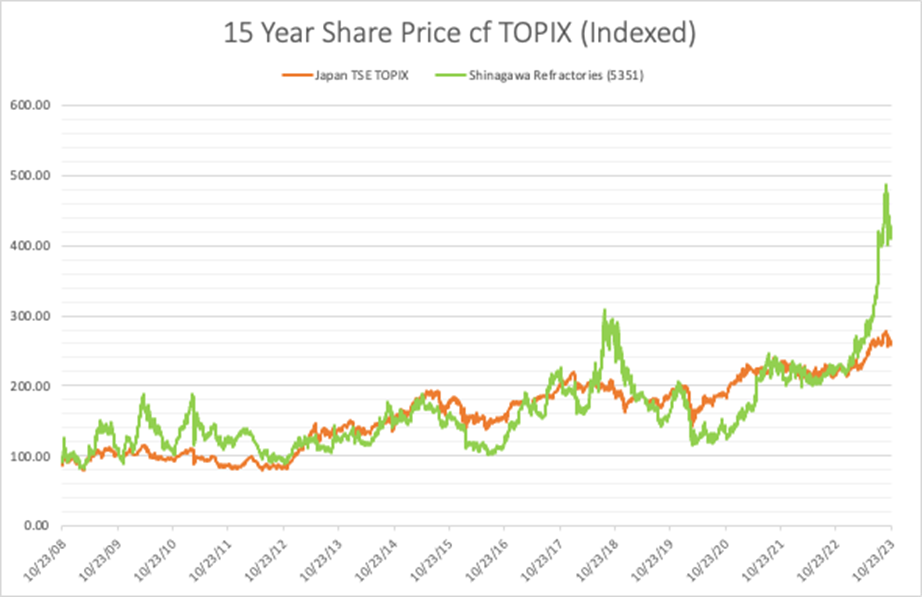

The shares have been neglected for many years

However, the share price has always been valued at a significant discount and spoilt by a remarkably low PBR. Investors would not have been interested in the company simply because of a litany of factors: the outlook of weak domestic crude steel production, consolidation of steel, non-ferrous and cement facilities, bargaining power of gigantic customers and management under the influence of JFE. The share price has been in a value trap for many years, making it difficult for investors to approach the company. IR has been poor, and surprisingly, an IR and public relations department was only set up at the end of last year, though the catch-up should be assessed positively.

The share price has doubled by the end of last year over 15 years, almost on a par with TOPIX. This year, they have finally started to deliver significant returns. The JPX’s strong push for reforms towards companies suffering low PBR and two upward earnings revisions have triggered investors’ attention to the company’s fundamentals.

Management performance is highly rated and reassuring

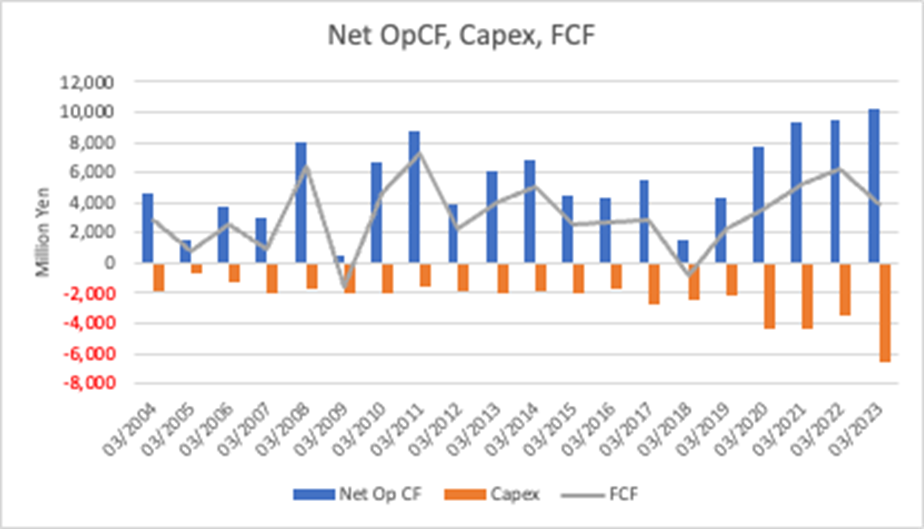

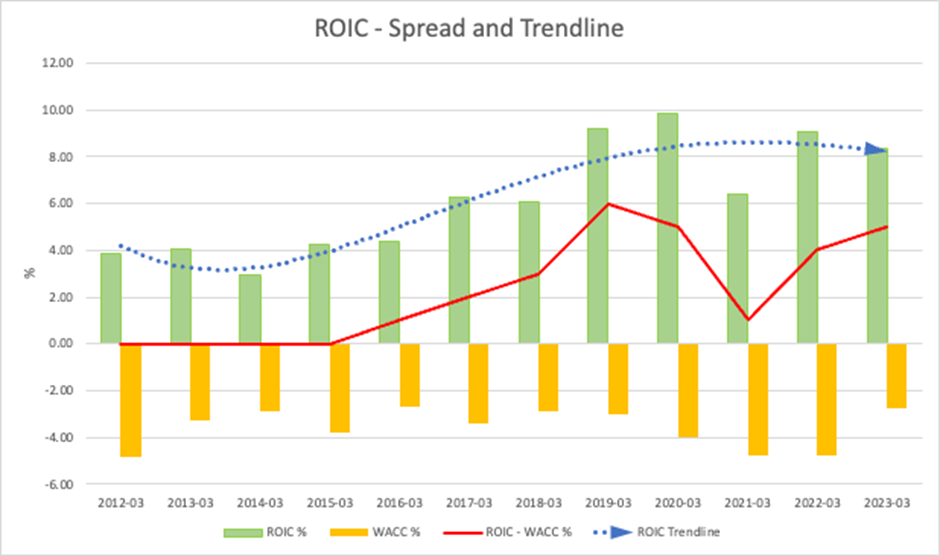

Despite aggressive investment in recent years, the company has remained FCF generative. Economic value creation also runs fine.

In sum, the company’s management is generally regarded as good, and we feel reassured about the future financial performance.

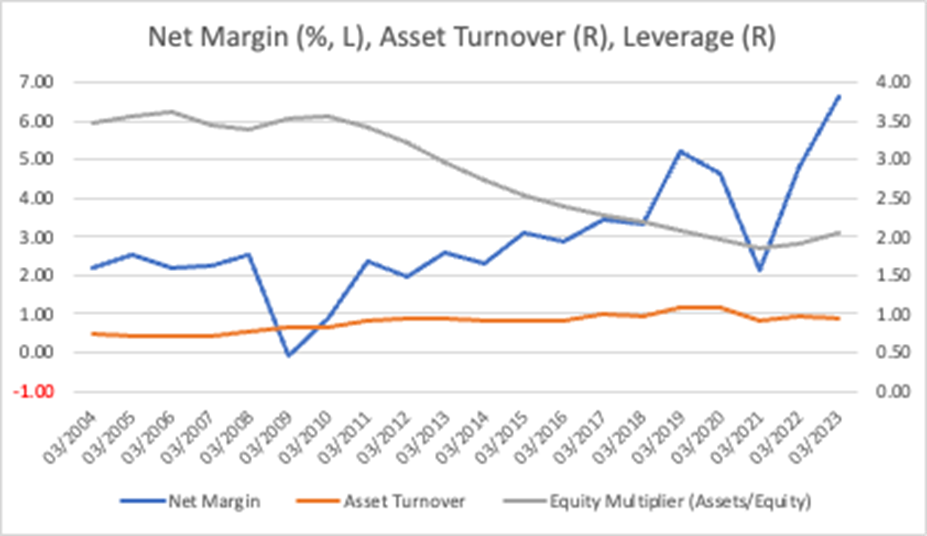

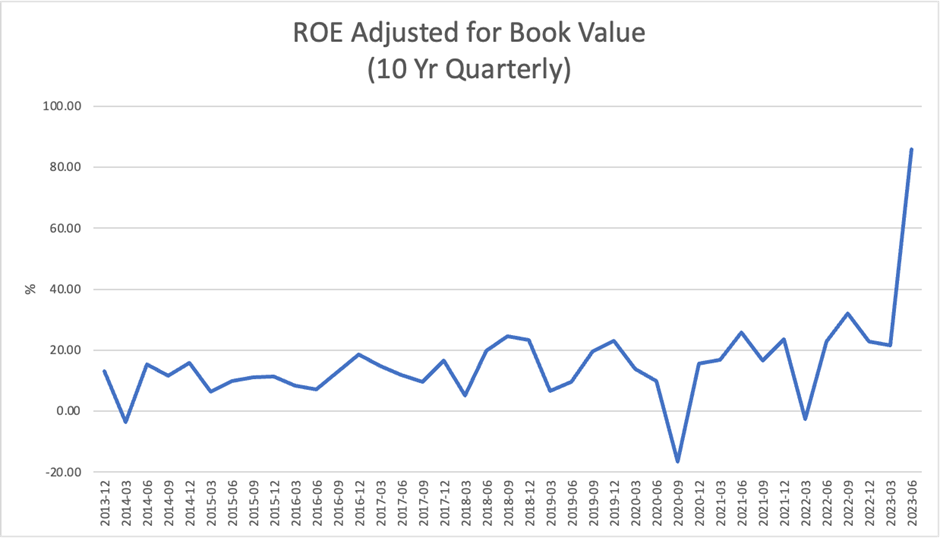

There is upside to ROE

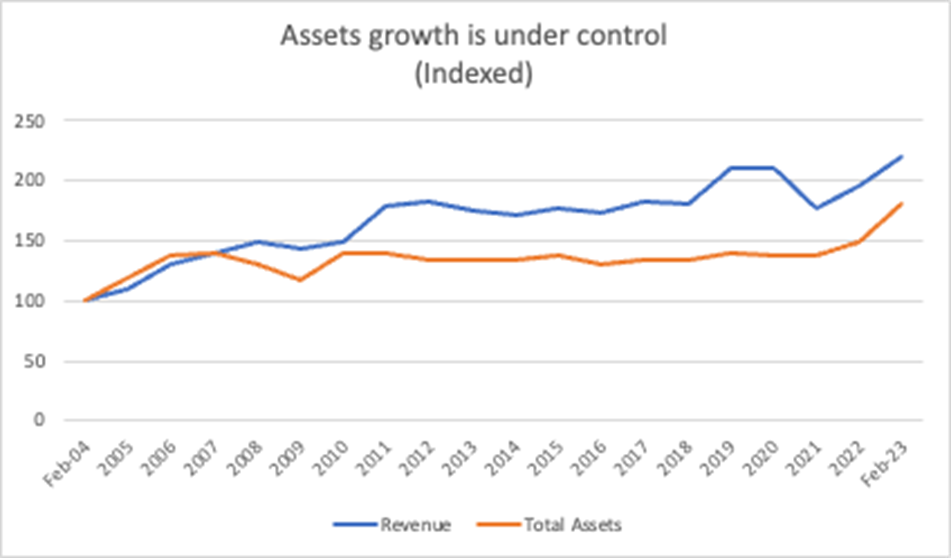

ROE has been driven primarily by an improvement in PL margin. Asset turnover is not unexpectedly low; it is stable. The pace of asset growth is in line with that of sales and appropriate. The deleveraging proved overdone, given the steady CF generation. Depending on management’s approach, there is significant room for ROE upside from increased leverage.

Share price upside is still significant

ROE jumped up due to the enormous gain on the sale of idle land in the 1Q results, while the share price is below book value, so ROE adjusted for book value (ROE / PBR), too, has jumped. The underlying adjusted ROE is estimated to be around 20%, suggesting a significant upside to the share price. ROE adjusted for book value is the inverse of PER, the so-called equity yield. This report does not examine its validity in predicting share prices in detail. Apple and other US mega-cap stocks demonstrate significant share price returns on low adjusted ROE. However, assuming that high figures indicate the shares’ upside would not be unreasonable.

Qualitative factors for the future

Positives for the future include: 1) the company’s major basic materials customers, such as steel, non-ferrous and cement, will consolidate their facilities, which will encourage the company to strengthen its cost competitiveness, 2) the consolidation of overseas basic materials industries will provide opportunities for M&A in refractory business, the core business of the company, 3) the overseas business, which currently accounts for 22% of sales, will grow and add to top-line growth, 4) the company is keen to sell idle land further, and 5) ROIC-oriented management will increase the valuation of the shares as positive investor expectation will grow. If valuations do not expand, a TOB by JFE, a 33.7% shareholder, would also be conceivable. Given the current share price and fine fundamentals, it would not surprise if hostile activists emerge as visible shareholders at any time.

The risk is increased economic volatility, with share prices likely to underperform if the global economy falls into recession. The three-year beta is 1.02 but has widened to 1.54 in 90 days, so the risk is significant if investor expectations about the near-term economic outlook deteriorate significantly.