Riken Technos (Price Discovery)

BUY

Profile

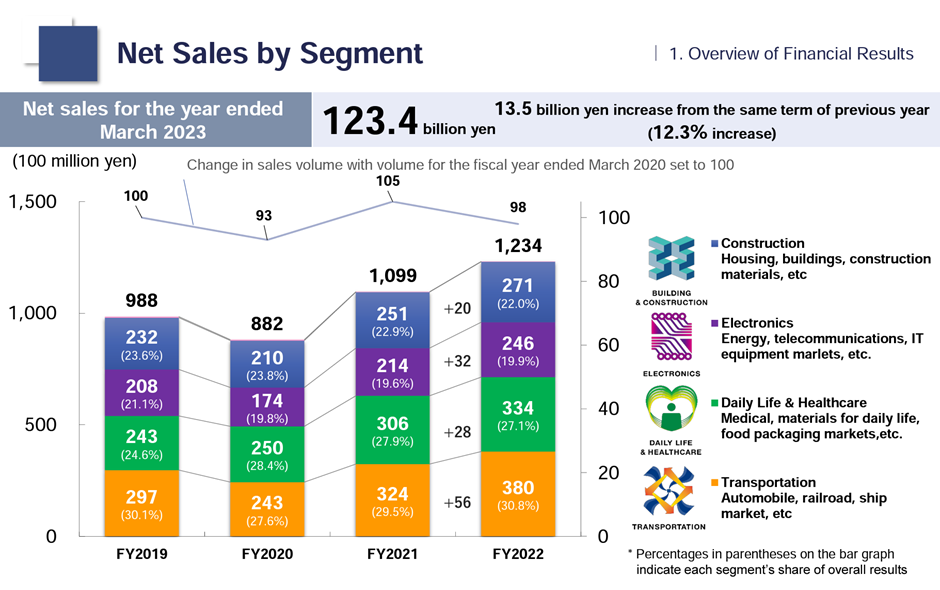

A manufacturer and seller of synthetic resin products including compounds, films, and food wrapping materials. Japan’s leading manufacturer of vinyl chloride compounds. In construction materials, strong in decorative films. Overseas sales account for 51% of total sales.

| Securities Code |

| TYO:4220 |

| Market Capitalization |

| 56,228 million yen |

| Industry |

| Chemistry |

Stock Hunter’s View

The large-scale share buyback plan surprised positively. The company is showing “seriousness” in response to JPX’s requests for improvement.

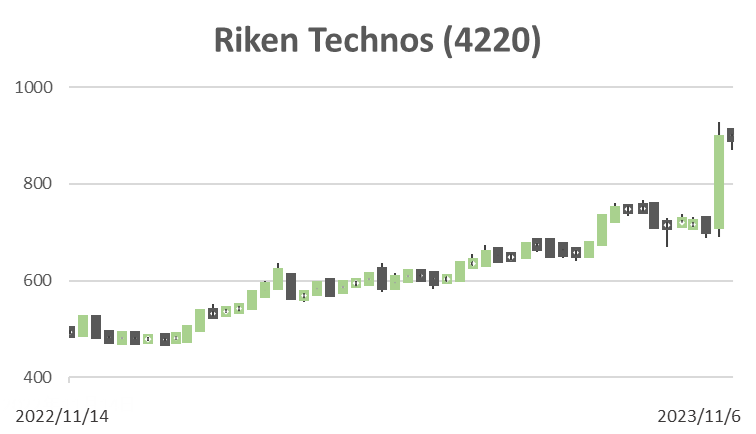

The shares of Riken Technos have seen a dramatic change in the market since the beginning of November. The company runs a diverse range of products, including resin compounds used in construction and civil engineering materials, automotive exteriors and medical equipment, as well as biomass compounds for which demand is expected to increase due to the trend towards waste plastics and EV (electric vehicle) charging cables and solar power generation cables.

On 30 October, the company announced its financial results for 2Q (Apr-Sep) of FY2023 and upward revisions to its full-year forecasts. The results were good; moreover, the share buyback announced simultaneously was a big surprise. It is extremely large-scale, with an upper limit of 7 billion yen and 8.5 million shares (13.4% of outstanding shares). The buyback period is from 10 November 2023 to 31 January 2024. All acquired treasury shares will be cancelled.

The announcement of the repurchase plan fell in with the announcement of concrete measures to realise management that is conscious of the cost of capital and share price, and the company’s seriousness can be seen in its “say it and do it” attitude. For the time being, it is expected to support the trading of the shares, and a year-end share price rally may be expected.

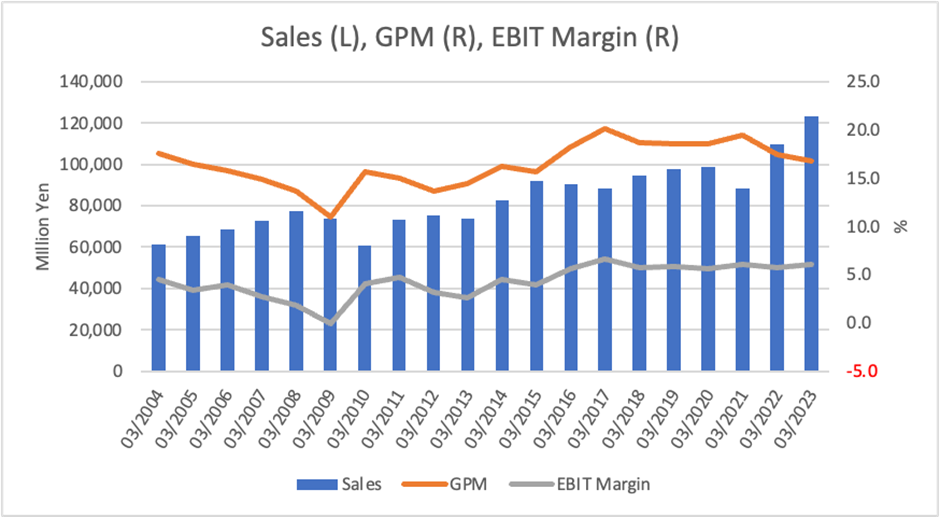

The company has further raised its record-high full-year operating profit forecast to 8.4 billion (+11.9% YoY), up 0.8 billion from its previous guidance, as it was able to hold down higher-than-expected electricity and other costs in 2Q, and as the weak yen has also provided a tailwind.

Investor’s View

BUY: Riken Technos is a good company that generates CF and economic value, being well positioned to capture global economic growth. However, its BS efficiency is poor. The management has finally woken up to the importance of ROE and has started to make impressive moves, which should prove a big positive for the share price. Near-term earnings momentum is strong thanks to product price increases.

(Source: Company)

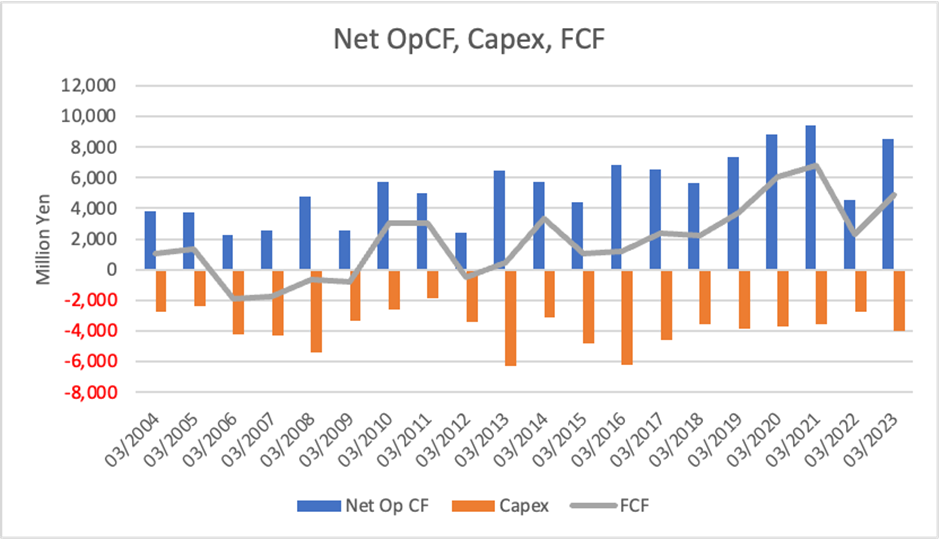

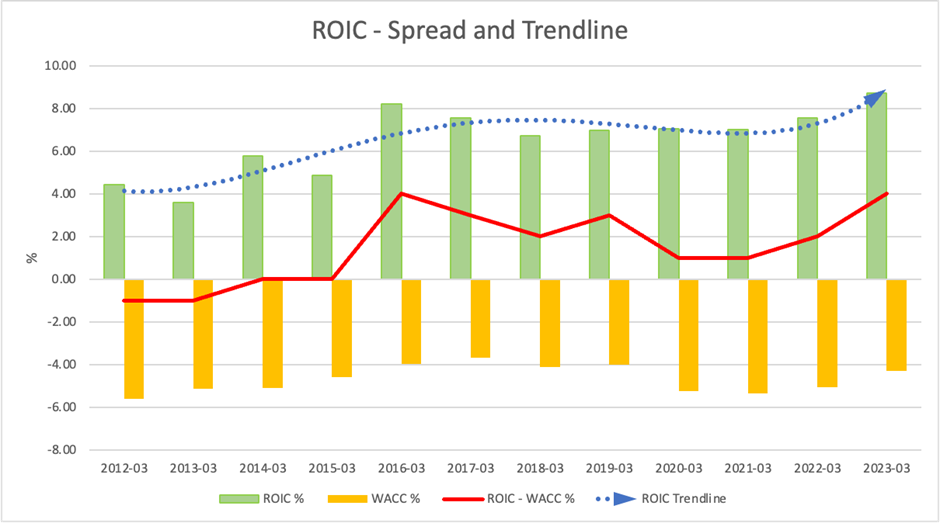

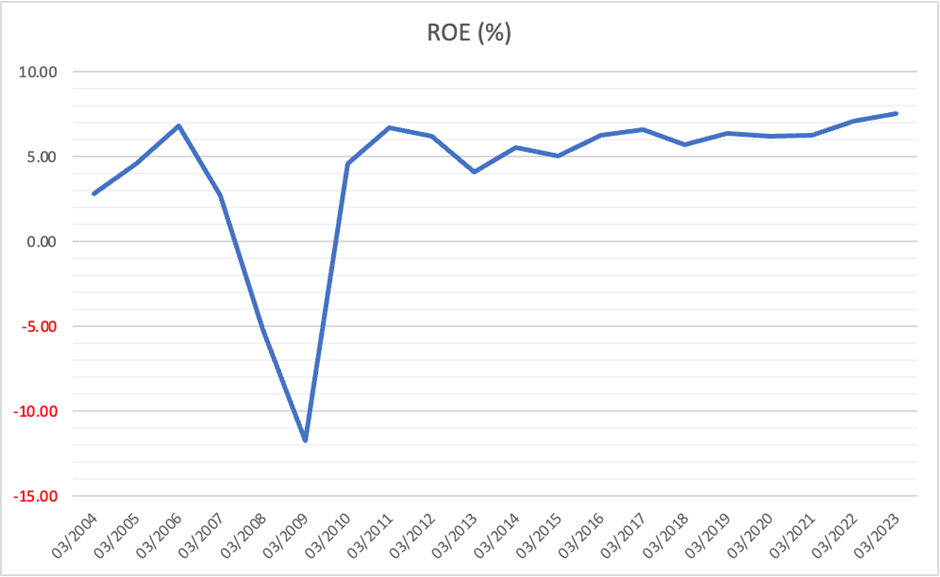

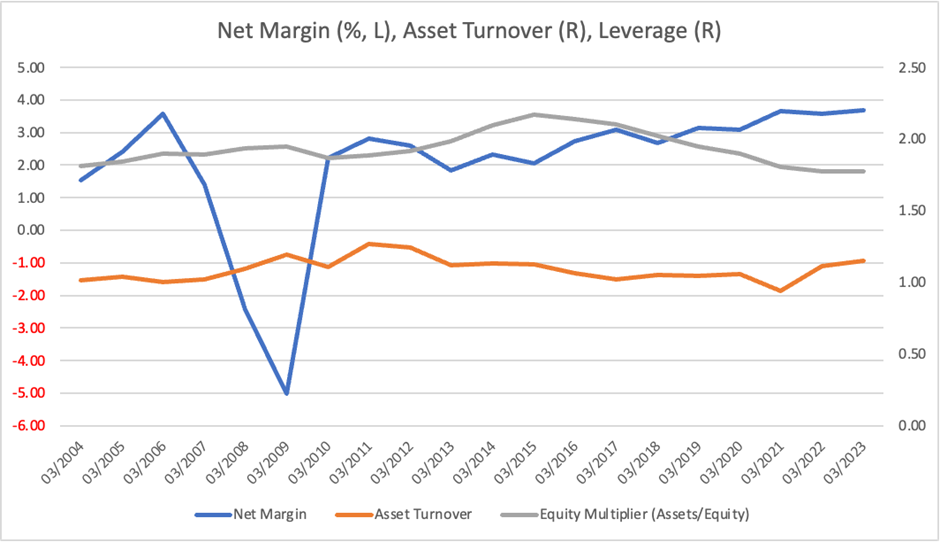

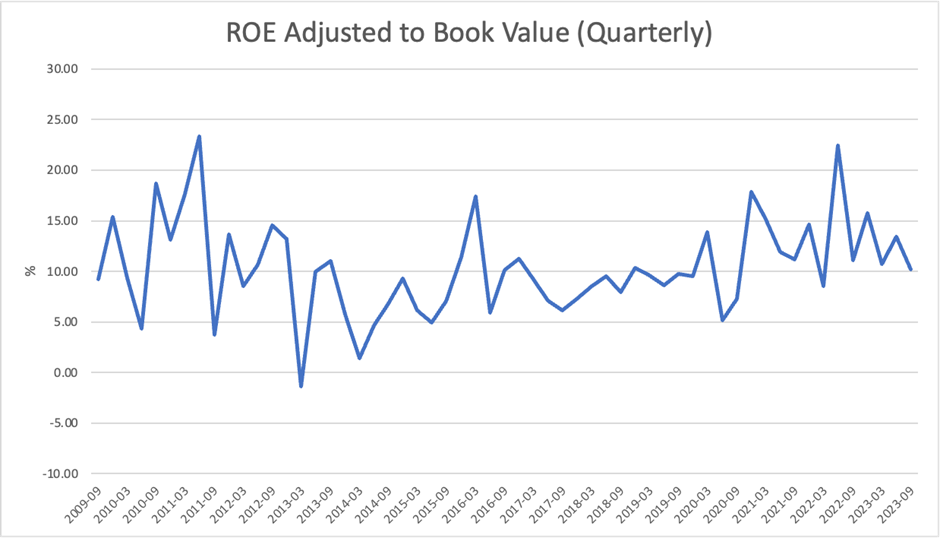

Riken Technos is a good company being stable, cash-generative and well-exposed to global economic growth. Despite the pandemic disaster, it has been creating economic value consistently. However, to date, management has not utilised CF well, so the BS has inflated, and ROE has never been attractive to investors.

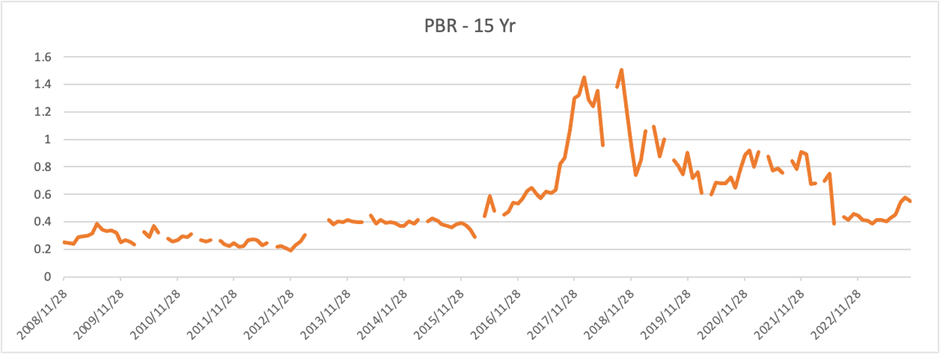

Year-to-date, the share price has been a steady outperformer, on the back of product price increases, a strong car production recovery, and a recovery in the global economy. Furthermore, the share price jumped following the upward revision of company guidance and the announcement of a significant share buyback on 30 October. Nonetheless, the shares still trade below book. ROE adjusted for PBR suggests the share price is at an attractive level.

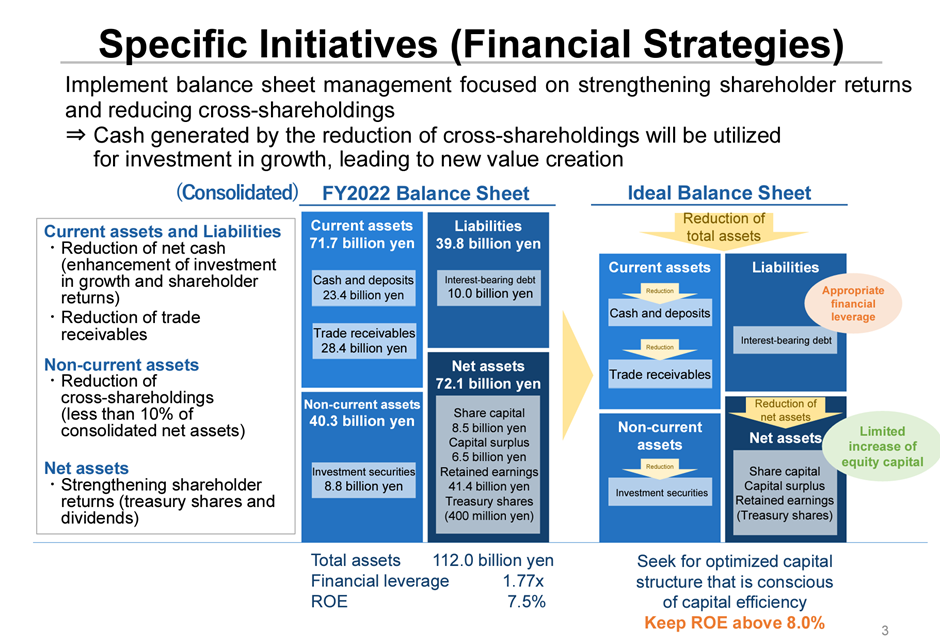

The balance sheet is inflated

Net cash at end-September was 11.7 billion yen against a market capitalisation of 56 billion yen. If LT investment securities of 10.1 billion are considered, adjusted net cash is 21.8 billion. Almost all investment securities are listed Japanese equities. While holdings of about 30 stocks generate some dividends, the balance sheet strikes as astonishing for investors. Investment securities have increased by 16% since the end of March 2023 as the Japanese equities market went up. In other words, the rising Japanese stock market inflates the company’s BS. Unsurprisingly, investors have not actively invested in a company that has left such a structure in place and whose ROE has little attraction.

Management understands exactly what makes PBR so low

In the company’s corporate release at the end of October, the management stated that the reason PBR is below 1x despite steady improvement in ROE and growing BPS is that ROE has not reached a level that exceeds the cost of shareholders’ equity due to the build-up of equity capital and that shareholders and investors have not yet appreciated the company’s growth potential. This is absolutely true. Regarding the latter, investors should be aware that the ROE adjusted for PBR is at an attractive level, as discussed above. We believe the shares are underrated.

Management’s capital policy is highly rated

In this circumstance, at the request of the JPX, the company announced measures to focus attention on the share price and investors. At the same time, a significant share buyback of 13.4% of outstanding shares, amounting to 7 billion yen, was announced. All repurchased shares will be cancelled. The specific measures are right on target: reducing cross-held equities, leaving no net cash on the table through investment and shareholder reverts, and reducing assets while achieving appropriate financial leverage and limiting the build-up of equity capital. While we are surprised at the management’s low target of 8% ROE in FY03/2025, we expect the sustainable ROE to be way higher than that. Steady improvement would be positive for the share price.

(Source: Company)