Aiphone (Price Discovery)

Sell on strength

Profile

Leader in the intercom industry. Focus on overseas expansion. Sales ratio: domestic housing 51%, care 14%, overseas 21%. The domestic business provides security systems for detached houses, apartment buildings, schools, public facilities, and commercial premises. Products include TV door phones, emergency call systems, wireless paging systems, and intercom applications. The nursing care business manufactures nurse calls for medical and welfare facilities and housing complex systems for older people.

| Securities Code |

| TYO:6718 |

| Market Capitalization |

| 49,249 million yen |

| Industry |

| Electronic equipment |

Stock Hunter’s View

Record-high profits are in sight after the past two fiscal years. Procurement difficulties have improved, and order backlogs are being booked as sales.

Aiphone, a leading manufacturer of intercom systems, exports and sells its products to some 70 countries around the world and has delivered many products to prominent buildings, including the White House in the US. The company has recently recovered from parts procurement difficulties, and its sales of mainstay TV door phones have improved significantly.

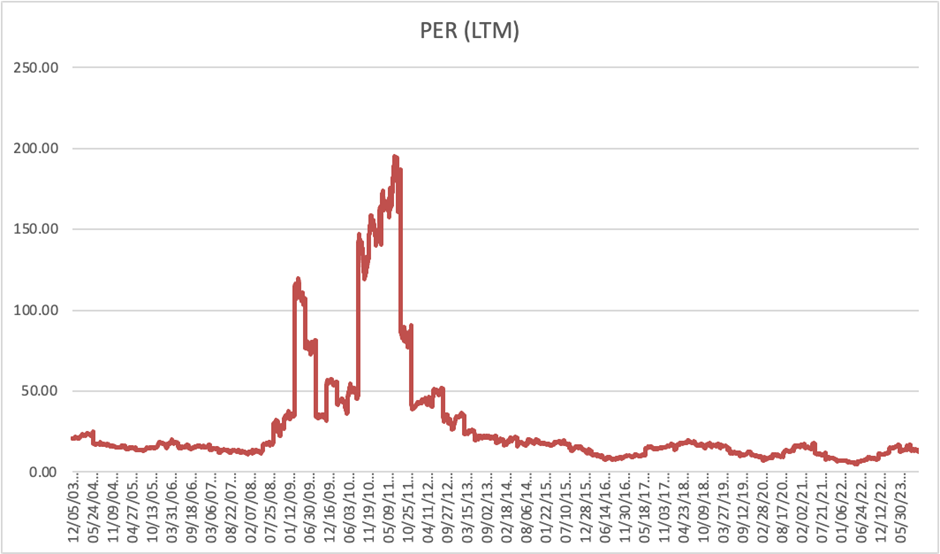

The company’s previously announced 2Q results for FY3/2024 (Apr-Sep) confirmed its good performance, with a 26% increase in sales and a 2.2-fold increase in operating profit. The progress rate of 2Q operating profit towards the full-year forecast is steady at 55%, and the profit is getting close to the record high in FY3/3022 (5,538 million yen) when demand for non-face-to-face and security services increased under COVID-19. The company plans to pay an annual dividend of 100 yen, an increase of 10 yen each for the interim and year-end.

In the Japan segment, the effect of price revisions for some products since orders received in October last year has come to the fore. Sales of rental condominiums increased significantly, while in the business market, capital investment in tenant buildings, schools, and government projects remained strong, and demand for manpower-saving and unmanned systems in railway stations and commercial facilities also remained high.

The North American segment achieved a significant increase in sales and profits due to the effect of the weak yen. Sales of IP network-compatible intercom systems and TV door phones were strong, mainly in the commercial and housing complex markets. Sales of TV door phones were also strong in line with changes in post-pandemic working styles.

Investor’s View

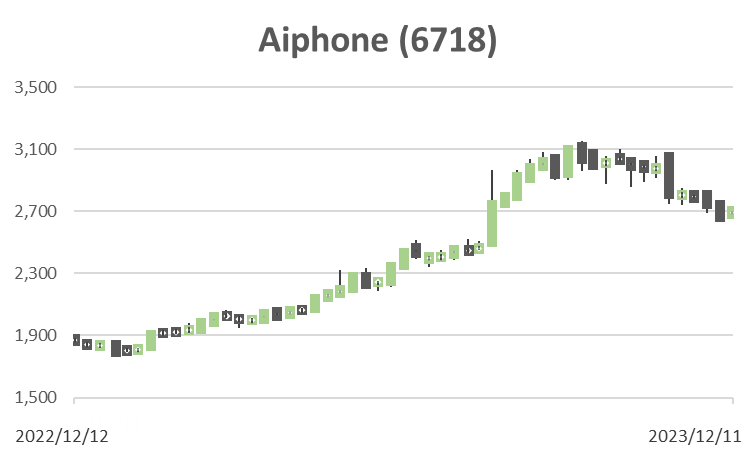

Sell on strength. With a market capitalisation of 43 billion yen, the company’s cash and securities typically amount to well over 20 billion yen. The share price has been below book value for 15 years, but the management has yet to understand shareholders’ expected return sufficiently. The earnings recovery is perhaps temporary. Holders should sell on another upward revision.

The share price soared on 1 August due to a 40% upward revision to full-year EPS; the catalyst was not the expectation of an improvement in low PBR. The earnings momentum will likely be a one-off, as the parts procurement difficulties have been resolved, and orders are being rapidly digested in North America and Japan. In addition to the recovery in sales volumes, the operating situation is positive as selling price adjustments are progressing. There may be another upward revision in the not-too-distant future.

Business attractive, shares unattractive

The expected dividend yield of 3.8% is attractive, and the business is excellent as it continues to generate CF. However, the shares are much less attractive for long-term accounts seeking high returns. The main reason for this is management’s insufficient attention to the cost of capital.

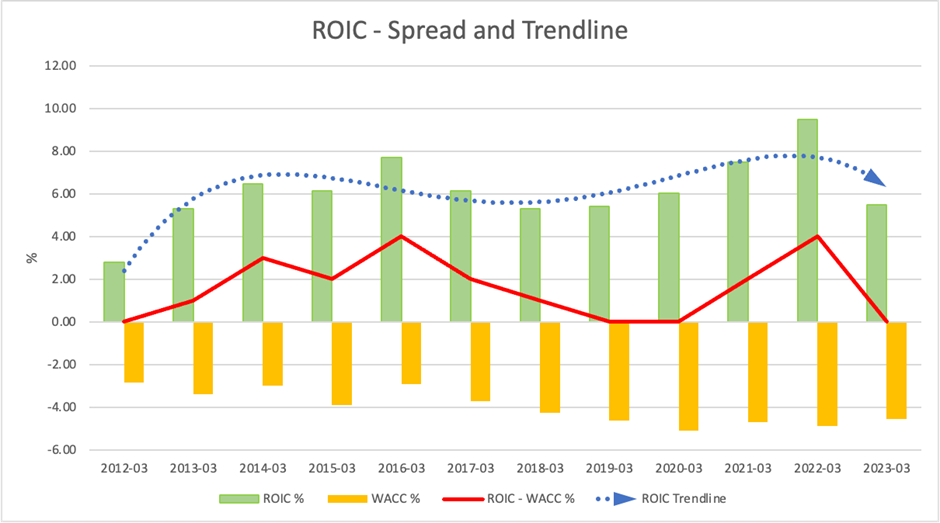

There is little hope of improving the return on capital

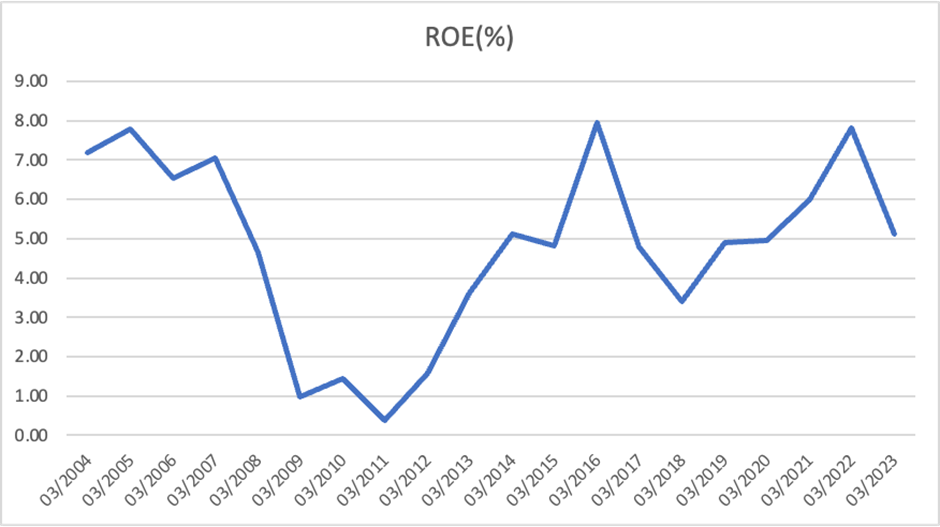

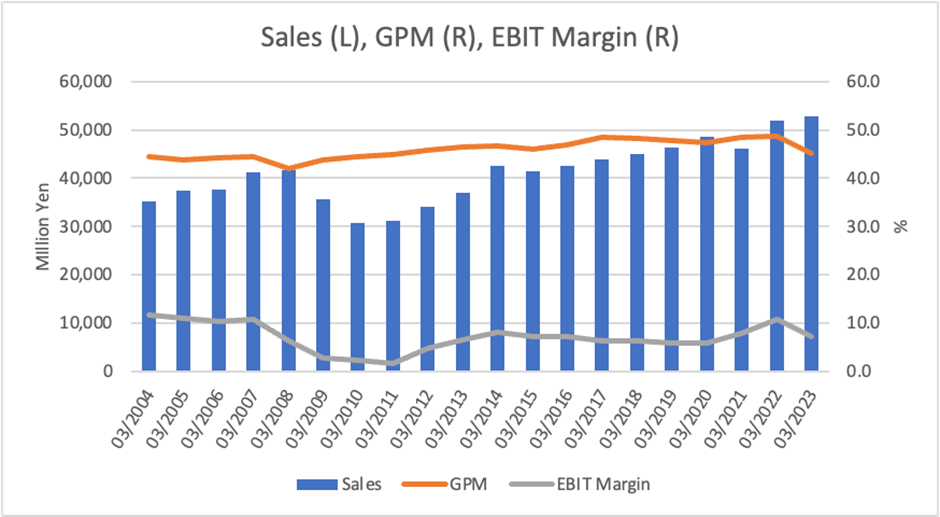

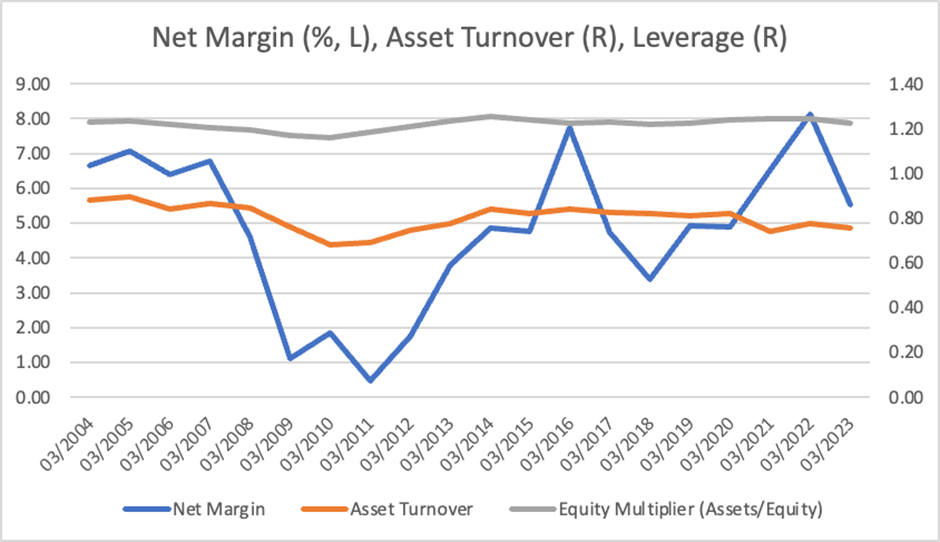

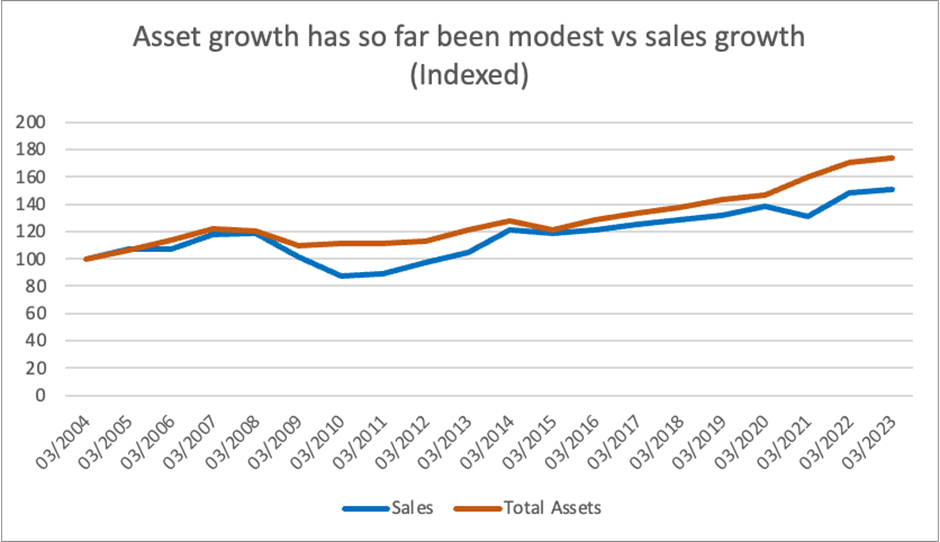

ROE is unlikely to reach a satisfactory level. TOPIX’s current ROE is 8.6%, while management’s target for FY3/2026 is 6.0%. BS is inflated with cash and securities. Asset turnover is permanently low. EBIT margins are unlikely to improve given the lack of innovation, competition in the market, price pressure, cost inflation in parts supply, labour, etc., and the costs of overseas expansion.

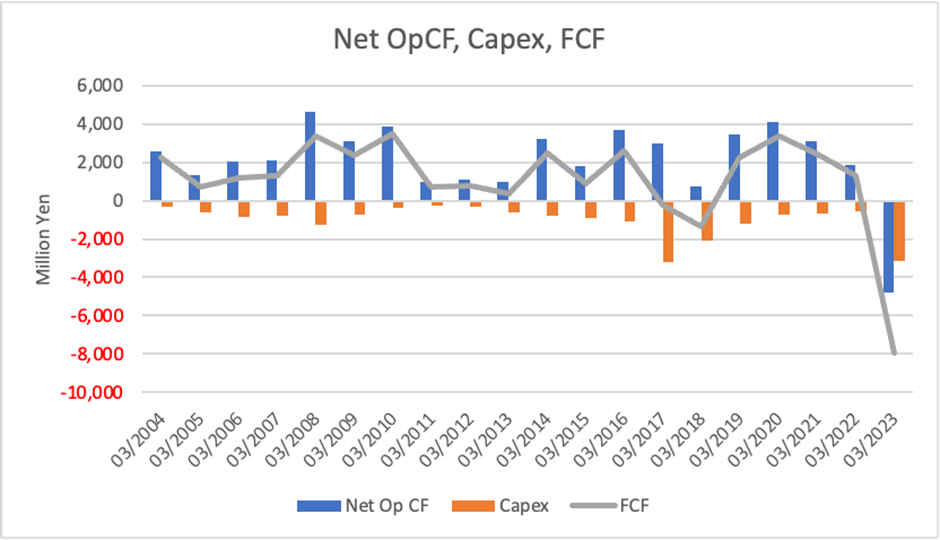

Debt/Total Capital averaged 1.68% over the 20 years, and management has left an average of 14 billion yen a year in net cash, in addition to marketable securities, during that time. This track record makes it unlikely that management will turn to aggressive debt inclusion measures to improve the ROIC spread and optimise the cost of capital.

The company has stated that it will invest 15 billion yen in growth over the next three years to use the cash flow. However, the details are not precise. The worry is that the significant expansion of investment over a short period could lead to asset expansion preceding sales growth and weigh on ROE. Management should use CF while presenting specific growth investment projects and returns to investors.

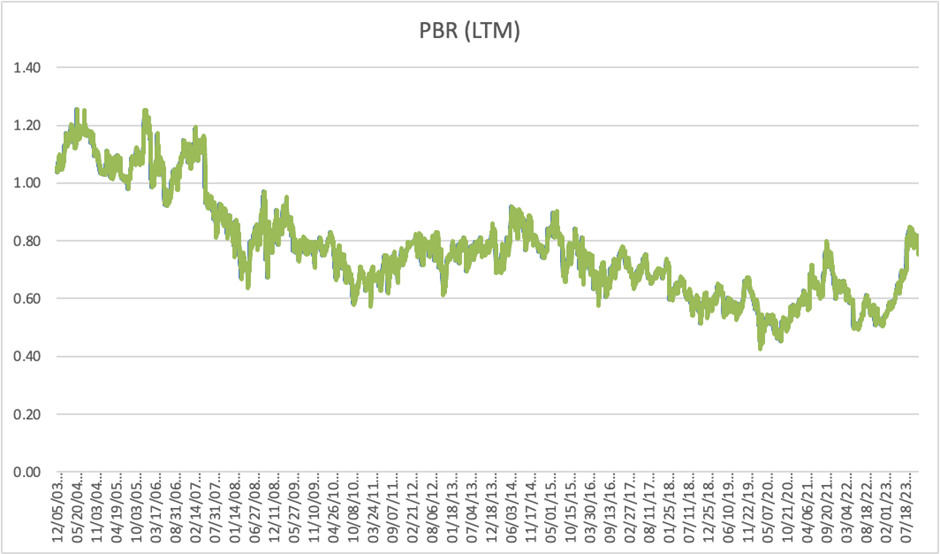

It is up to management to expand valuations

Current management is seen as far from being conscious of share price and cost of capital. As in the past, none of the investors will likely expect attractive improvements in ROE and ROIC. The shares have traded below book value since 2007, which reflects this lack of positive expectation. However, the attraction of the stock lies in various room for improvements once management turns to improve the value of the shares. For example, the share price multiples could expand by a structural improvement in ROE through streamlining the balance sheet and reasonable utilisation of CF.

BS is inefficient due to cash pile and securities holdings

Last year, net cash decreased by 10 billion yen YoY due to a sharp increase in inventory investment to compensate for a shortage of inventories due to procurement difficulties and land acquisition in Nagoya City. It is reasonable to estimate that net cash usually would be close to 20 billion yen. In addition, there are nearly 9 billion yen in securities, most of which are cross-holdings in 37 listed stocks. These account for around 40% of assets and significantly drag on return on capital. Investments in the last financial year included an outlay of 2.5 billion yen for land acquisition. This was the largest investment in the previous 20 years and one of the main reasons for the large FCF deficit. Despite being a significant investment, its purpose has not been explained to investors. The considerable information asymmetry is perceived as a risk for shareholders and investors.